This version of the form is not currently in use and is provided for reference only. Download this version of

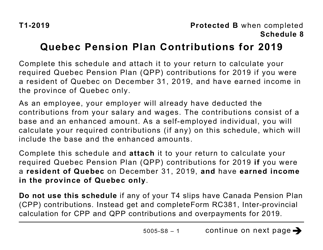

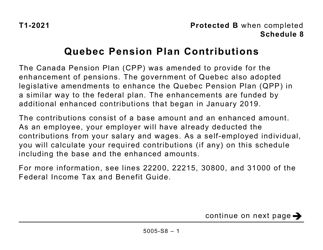

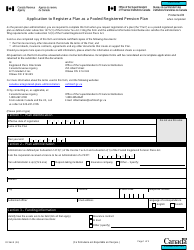

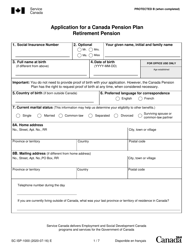

Form 5000-S8 Schedule 8

for the current year.

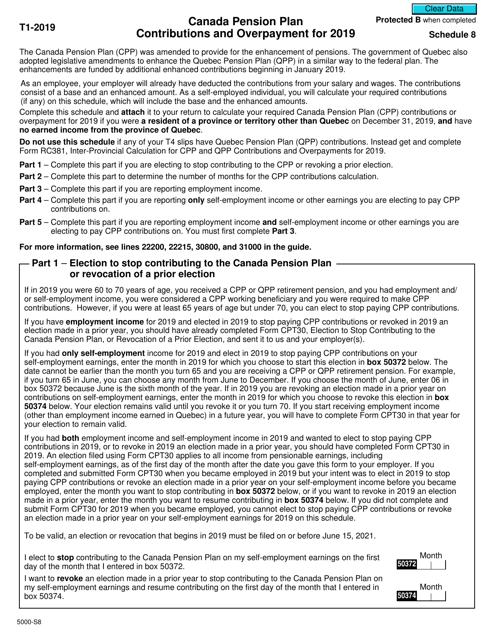

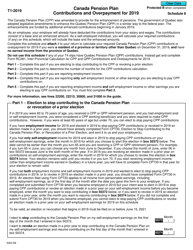

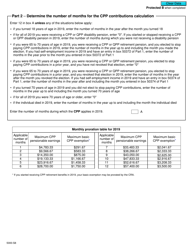

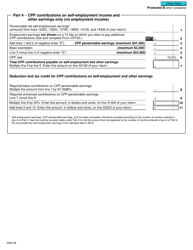

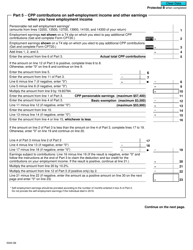

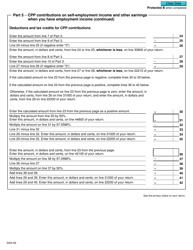

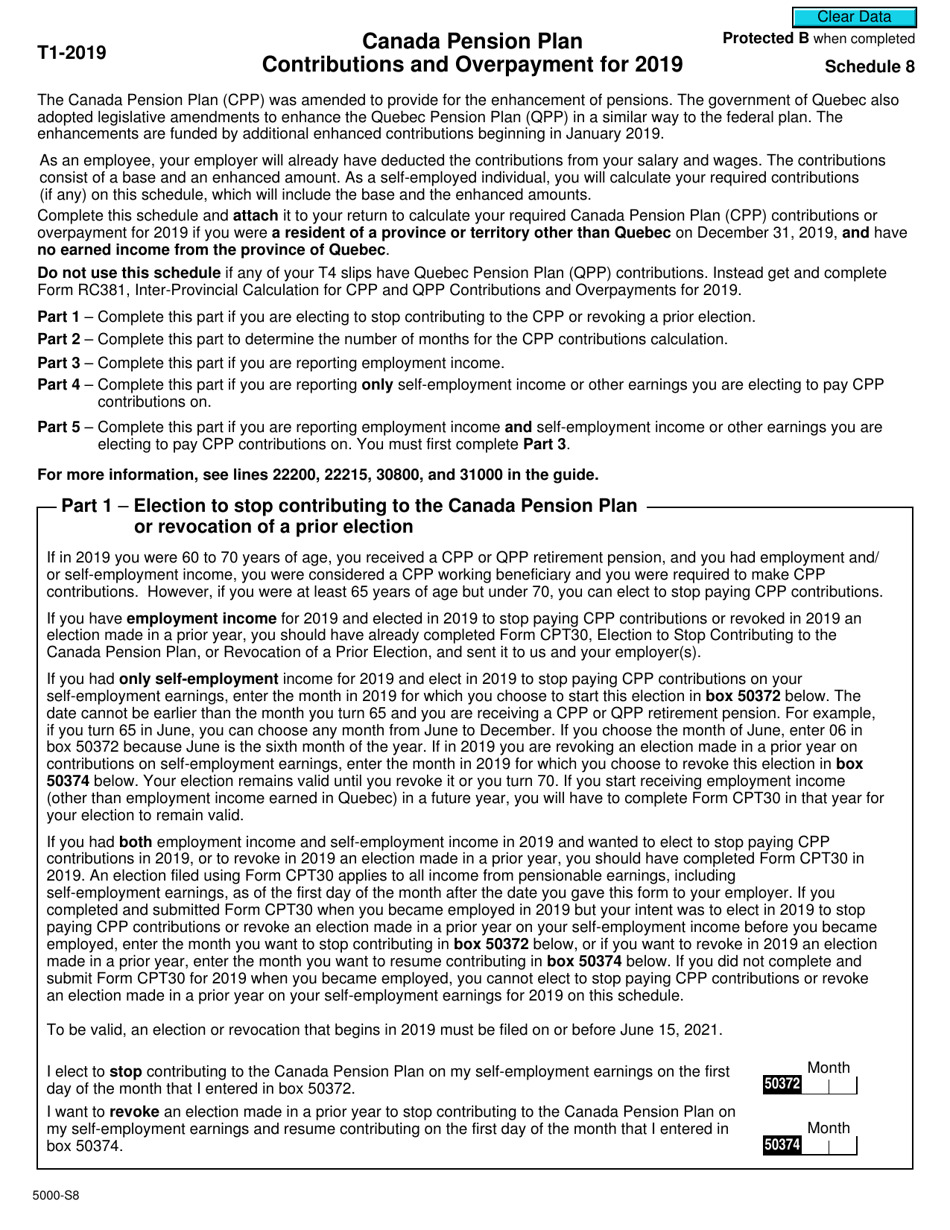

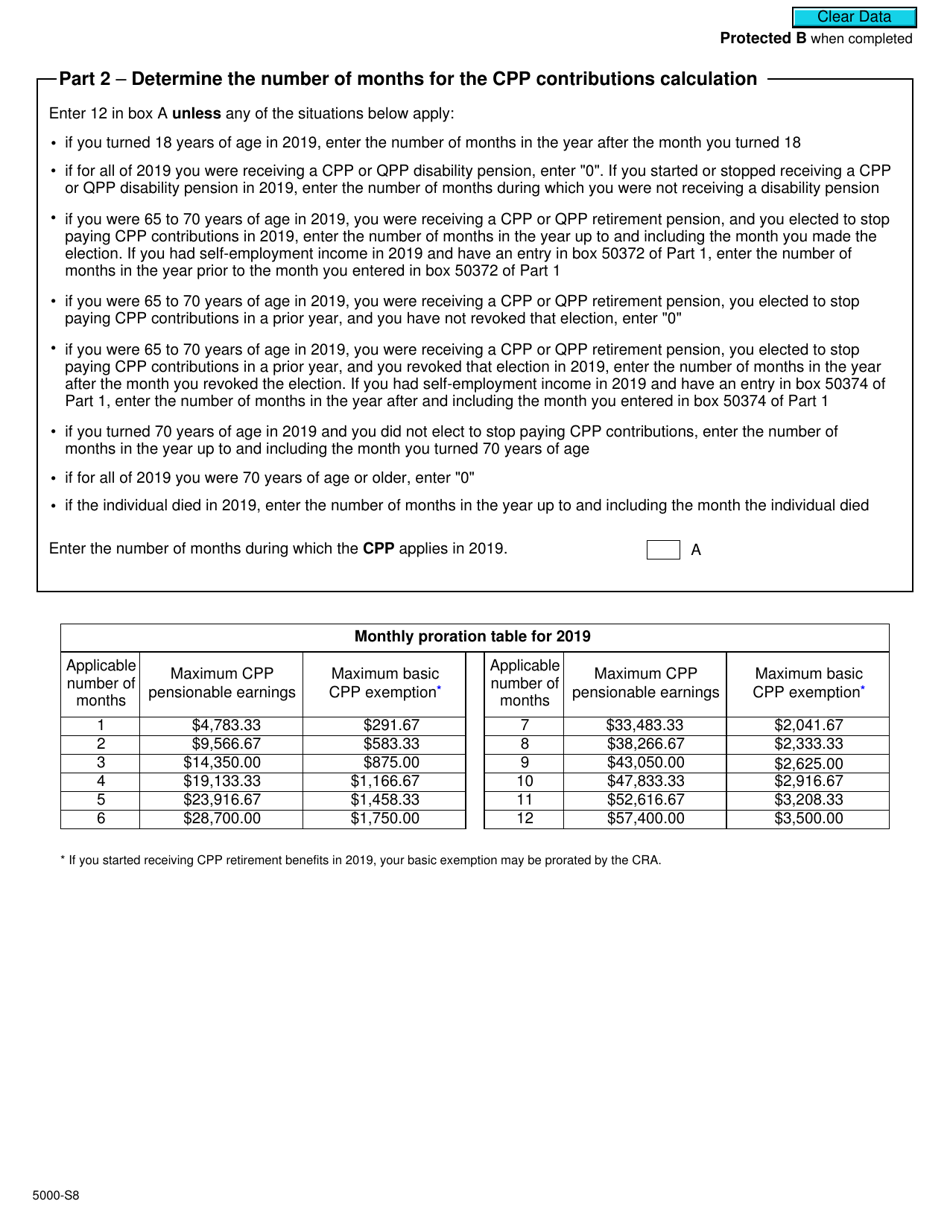

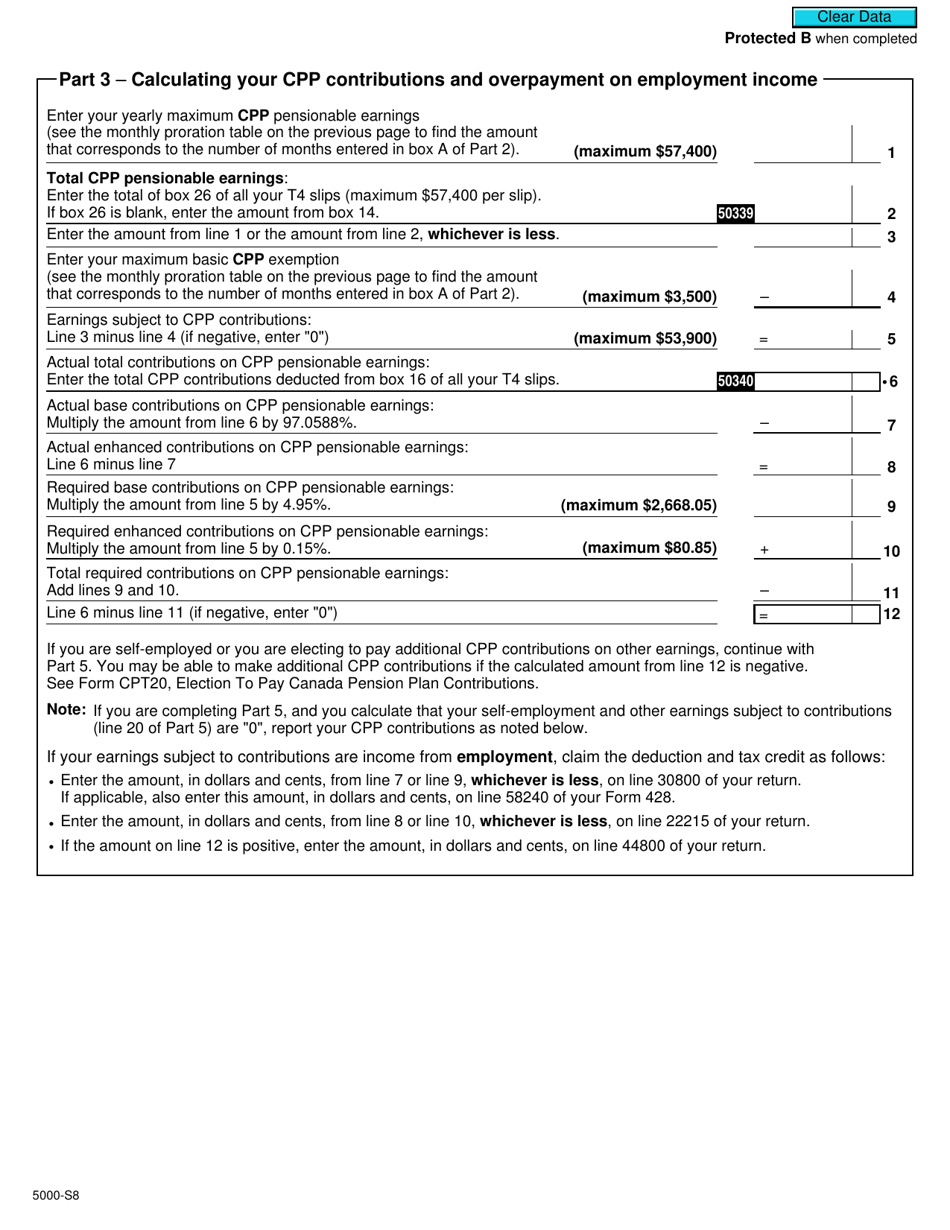

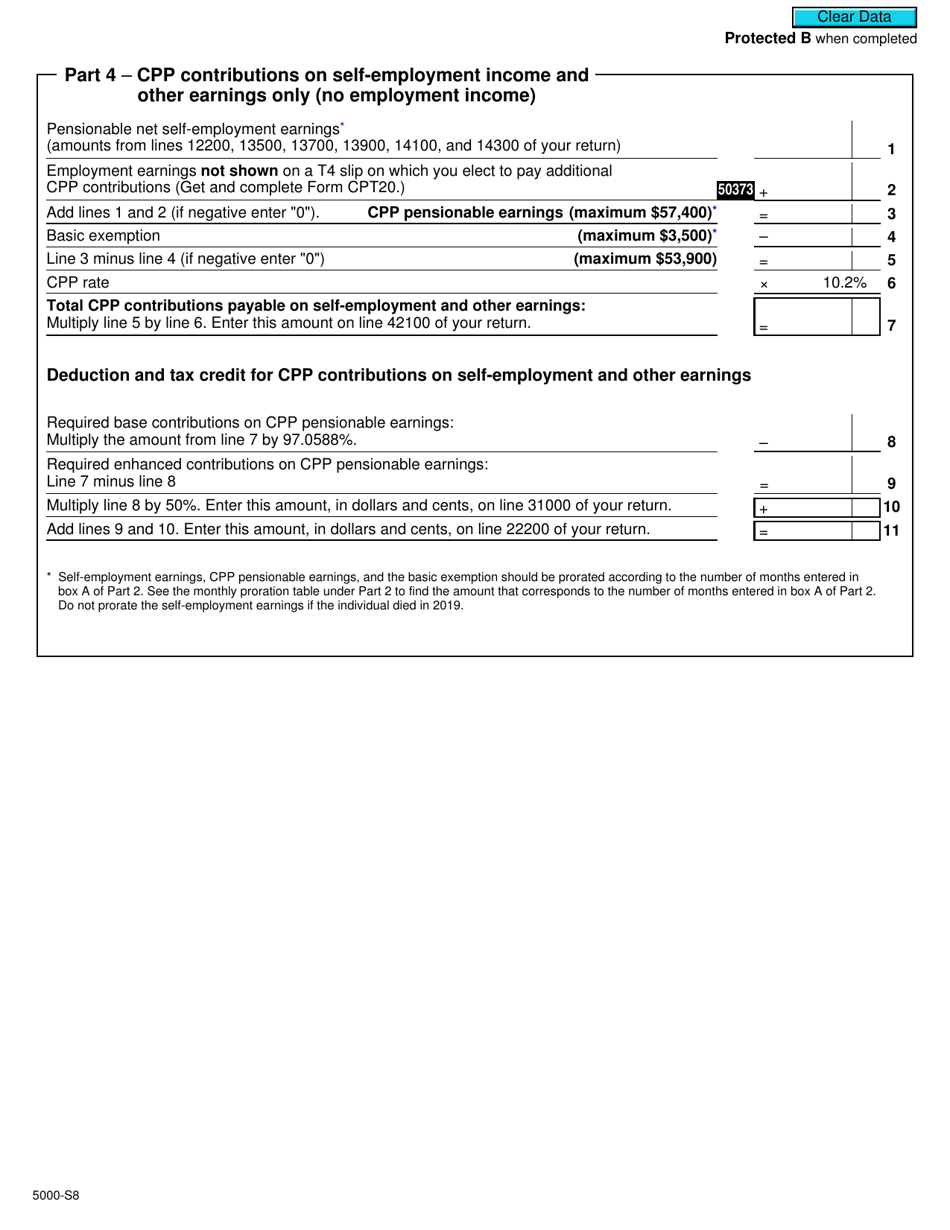

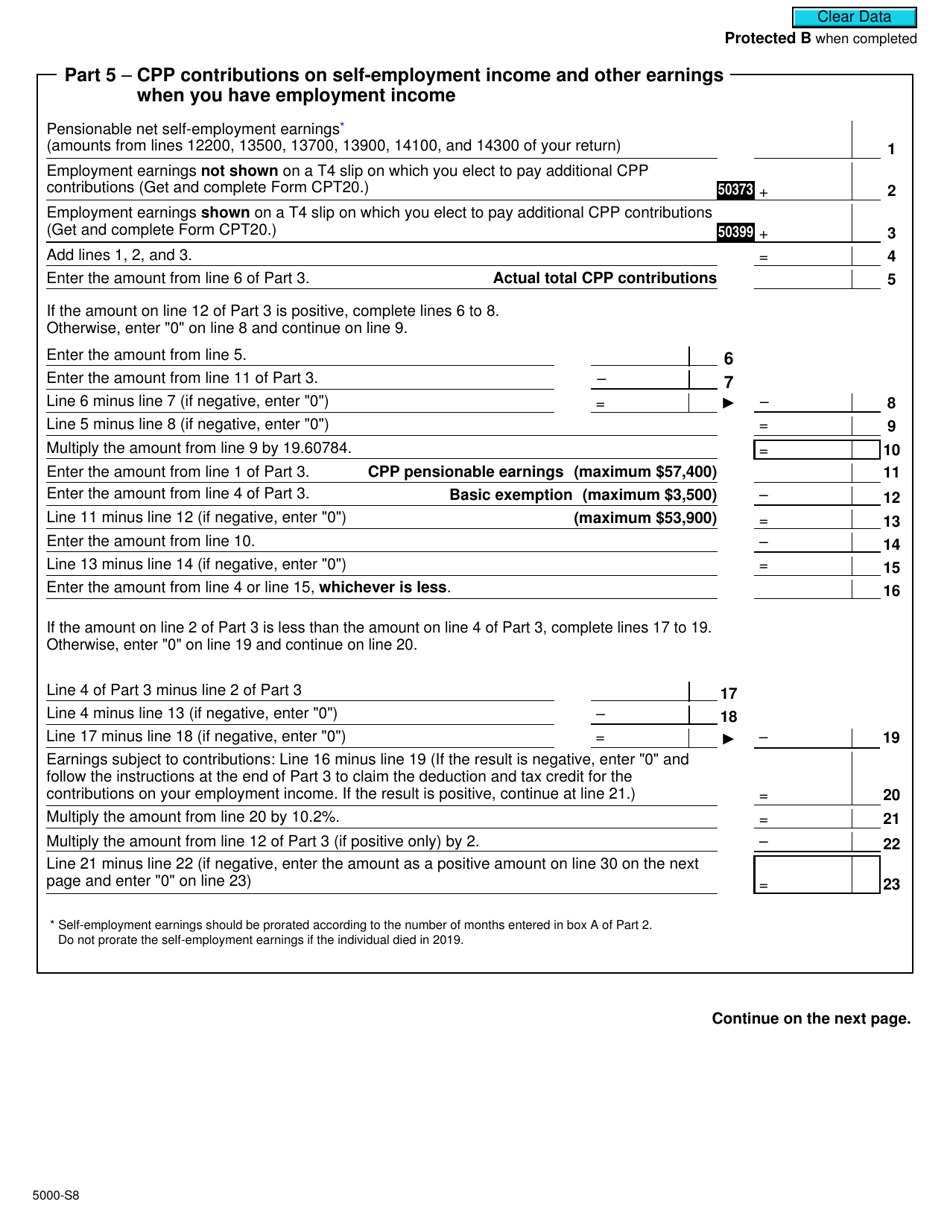

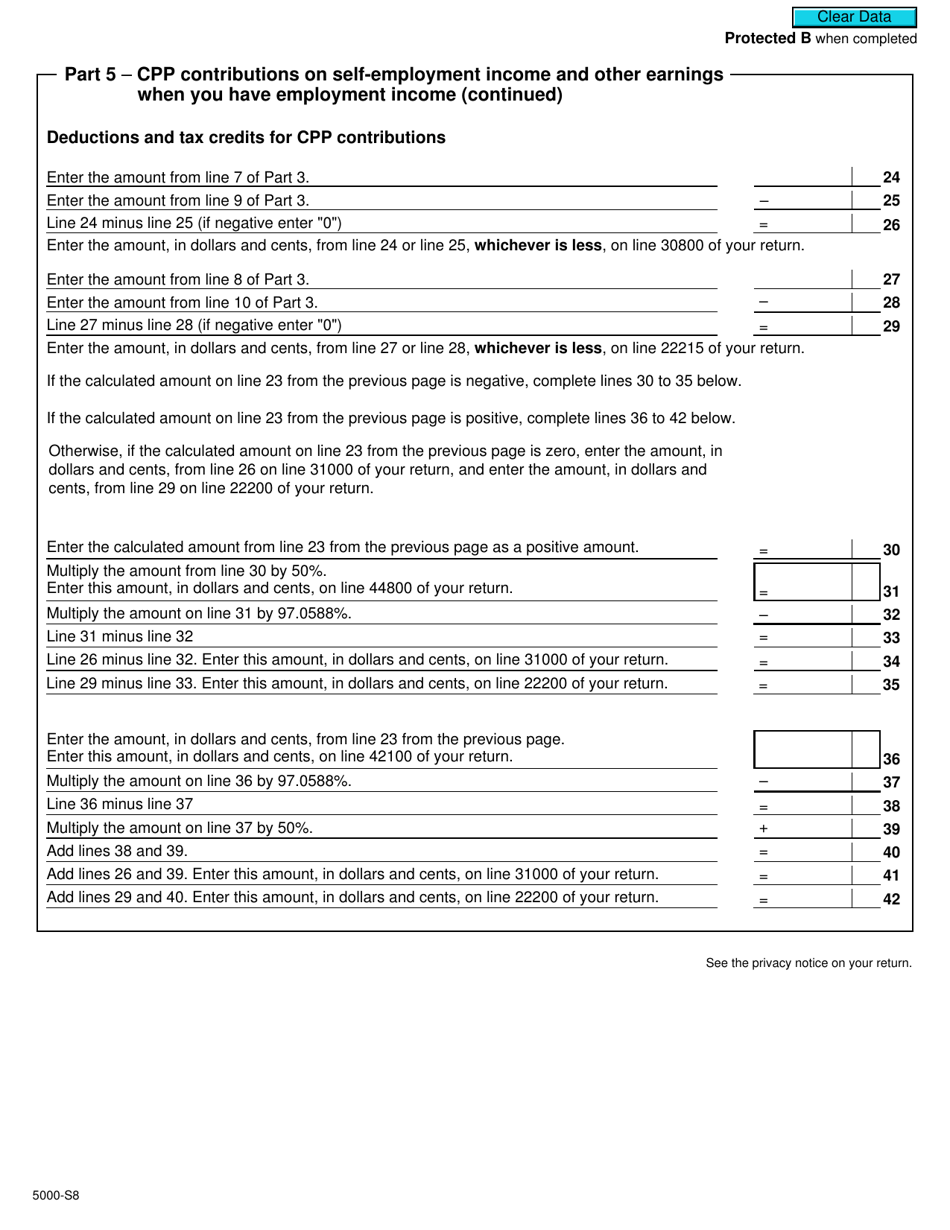

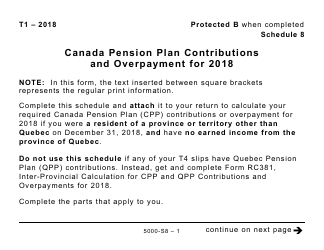

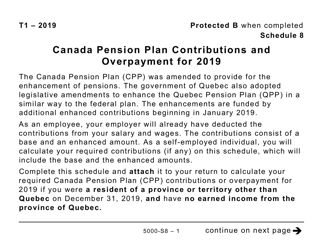

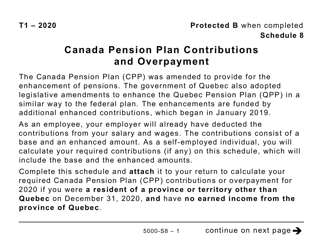

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment - Canada

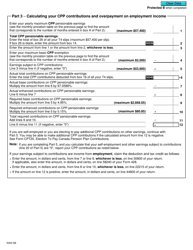

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment is used in Canada to report contributions made to the Canada Pension Plan and any overpayments. It helps individuals track their pension contributions and claim refunds if they have made any overpayments.

The individual who wants to report their Canada Pension Plan contributions and overpayments files the Form 5000-S8 Schedule 8 in Canada.

FAQ

Q: What is Form 5000-S8?

A: Form 5000-S8 is a tax form used to report Canada Pension Plan (CPP) contributions and overpayments.

Q: What is the Canada Pension Plan?

A: The Canada Pension Plan (CPP) is a social insurance program that provides retirement, disability, and survivor benefits to eligible individuals.

Q: Who needs to fill out Form 5000-S8?

A: Individuals who have made CPP contributions or overpayments during the tax year need to fill out Form 5000-S8.

Q: What information is required on Form 5000-S8?

A: Form 5000-S8 requires information such as your social insurance number, total CPP contributions or overpayments made, and the amount eligible for a refund.

Q: When is the deadline to submit Form 5000-S8?

A: The deadline to submit Form 5000-S8 is typically April 30th of the following year, or June 15th if you or your spouse or common-law partner are self-employed.

Q: Are CPP contributions tax-deductible?

A: No, CPP contributions are not tax-deductible.

Q: Can I get a refund for CPP overpayments?

A: Yes, if you have made CPP overpayments, you may be eligible for a refund.

Q: What happens if I don't submit Form 5000-S8?

A: If you don't submit Form 5000-S8, you may not receive a refund for your CPP overpayments or be properly credited for your CPP contributions.