This version of the form is not currently in use and is provided for reference only. Download this version of

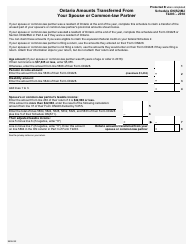

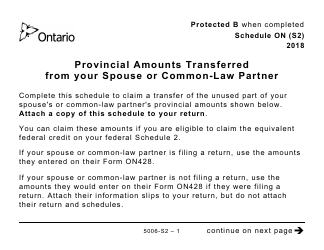

Form 5000-S2 Schedule 2

for the current year.

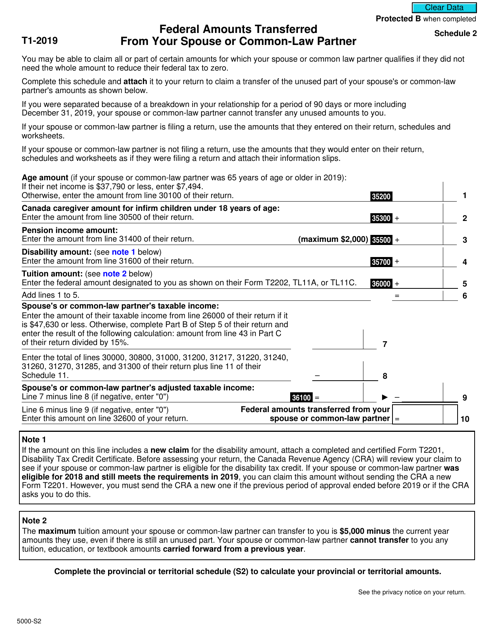

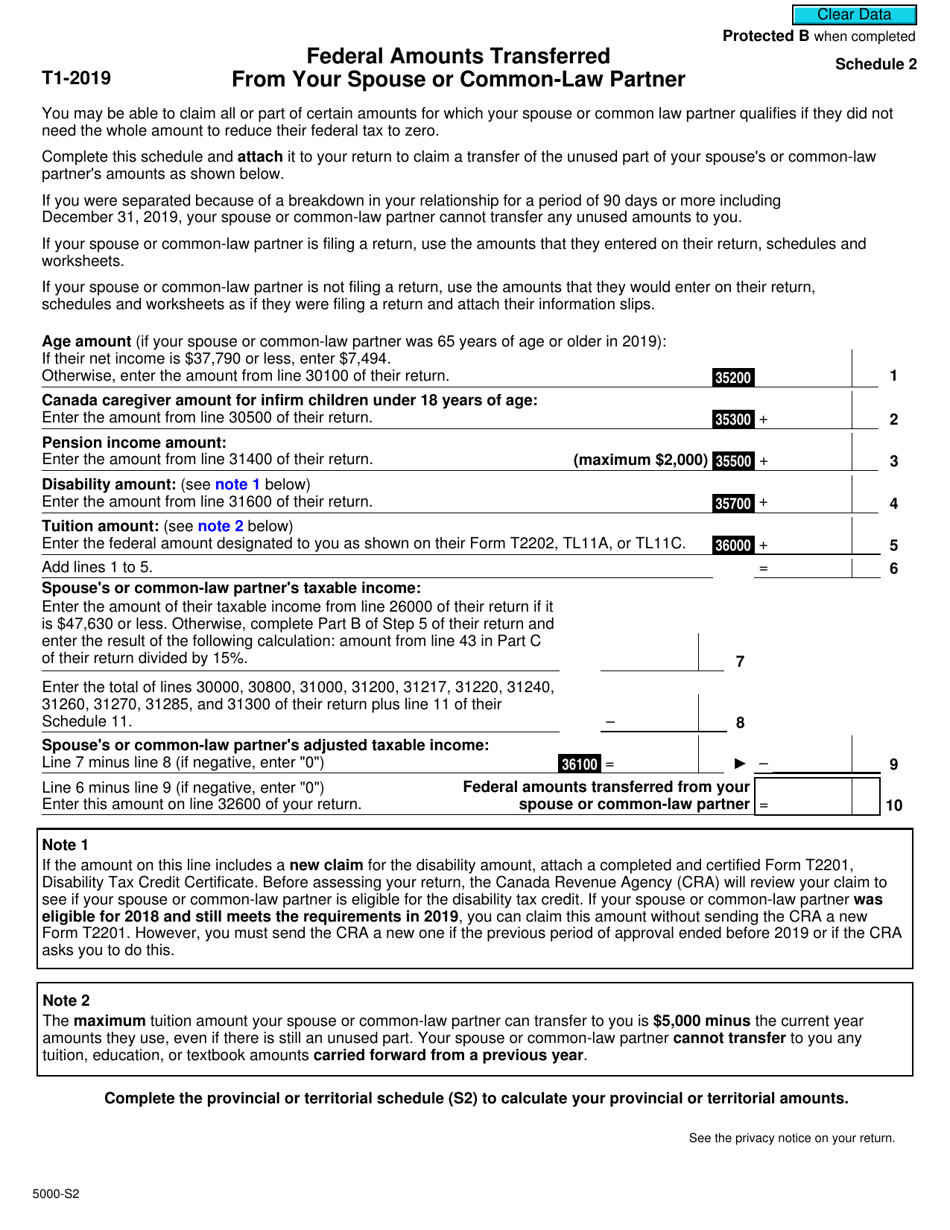

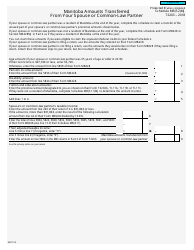

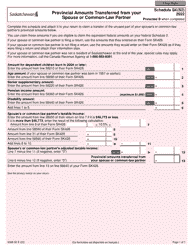

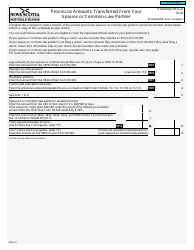

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner is used in Canada to report any federal amounts that you transferred from your spouse or common-law partner's tax return to your own. This can include certain deductions, credits, and other federal tax amounts.

In Canada, the Form 5000-S2 Schedule 2 for Federal Amounts Transferred From Your Spouse or Common-Law Partner is filed by the individual who is claiming the transferred amounts.

FAQ

Q: What is Form 5000-S2?

A: Form 5000-S2 is a schedule used in Canada for reporting federal amounts transferred from your spouse or common-law partner.

Q: What is Schedule 2?

A: Schedule 2 is a specific section of Form 5000-S2 that deals with federal amounts transferred from your spouse or common-law partner.

Q: Why do I need to fill out Schedule 2?

A: You need to fill out Schedule 2 if you have received any federal amounts transferred from your spouse or common-law partner that need to be reported for tax purposes.

Q: What are federal amounts transferred from a spouse or common-law partner?

A: Federal amounts transferred from a spouse or common-law partner include certain tax credits, deductions, and other benefits that can be transferred to you in order to reduce your tax liability.

Q: How do I fill out Schedule 2?

A: To fill out Schedule 2, you will need to provide information about the federal amounts transferred to you, including the type of transfer, the amount transferred, and the name and social insurance number (SIN) of your spouse or common-law partner.

Q: When is the deadline to file Form 5000-S2?

A: The deadline to file Form 5000-S2 is usually the same as the deadline for filing your income tax return, which is April 30th for most individuals in Canada.

Q: What happens if I don't file Schedule 2?

A: If you don't file Schedule 2 when required, you may miss out on potential tax savings or deductions that could reduce your tax liability.

Q: Do I need to include supporting documents with Schedule 2?

A: In most cases, you don't need to include supporting documents with Schedule 2. However, you should keep any relevant documentation for your records in case the CRA requests it.