This version of the form is not currently in use and is provided for reference only. Download this version of

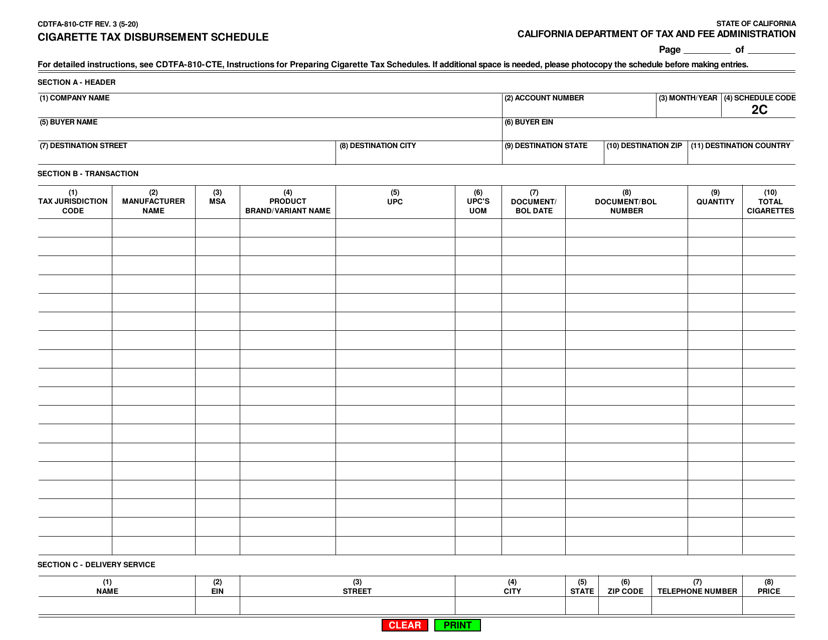

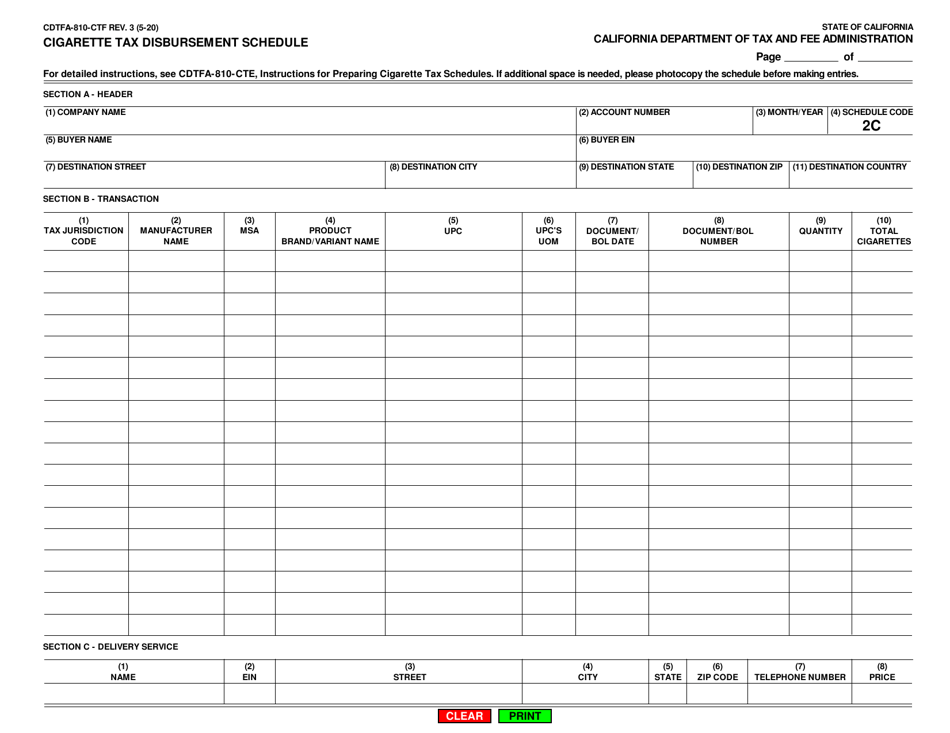

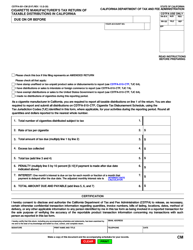

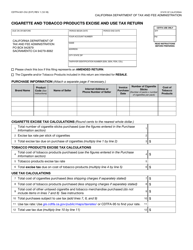

Form CDTFA-810-CTF

for the current year.

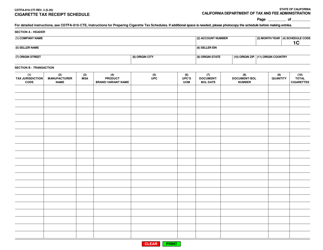

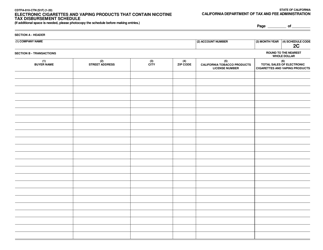

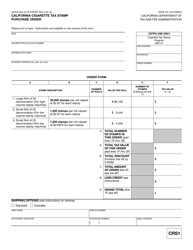

Form CDTFA-810-CTF Cigarette Tax Disbursement Schedule - California

What Is Form CDTFA-810-CTF?

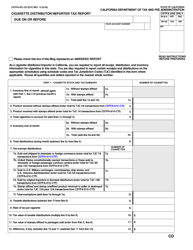

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CDTFA-810-CTF?

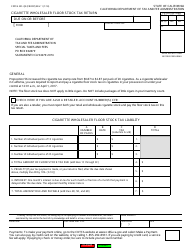

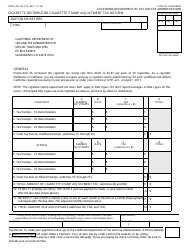

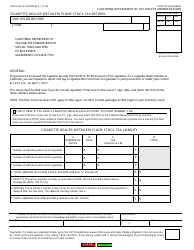

A: Form CDTFA-810-CTF is the Cigarette Tax Disbursement Schedule in California.

Q: What is the purpose of Form CDTFA-810-CTF?

A: The purpose of Form CDTFA-810-CTF is to report the disbursement of cigarette tax funds in California.

Q: Who needs to file Form CDTFA-810-CTF?

A: Cigarette wholesalers and stamping agents in California need to file Form CDTFA-810-CTF.

Q: When is Form CDTFA-810-CTF due?

A: Form CDTFA-810-CTF is due on a monthly basis by the 10th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form CDTFA-810-CTF?

A: Yes, there are penalties for late filing of Form CDTFA-810-CTF. It is important to file the form on time to avoid penalties.

Q: Is there a fee for filing Form CDTFA-810-CTF?

A: No, there is no fee for filing Form CDTFA-810-CTF.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-810-CTF by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.