This version of the form is not currently in use and is provided for reference only. Download this version of

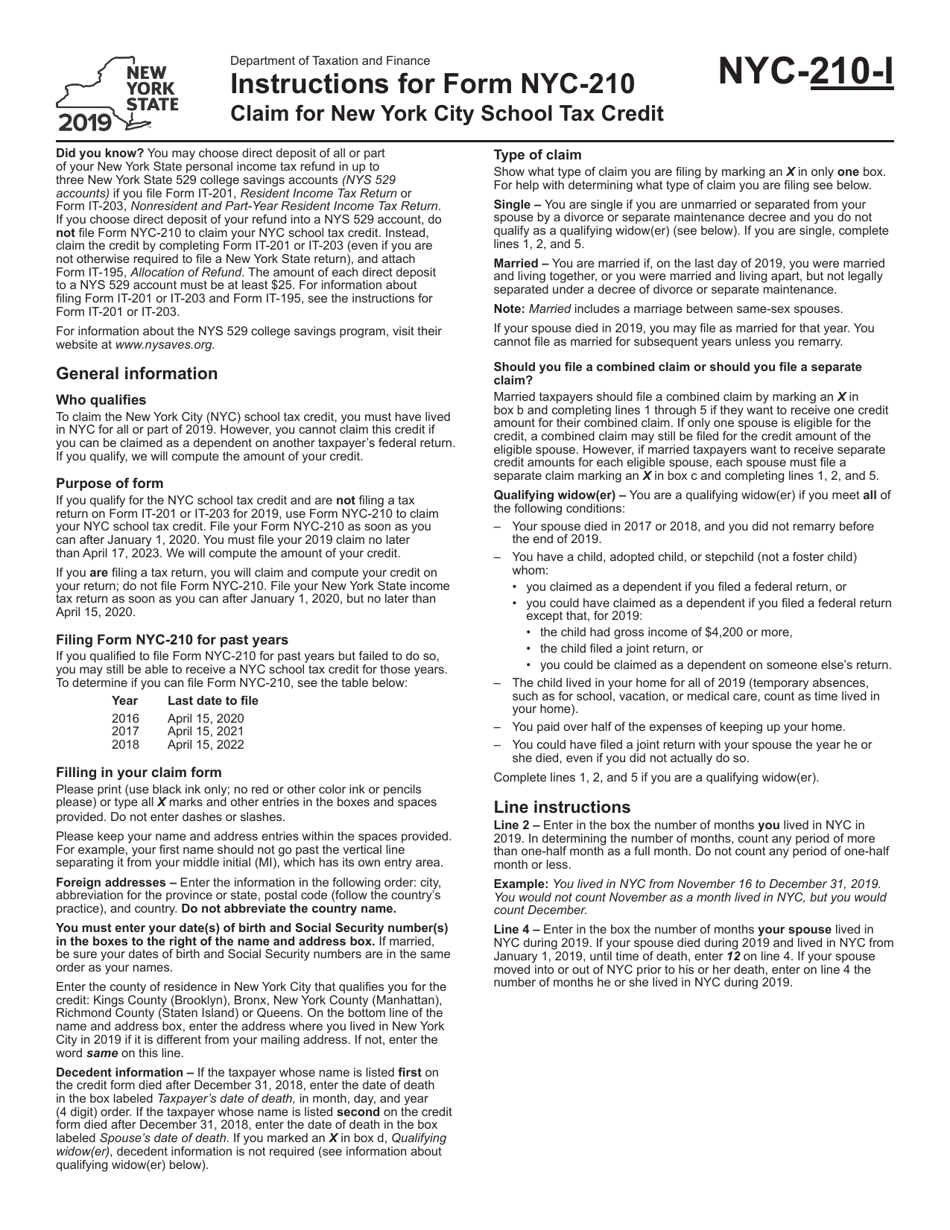

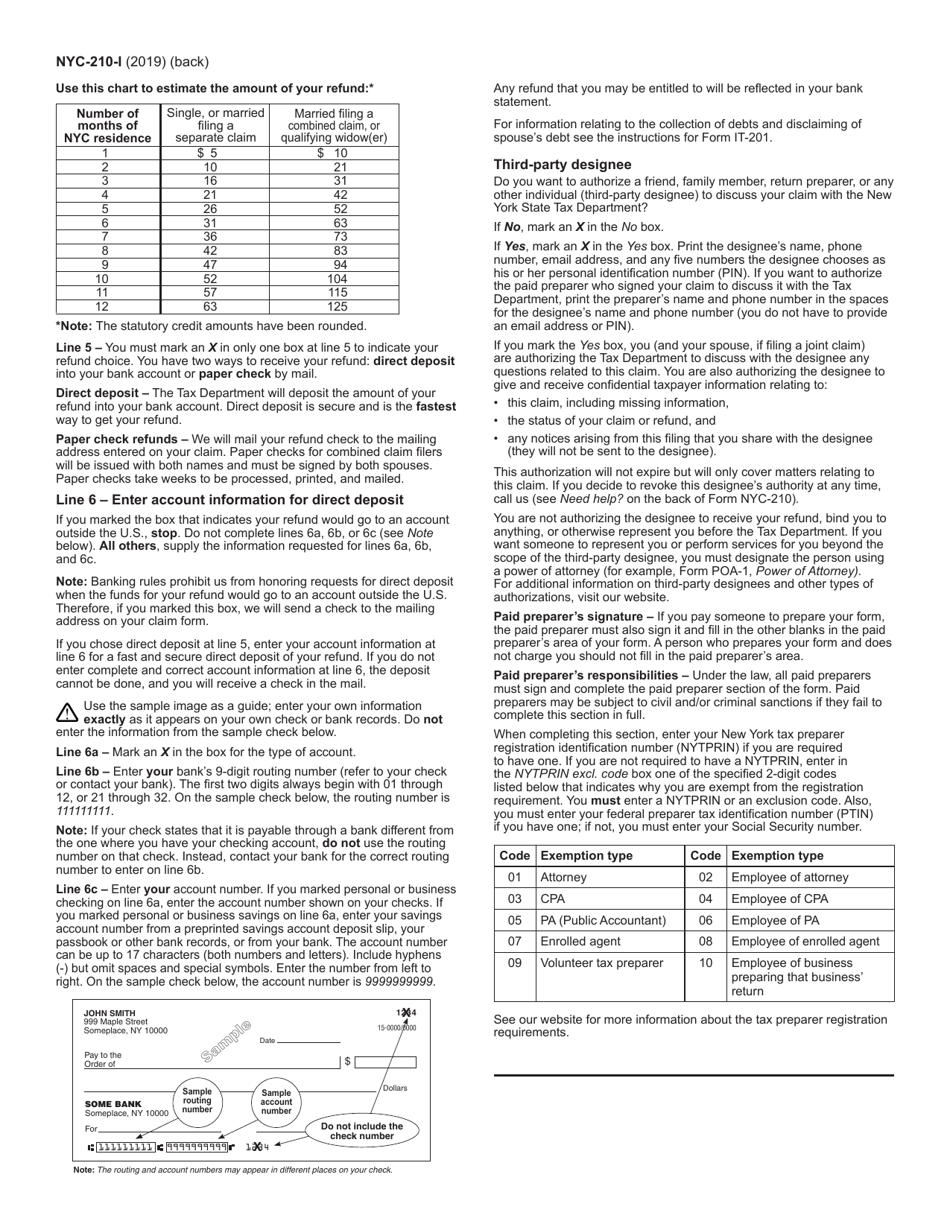

Instructions for Form NYC-210

for the current year.

Instructions for Form NYC-210 Claim for New York City School Tax Credit - New York

This document contains official instructions for Form NYC-210 , Claim for New York City School Tax Credit - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form NYC-210?

A: Form NYC-210 is a form used to claim the New York City School Tax Credit.

Q: Who can claim the New York City School Tax Credit?

A: Residents of New York City who are eligible for the credit can claim it.

Q: What is the purpose of the New York City School Tax Credit?

A: The credit is meant to help offset the cost of school taxes for eligible residents.

Q: How do I qualify for the New York City School Tax Credit?

A: To qualify, you must meet certain income requirements and be the owner or tenant of property in New York City.

Q: What documents do I need to complete Form NYC-210?

A: You will need your federal tax return, as well as documentation regarding your New York City school taxes.

Q: When is the deadline to file Form NYC-210?

A: The deadline to file Form NYC-210 is typically April 15th of each year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.