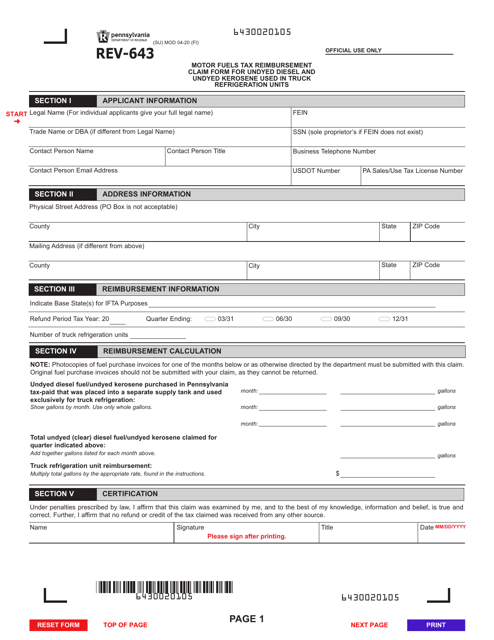

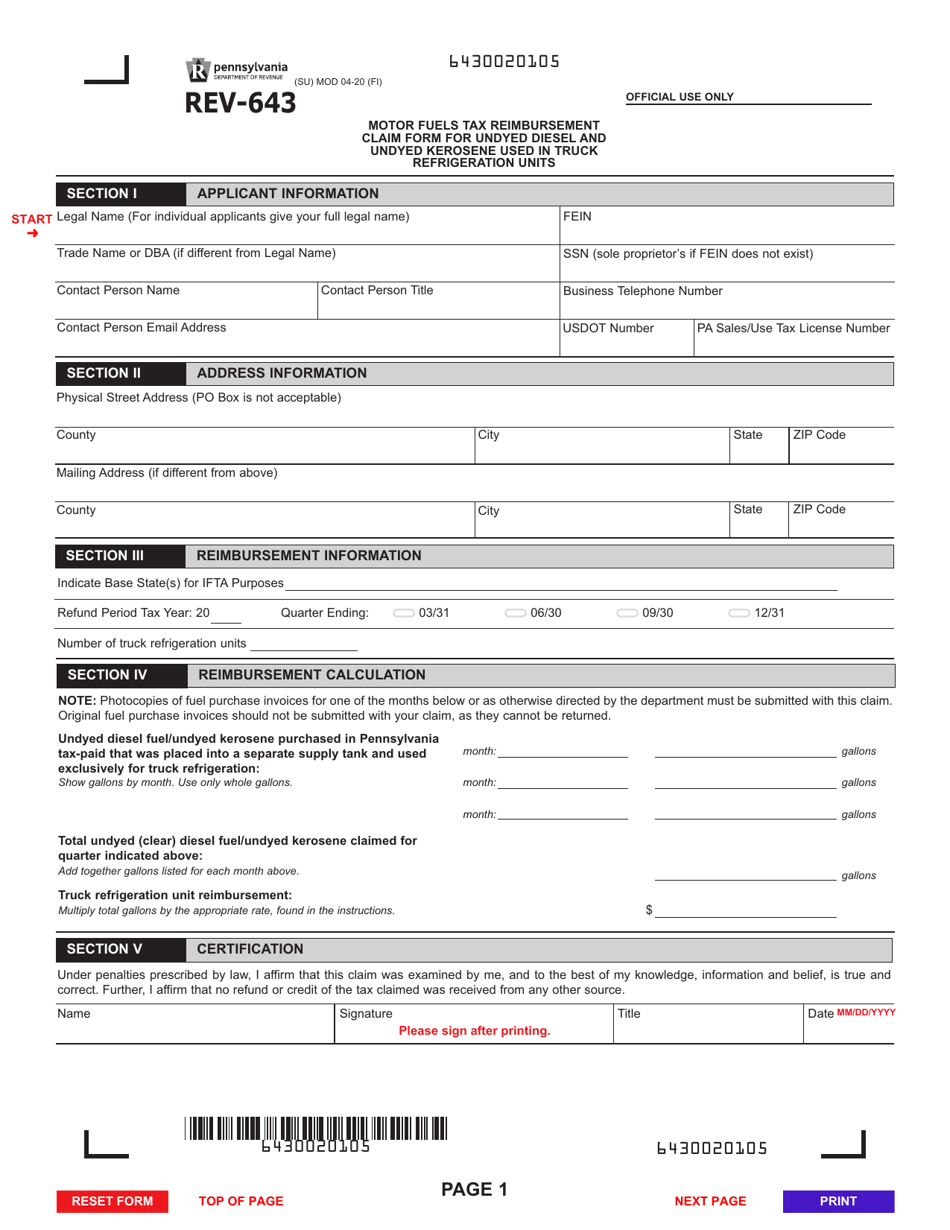

Form REV-643 Motor Fuels Tax Reimbursement Claim Form for Undyed Diesel and Undyed Kerosene Used in Truck Refrigeration Units - Pennsylvania

What Is Form REV-643?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-643?

A: Form REV-643 is a Motor Fuels Tax Reimbursement Claim form for undyed diesel and undyed kerosene used in truck refrigeration units in Pennsylvania.

Q: Who can use Form REV-643?

A: Truck owners or operators who use undyed diesel or undyed kerosene in their refrigeration units can use Form REV-643.

Q: What is the purpose of Form REV-643?

A: The purpose of Form REV-643 is to claim a reimbursement for motor fuelstax paid on undyed diesel and undyed kerosene used in truck refrigeration units.

Q: What information do I need to fill out Form REV-643?

A: You will need information such as your contact details, fuel consumption records, and proof of tax payment to fill out Form REV-643.

Q: When is the deadline for submitting Form REV-643?

A: Form REV-643 must be submitted no later than three years from the date of the purchase or delivery of the motor fuel.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-643 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.