This version of the form is not currently in use and is provided for reference only. Download this version of

Form E-585

for the current year.

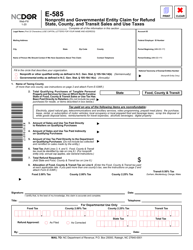

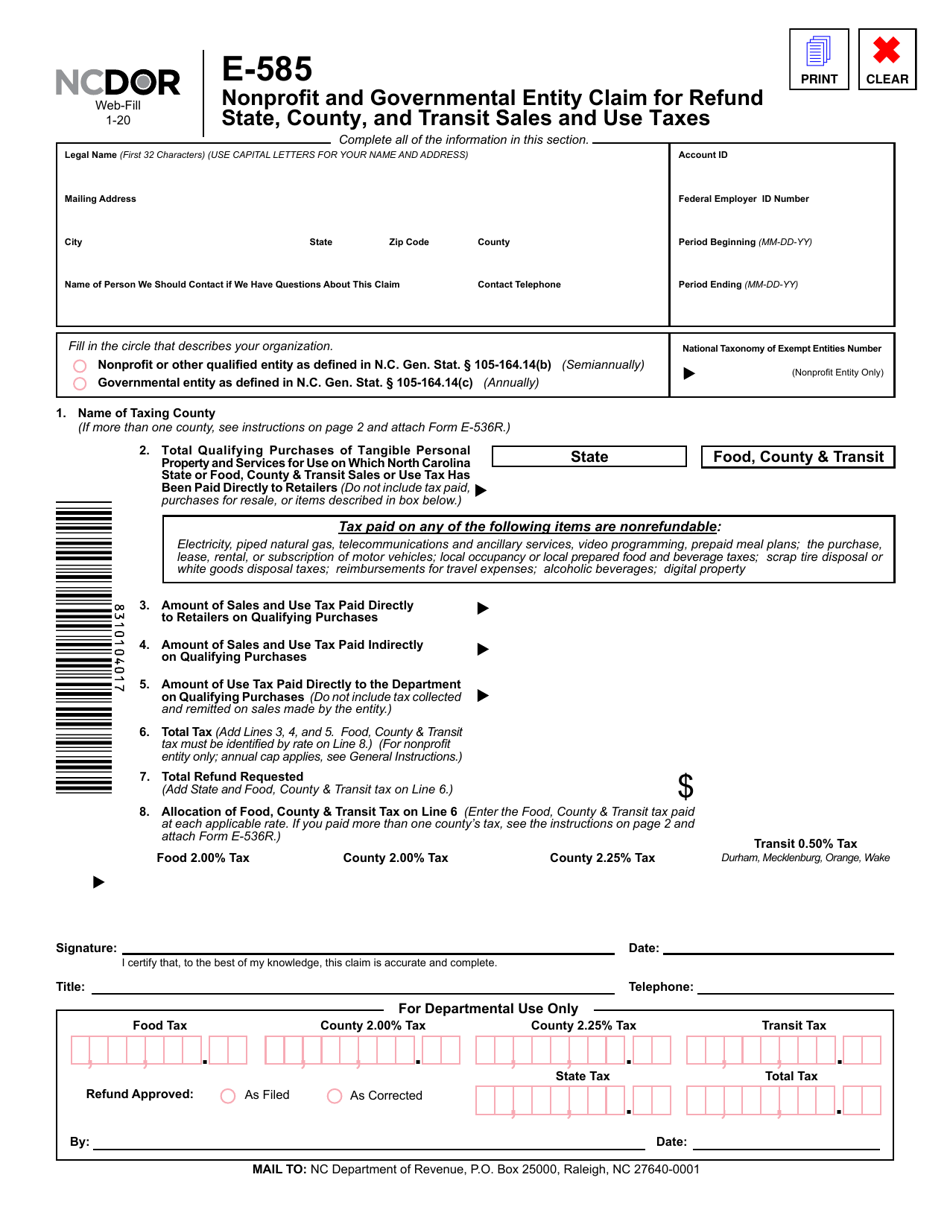

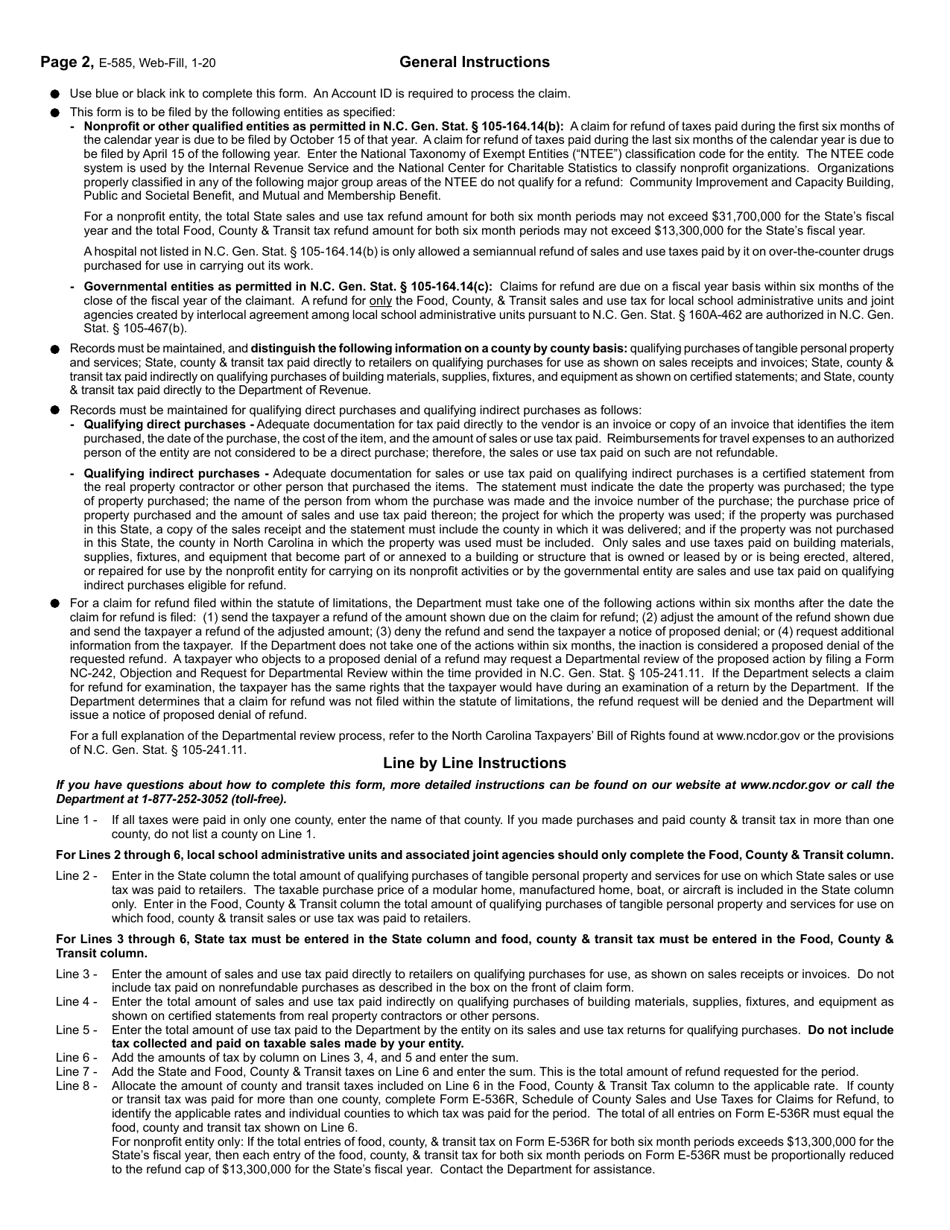

Form E-585 Nonprofit and Governmental Entity Claim for Refund State, County, and Transit Sales and Use Taxes - North Carolina

What Is Form E-585?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-585?

A: Form E-585 is a document used to claim a refund for state, county, and transit sales and use taxes in North Carolina.

Q: Who can use Form E-585?

A: Nonprofit and governmental entities can use Form E-585 to claim a refund for sales and use taxes in North Carolina.

Q: What taxes can be refunded with Form E-585?

A: Form E-585 can be used to claim a refund for state, county, and transit sales and use taxes in North Carolina.

Q: How do I complete Form E-585?

A: To complete Form E-585, you need to provide information about your organization, the taxes being claimed, and supporting documentation.

Q: Are there any deadlines for filing Form E-585?

A: Yes, Form E-585 must be filed within six months after the end of the month in which the taxes were paid.

Q: How long does it take to receive a refund after filing Form E-585?

A: The processing time for refunds can vary, but it generally takes about 90 days to receive a refund after filing Form E-585.

Form Details:

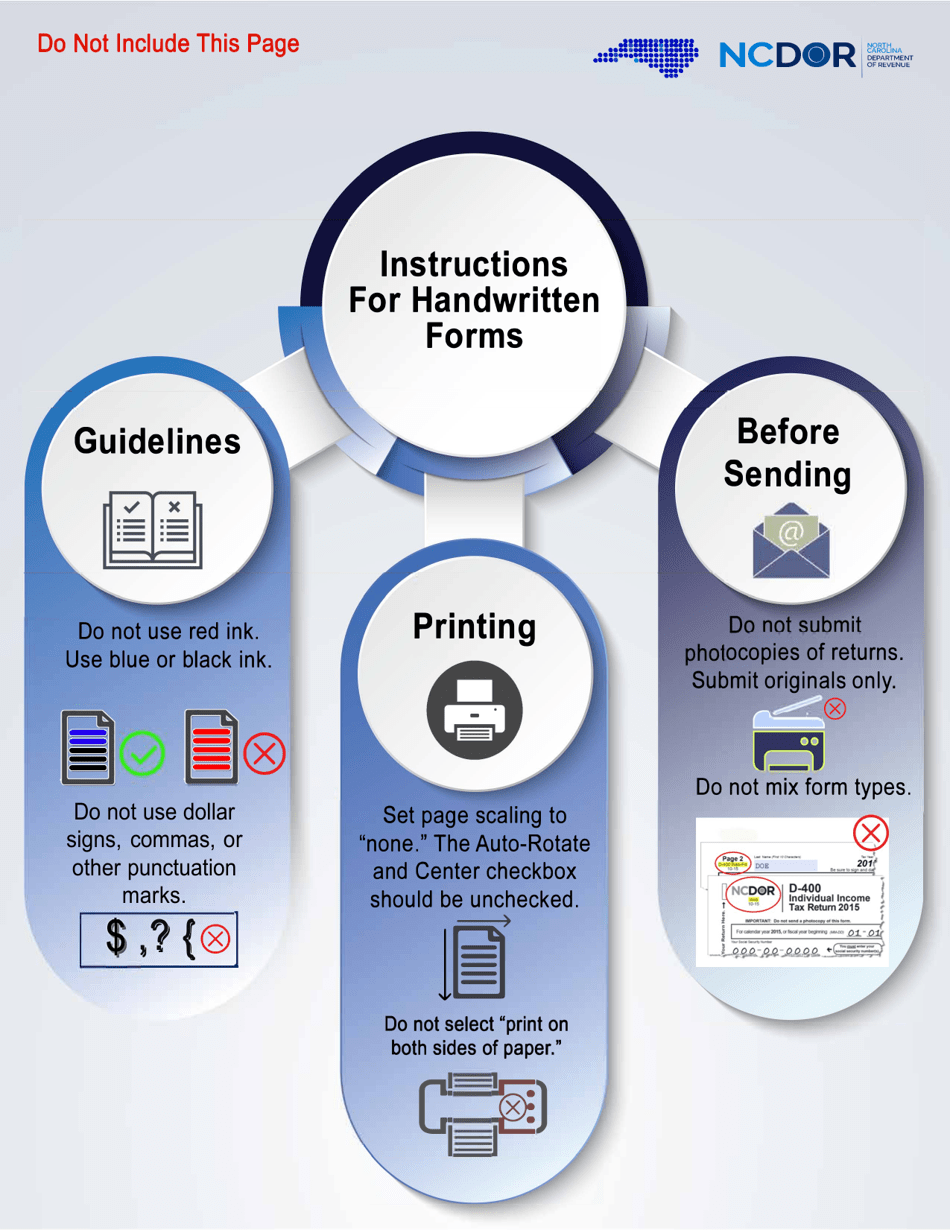

- Released on January 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-585 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.