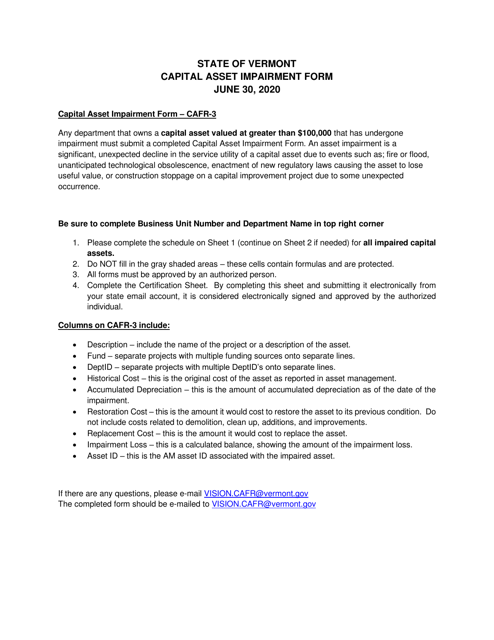

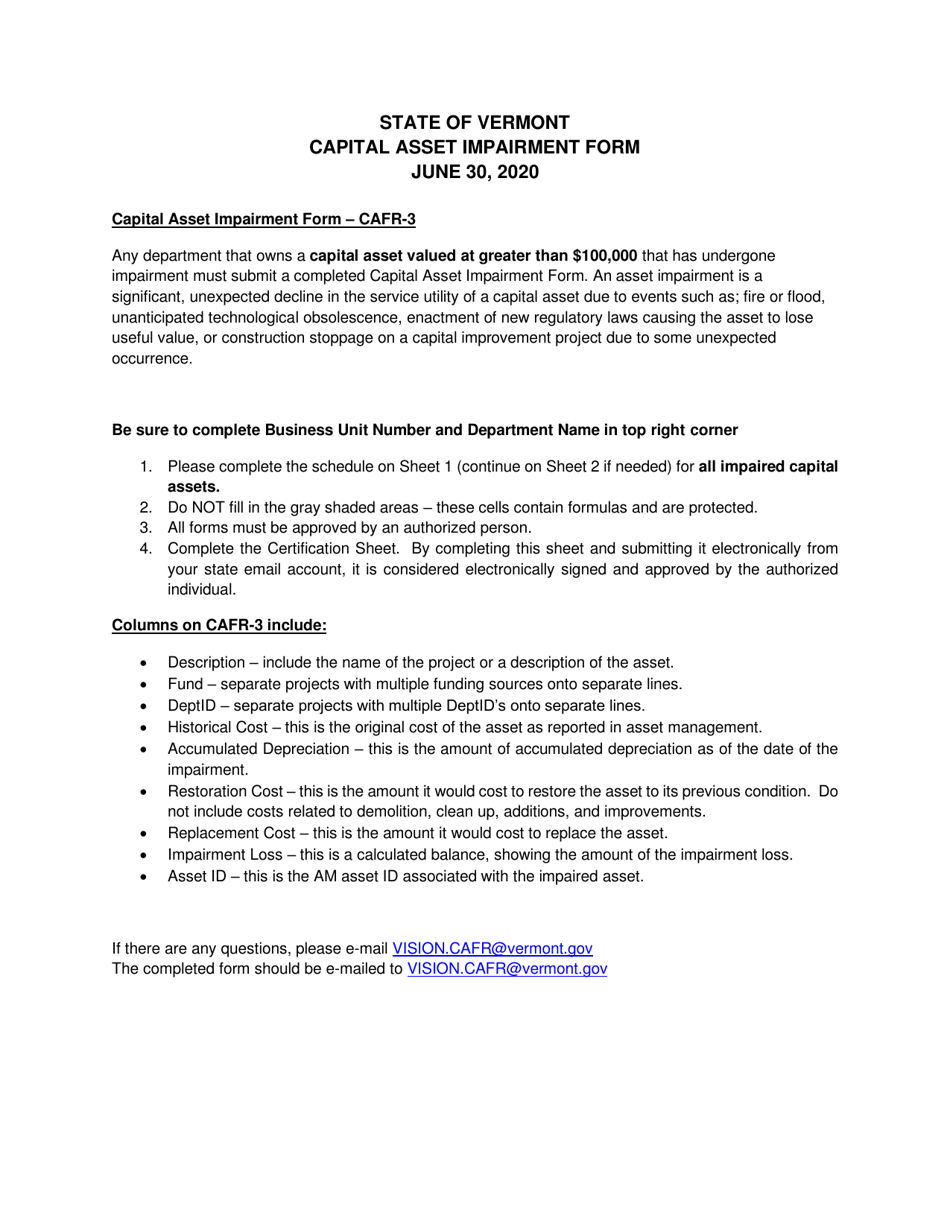

Instructions for Form CAFR-3 Capital Asset Impairment Form - Vermont

This document contains official instructions for Form CAFR-3 , Capital Asset Impairment Form - a form released and collected by the Vermont Department of Finance & Management.

FAQ

Q: What is Form CAFR-3?

A: Form CAFR-3 is the Capital Asset Impairment Form.

Q: What is the purpose of Form CAFR-3?

A: The purpose of Form CAFR-3 is to report any impairment of capital assets in Vermont.

Q: Who needs to file Form CAFR-3?

A: All entities in Vermont that have capital assets and experienced impairments need to file Form CAFR-3.

Q: When is Form CAFR-3 due?

A: Form CAFR-3 is due within 90 days after the end of the calendar year.

Q: What information do I need to provide on Form CAFR-3?

A: You need to provide information about the impaired capital assets, including the description, cost, date of impairment, and estimated fair value.

Q: Are there any penalties for not filing Form CAFR-3?

A: Yes, there may be penalties for failure to file or for filing false or incomplete information on Form CAFR-3. It is important to file the form accurately and on time.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Finance & Management.