This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-T

for the current year.

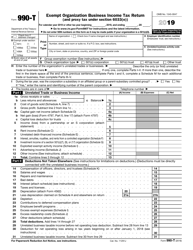

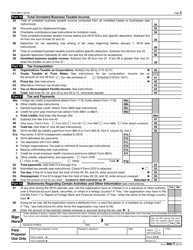

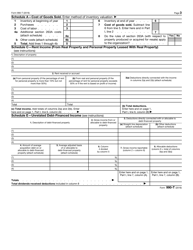

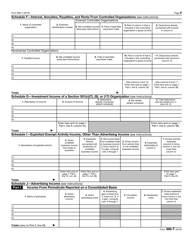

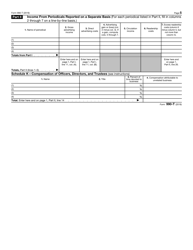

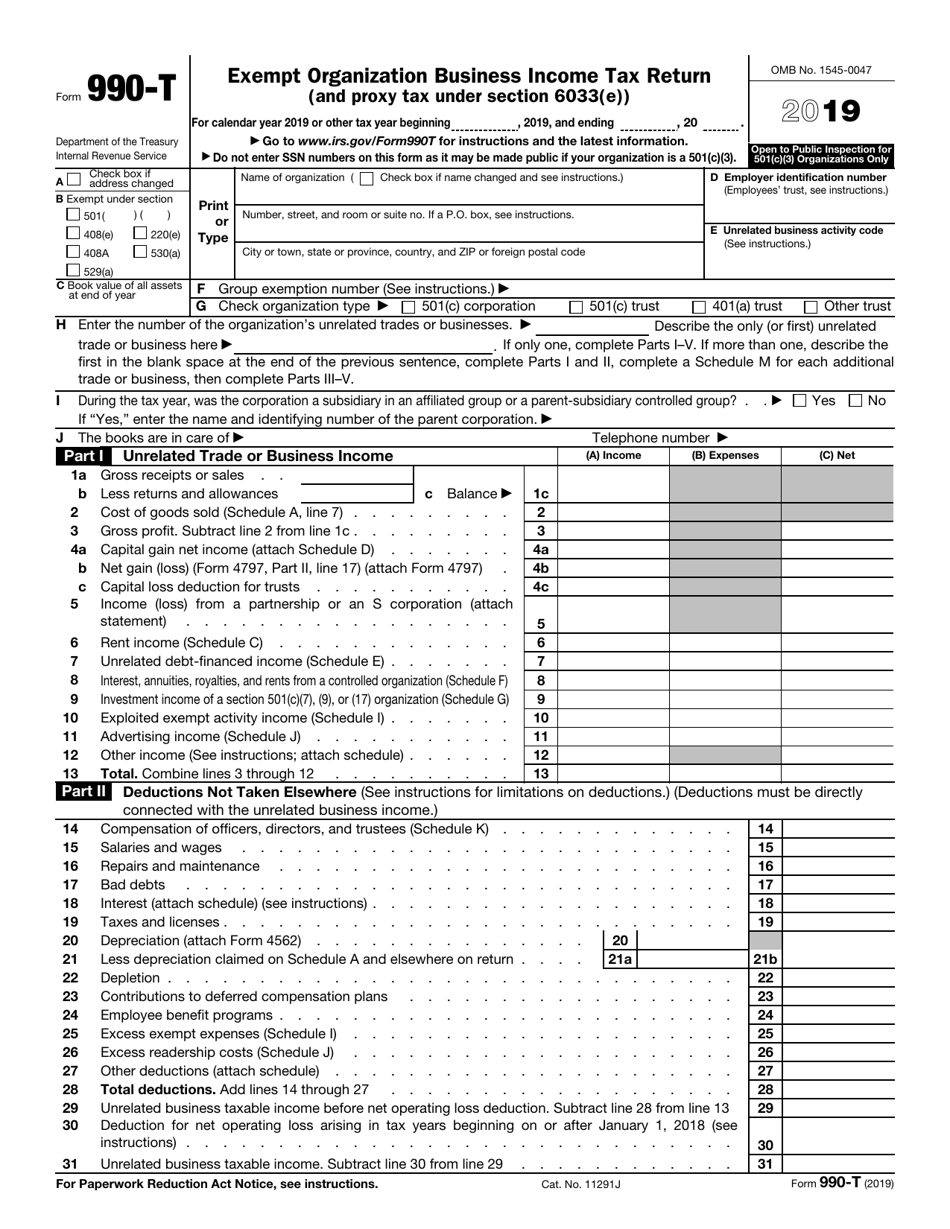

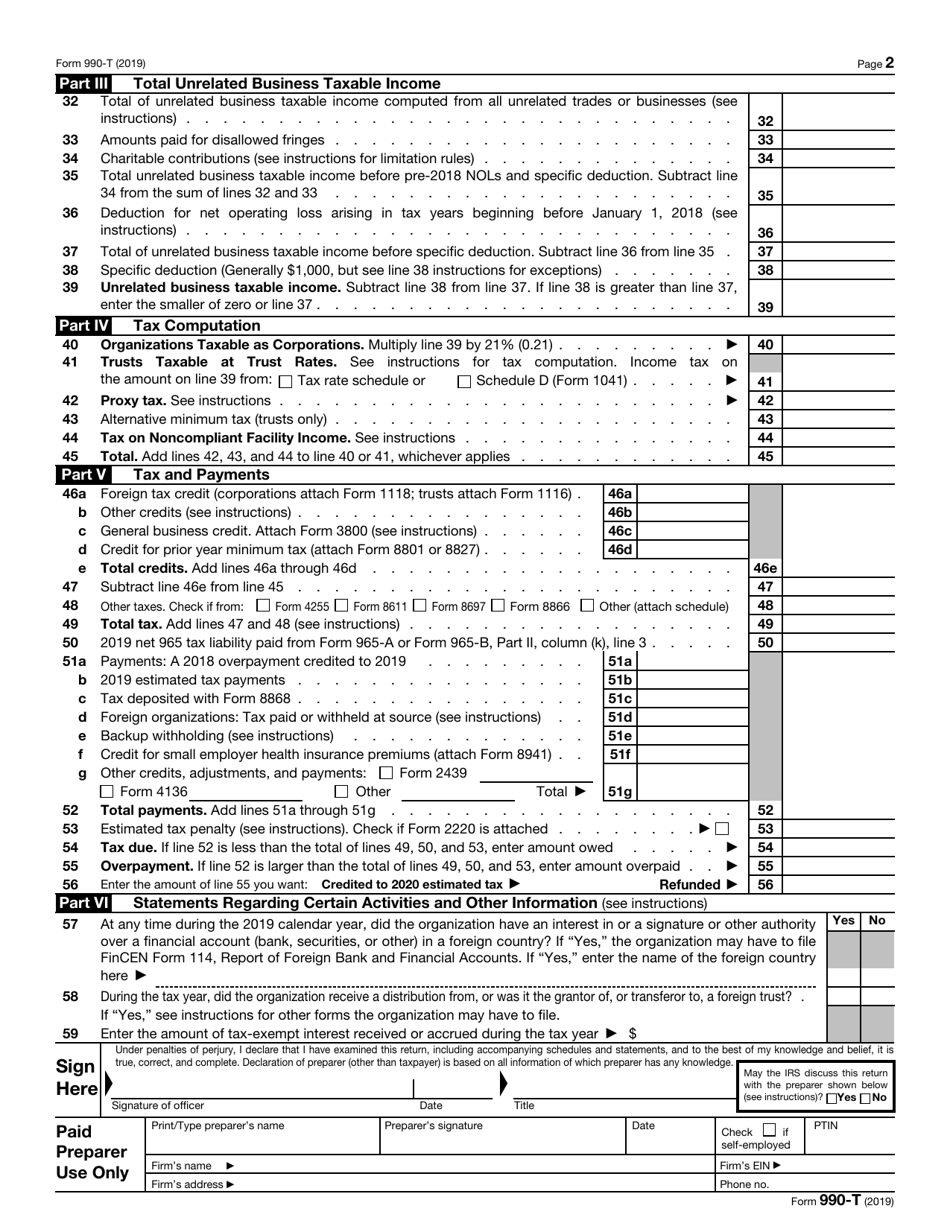

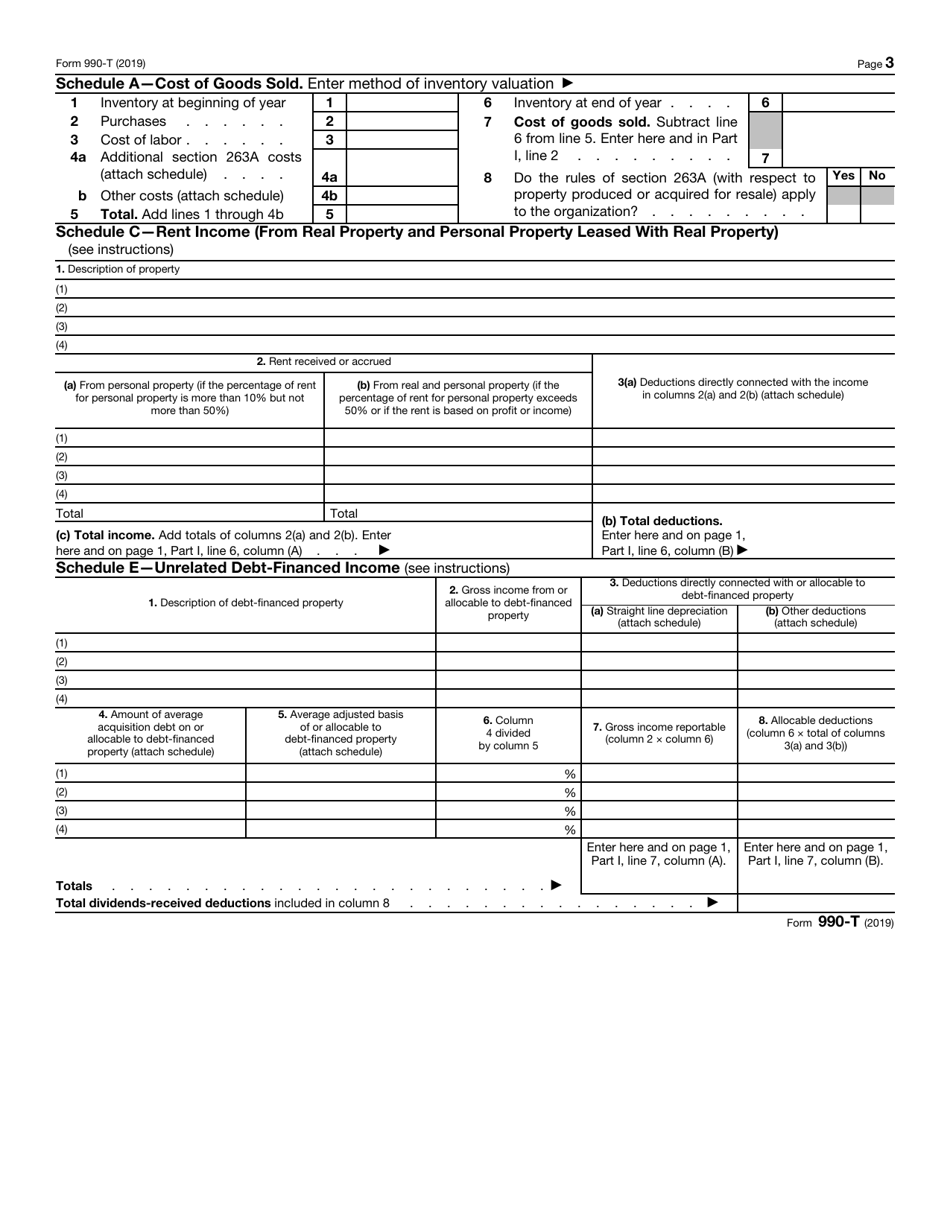

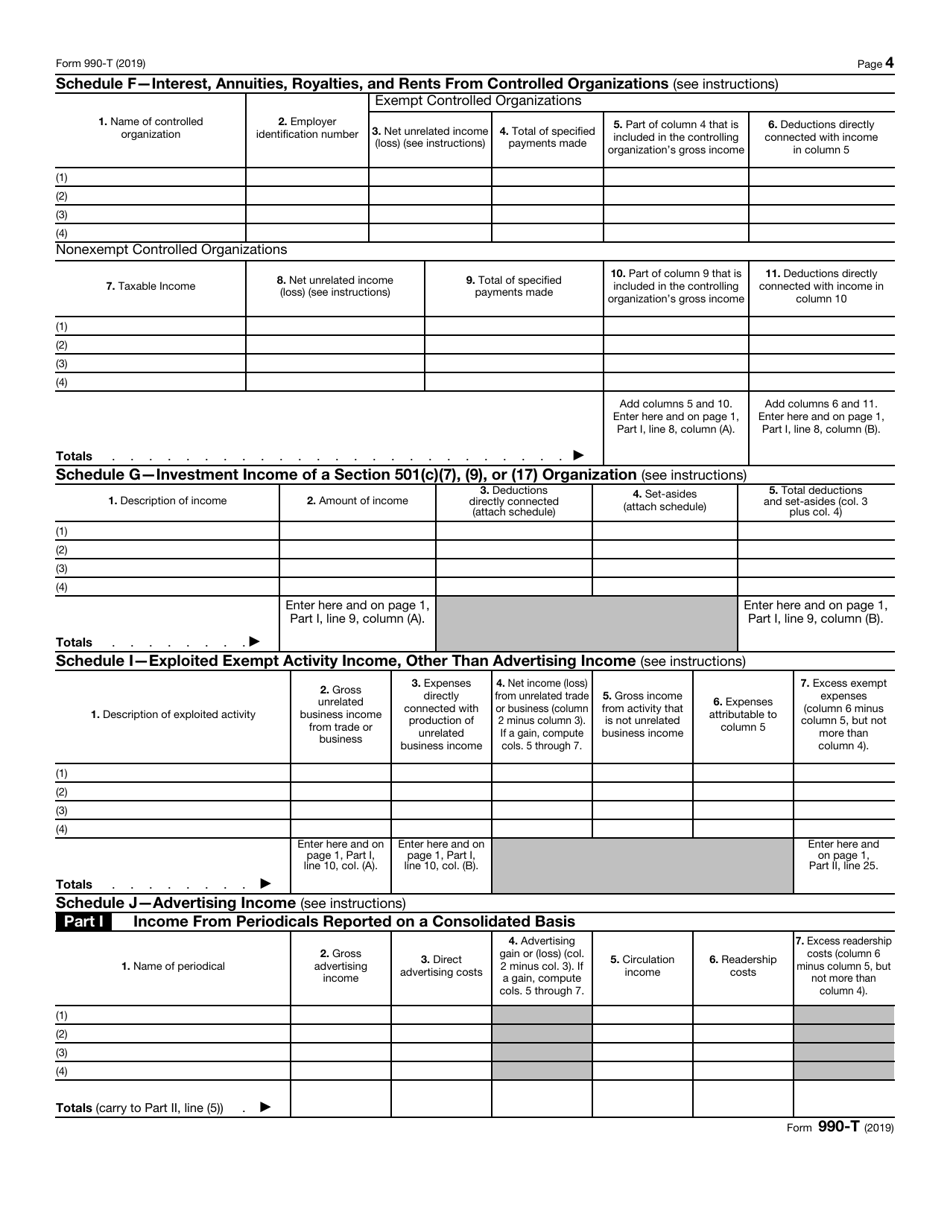

IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

What Is IRS Form 990-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is a tax return form for exempt organizations to report their business income.

Q: Who needs to file IRS Form 990-T?

A: Exempt organizations that have unrelated business income (UBI) of $1,000 or more must file IRS Form 990-T.

Q: What is unrelated business income?

A: Unrelated business income refers to income generated from a trade or business that is not substantially related to the organization's exempt purpose.

Q: What is the purpose of IRS Form 990-T?

A: The purpose of IRS Form 990-T is to calculate and report the tax owed on an exempt organization's unrelated business income.

Q: What is proxy tax under Section 6033(e)?

A: Proxy tax under Section 6033(e) refers to the tax imposed on certain tax-exempt organizations that spend excessive amounts on lobbying activities.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-T through the link below or browse more documents in our library of IRS Forms.