This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-T

for the current year.

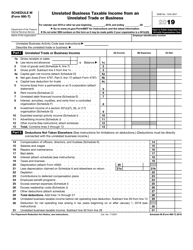

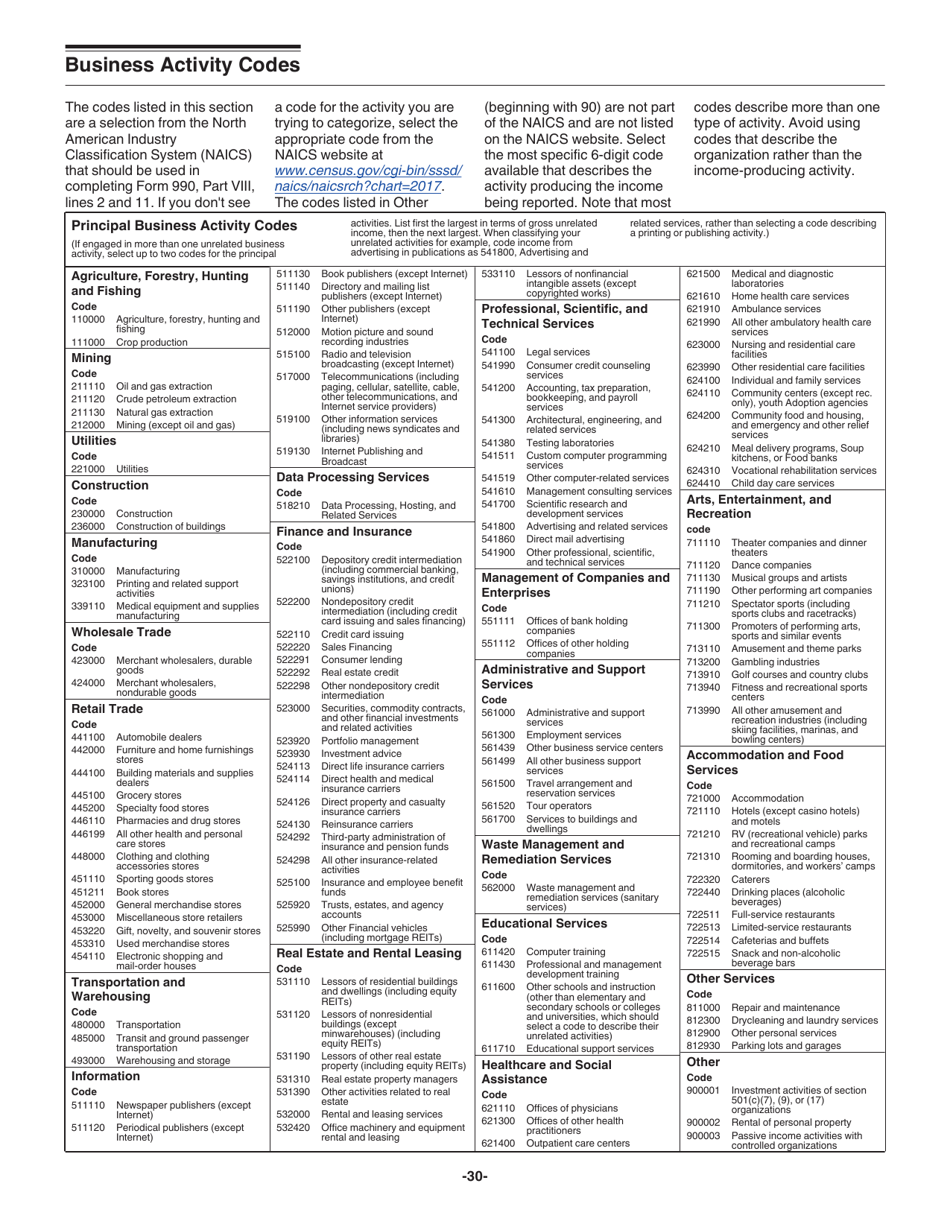

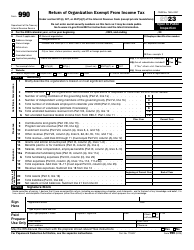

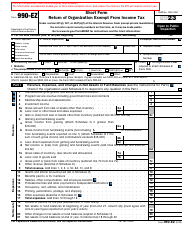

Instructions for IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

This document contains official instructions for IRS Form 990-T , Exempt Organization Proxy Tax Under Section 6033(E)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-T Schedule M is available for download through this link.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is the Exempt Organization Business Income Tax Return.

Q: Who needs to file IRS Form 990-T?

A: Exempt organizations with business income of $1,000 or more need to file IRS Form 990-T.

Q: What is the purpose of filing IRS Form 990-T?

A: The purpose of filing IRS Form 990-T is to report and pay taxes on business income earned by exempt organizations.

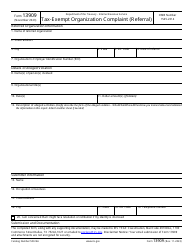

Q: What is proxy tax under Section 6033(E)?

A: Proxy tax under Section 6033(E) is a tax imposed on certain lobbying and political expenditures by exempt organizations.

Q: Who needs to pay proxy tax under Section 6033(E)?

A: Exempt organizations that engage in lobbying or political activities may need to pay proxy tax under Section 6033(E).

Q: Are there any exemptions or deductions available on IRS Form 990-T?

A: Yes, certain exemptions and deductions are available on IRS Form 990-T, such as deductions for expenses directly connected to unrelated business income.

Q: What are the filing deadlines for IRS Form 990-T?

A: The filing deadline for IRS Form 990-T is generally the 15th day of the 5th month after the end of the organization's fiscal year.

Instruction Details:

- This 32-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.