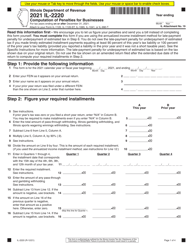

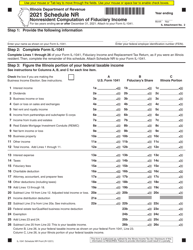

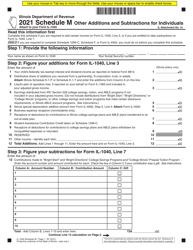

Instructions for Form IL-2210 Computation of Penalties for Individuals - Illinois

This document contains official instructions for Form IL-2210 , Computation of Penalties for Individuals - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-2210 is available for download through this link.

FAQ

Q: What is Form IL-2210?

A: Form IL-2210 is a form used to calculate penalties for individuals in Illinois.

Q: What is the purpose of Form IL-2210?

A: The purpose of Form IL-2210 is to calculate penalties for individuals who did not pay enough income tax throughout the year.

Q: Who needs to file Form IL-2210?

A: Individuals in Illinois who did not pay enough income tax throughout the year may need to file Form IL-2210.

Q: What penalties are calculated on Form IL-2210?

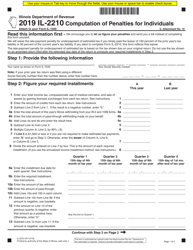

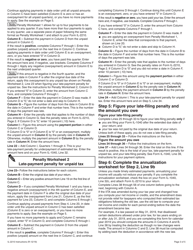

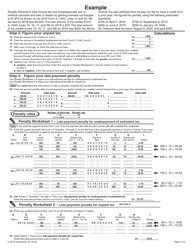

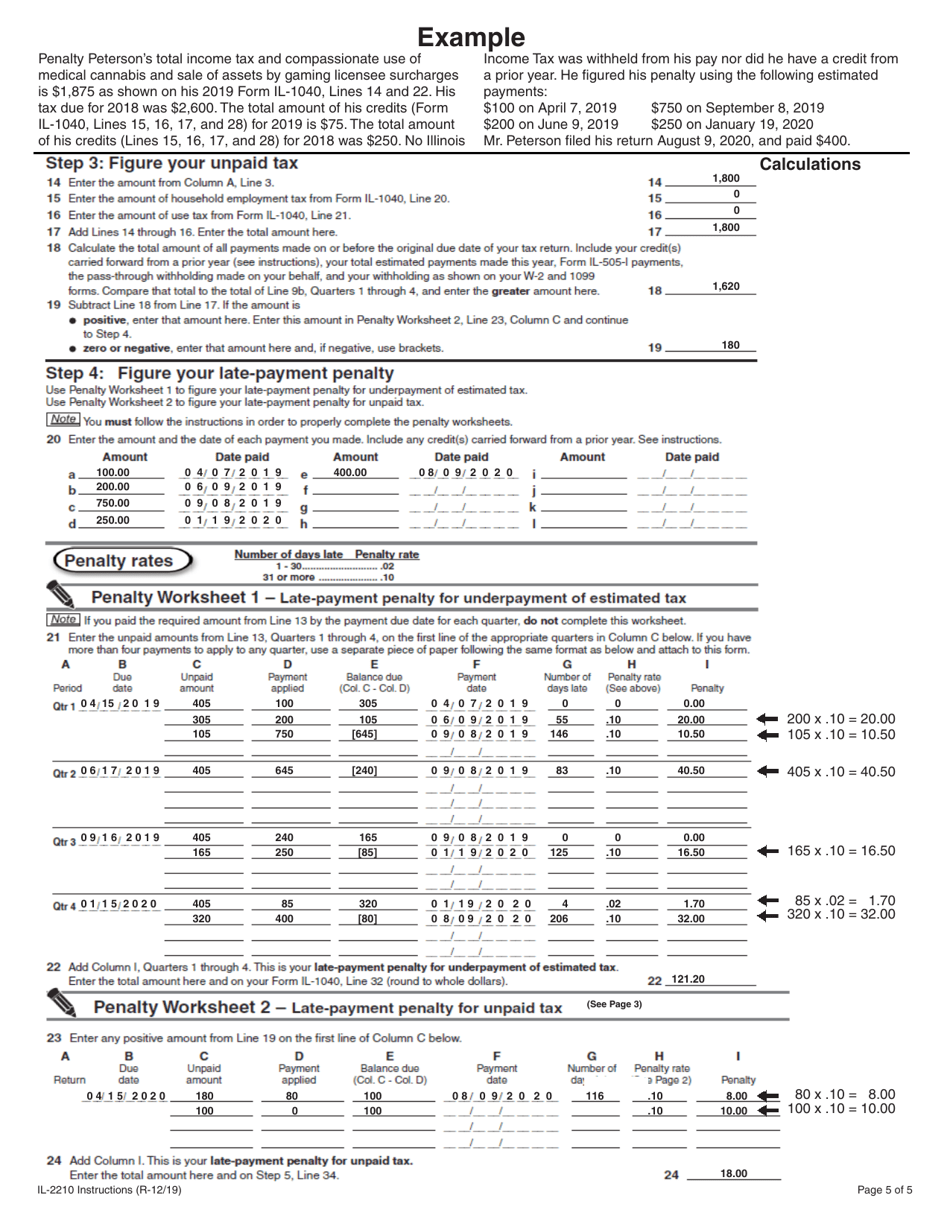

A: Form IL-2210 calculates penalties for underpayment of estimated tax and late payment.

Q: How do I fill out Form IL-2210?

A: Form IL-2210 requires you to provide information about your income, estimated tax payments, and any penalties you may owe.

Q: When is Form IL-2210 due?

A: Form IL-2210 is typically due on the same date as your Illinois income tax return, which is usually April 15th.

Q: Are there any exceptions or special circumstances for filing Form IL-2210?

A: There may be exceptions or special circumstances that exempt you from filing Form IL-2210. Consult the instructions or a tax professional for more information.

Q: What happens if I don't file Form IL-2210?

A: If you are required to file Form IL-2210 and do not do so, you may be subject to additional penalties and interest on your tax liability.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.