This version of the form is not currently in use and is provided for reference only. Download this version of

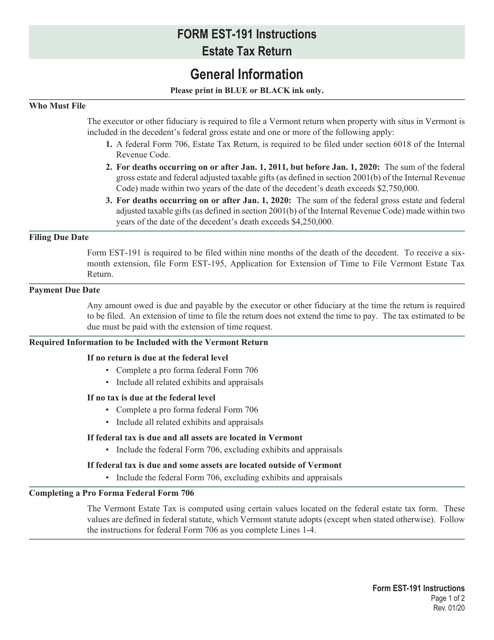

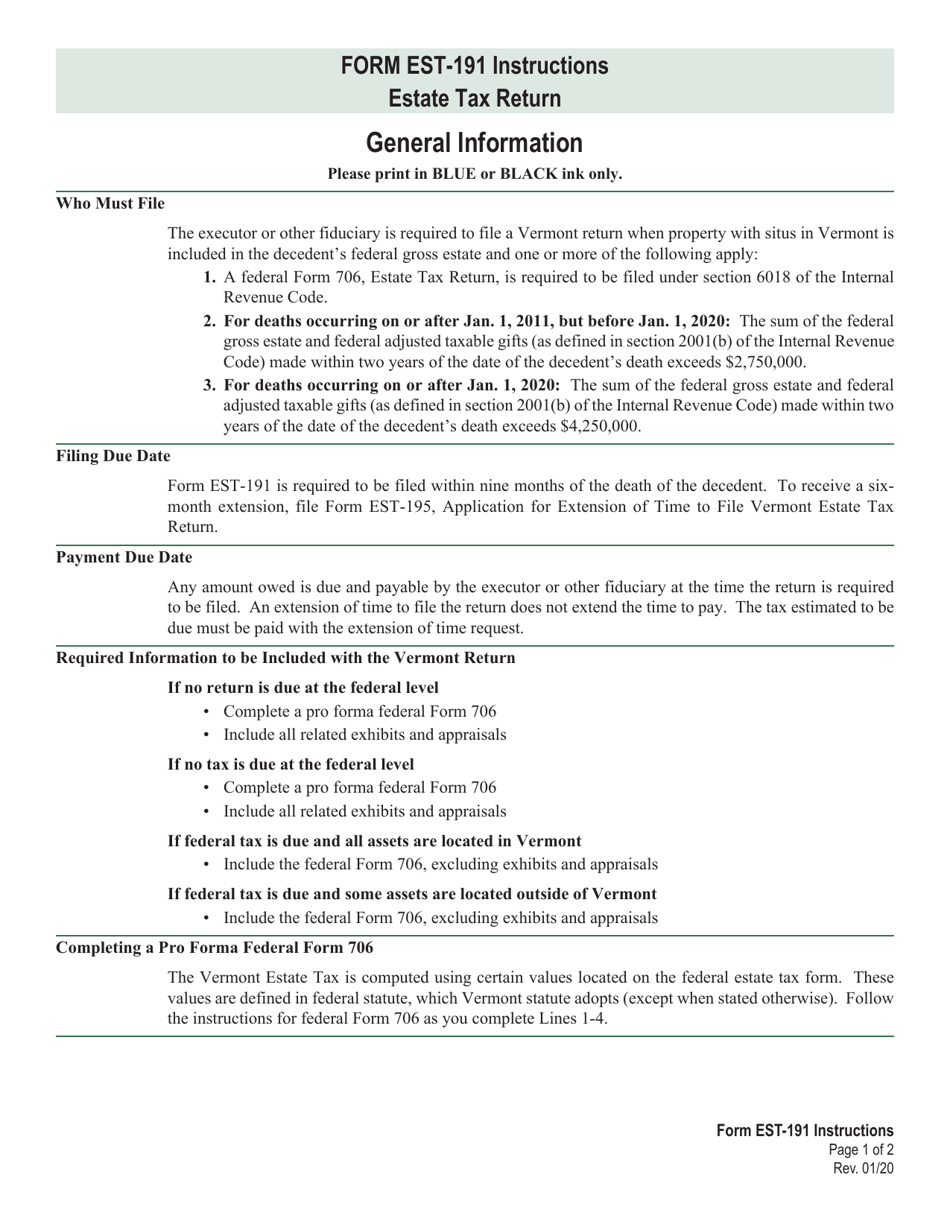

Instructions for VT Form EST-191

for the current year.

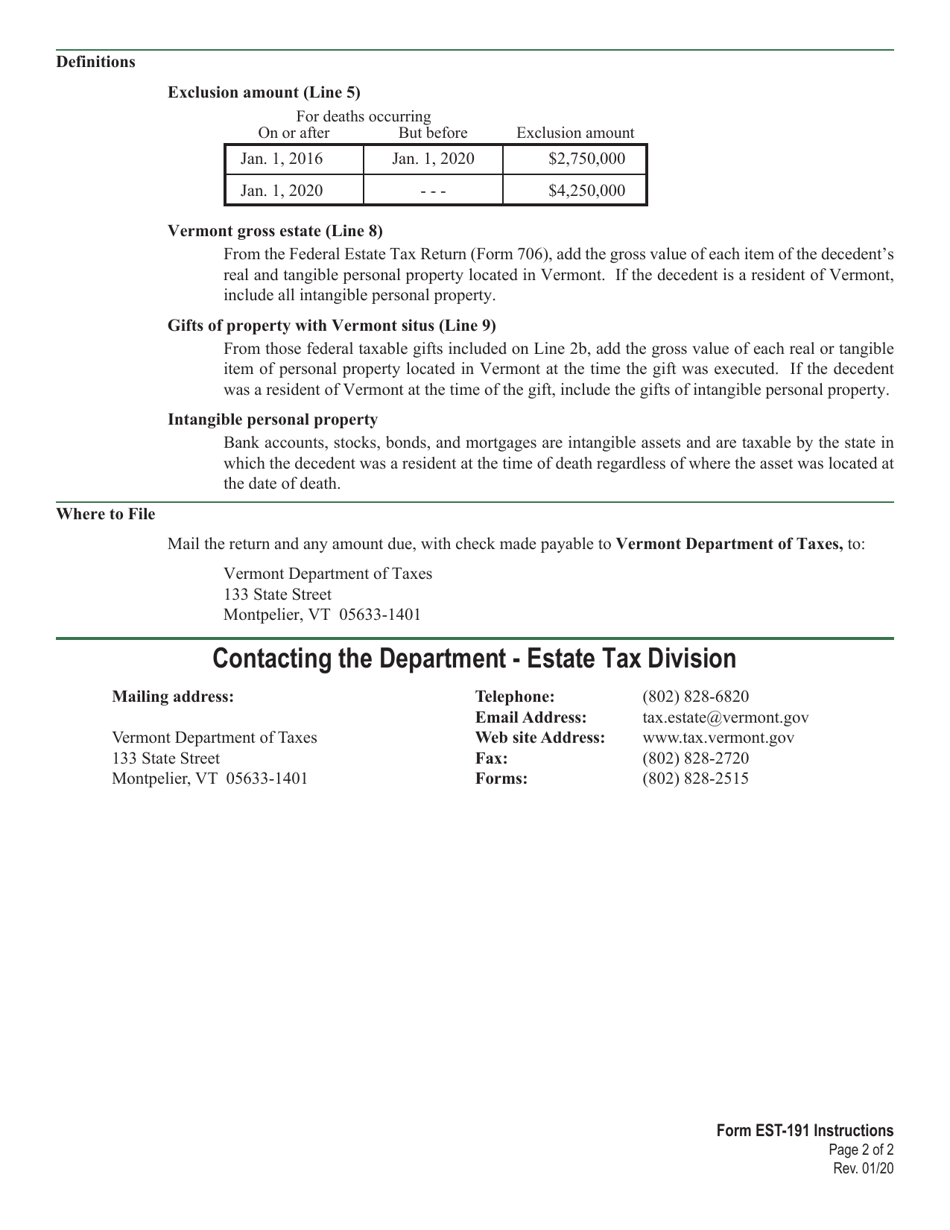

Instructions for VT Form EST-191 Estate Tax Return - Vermont

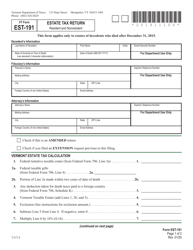

This document contains official instructions for VT Form EST-191 , Estate Tax Return - a form released and collected by the Vermont Department of Taxes. An up-to-date fillable VT Form EST-191 is available for download through this link.

FAQ

Q: What is VT Form EST-191?

A: VT Form EST-191 is the Estate Tax Return specifically used in the state of Vermont.

Q: Who needs to file Form EST-191?

A: The person responsible for administering the estate of a deceased person in Vermont may need to file Form EST-191.

Q: What information is required on Form EST-191?

A: Form EST-191 requires information about the deceased person, the estate, and the estate's assets and liabilities.

Q: When is Form EST-191 due?

A: Form EST-191 is generally due nine months after the date of the deceased person's death.

Q: Are there any filing extensions available?

A: Yes, Vermont allows for an automatic extension to file Form EST-191 if Form 706, the federal estate tax return, has been filed.

Q: Is there an estate tax in Vermont?

A: Yes, Vermont has an estate tax that is imposed on the transfer of assets from a deceased person's estate.

Q: How is the estate tax calculated in Vermont?

A: The estate tax in Vermont is calculated based on the value of the assets transferred and is subject to a progressive tax rate.

Q: Is professional assistance recommended for filing Form EST-191?

A: While not required, it is recommended to seek professional assistance when filing Form EST-191 to ensure accuracy and compliance with Vermont tax laws.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.