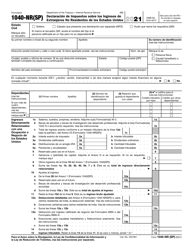

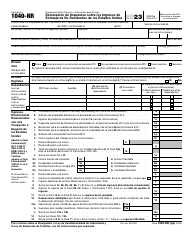

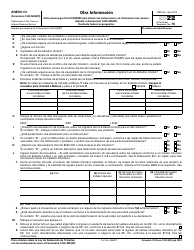

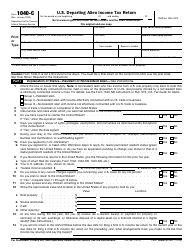

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-NR

for the current year.

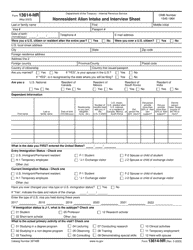

Instructions for IRS Form 1040-NR U.S. Nonresident Alien Income Tax Return

This document contains official instructions for IRS Form 1040-NR , U.S. Nonresident Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-NR is available for download through this link.

FAQ

Q: What is IRS Form 1040-NR?

A: IRS Form 1040-NR is the U.S. Nonresident Alien Income Tax Return.

Q: Who needs to file IRS Form 1040-NR?

A: Nonresident aliens who have income from U.S. sources need to file IRS Form 1040-NR.

Q: What is considered U.S. source income?

A: U.S. source income includes wages, salaries, tips, and income from investments or business activities in the U.S.

Q: Are there any exceptions for filing IRS Form 1040-NR?

A: Yes, there are certain exceptions based on income and residency status. It is best to consult the IRS or a tax professional for specific guidance.

Q: What documents do I need to complete IRS Form 1040-NR?

A: You will generally need your passport, visa, and any relevant income statements, such as W-2 forms or 1099 forms.

Q: Is there a deadline for filing IRS Form 1040-NR?

A: Yes, the deadline for filing IRS Form 1040-NR is usually April 15th, but it may vary depending on individual circumstances.

Q: Can I claim tax deductions or credits on IRS Form 1040-NR?

A: Yes, nonresident aliens may be eligible for certain deductions or credits, such as the standard deduction or the foreign tax credit. However, eligibility criteria and limitations apply.

Q: What happens if I don't file IRS Form 1040-NR?

A: If you are required to file IRS Form 1040-NR but fail to do so, you may face penalties, interest, and other consequences from the IRS.

Instruction Details:

- This 80-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.