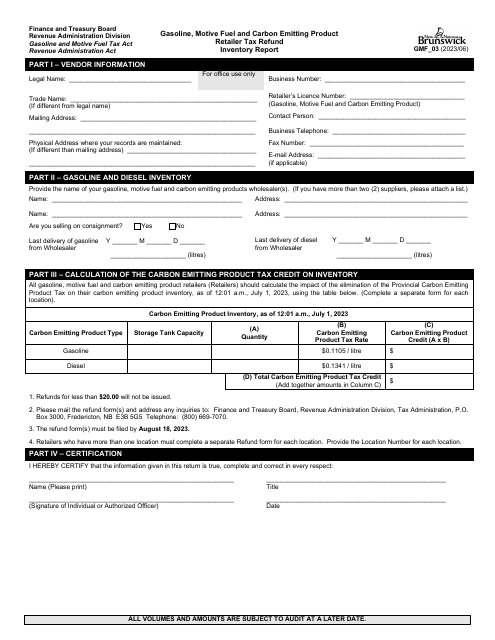

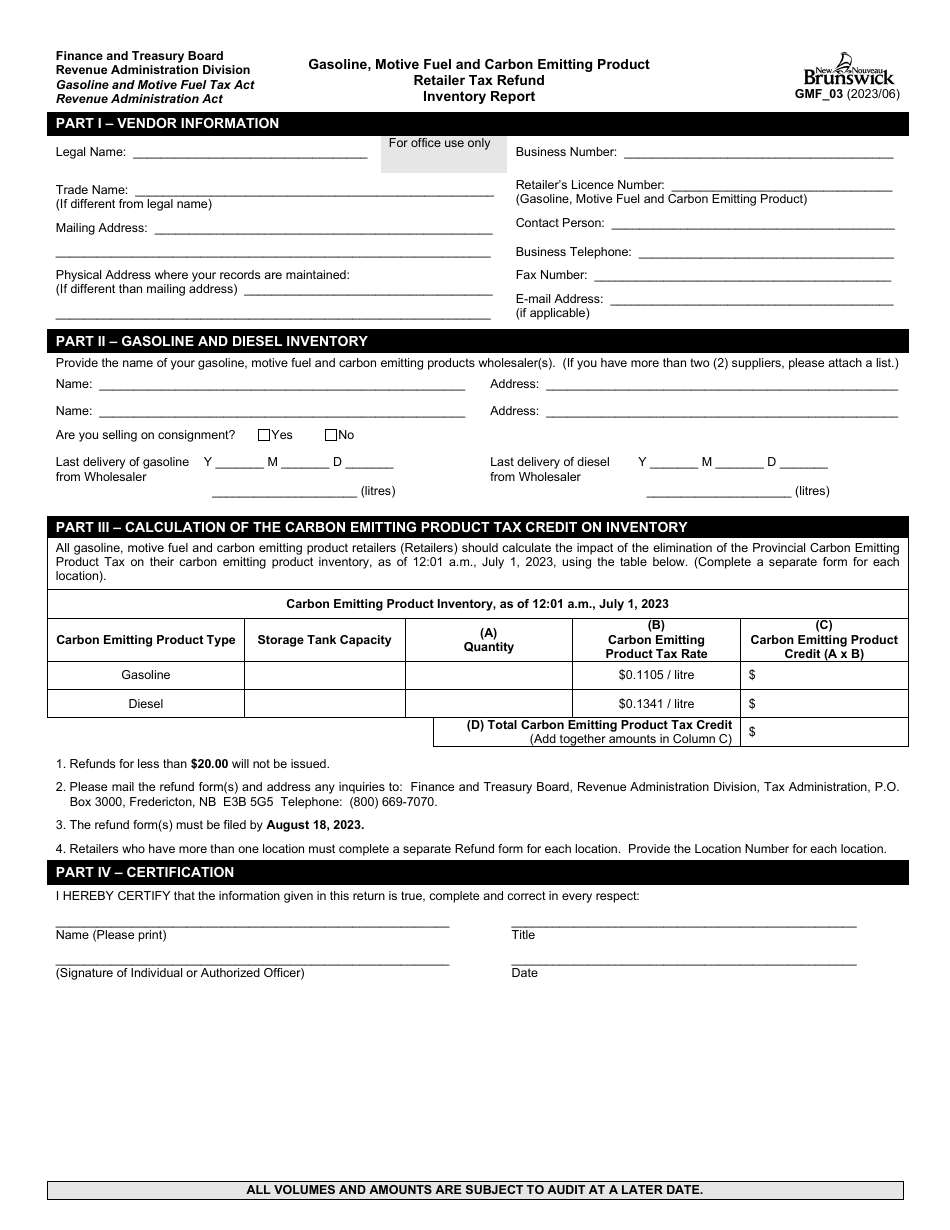

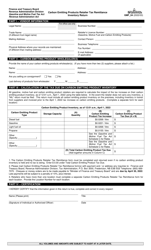

Form GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report - New Brunswick, Canada

Form GMF_03, Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report, is used in New Brunswick, Canada to report the inventory of gasoline, motive fuel, and carbon-emitting products held by retailers who are eligible for tax refunds. The form helps calculate the amount of tax refund retailers are entitled to based on their inventory levels.

The Form GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report in New Brunswick, Canada is filed by the retailers of gasoline, motive fuel, and carbon emitting products.

Form GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report - New Brunswick, Canada - Frequently Asked Questions (FAQ)

Q: What is the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report? A: The GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report is a report used in New Brunswick, Canada to track tax refunds for gasoline, motive fuel, and carbon emitting products.

Q: Who is required to file the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report? A: Retailers in New Brunswick, Canada who sell gasoline, motive fuel, and carbon emitting products are required to file the GMF_03 report.

Q: What information is included in the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report? A: The GMF_03 report includes information such as inventory counts, purchases, sales, tax refunds, and other details related to gasoline, motive fuel, and carbon emitting products.

Q: What is the purpose of the GMF_03 Gasoline, Motive Fuel and Carbon Emitting Product Retailer Tax Refund Inventory Report? A: The purpose of the GMF_03 report is to track and calculate tax refunds for retailers who sell gasoline, motive fuel, and carbon emitting products in New Brunswick, Canada.