This version of the form is not currently in use and is provided for reference only. Download this version of

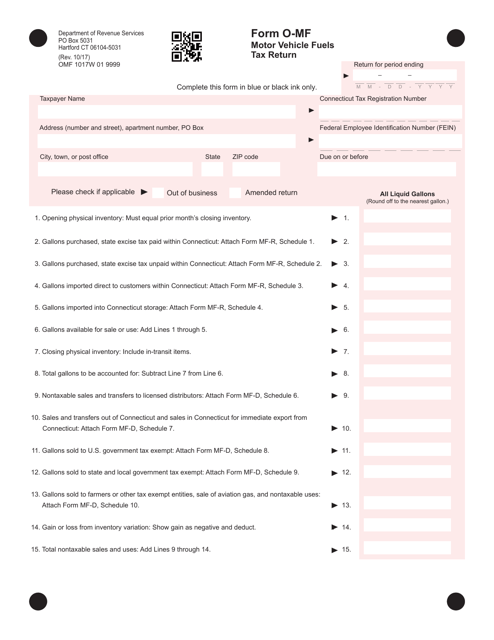

Form O-MF

for the current year.

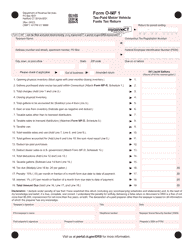

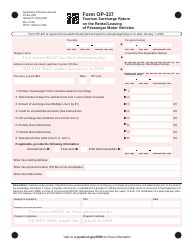

Form O-MF Motor Vehicle Fuels Tax Return - Connecticut

What Is Form O-MF?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form O-MF?

A: Form O-MF is the Motor Vehicle Fuels Tax Return used in Connecticut.

Q: Who needs to file Form O-MF?

A: Anyone who sells or uses taxable motor vehicle fuels in Connecticut needs to file Form O-MF.

Q: What is motor vehicle fuels tax?

A: Motor vehicle fuels tax is a tax imposed on the sale or use of certain fuels used to power motor vehicles.

Q: How often do I need to file Form O-MF?

A: Form O-MF must be filed monthly on or before the 25th day of the month following the taxable period.

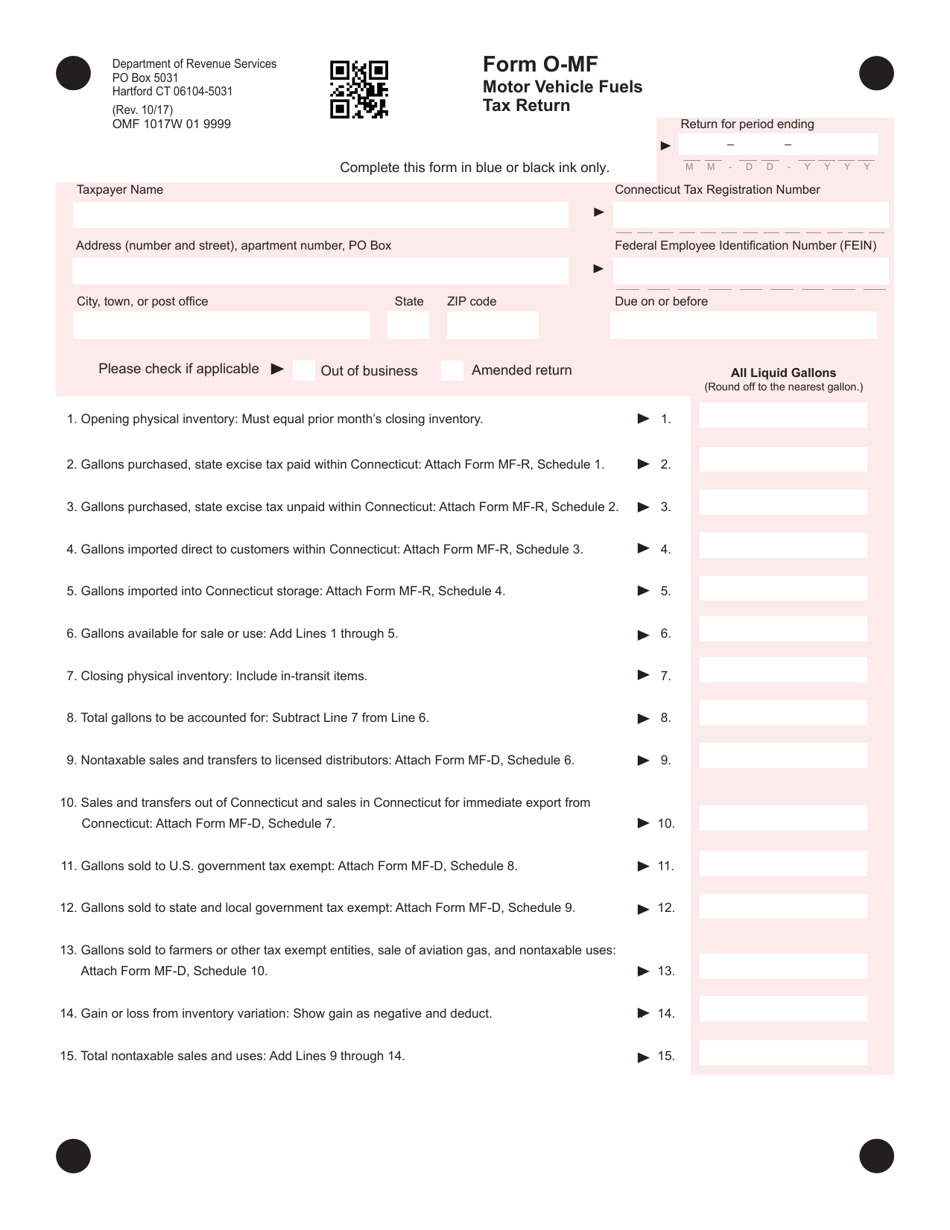

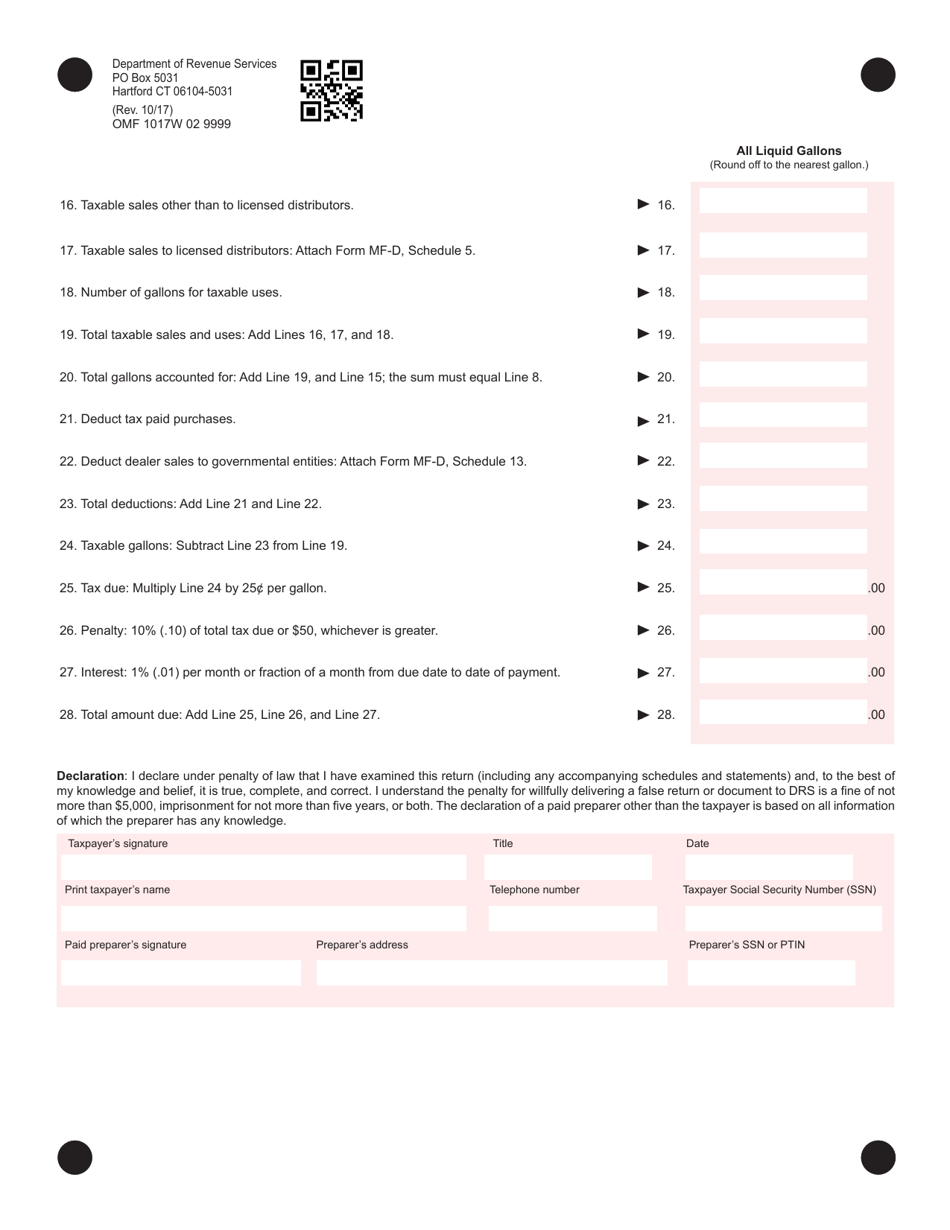

Q: What information do I need to include on Form O-MF?

A: You need to provide information such as fuel sales, fuel inventory, taxable gallons, and tax due.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges and possible audits.

Q: Can I file Form O-MF electronically?

A: Yes, the Connecticut Department of Revenue Services offers the option to file Form O-MF electronically.

Q: What other documentation do I need to include with Form O-MF?

A: You may need to include copies of invoices, bills of lading, or other supporting documentation with Form O-MF.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form O-MF by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.