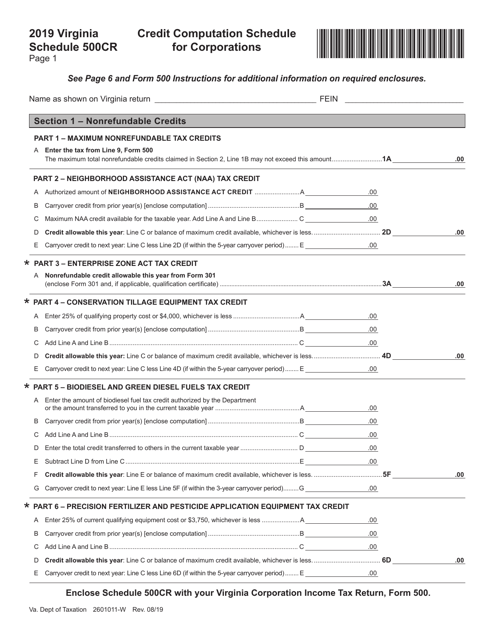

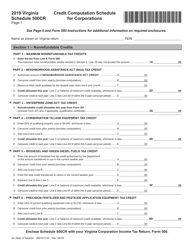

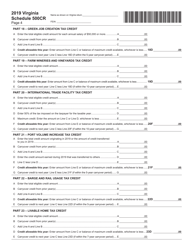

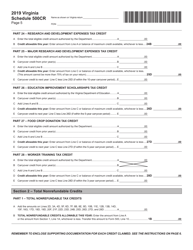

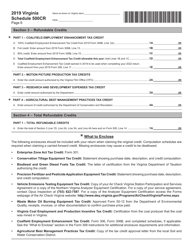

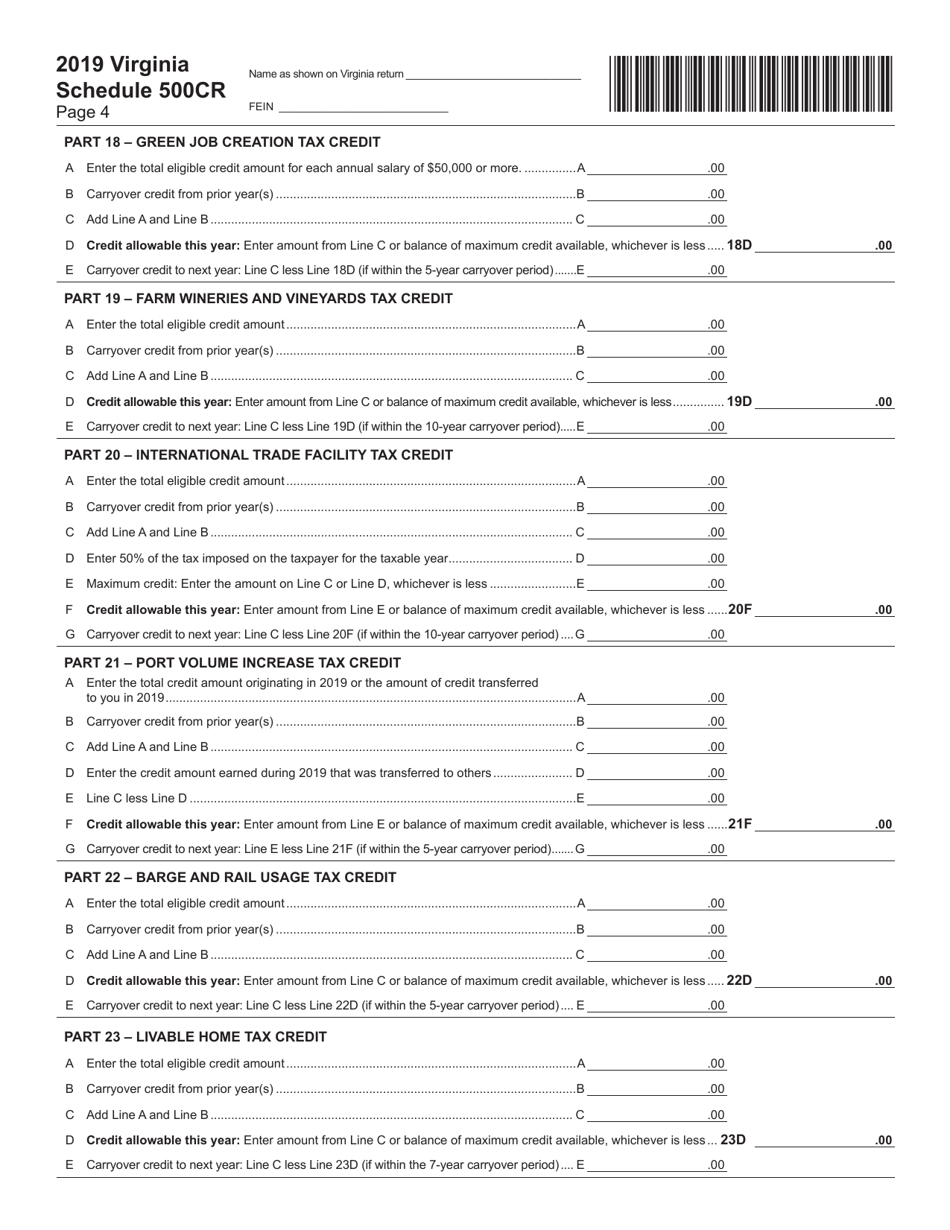

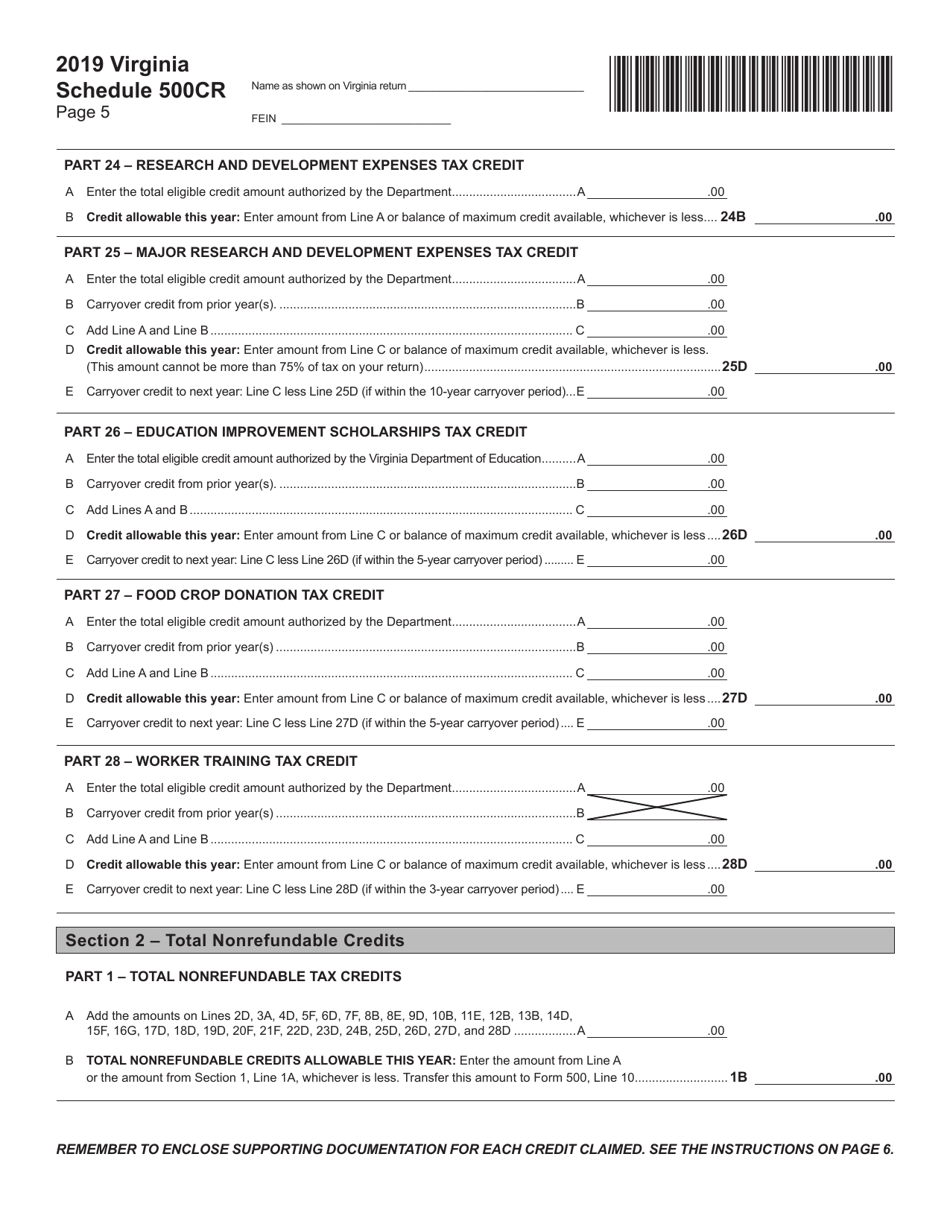

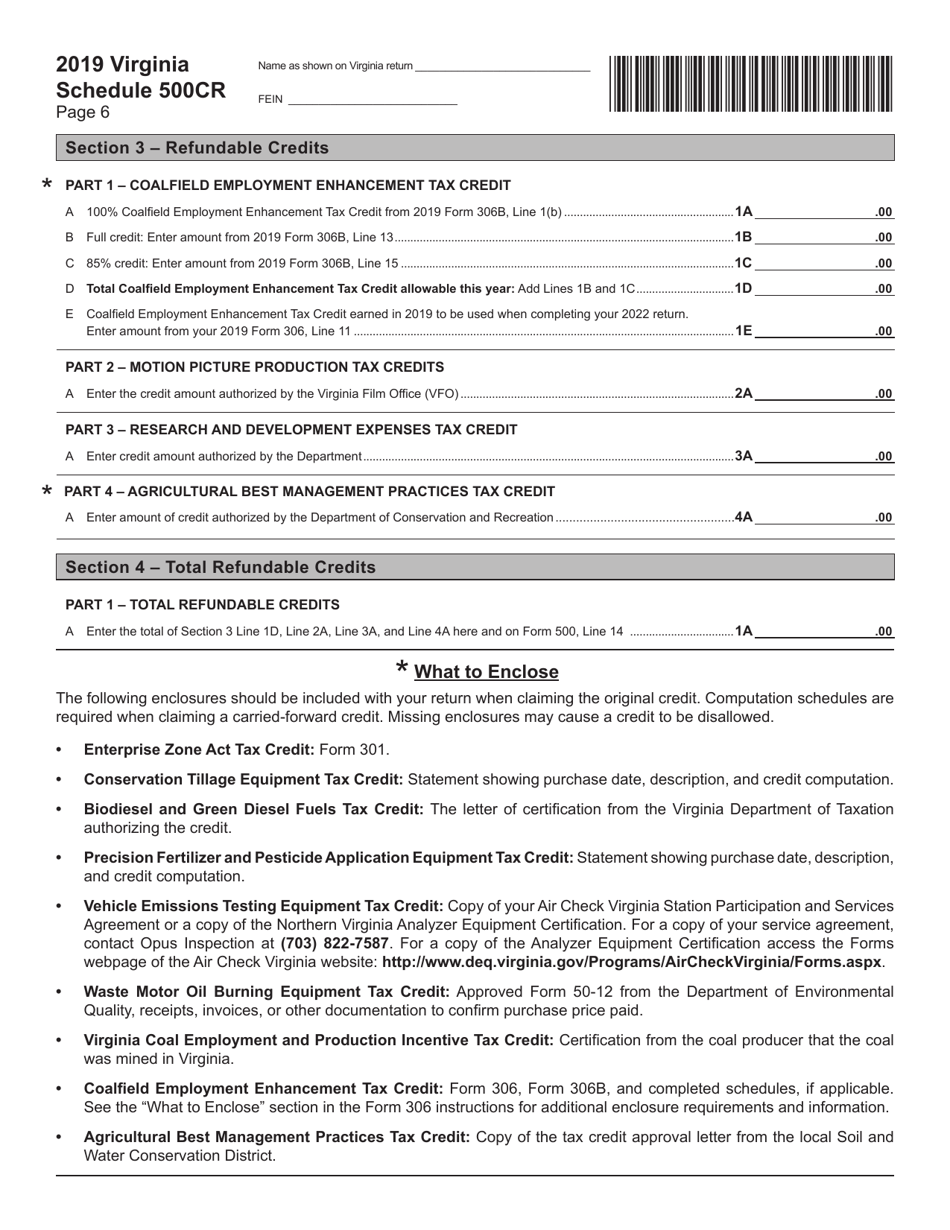

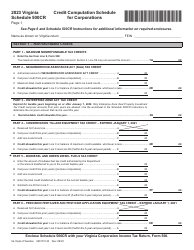

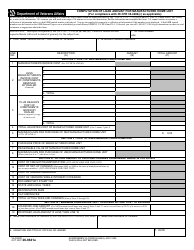

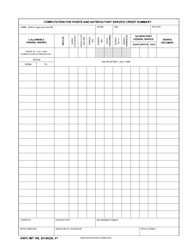

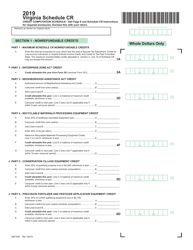

Form 500 Schedule 500CR Credit Computation Schedule for Corporations - Virginia

What Is Form 500 Schedule 500CR?

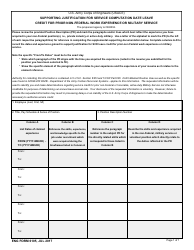

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 500, Virginia Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 500 Schedule 500CR?

A: Form 500 Schedule 500CR is the Credit Computation Schedule for Corporations in Virginia.

Q: Who needs to file Form 500 Schedule 500CR?

A: Corporations in Virginia who want to claim specific tax credits.

Q: What is the purpose of Form 500 Schedule 500CR?

A: The purpose of this form is to calculate and claim tax credits available to corporations in Virginia.

Q: Is Form 500 Schedule 500CR specific to Virginia?

A: Yes, Form 500 Schedule 500CR is specific to corporations in Virginia.

Q: When is the deadline to file Form 500 Schedule 500CR?

A: The deadline to file Form 500 Schedule 500CR is typically the same as the corporate income tax return deadline in Virginia.

Q: Are there any prerequisites to filing Form 500 Schedule 500CR?

A: Yes, corporations must meet certain requirements and have supporting documentation to claim tax credits using this form.

Q: Can individuals use Form 500 Schedule 500CR?

A: No, this form is specifically for corporations in Virginia and not for individuals.

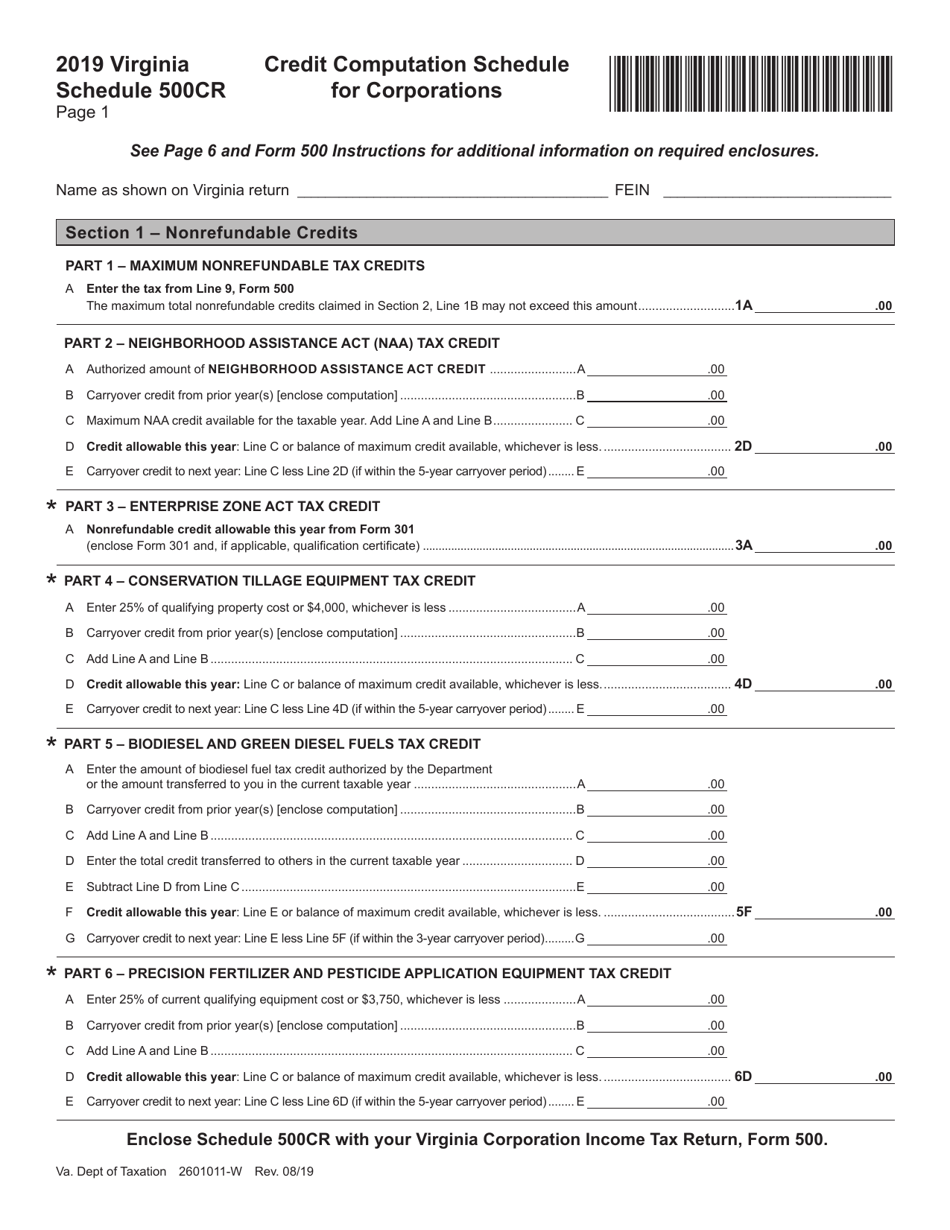

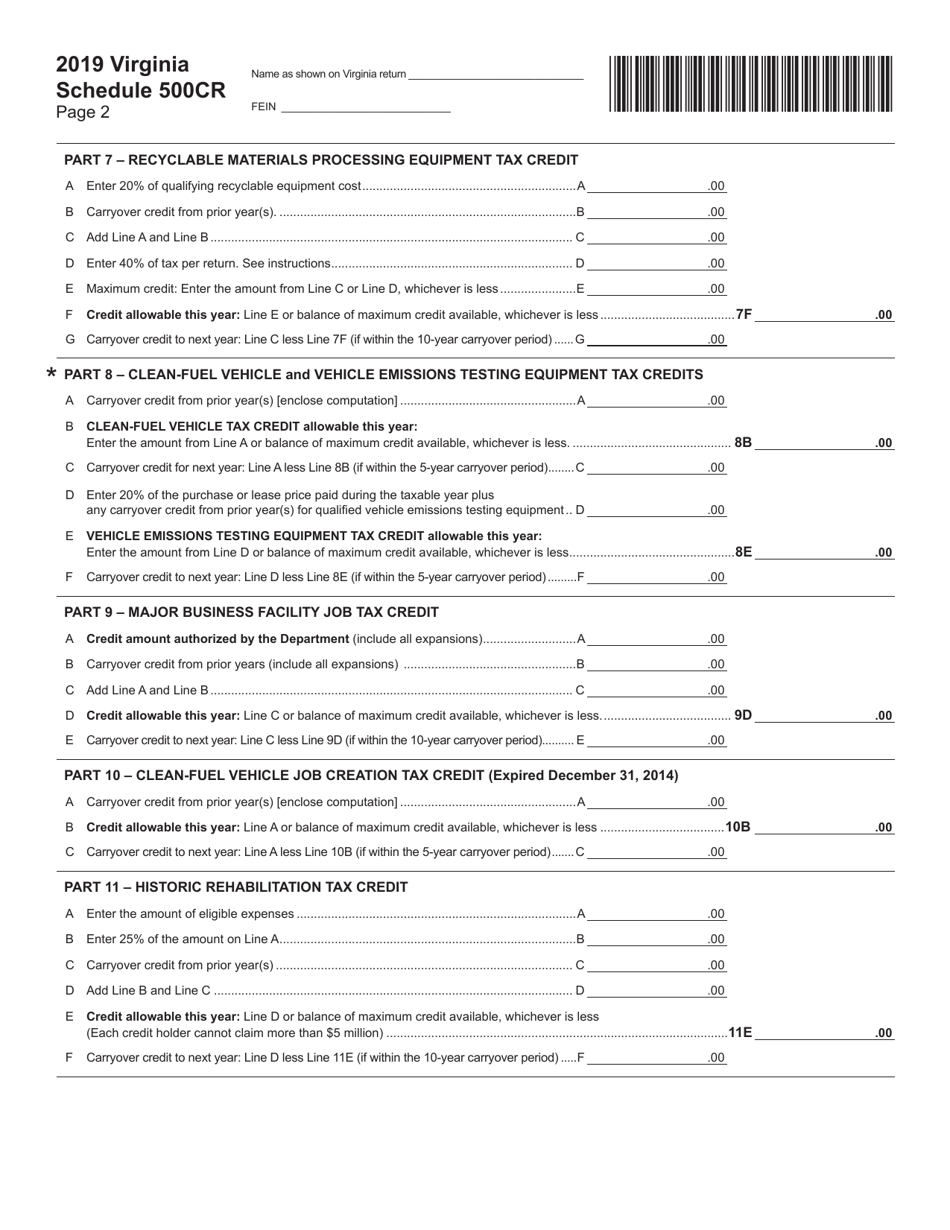

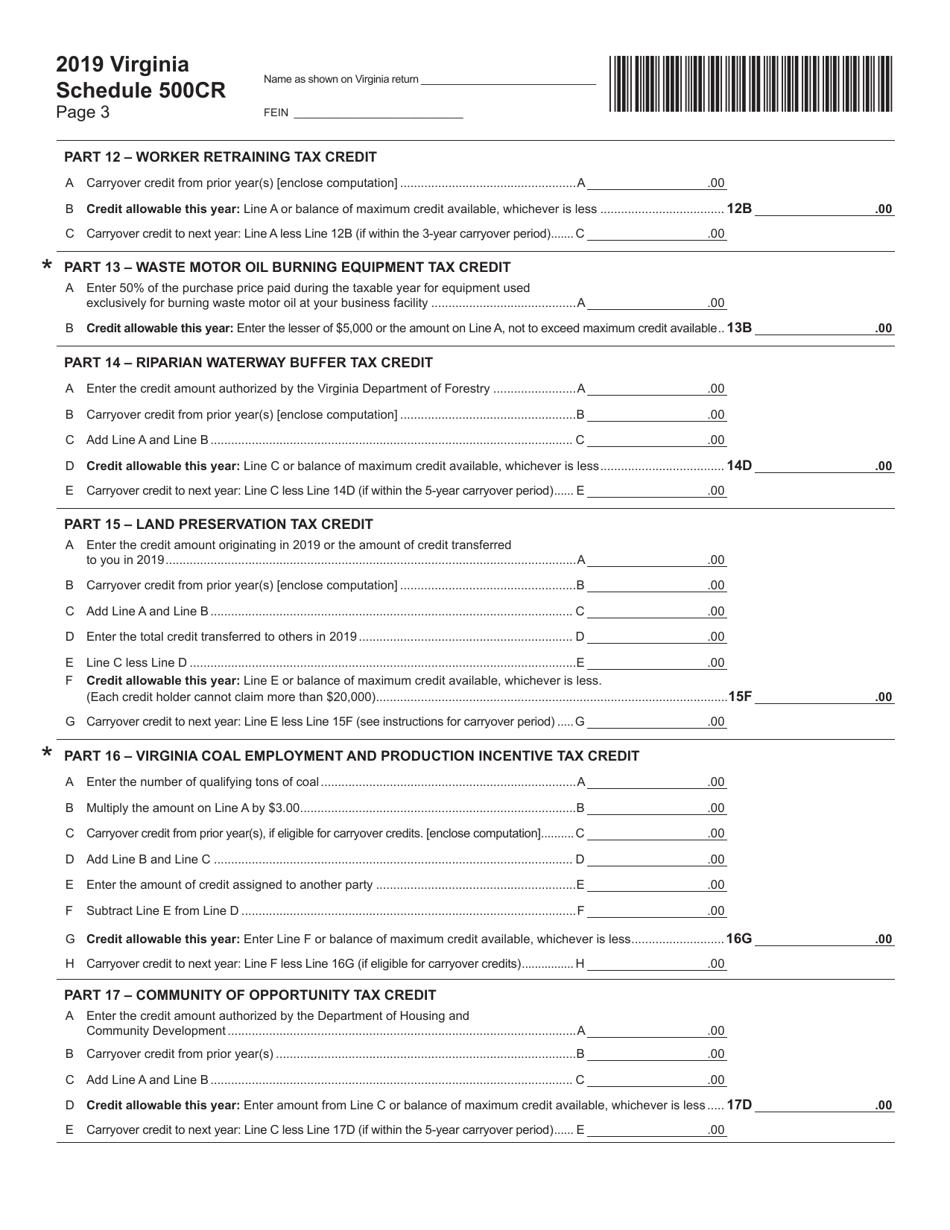

Q: What types of tax credits can be claimed using Form 500 Schedule 500CR?

A: Various tax credits are available, such as the job creation and investment tax credit, the research and development expenses tax credit, and the green job creation tax credit.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 500 Schedule 500CR by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.