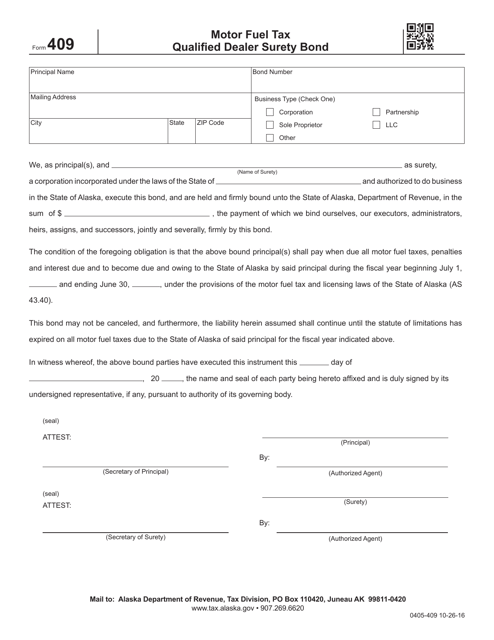

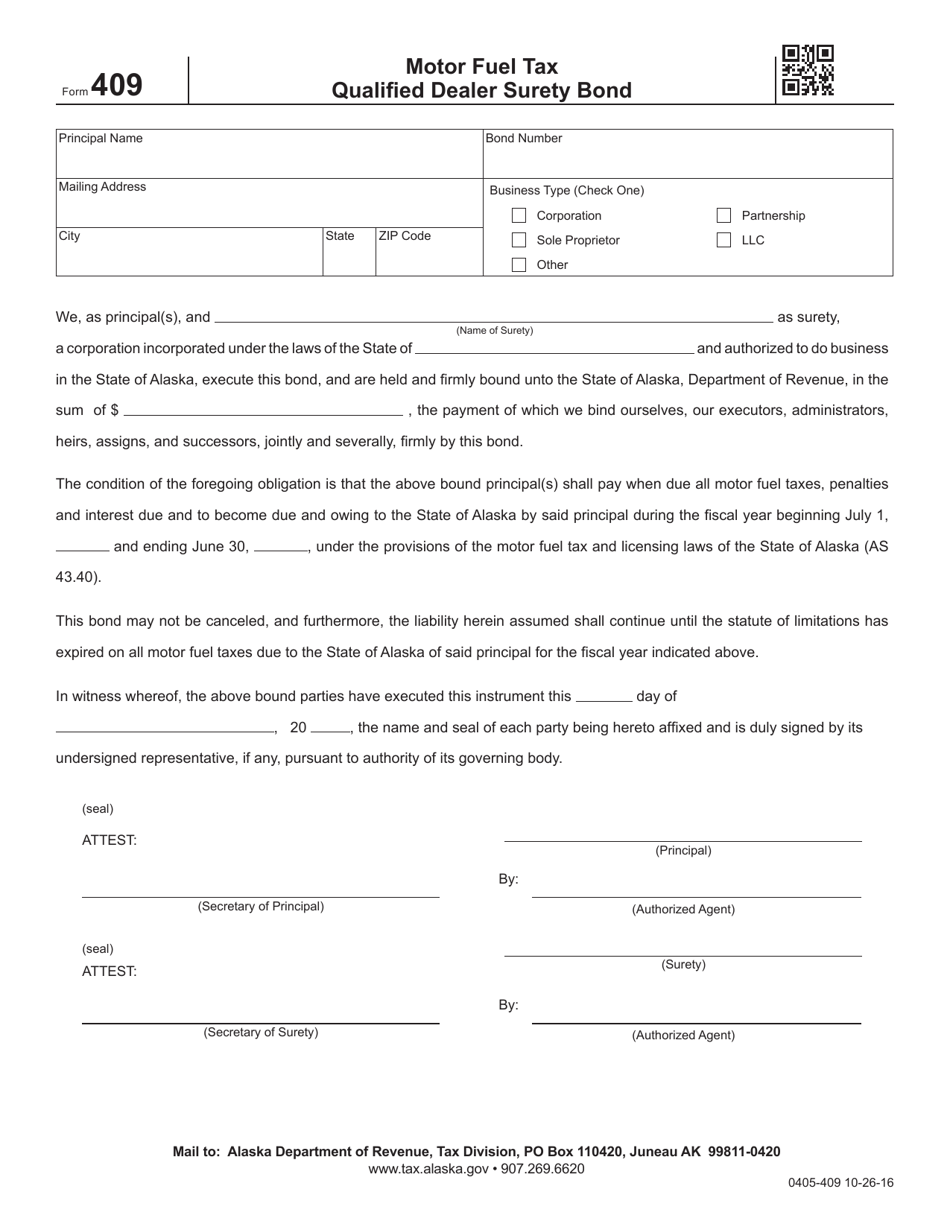

Form 409 Motor Fuel Tax Qualified Dealer Surety Bond - Alaska

What Is Form 409?

This is a legal form that was released by the Alaska Department of Revenue - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 409?

A: Form 409 is the Motor Fuel Tax Qualified Dealer Surety Bond used in Alaska.

Q: What is the purpose of Form 409?

A: The purpose of Form 409 is to provide a surety bond that guarantees the payment of motor fuel taxes by qualified dealers in Alaska.

Q: Who needs to fill out Form 409?

A: Qualified dealers of motor fuel in Alaska need to fill out Form 409.

Q: How much is the surety bond amount?

A: The surety bond amount varies depending on the qualified dealer's average monthly motor fuel tax liability.

Q: What happens if a qualified dealer fails to pay motor fuel taxes?

A: If a qualified dealer fails to pay motor fuel taxes, the surety bond can be used to cover the outstanding amount.

Q: How long is the surety bond valid for?

A: The surety bond is valid for one year and needs to be renewed annually.

Q: Are there any fees associated with Form 409?

A: Yes, there are fees associated with Form 409. The fees depend on the dealer's average monthly motor fuel tax liability.

Q: What if I have more questions about Form 409?

A: If you have more questions about Form 409, you can contact the Alaska Department of Revenue's Motor Fuel Tax Section for assistance.

Form Details:

- Released on October 26, 2016;

- The latest edition provided by the Alaska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 409 by clicking the link below or browse more documents and templates provided by the Alaska Department of Revenue.