Instructions for Form CDTFA-810-CTF, CDTFA-810-CTI - California

This document contains official instructions for Form CDTFA-810-CTF , and Form CDTFA-810-CTI . Both forms are released and collected by the California Department of Tax and Fee Administration. An up-to-date fillable Form CDTFA-810-CTF is available for download through this link. The latest available Form CDTFA-810-CTI can be downloaded through this link.

FAQ

Q: What is Form CDTFA-810-CTF?

A: Form CDTFA-810-CTF is the California Cannabis Tax Return for Distributors.

Q: What is Form CDTFA-810-CTI?

A: Form CDTFA-810-CTI is the California Cannabis Tax Return for Cultivators.

Q: Who should file Form CDTFA-810-CTF?

A: Distributors of cannabis in California should file Form CDTFA-810-CTF.

Q: Who should file Form CDTFA-810-CTI?

A: Cultivators of cannabis in California should file Form CDTFA-810-CTI.

Q: When is the due date for filing Form CDTFA-810-CTF?

A: The due date for filing Form CDTFA-810-CTF is the last day of the month following the reporting period.

Q: When is the due date for filing Form CDTFA-810-CTI?

A: The due date for filing Form CDTFA-810-CTI is the last day of the month following the reporting period.

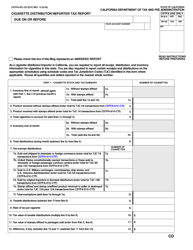

Q: What taxes are reported on Form CDTFA-810-CTF?

A: Form CDTFA-810-CTF is used to report the cannabis excise tax and the cannabis cultivation tax.

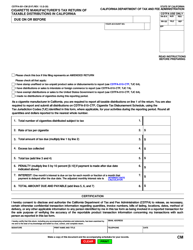

Q: What taxes are reported on Form CDTFA-810-CTI?

A: Form CDTFA-810-CTI is used to report the cannabis cultivation tax.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Department of Tax and Fee Administration.