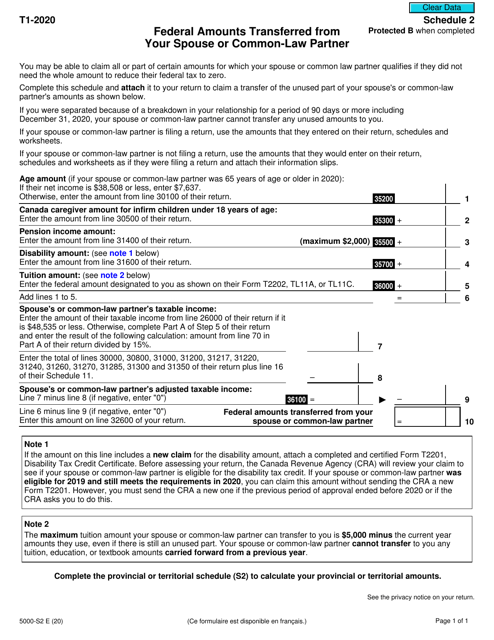

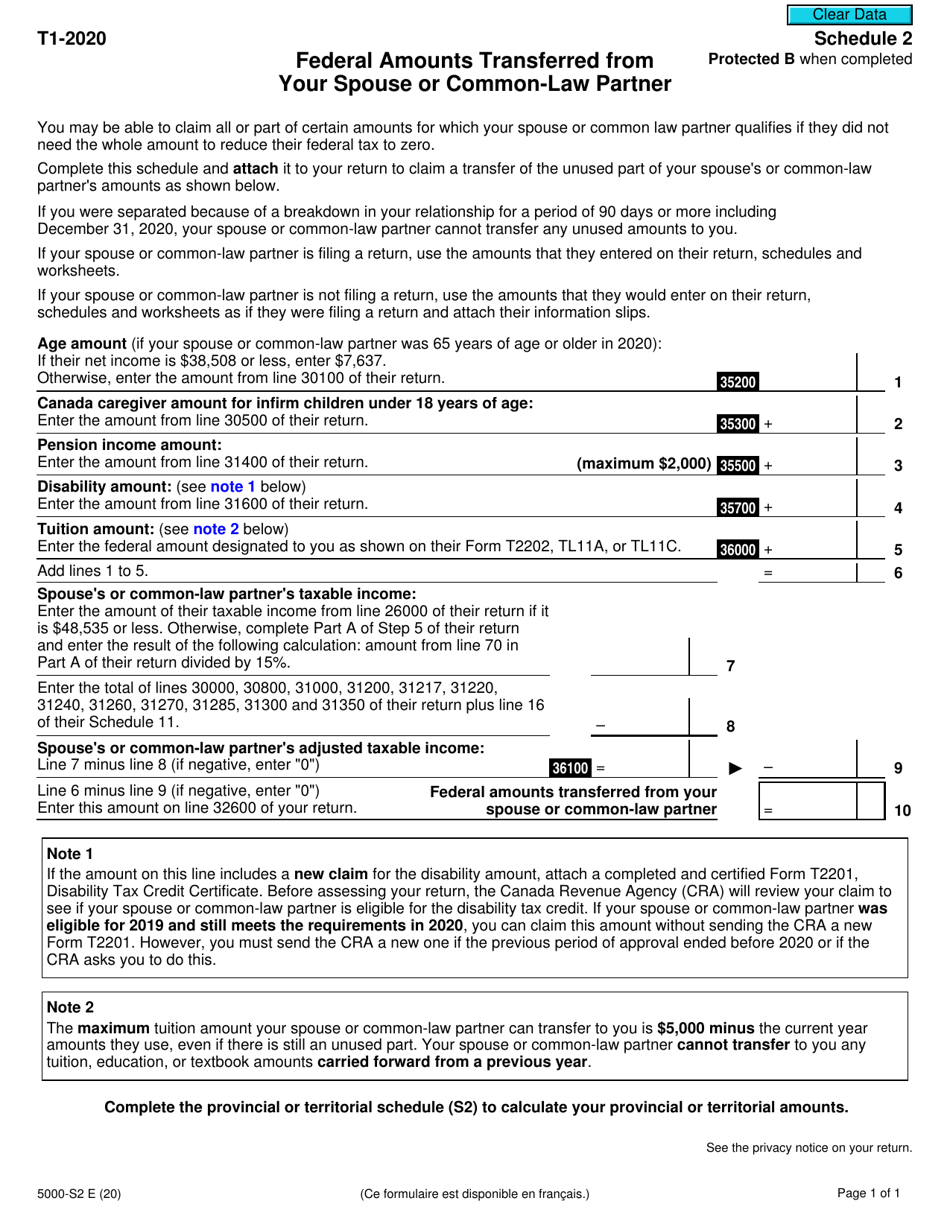

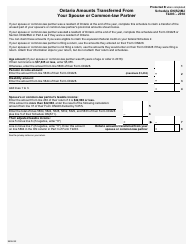

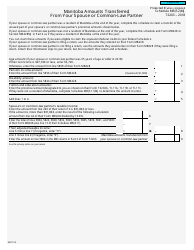

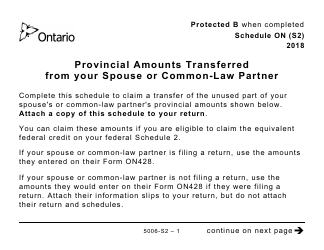

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5000-S2 Schedule 2 is used in Canada to report federal amounts that were transferred from your spouse or common-law partner. This form is typically used when you want to allocate certain amounts, such as the age amount or pension income, to your partner for income tax purposes.

The individual who files the Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner in Canada is the taxpayer themselves.

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5000-S2 Schedule 2?

A: Form 5000-S2 Schedule 2 is a document used in Canada for reporting federal amounts transferred from your spouse or common-law partner.

Q: What are federal amounts transferred from your spouse or common-law partner?

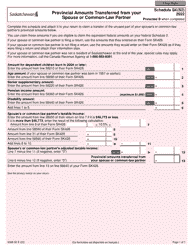

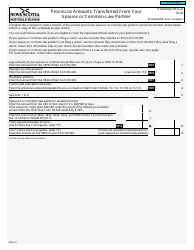

A: Federal amounts transferred from your spouse or common-law partner refer to certain tax credits, deductions, or benefits that can be transferred from one spouse or common-law partner to the other.

Q: Why would someone transfer federal amounts from their spouse or common-law partner?

A: Transferring federal amounts from a spouse or common-law partner can help reduce the overall tax burden and maximize the available tax benefits.

Q: Who can use Form 5000-S2 Schedule 2?

A: Form 5000-S2 Schedule 2 can be used by individuals in Canada who want to transfer federal amounts from their spouse or common-law partner.

Q: Is Form 5000-S2 Schedule 2 applicable in the United States?

A: No, Form 5000-S2 Schedule 2 is specific to Canada and is not applicable in the United States.

Q: What should I do with Form 5000-S2 Schedule 2 once completed?

A: Once completed, Form 5000-S2 Schedule 2 should be filed with your personal income tax return in Canada.

Q: Are there any eligibility requirements for transferring federal amounts?

A: Yes, there are specific eligibility requirements and restrictions for transferring federal amounts from a spouse or common-law partner. It is recommended to review the instructions or consult with a tax professional for more information.

Q: Can I transfer federal amounts from a former spouse or common-law partner?

A: In some cases, it may be possible to transfer federal amounts from a former spouse or common-law partner. However, eligibility requirements and specific rules apply. Consult with a tax professional for guidance.

Q: What are some examples of federal amounts that can be transferred?

A: Examples of federal amounts that can be transferred include the age amount, the pension income amount, the disability amount, and the tuition and education amounts.