This version of the form is not currently in use and is provided for reference only. Download this version of

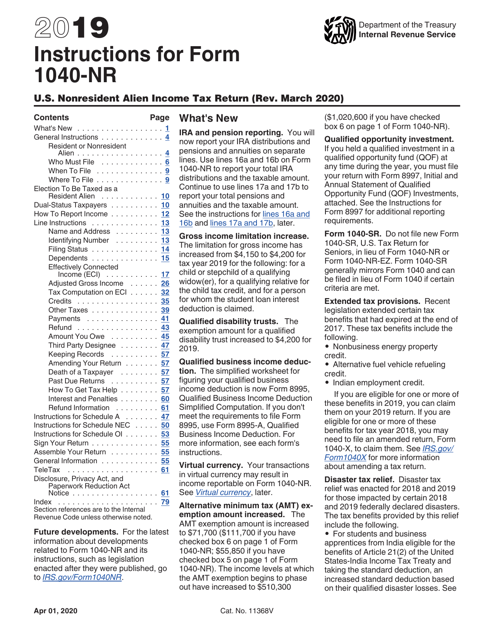

Instructions for IRS Form 1040-NR

for the current year.

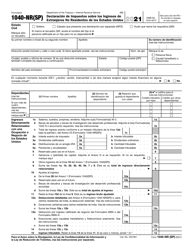

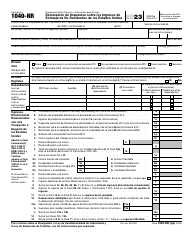

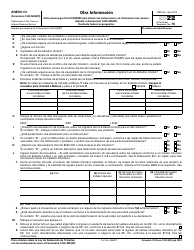

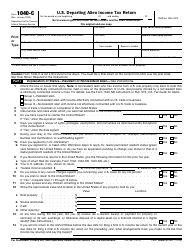

Instructions for IRS Form 1040-NR U.S. Nonresident Alien Income Tax Return

This document contains official instructions for IRS Form 1040-NR , U.S. Nonresident Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-NR is available for download through this link.

FAQ

Q: What is IRS Form 1040-NR?

A: IRS Form 1040-NR is the U.S. Nonresident Alien Income Tax Return.

Q: Who needs to file IRS Form 1040-NR?

A: Nonresident aliens who have earned income from U.S. sources need to file IRS Form 1040-NR.

Q: What is the purpose of filing IRS Form 1040-NR?

A: The purpose is to report and pay taxes on income earned in the U.S. by nonresident aliens.

Q: What are the filing requirements for IRS Form 1040-NR?

A: If you are a nonresident alien and have U.S. income that is subject to taxation, you need to file IRS Form 1040-NR.

Q: Can I use IRS Form 1040-NR if I am a U.S. citizen?

A: No, IRS Form 1040-NR is for nonresident aliens only. U.S. citizens should use different forms like Form 1040.

Q: When is the deadline for filing IRS Form 1040-NR?

A: The deadline for filing IRS Form 1040-NR is usually April 15th.

Q: Is there any penalty for late filing of IRS Form 1040-NR?

A: Yes, there may be penalties for late filing or failure to file IRS Form 1040-NR.

Q: Do I need to include my foreign income on IRS Form 1040-NR?

A: No, IRS Form 1040-NR is only for reporting U.S. source income. Foreign income should be reported on other forms.

Q: Can I e-file IRS Form 1040-NR?

A: No, currently e-filing is not available for IRS Form 1040-NR. It must be filed by mail.

Instruction Details:

- This 80-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.