This version of the form is not currently in use and is provided for reference only. Download this version of

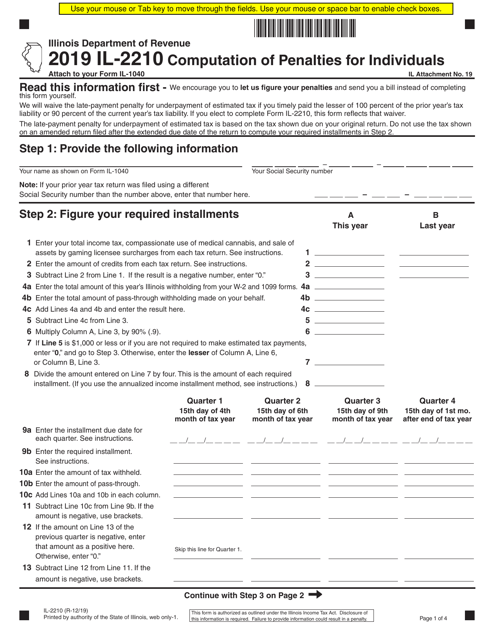

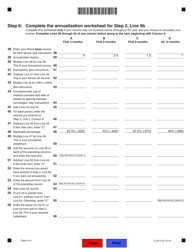

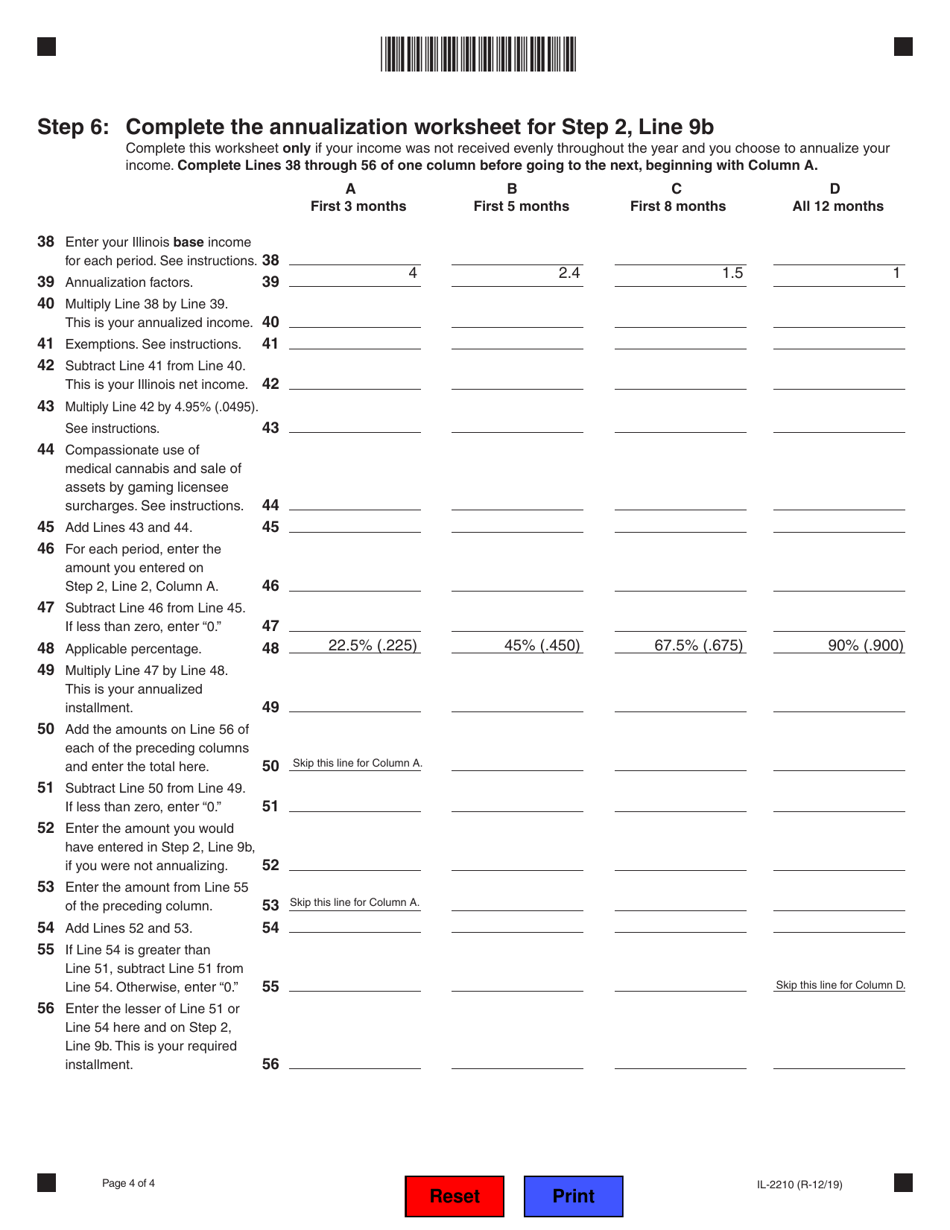

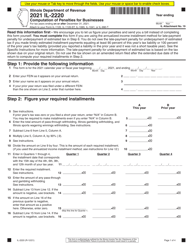

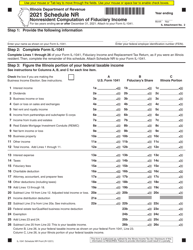

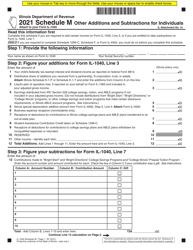

Form IL-2210

for the current year.

Form IL-2210 Computation of Penalties for Individuals - Illinois

What Is Form IL-2210?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-2210?

A: Form IL-2210 is a form used by individuals in Illinois to compute penalties for underpayment of estimated tax.

Q: Who needs to file Form IL-2210?

A: Individuals in Illinois who have underpaid their estimated tax may need to file Form IL-2210.

Q: What is the purpose of Form IL-2210?

A: The purpose of Form IL-2210 is to calculate any penalties owed for underpayment of estimated tax.

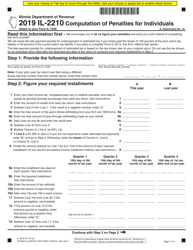

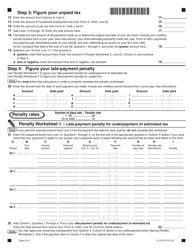

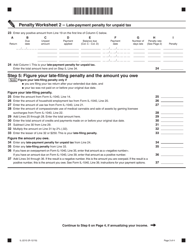

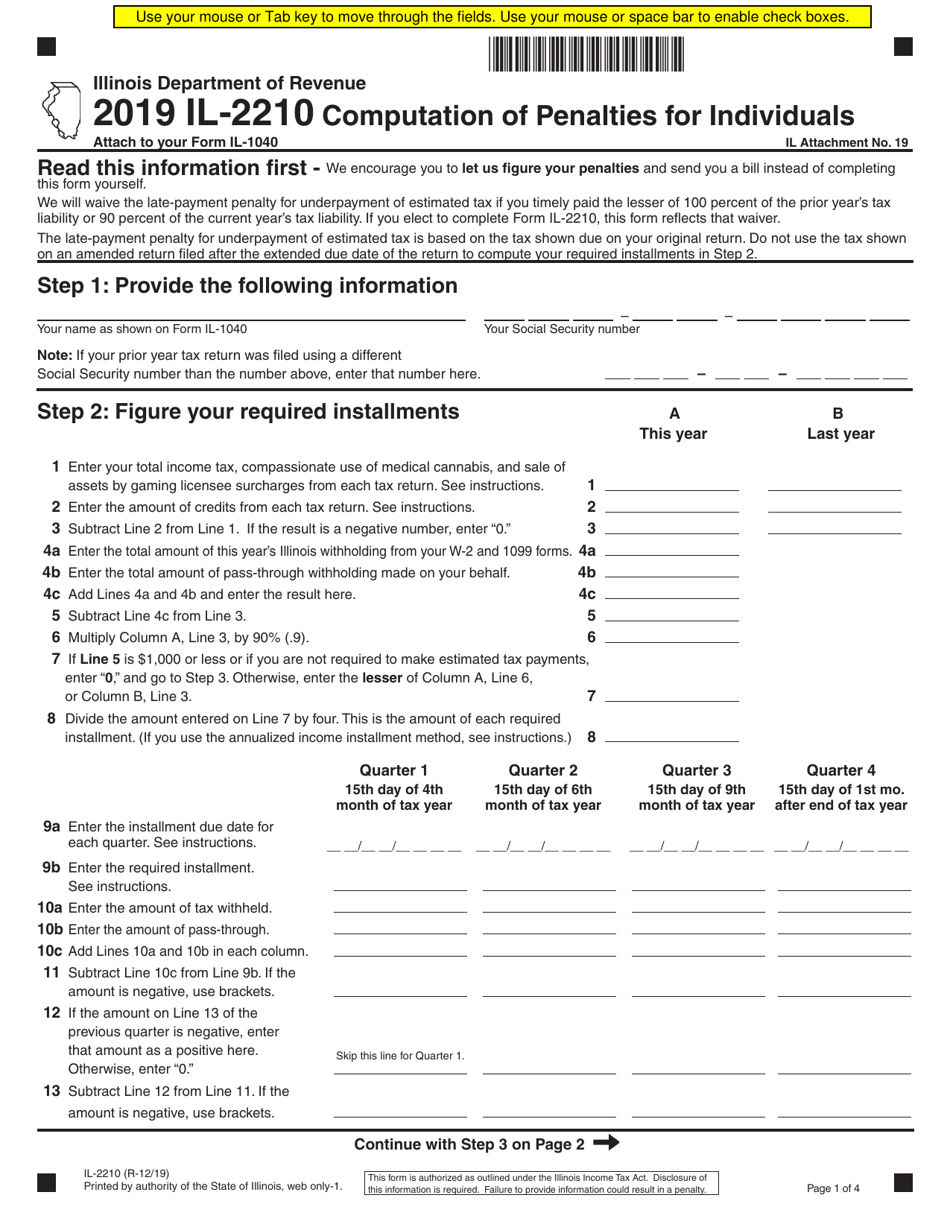

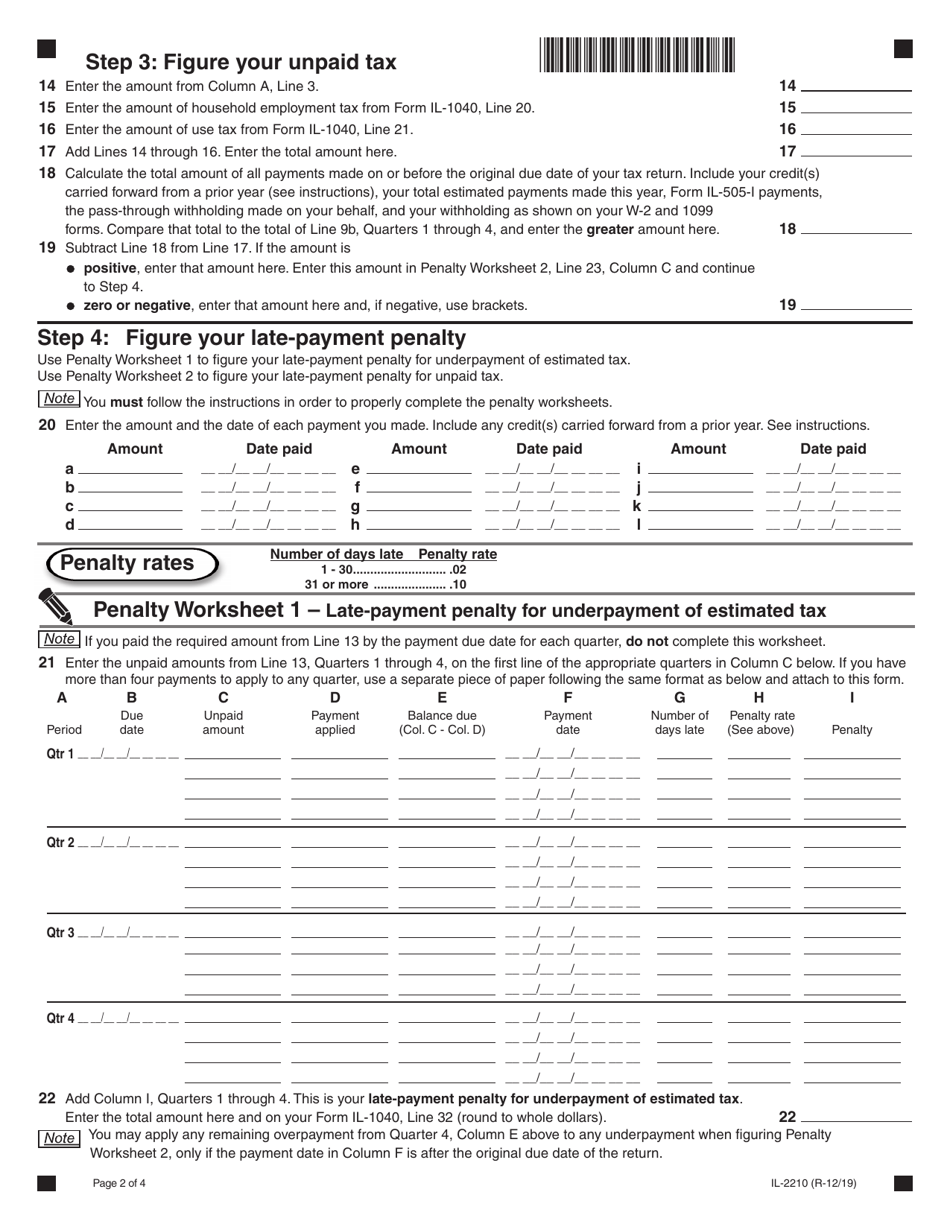

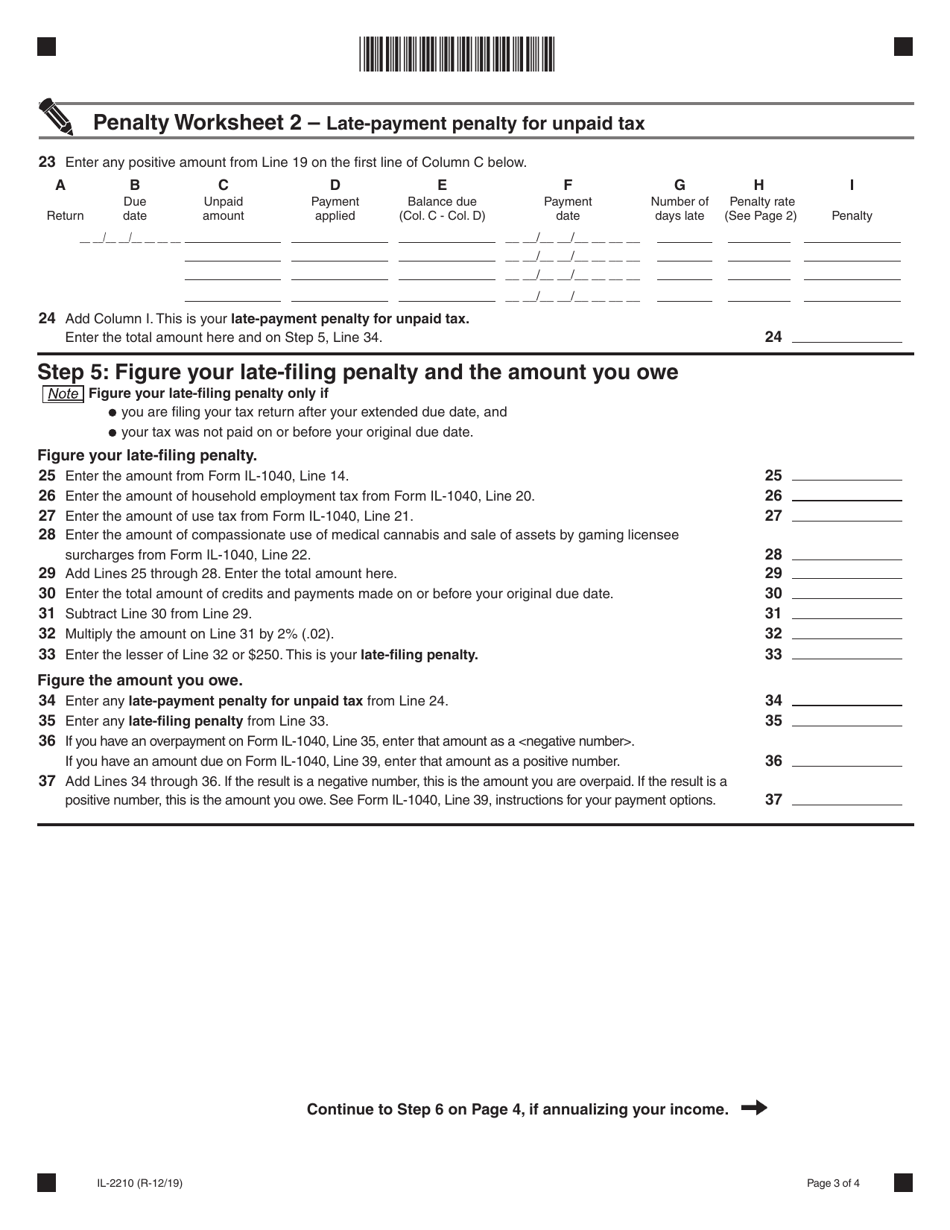

Q: How is the penalty calculated on Form IL-2210?

A: The penalty on Form IL-2210 is calculated based on the amount of unpaid tax and the number of days the tax was underpaid.

Q: When is Form IL-2210 due?

A: Form IL-2210 is due on the same date as your Illinois individual income tax return, which is typically April 15th.

Q: Are there any exemptions to the penalty on Form IL-2210?

A: Yes, there are certain exemptions available that may waive the penalty on Form IL-2210. These exemptions include exceptions for senior citizens, farmers, and others.

Q: Do I need to include Form IL-2210 with my tax return?

A: You may need to include Form IL-2210 with your tax return if you have underpaid your estimated tax and owe penalties.

Q: Can Form IL-2210 be filed electronically?

A: Yes, Form IL-2210 can be filed electronically through the Illinois Department of Revenue's e-file system.

Q: Can I amend my Form IL-2210 if I make a mistake?

A: Yes, you can amend Form IL-2210 if you make a mistake. You will need to file an amended form with the correct information.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2210 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.