This version of the form is not currently in use and is provided for reference only. Download this version of

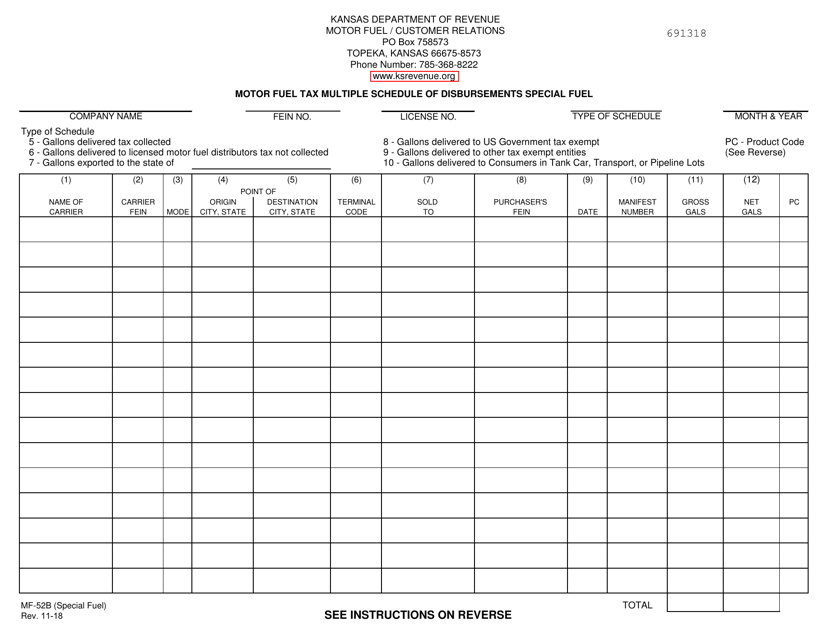

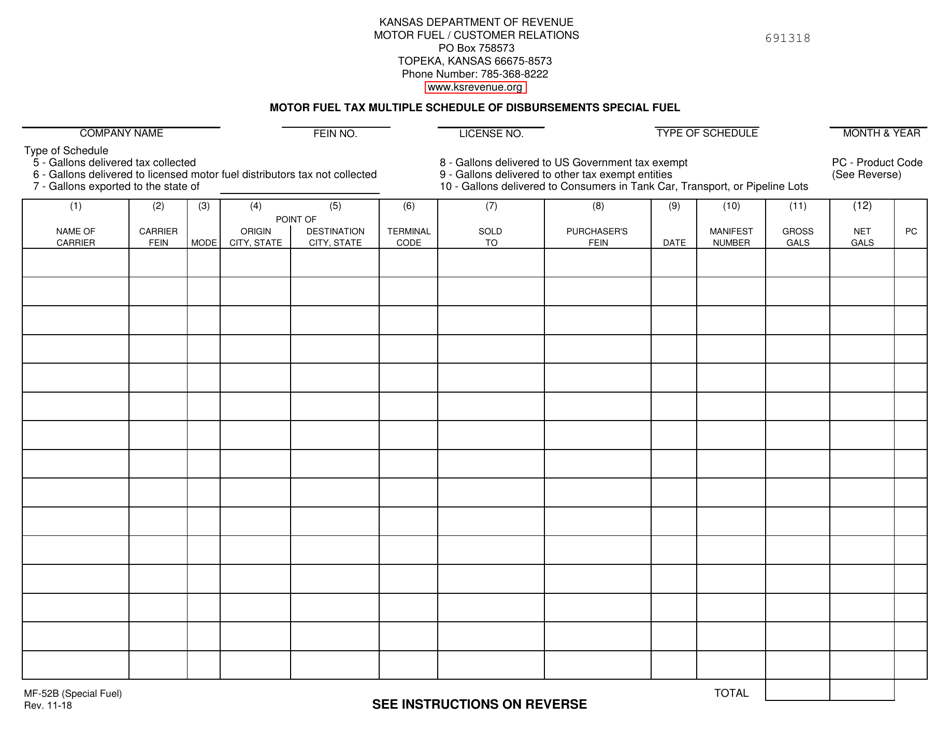

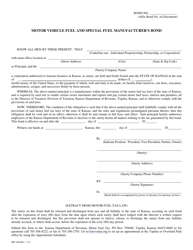

Form MF-52B (SPECIAL FUEL)

for the current year.

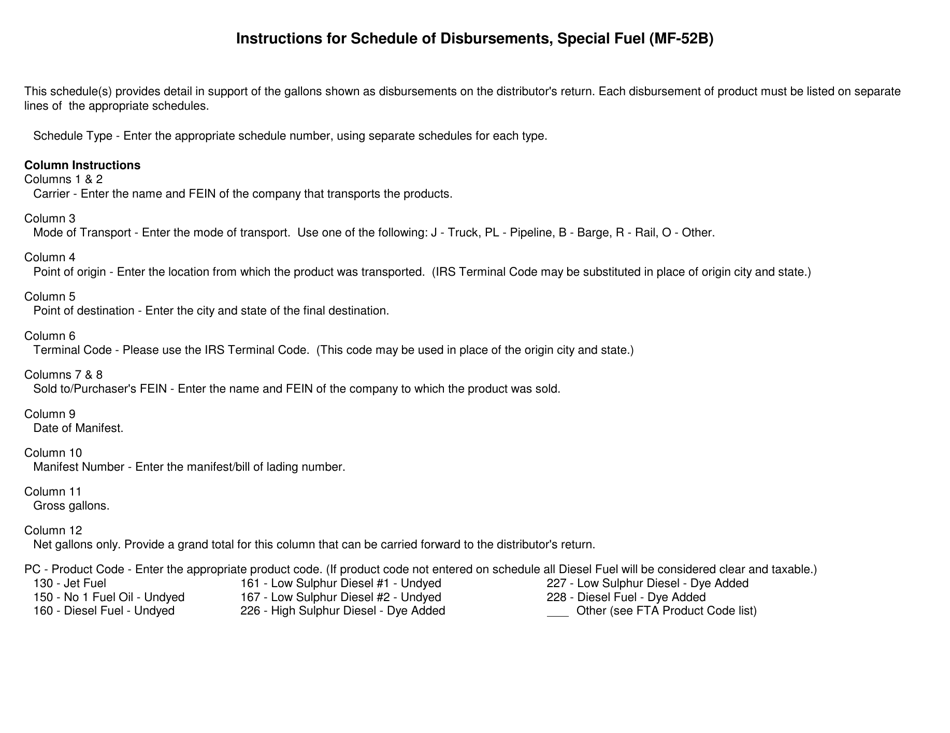

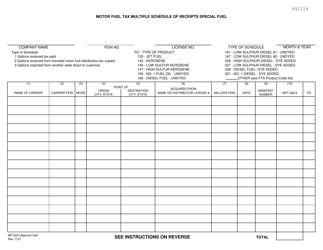

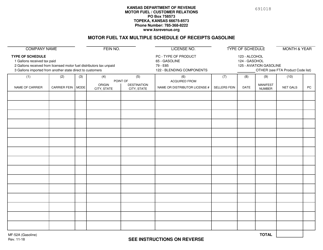

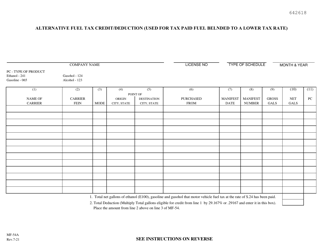

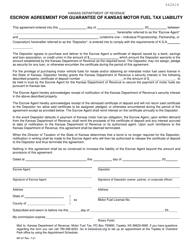

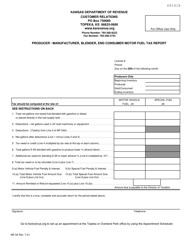

Form MF-52B (SPECIAL FUEL) Motor Fuel Tax Multiple Schedule of Disbursements Special Fuel - Kansas

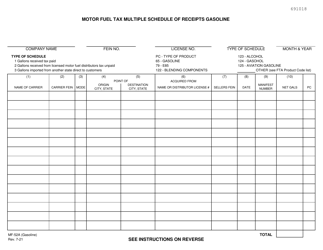

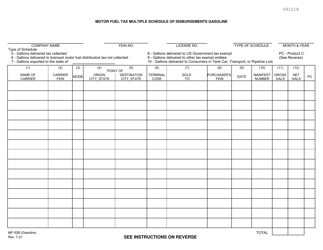

What Is Form MF-52B (SPECIAL FUEL)?

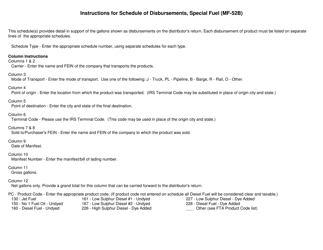

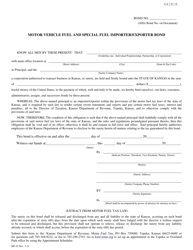

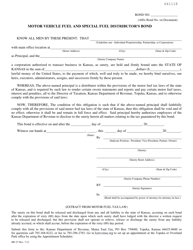

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

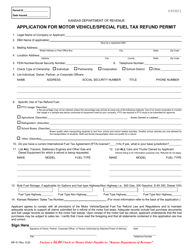

Q: What is Form MF-52B?

A: Form MF-52B is a schedule of disbursements for motor fuel tax for special fuel in Kansas.

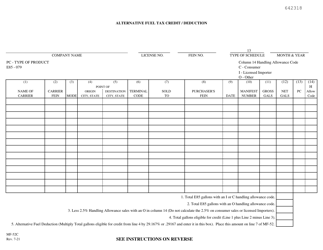

Q: What is special fuel?

A: Special fuel refers to fuel other than gasoline, diesel fuel, or kerosene that is used to propel motor vehicles, equipment, or machinery.

Q: Who needs to file Form MF-52B?

A: Businesses or individuals who use special fuel in Kansas and are subject to motor fuel tax must file Form MF-52B to report their disbursements.

Q: What is the purpose of Form MF-52B?

A: The purpose of Form MF-52B is to report the disbursements of special fuel and calculate the motor fuel tax owed to the state of Kansas.

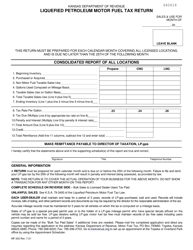

Q: How often should Form MF-52B be filed?

A: Form MF-52B should be filed monthly, along with payment of the motor fuel tax.

Q: Are there any exemptions for motor fuel tax in Kansas?

A: Yes, certain exemptions may apply, such as fuel used for agricultural purposes or fuel used in certain state or local government vehicles.

Q: What happens if I fail to file or pay the motor fuel tax?

A: Failure to file or pay the motor fuel tax can result in penalties and interest, as well as potential legal action by the state of Kansas.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-52B (SPECIAL FUEL) by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.