This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule 500CR

for the current year.

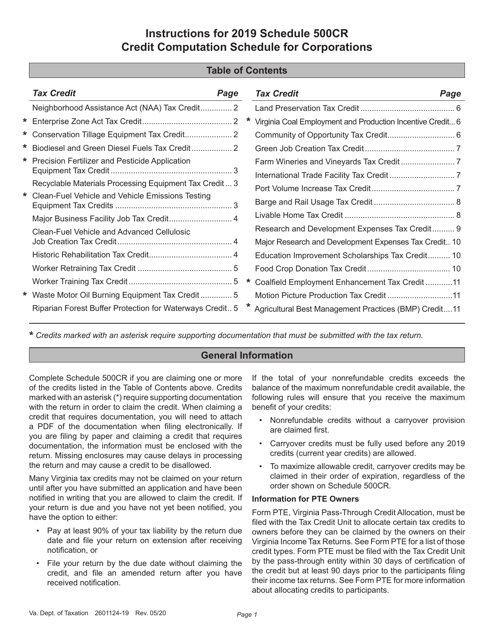

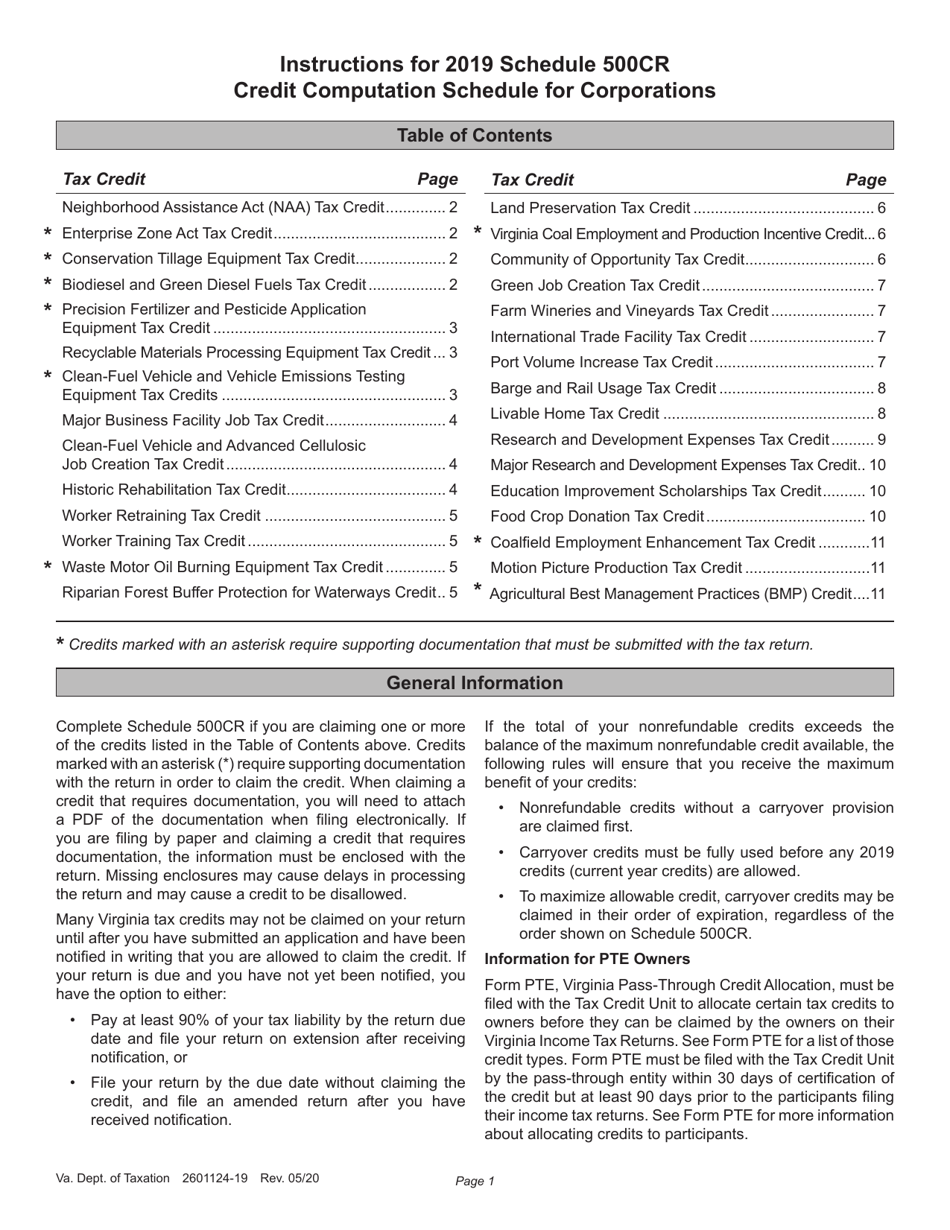

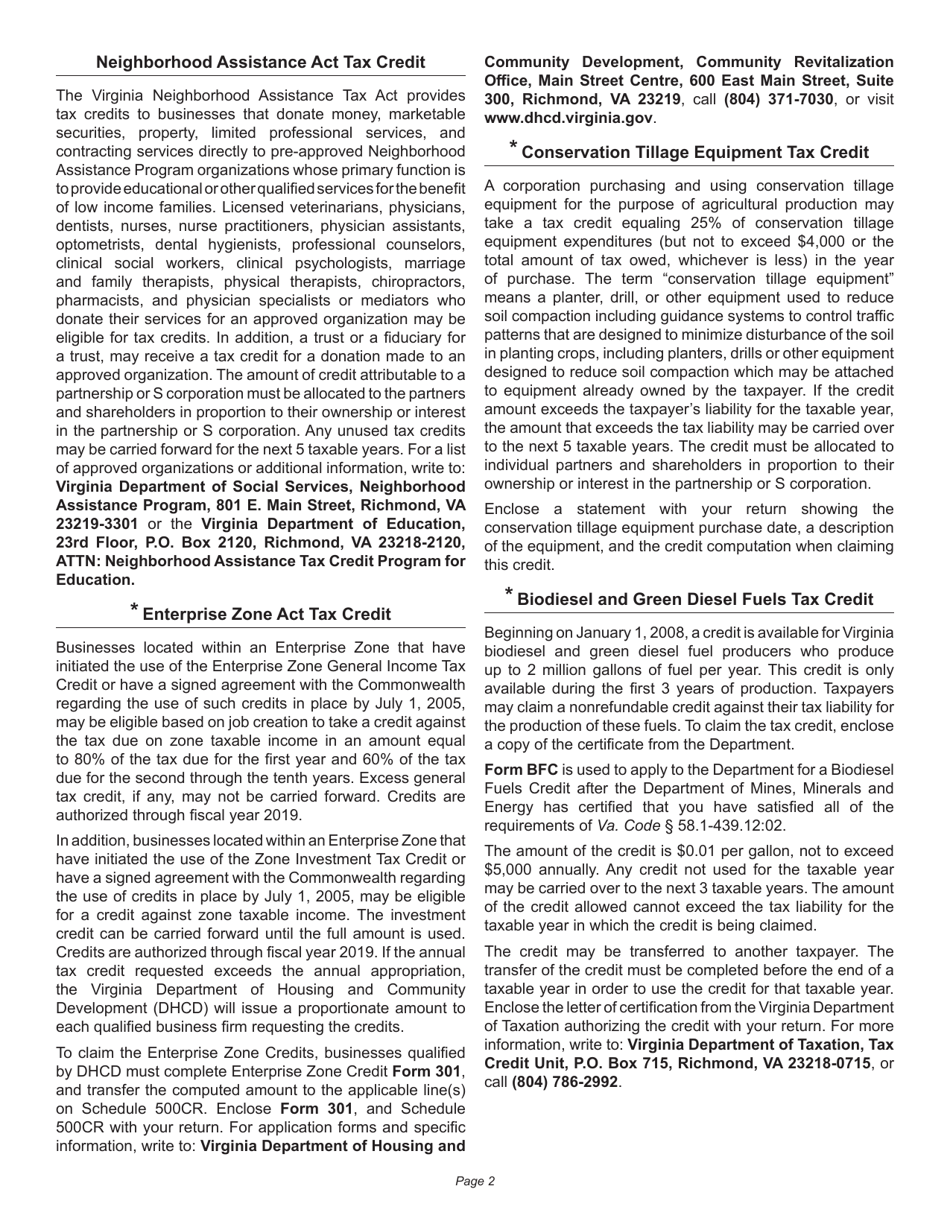

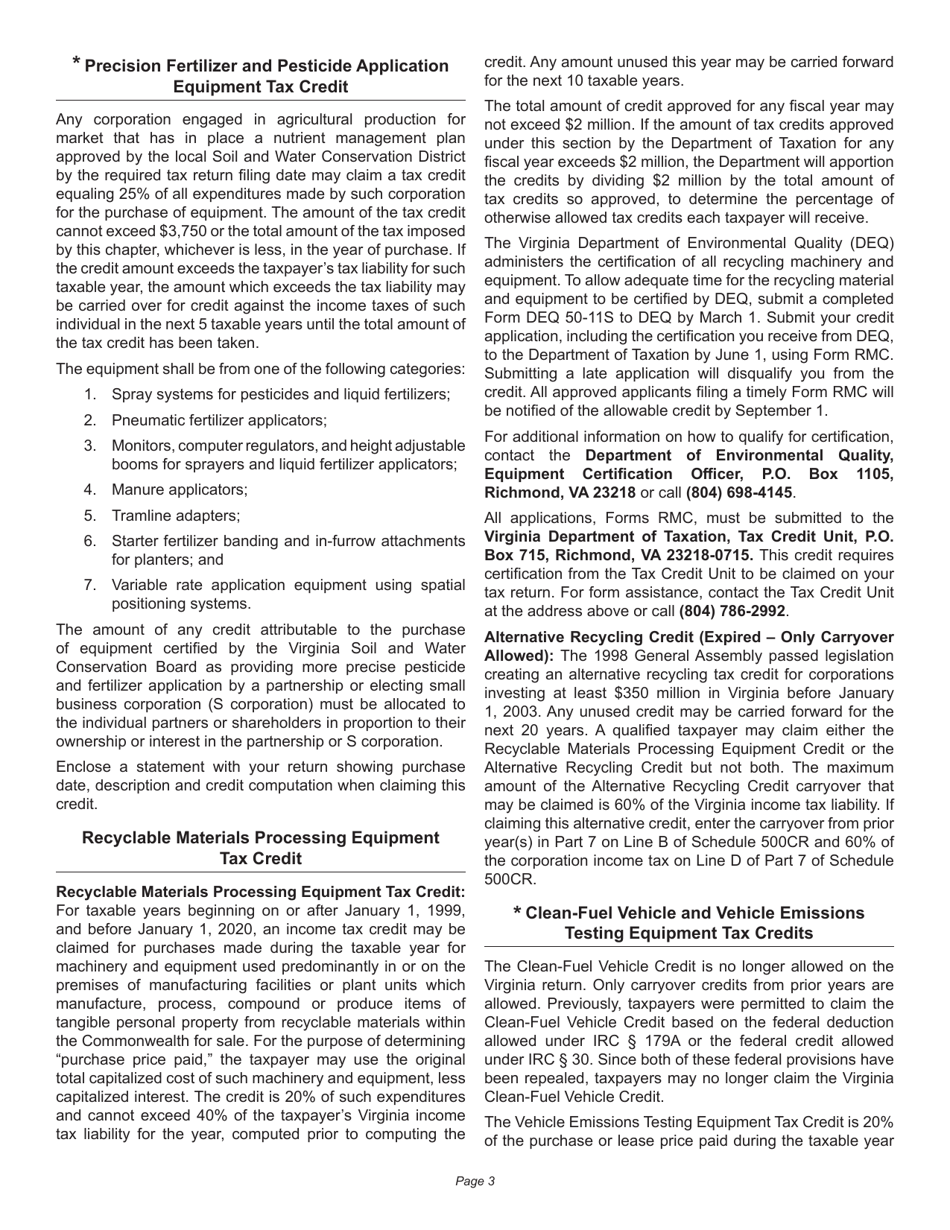

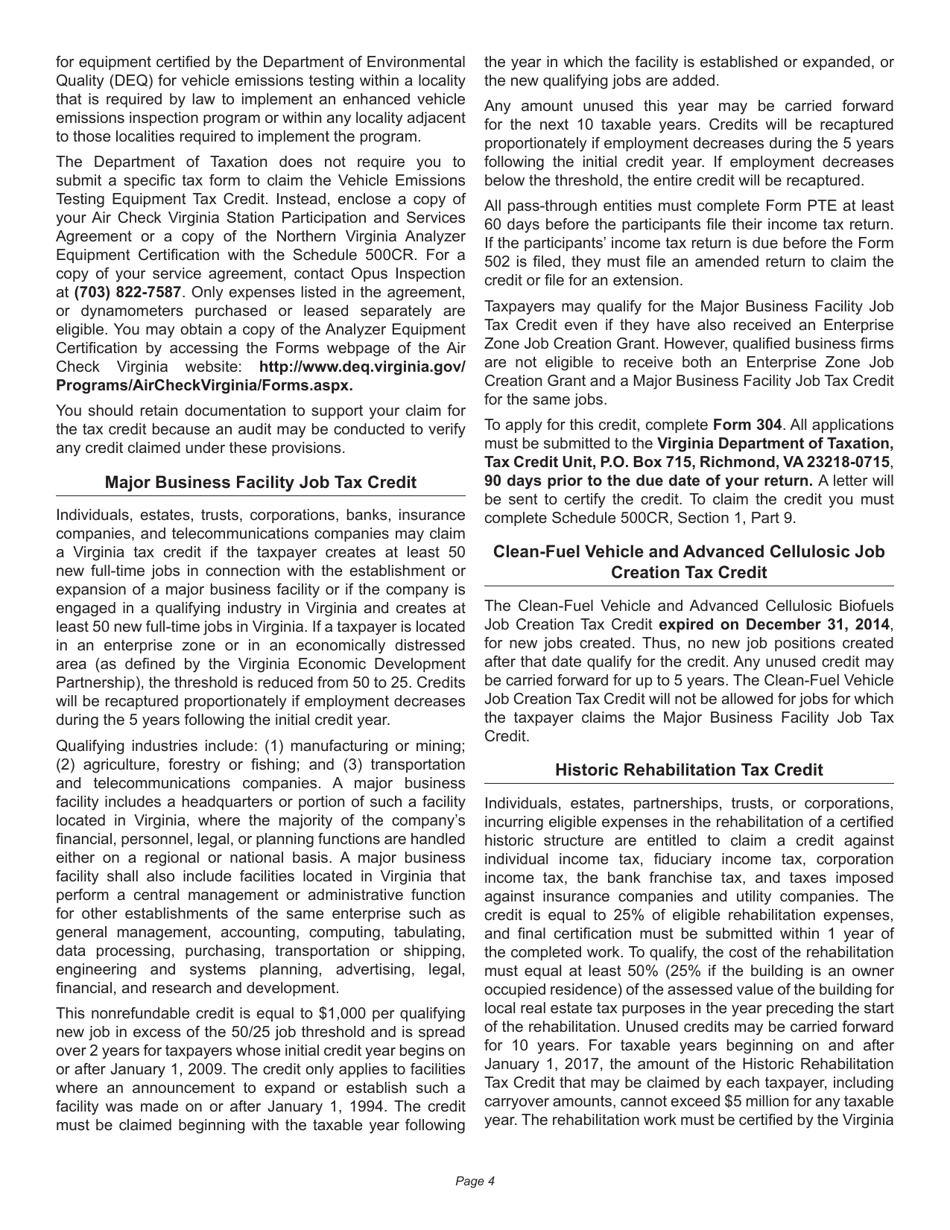

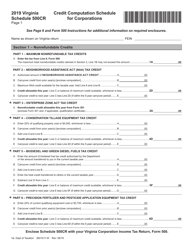

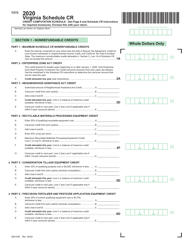

Instructions for Schedule 500CR Credit Computation Schedule for Corporation Returns - Virginia

This document contains official instructions for Schedule 500CR , Credit Computation Schedule for Corporation Returns - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Schedule 500CR?

A: Schedule 500CR is the Credit Computation Schedule for Corporation Returns in Virginia.

Q: Why is Schedule 500CR required?

A: Schedule 500CR is required to calculate and claim various tax credits available to corporations in Virginia.

Q: Who needs to file Schedule 500CR?

A: Corporations filing tax returns in Virginia that are eligible for tax credits must file Schedule 500CR.

Q: What are some tax credits that can be claimed using Schedule 500CR?

A: Some tax credits that can be claimed using Schedule 500CR include the Job Creation and Investment, Research and Development, and Enterprise Zone credits.

Q: What information is required to complete Schedule 500CR?

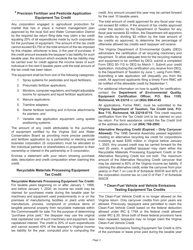

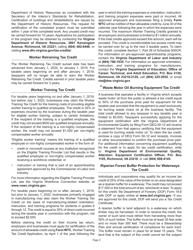

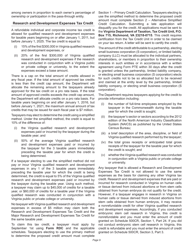

A: To complete Schedule 500CR, you will need to provide details about the specific tax credits claimed, including calculations and supporting documentation.

Q: When is Schedule 500CR due?

A: Schedule 500CR is typically due at the same time as the corporation's annual tax return, which is generally due on the 15th day of the 4th month following the end of the tax year.

Q: Is Schedule 500CR applicable only to Virginia corporations?

A: Yes, Schedule 500CR is specific to corporations filing tax returns in Virginia and claiming tax credits offered by the state.

Q: Are there any penalties for not filing Schedule 500CR?

A: Failure to file Schedule 500CR when required may result in penalties, such as the loss of tax credits or additional taxes owed.

Instruction Details:

- This 11-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.