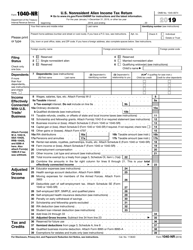

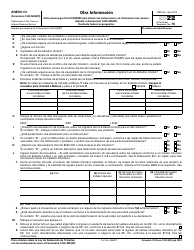

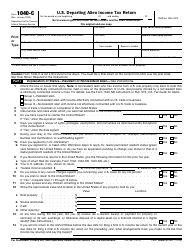

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040-NR

for the current year.

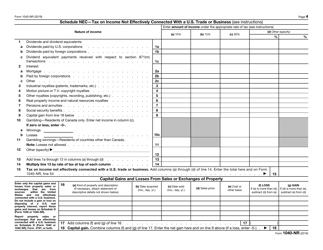

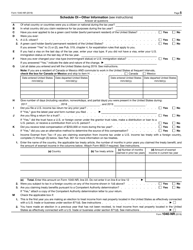

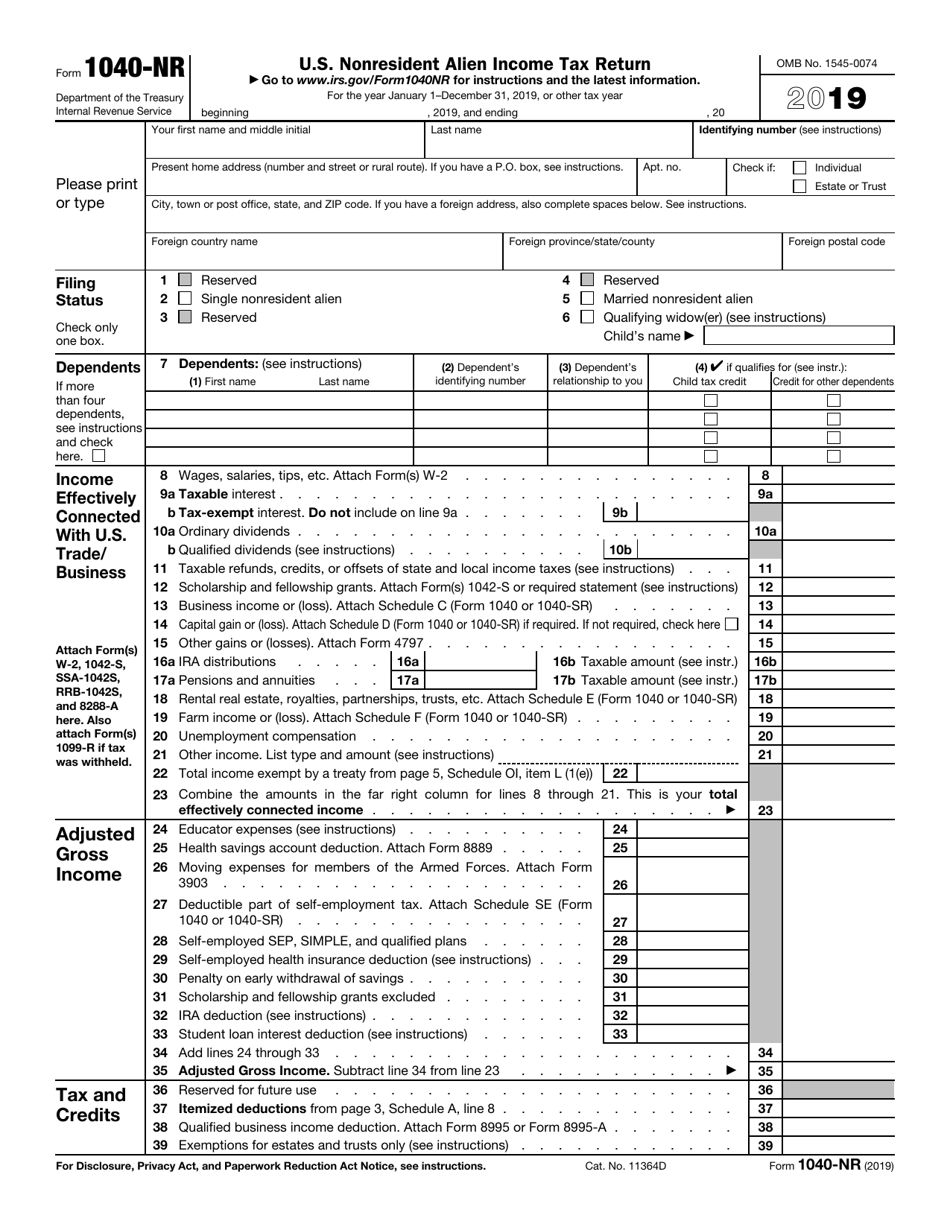

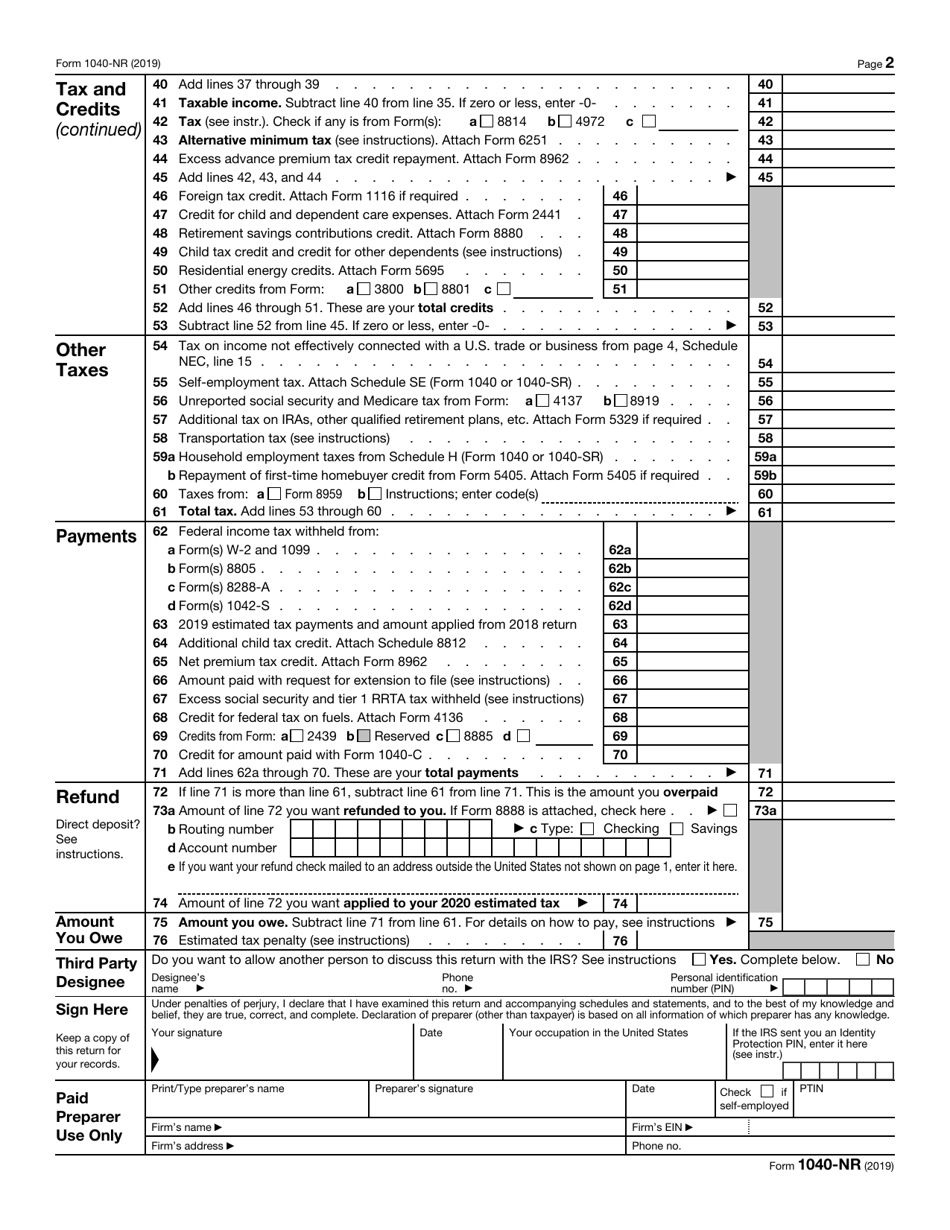

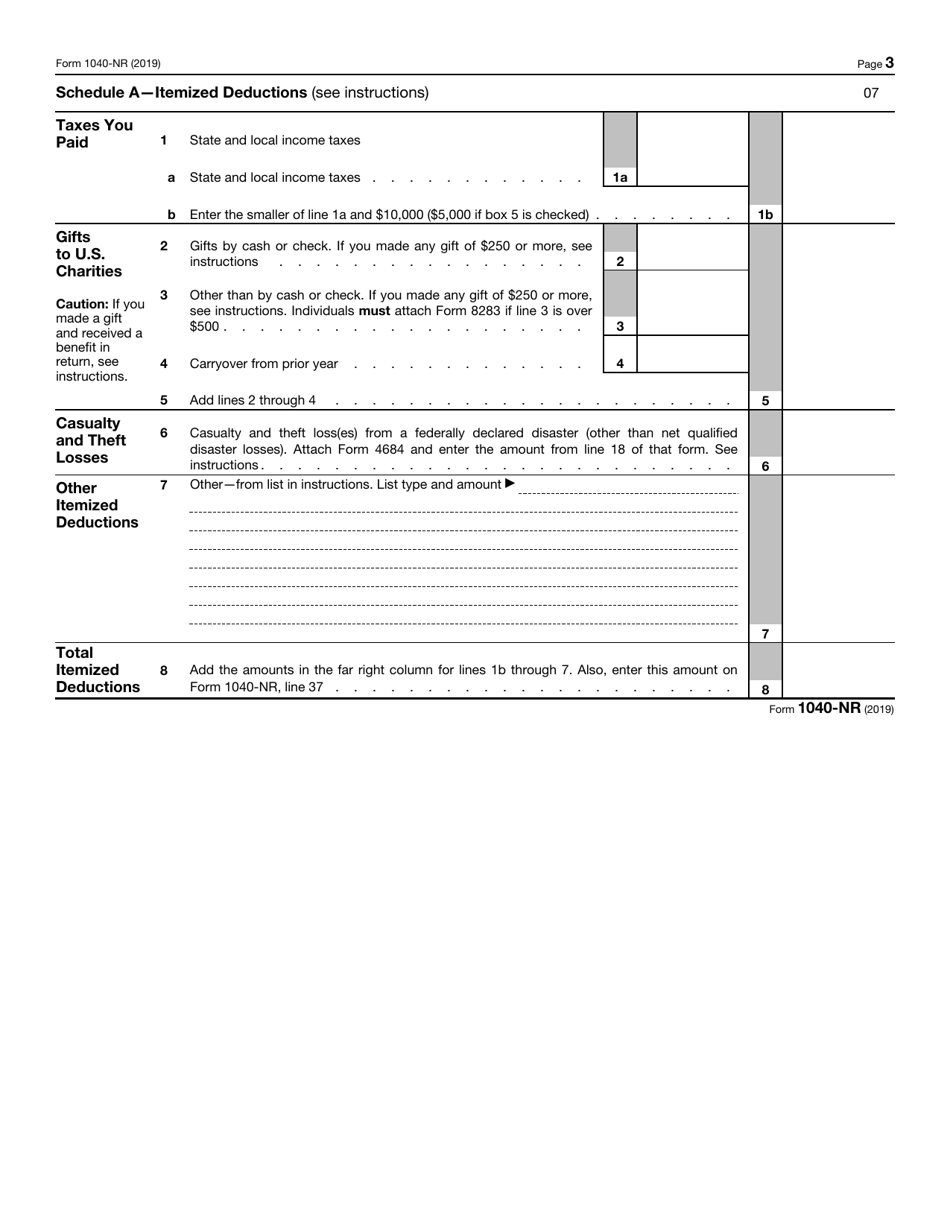

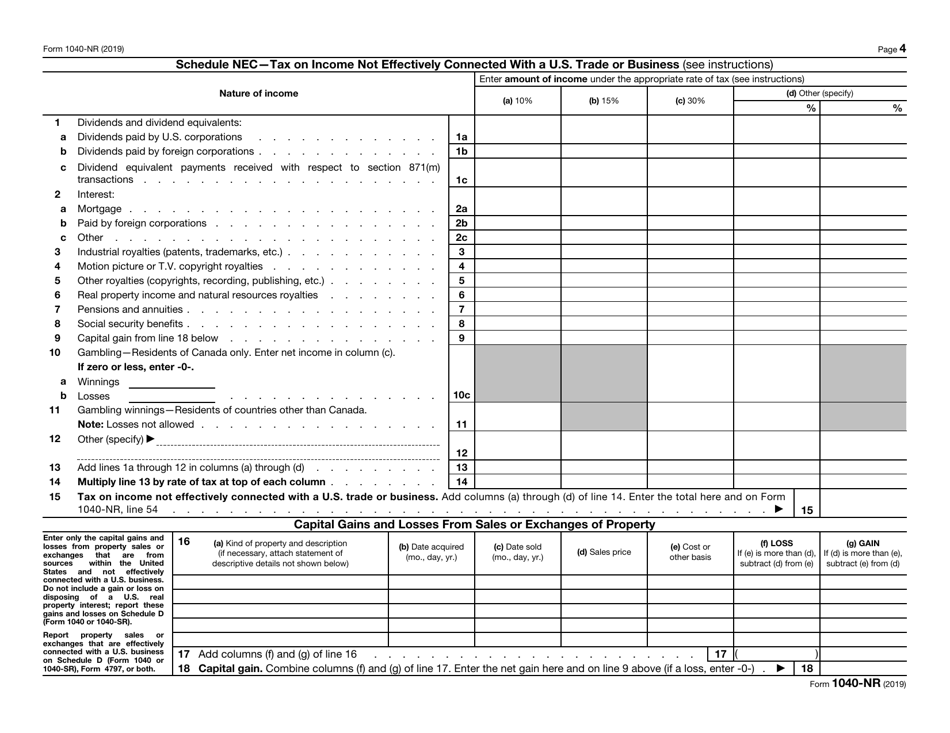

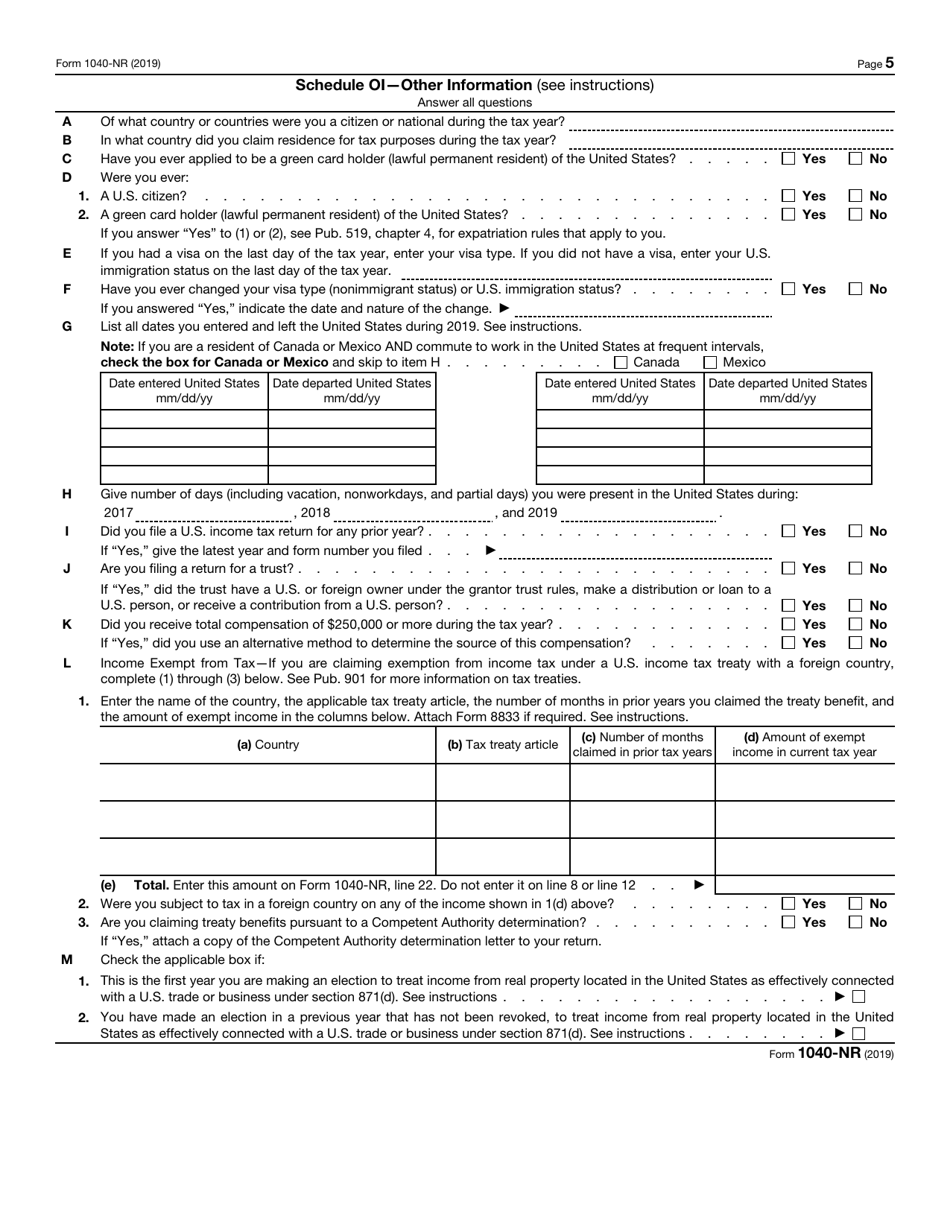

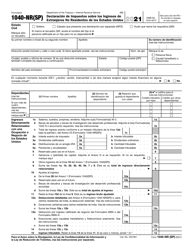

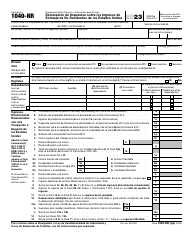

IRS Form 1040-NR U.S. Nonresident Alien Income Tax Return

What Is IRS Form 1040-NR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-NR?

A: IRS Form 1040-NR is the U.S. Nonresident Alien Income Tax Return.

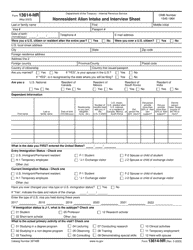

Q: Who needs to file Form 1040-NR?

A: Nonresident aliens who have income from U.S. sources or who want to claim a refund of overpaid taxes need to file Form 1040-NR.

Q: What is the purpose of Form 1040-NR?

A: The purpose of Form 1040-NR is to report and calculate the tax liability or refund for nonresident aliens who have income from U.S. sources.

Q: Are all nonresident aliens required to file Form 1040-NR?

A: No, not all nonresident aliens are required to file Form 1040-NR. It depends on their income and specific circumstances.

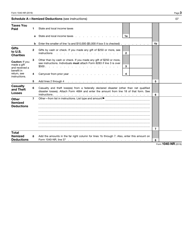

Q: Can nonresident aliens claim deductions and credits on Form 1040-NR?

A: Yes, nonresident aliens may be eligible to claim certain deductions and credits on Form 1040-NR.

Q: Is there a due date for filing Form 1040-NR?

A: Yes, the due date for filing Form 1040-NR is generally April 15th, but it can vary depending on individual circumstances.

Q: What happens if I fail to file Form 1040-NR?

A: If you are required to file Form 1040-NR and fail to do so, you may face penalties and interest on the unpaid taxes.

Q: Can I e-file Form 1040-NR?

A: Yes, nonresident aliens can e-file Form 1040-NR using certain approved tax software or through a tax professional.

Q: Can I get an extension to file Form 1040-NR?

A: Yes, you can request an extension to file Form 1040-NR using Form 4868, but you must still pay any taxes owed by the original due date.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-NR through the link below or browse more documents in our library of IRS Forms.