This version of the form is not currently in use and is provided for reference only. Download this version of

Form GMF_03

for the current year.

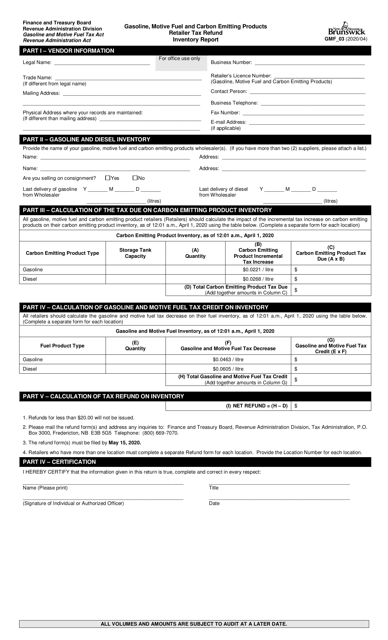

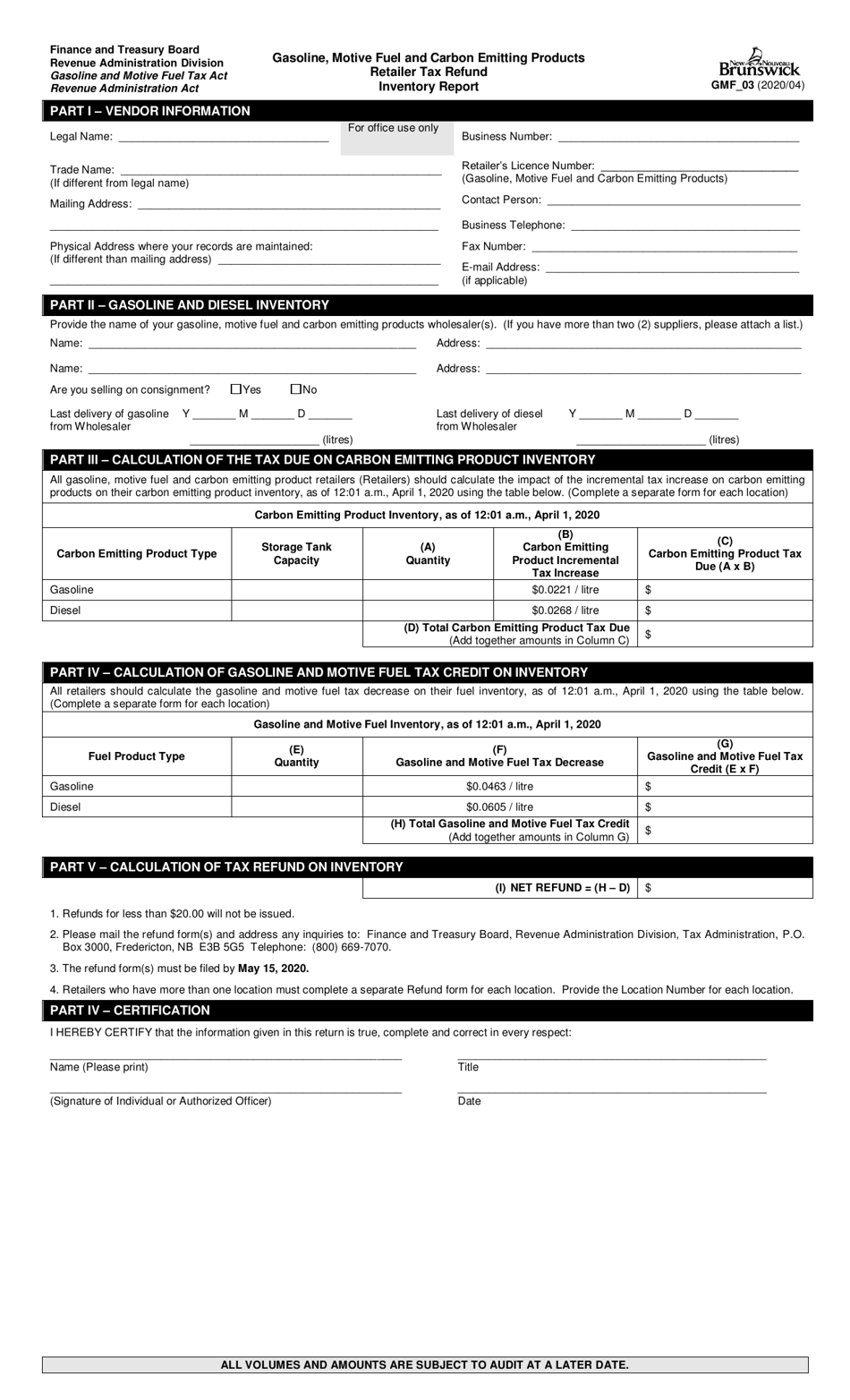

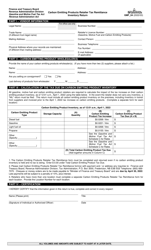

Form GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report - New Brunswick, Canada

Form GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report is used in New Brunswick, Canada, by retailers of gasoline, motive fuel, and carbon-emitting products to report their inventory and claim tax refunds.

The Form GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report in New Brunswick, Canada is filed by retailers who sell gasoline, motive fuel, and carbon emitting products in the province.

FAQ

Q: What is the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report?

A: The GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report is a document used in New Brunswick, Canada to report the inventory of gasoline, motive fuel, and carbon emitting products held by retailers for the purpose of claiming tax refunds.

Q: Who needs to file the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report?

A: Retailers of gasoline, motive fuel, and carbon emitting products in New Brunswick, Canada need to file the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report.

Q: What is the purpose of the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report?

A: The purpose of the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report is to report the inventory of taxable products held by retailers, which is used to calculate tax refunds.

Q: What information is required on the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report?

A: The GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report requires information such as the opening inventory, purchases, sales, closing inventory, and tax refunds claimed for each taxable product.

Q: When is the deadline to file the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report?

A: The deadline to file the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Products Retailer Tax Refund Inventory Report in New Brunswick, Canada is usually within 30 days following the end of the reporting period.