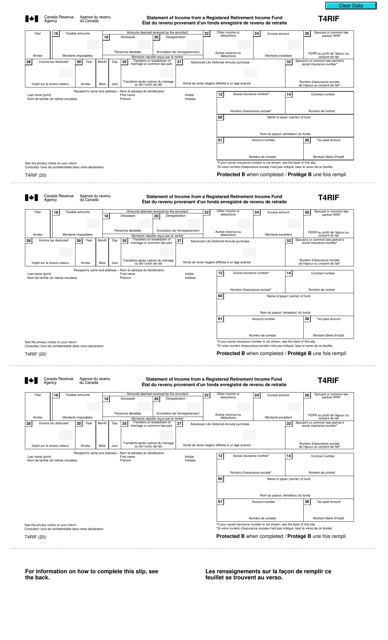

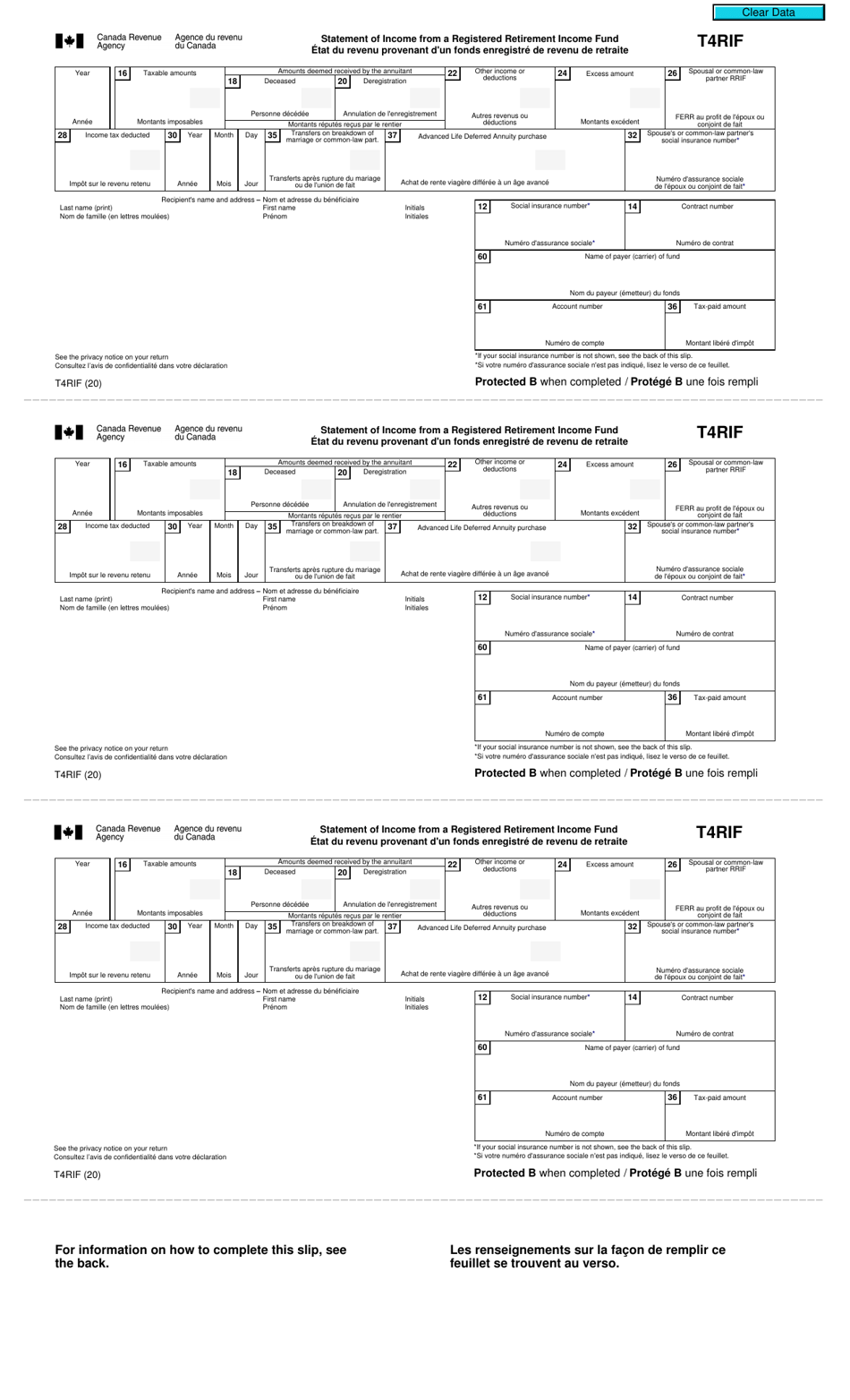

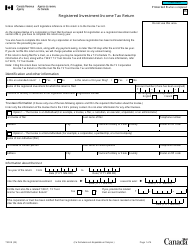

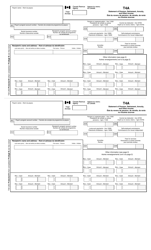

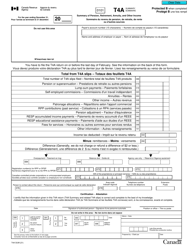

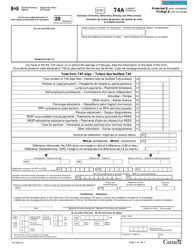

Form T4RIF Statement of Income From a Registered Retirement Income Fund - Canada (English / French)

The Form T4RIF is used in Canada to report income received from a Registered Retirement Income Fund (RRIF). It is used to report this income for tax purposes.

The Form T4RIF statement of income from a Registered Retirement Income Fund in Canada is typically filed by the recipient of the income.

Form T4RIF Statement of Income From a Registered Retirement Income Fund - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is a T4RIF statement?

A: A T4RIF statement is a statement of income from a Registered Retirement Income Fund (RRIF) in Canada.

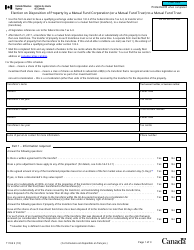

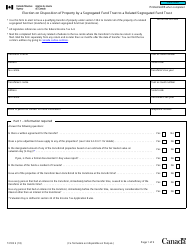

Q: What is a Registered Retirement Income Fund (RRIF)?

A: A Registered Retirement Income Fund (RRIF) is a type of retirement income plan in Canada that provides income to retirees.

Q: Who receives a T4RIF statement?

A: Individuals who have received income from a Registered Retirement Income Fund (RRIF) in Canada receive a T4RIF statement.

Q: What information is included in a T4RIF statement?

A: A T4RIF statement includes information about the income received from a Registered Retirement Income Fund (RRIF), such as the total amount received and any tax withheld.

Q: Why is a T4RIF statement important?

A: A T4RIF statement is important because it provides individuals with information about their income from a Registered Retirement Income Fund (RRIF), which may be taxable.

Q: Do I need to include my T4RIF statement when filing my taxes?

A: Yes, you need to include your T4RIF statement when filing your taxes in Canada.

Q: Can I get a T4RIF statement in both English and French?

A: Yes, you can get a T4RIF statement in both English and French as it is available in both languages.