This version of the form is not currently in use and is provided for reference only. Download this version of

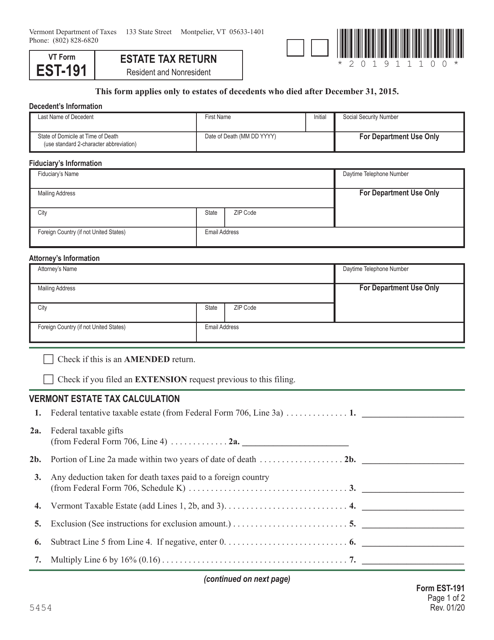

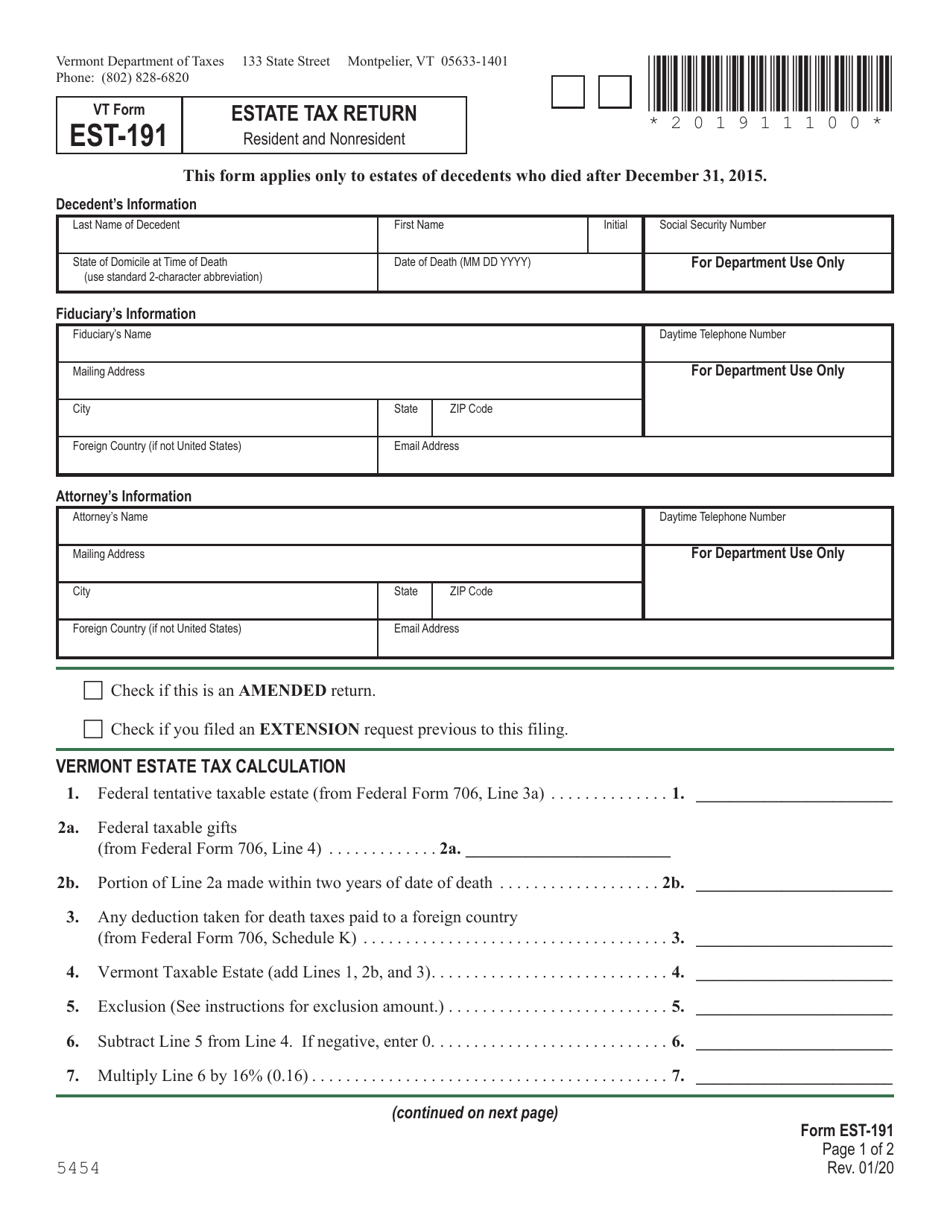

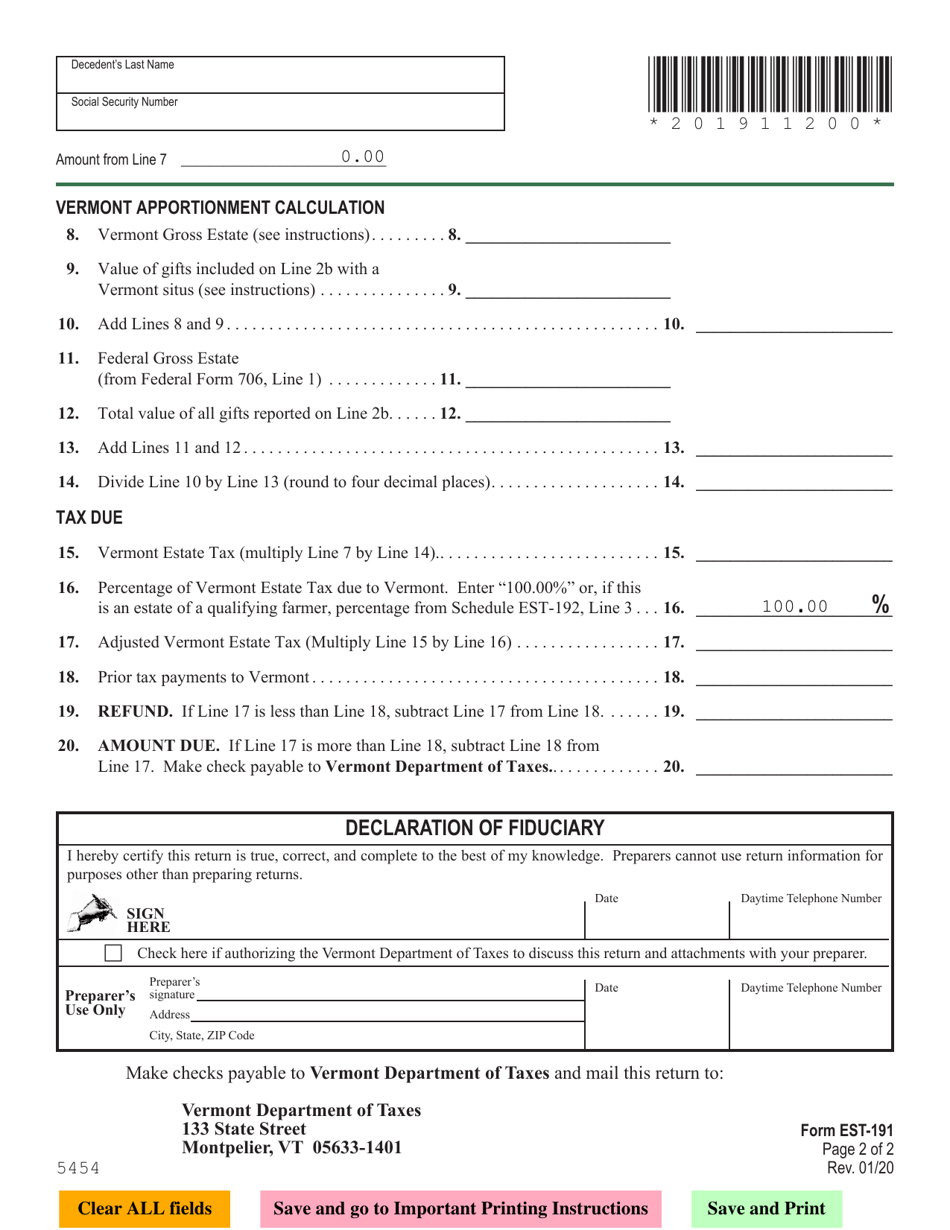

VT Form EST-191

for the current year.

VT Form EST-191 Estate Tax Return - Vermont

What Is VT Form EST-191?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the form EST-191?

A: The form EST-191 is the Estate Tax Return for Vermont.

Q: Who needs to file form EST-191?

A: Anyone who is the executor or administrator of an estate and meets the filing requirements must file form EST-191.

Q: What is the purpose of form EST-191?

A: The purpose of form EST-191 is to report and pay estate taxes owed to the state of Vermont.

Q: What information is required on form EST-191?

A: Form EST-191 requires information about the deceased person, the estate, and the assets and liabilities of the estate.

Q: When is form EST-191 due?

A: Form EST-191 is due nine months after the date of the decedent's death.

Q: Are there any exceptions or exemptions to filing form EST-191?

A: There may be exceptions or exemptions available depending on the size of the estate and other factors. It is best to consult the instructions or seek professional advice.

Q: What happens if I don't file form EST-191?

A: If you fail to file form EST-191 or make a late payment, you may be subject to penalties and interest.

Q: Can I get an extension to file form EST-191?

A: Yes, you can request an extension to file form EST-191 by submitting Form IN-151 with an estimated payment.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form EST-191 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.