This version of the form is not currently in use and is provided for reference only. Download this version of

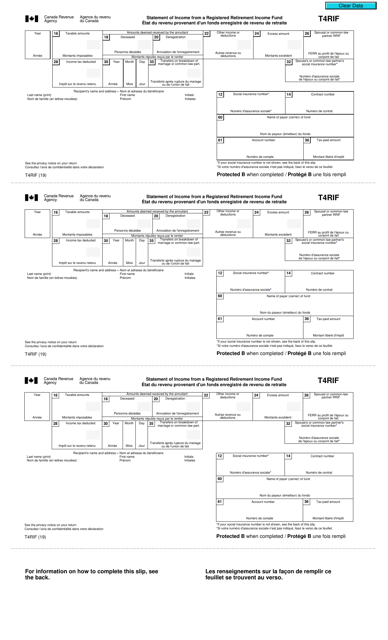

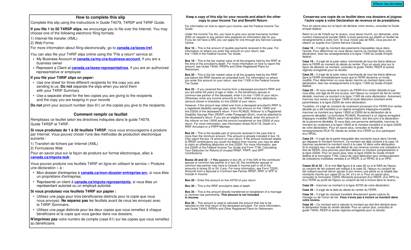

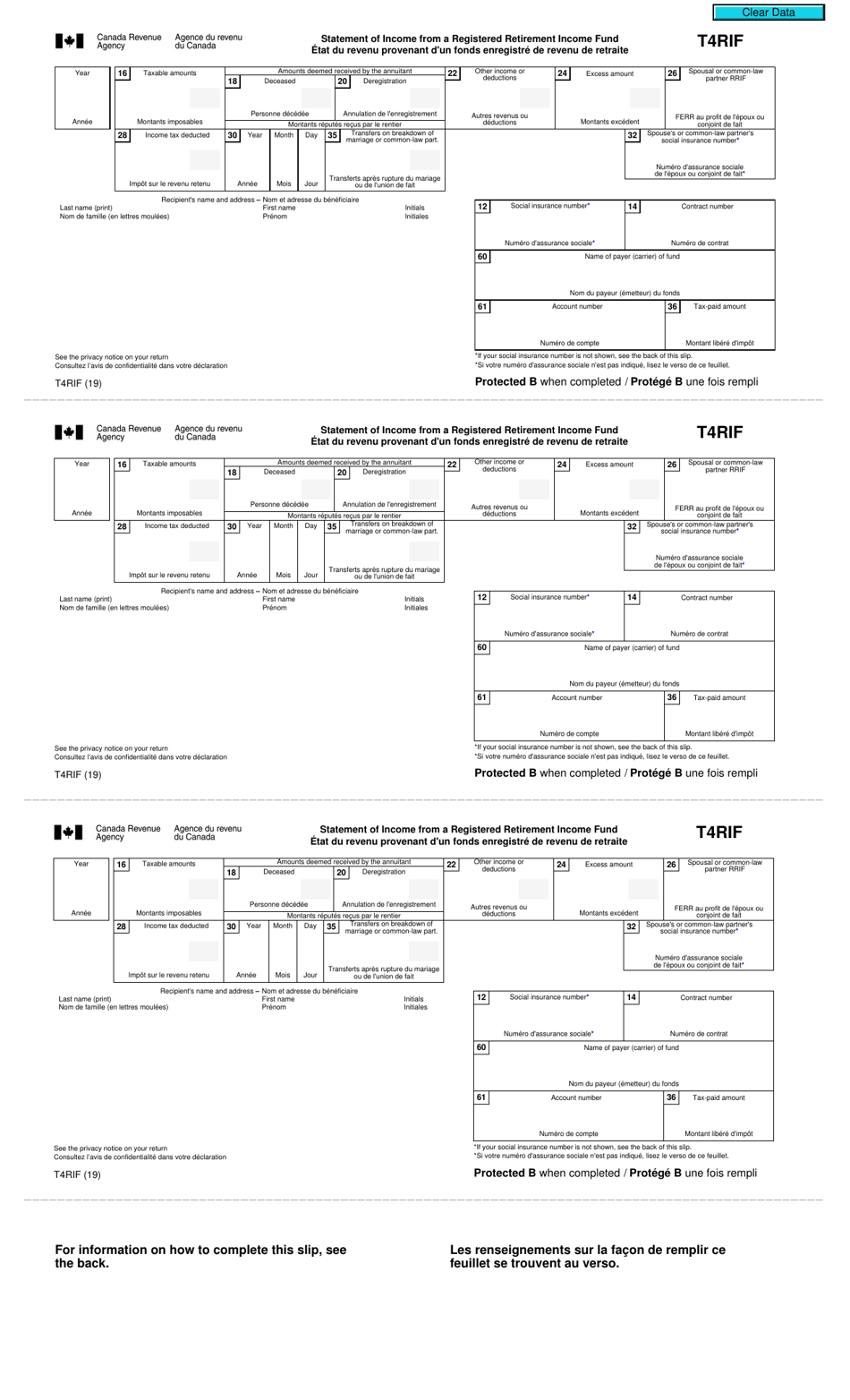

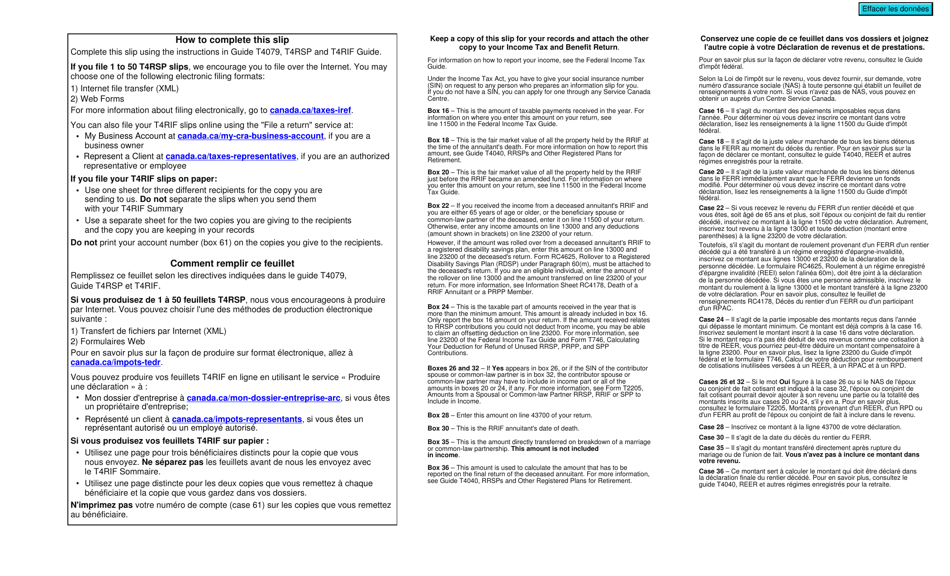

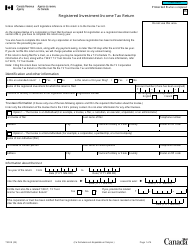

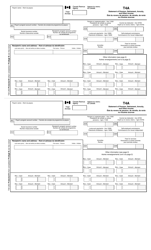

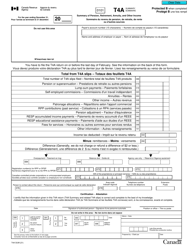

Form T4RIF

for the current year.

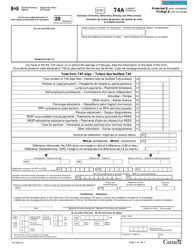

Form T4RIF Statement of Income From a Registered Retirement Income Fund - Canada (English / French)

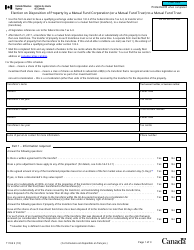

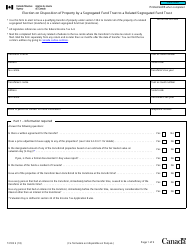

Form T4RIF is a statement of income from a Registered Retirement Income Fund (RRIF) in Canada. This form is used to report the income received from your RRIF on your Canadian tax return. It is important for tax purposes and helps determine your tax liability.

The individual who received income from a Registered Retirement Income Fund (RRIF) is responsible for filing the Form T4RIF statement of income in Canada.

FAQ

Q: What is a T4RIF statement?

A: A T4RIF statement is a document that shows your income from a Registered Retirement Income Fund (RRIF) in Canada.

Q: What is a RRIF?

A: A RRIF is a retirement income fund where you can hold and withdraw money from your registered retirement savings plan (RRSP) as income.

Q: Why do I need a T4RIF statement?

A: You need a T4RIF statement to report your income from a RRIF to the Canada Revenue Agency (CRA) for tax purposes.

Q: How do I get a T4RIF statement?

A: You will receive a T4RIF statement from your financial institution or plan administrator if you have received income from a RRIF.

Q: What information is included in a T4RIF statement?

A: A T4RIF statement includes your name, address, Social Insurance Number (SIN), and the amount of income you received from your RRIF.

Q: Is a T4RIF statement bilingual?

A: Yes, a T4RIF statement is available in both English and French.

Q: When do I need to file my T4RIF statement?

A: You need to file your T4RIF statement with your income tax return by the deadline set by the CRA.

Q: What happens if I don't include my T4RIF income on my tax return?

A: If you don't include your T4RIF income on your tax return, you may be subject to penalties and interest by the CRA.

Q: Can I request a copy of my T4RIF statement?

A: Yes, you can request a copy of your T4RIF statement from your financial institution or plan administrator if you have lost or misplaced it.

Q: Can I e-file my T4RIF statement?

A: Yes, you can e-file your T4RIF statement along with your income tax return using certified tax software or through a tax professional.