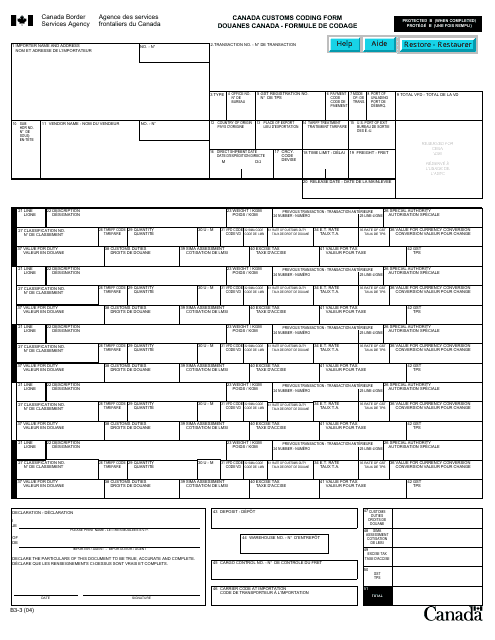

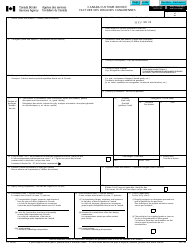

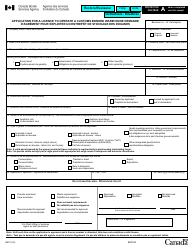

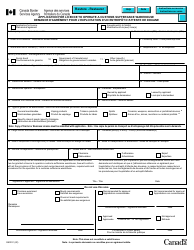

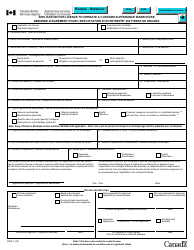

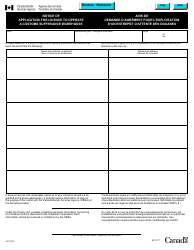

Form B3-3 Canada Customs Coding Form - Canada (English / French)

What Is Form B3-3?

Form B3-3, Canada Customs Coding Form, is used to describe any type of goods, materials, animals, or other items that are imported by a business entity into Canada. This form helps take an extensive account of each different item being imported in order to ensure anything imported into Canada has met strict inspection measures.

Alternate Name:

- Canada Customs Declaration Form;

- Canada Customs Form.

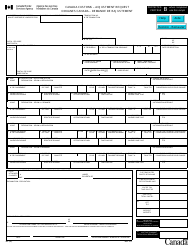

There will also be several times you will need the specific code number on the document to describe values such as another country's currency, imports from the United States that will use a three-letter code, and items imported from other countries that will use a two letter code.

This form is issued by the Canadian Border Services Agency and was last updated on January 1, 2004. A fillable Canada Customs Declaration Form is available for download through the link below.

How to Fill Out B3-3 Form?

To complete a Canada Customs Form you will want to include the following information:

- Your information and address as the importing entity:

- Transaction number for the imports, office number you are registering at, Goods and Services Tax (GST) information, payment, how the items will be transported into Canada, and the total monetary value amount being declared.

- Name of the vendor, country where the items originated from, port the items exited the country from, any tariffs placed on the items, date items were shipped, the total weight of the shipment, and date items are expected to be released from customs.

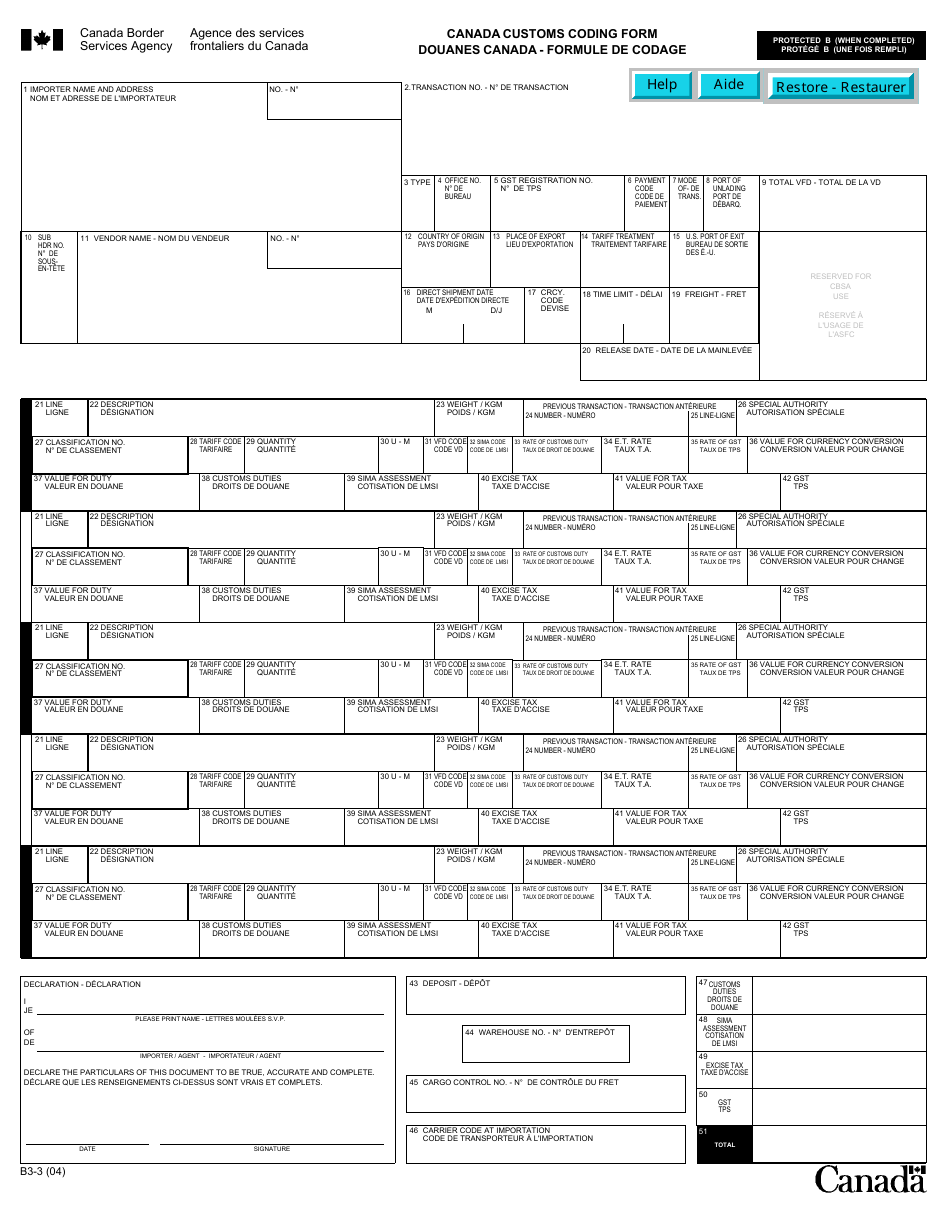

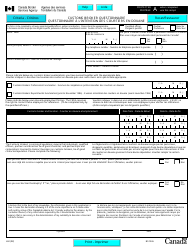

- The section below is where you will list information for each type of item you will be importing:

- Each group of items will need to be weighed independently of the total shipment, amount, value for the total of each item, any customs duties that will be charged, customs codes, and taxes charged. You will also have a section where you can highlight if the item requires special authority at the time it enters Canada.

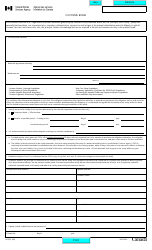

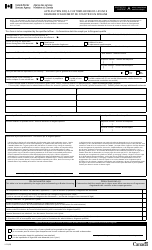

- Several of the sections of Form B3-3 will be filled in for you by customs officials, such as the code for payment, date customs will release the items, a previous transaction number or line, and numbered warehouse where the items will be stored.

- At the end of the form, you will need to sign and date a declaration that all information listed in the form is accurate and true to the best of your knowledge. You will also need to calculate the total amounts due for customs and GST.