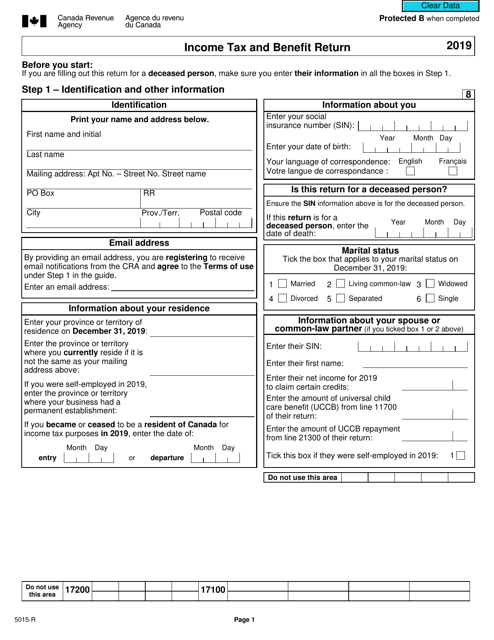

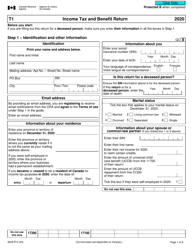

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5015-R

for the current year.

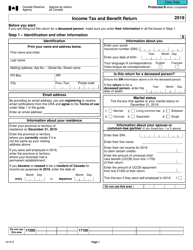

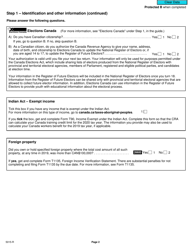

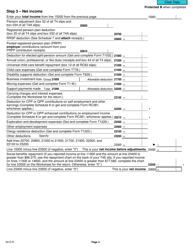

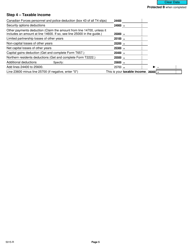

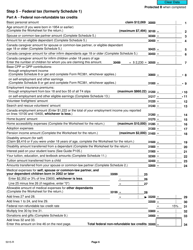

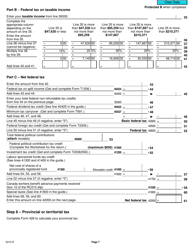

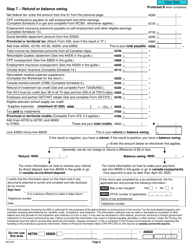

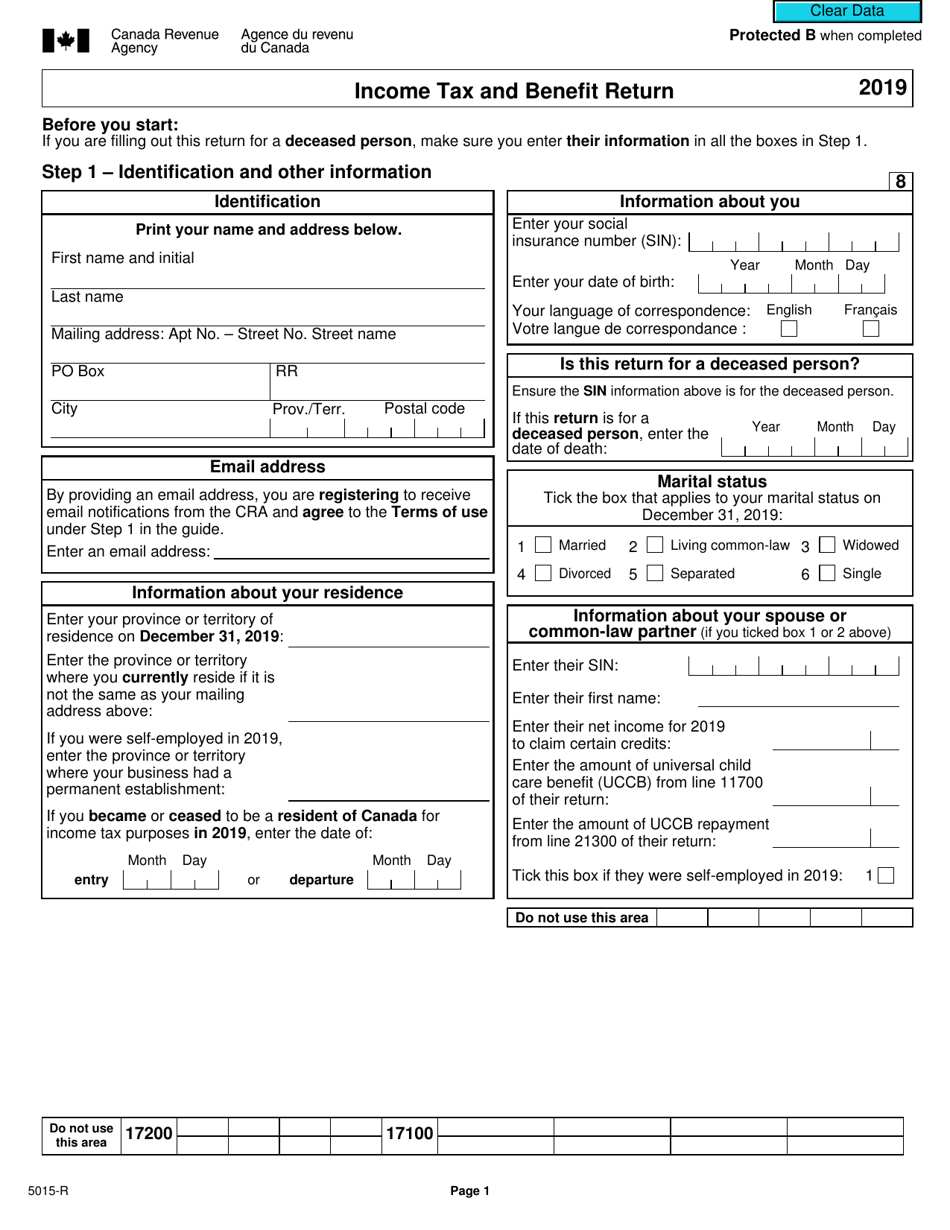

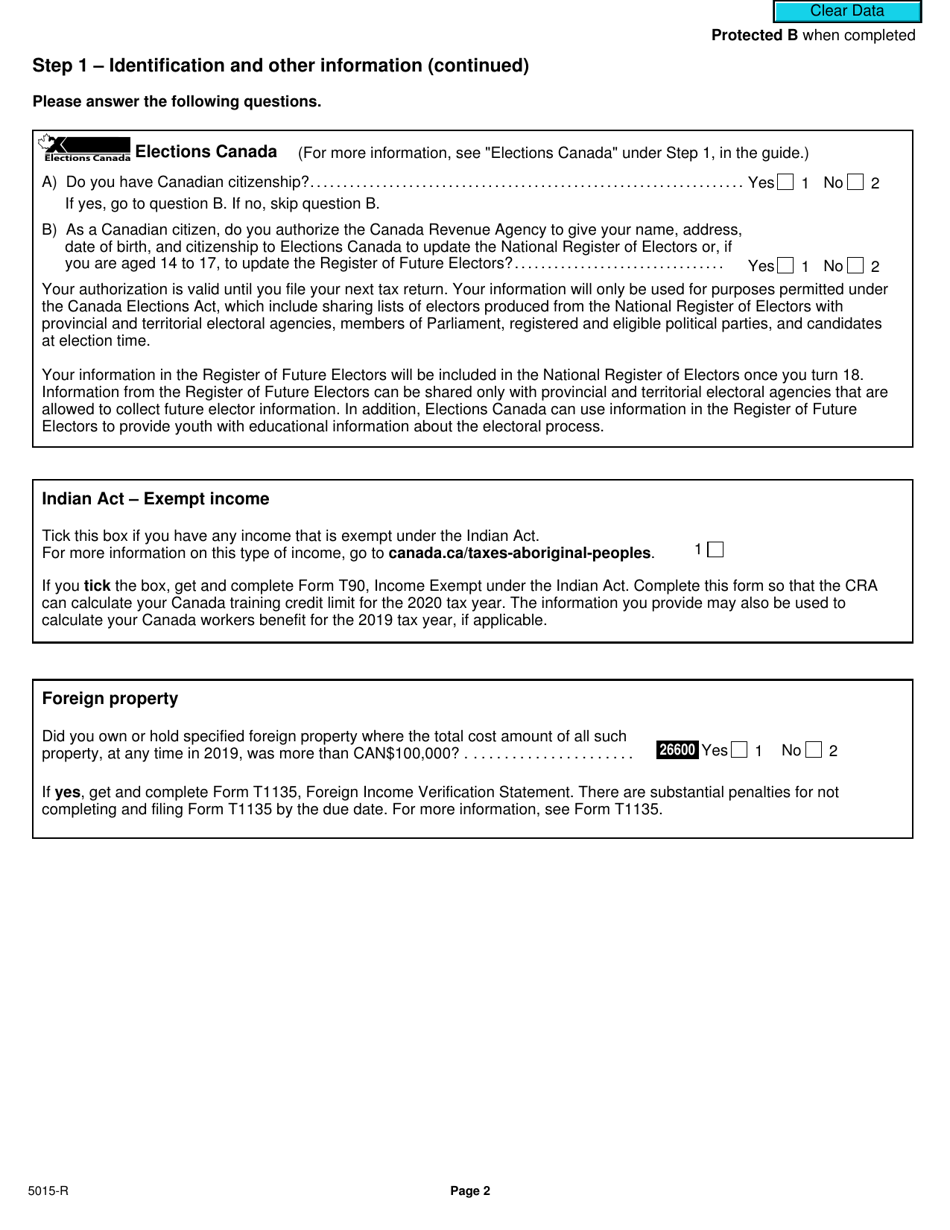

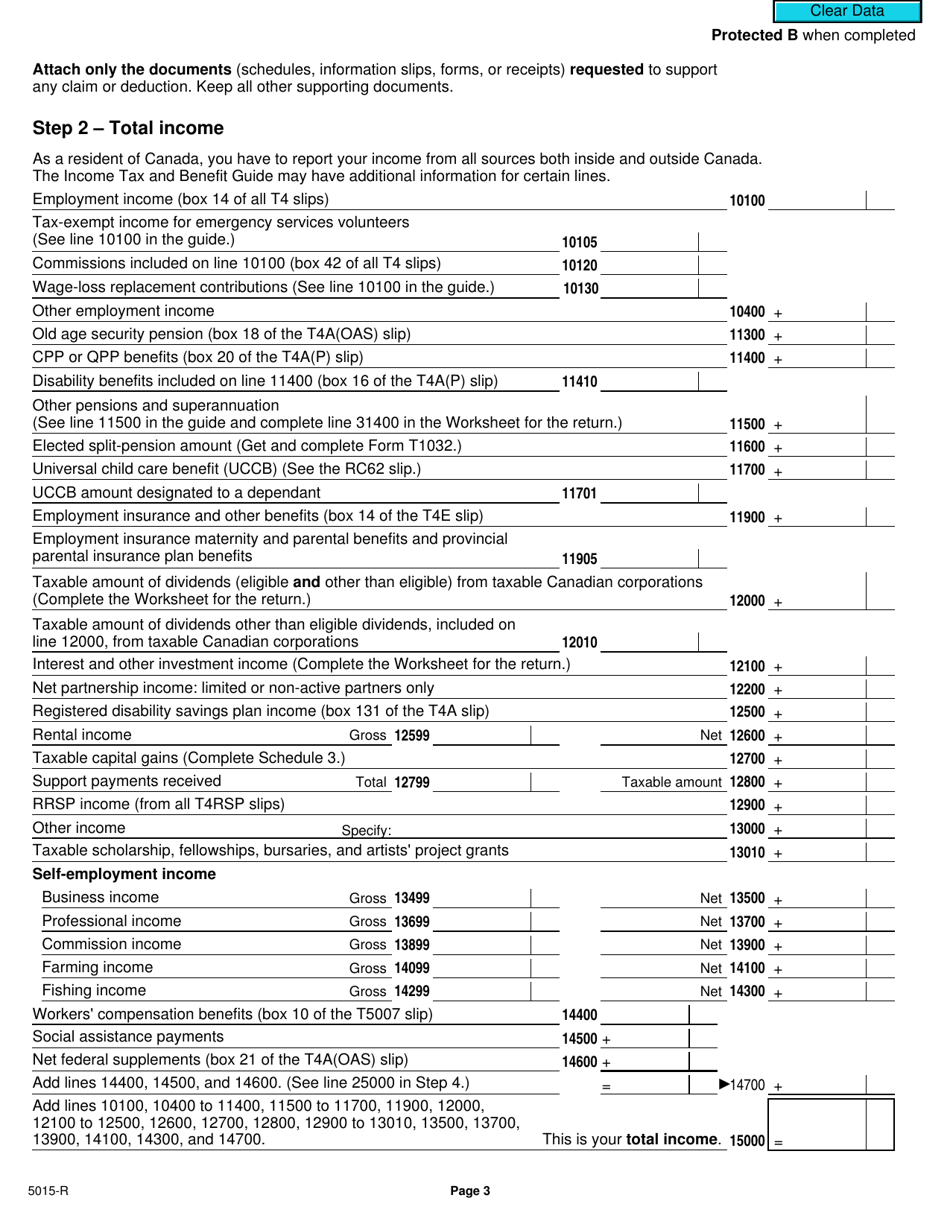

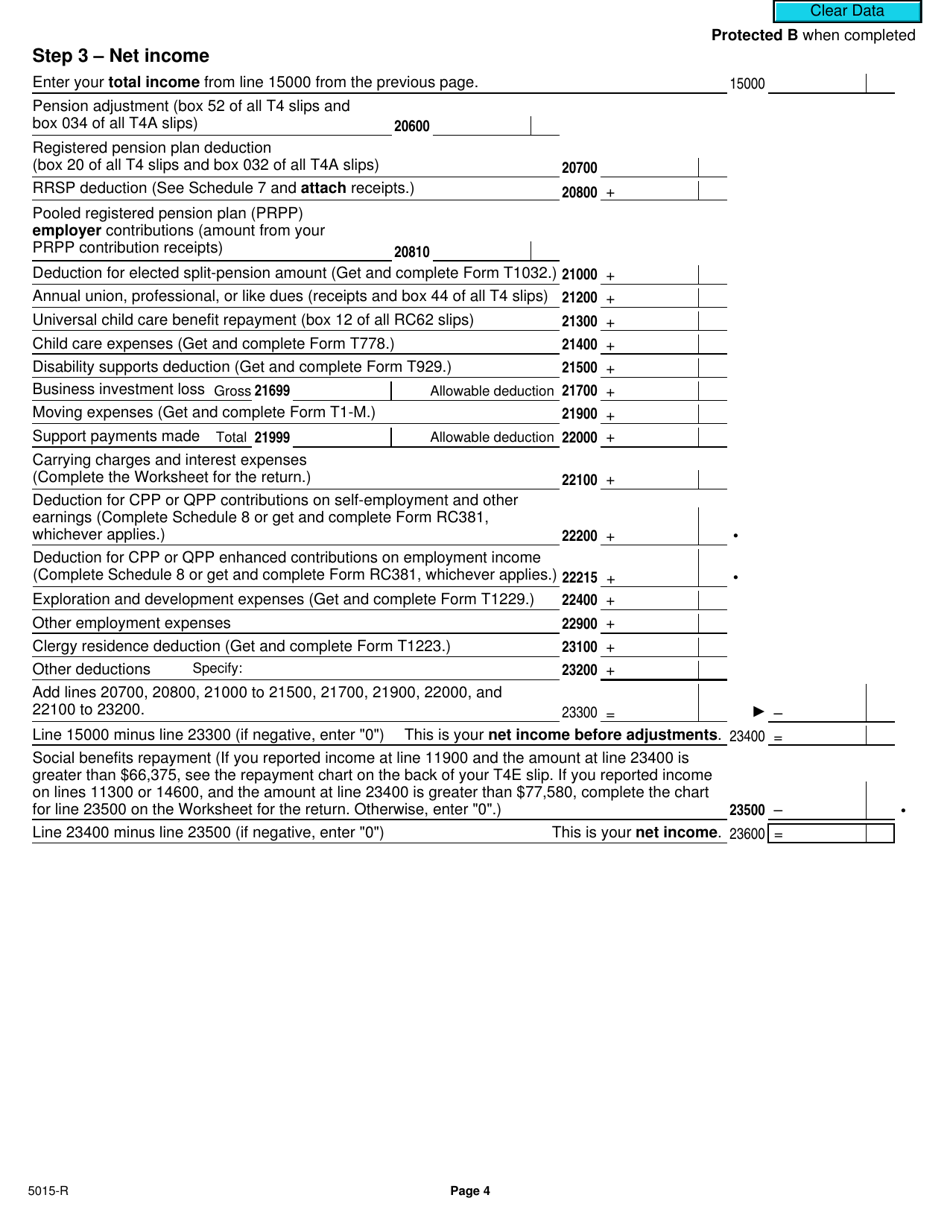

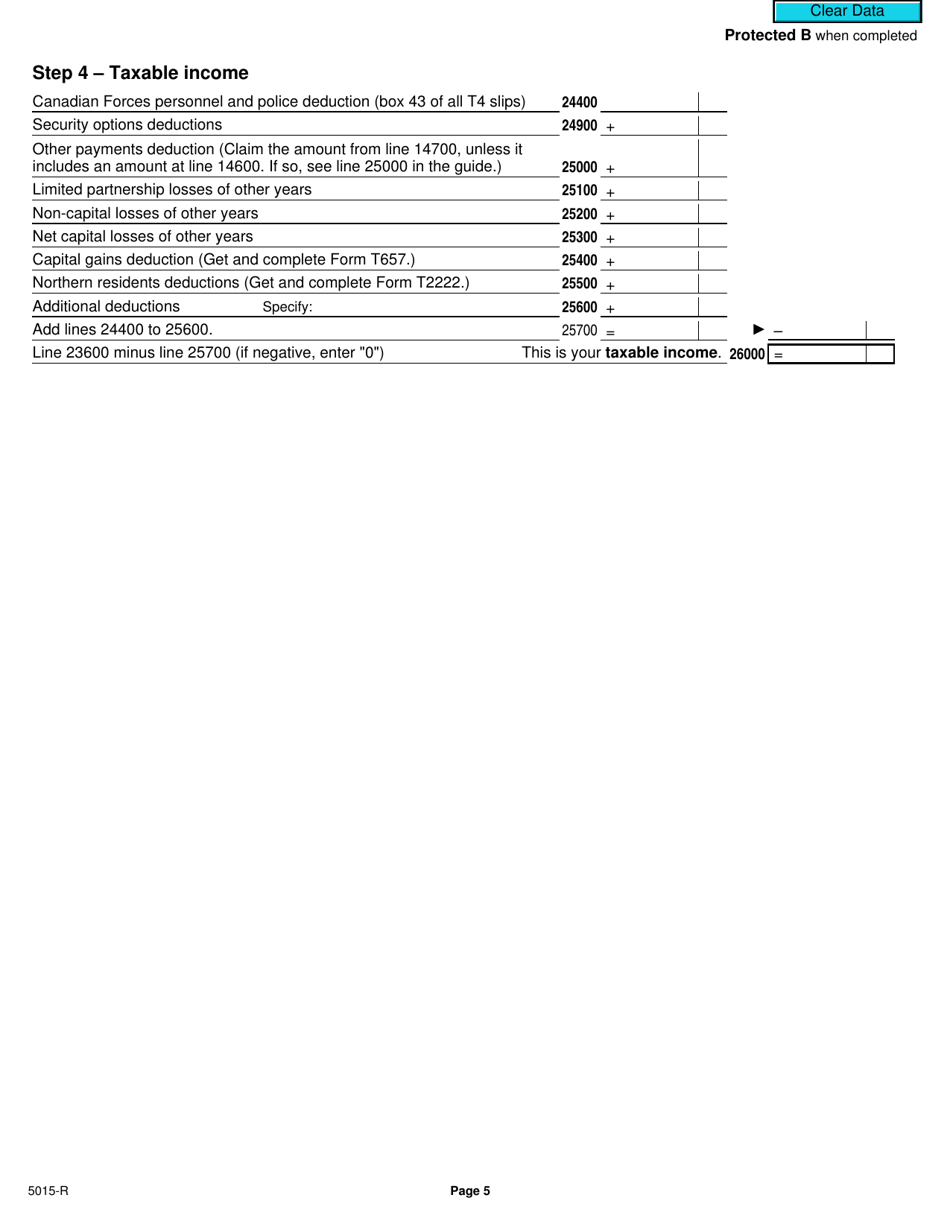

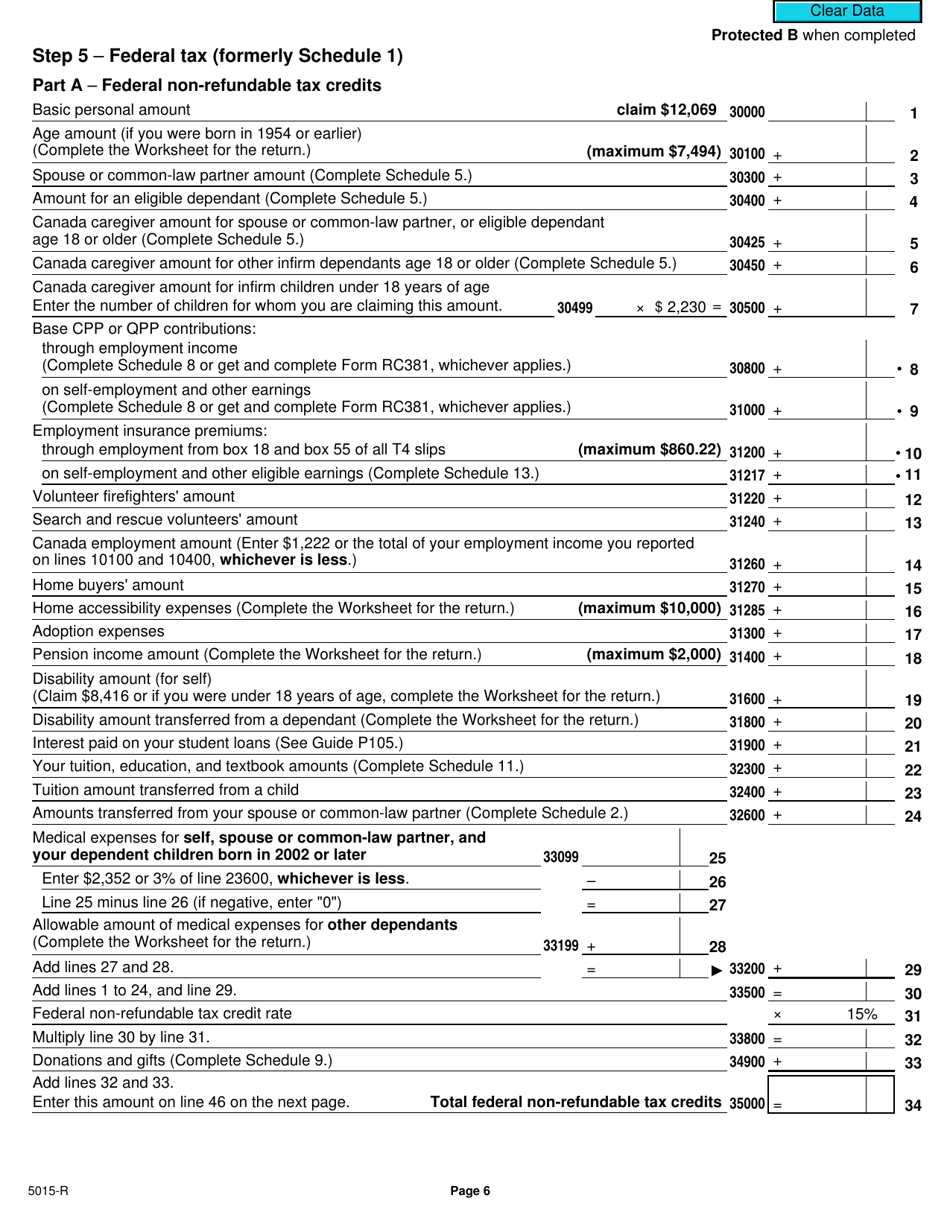

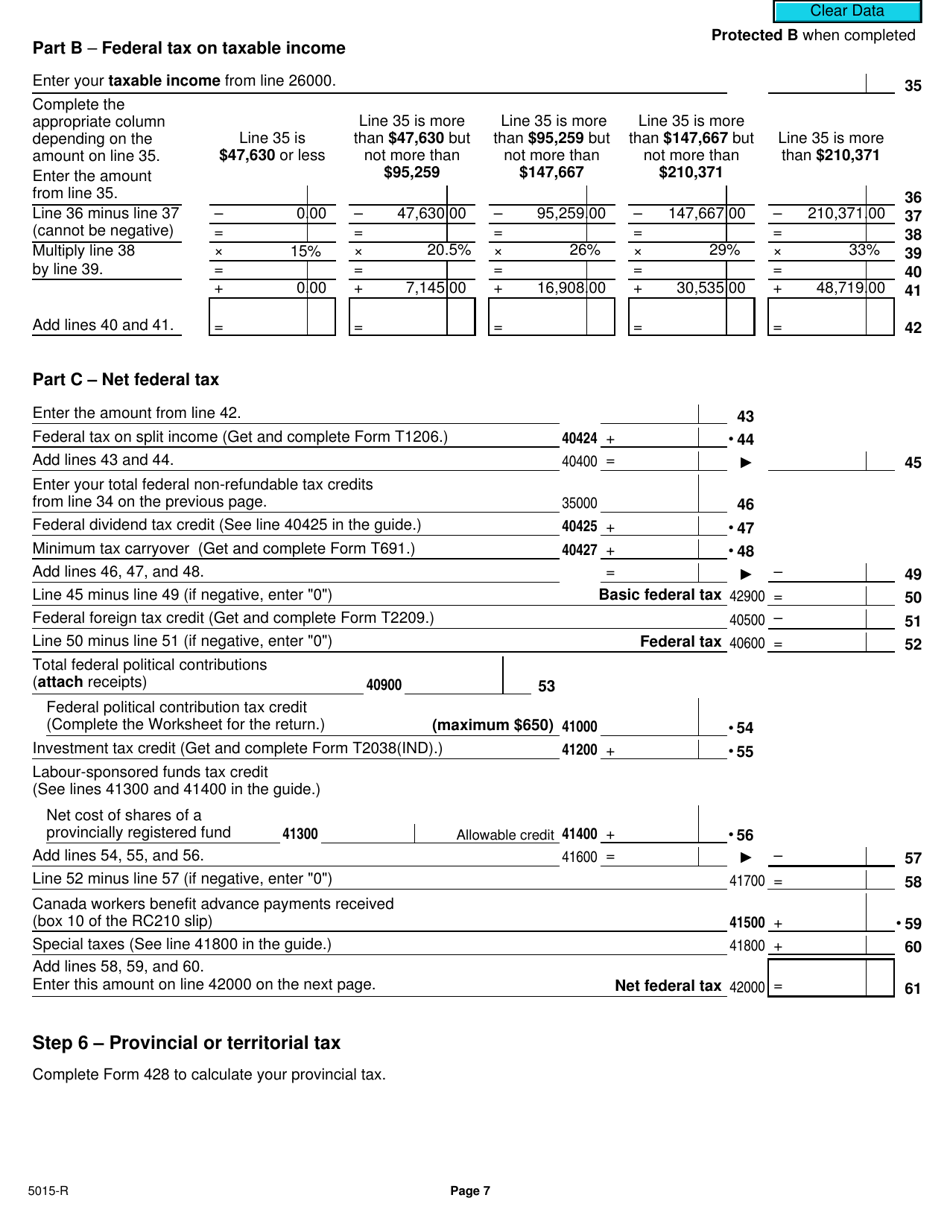

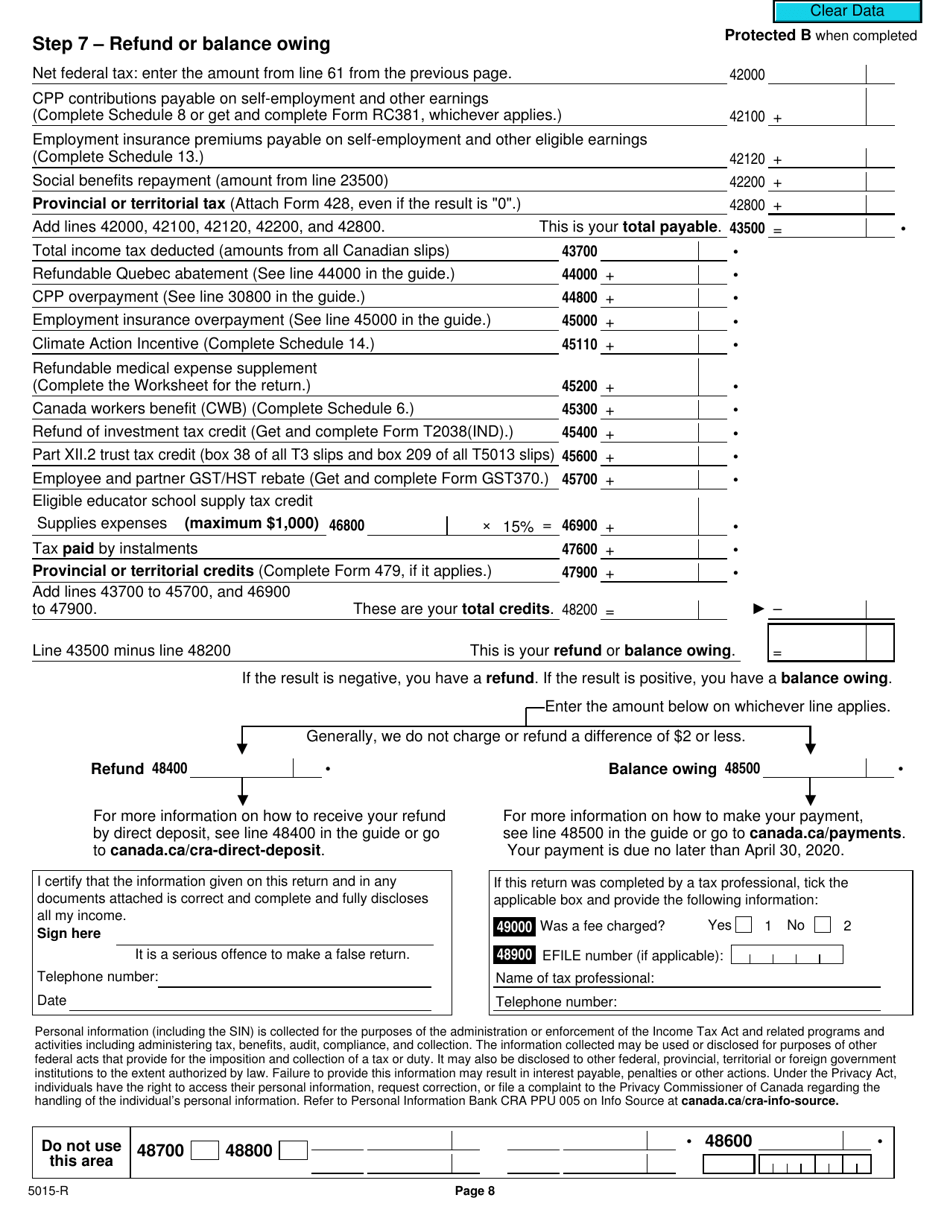

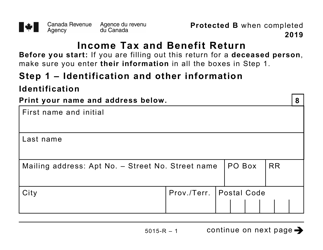

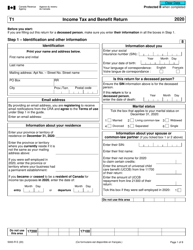

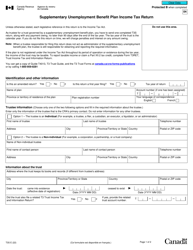

Form 5015-R Income Tax and Benefit Return - Alberta, Manitoba, Saskatchewan - Canada

Form 5015-R Income Tax and Benefit Return is used in Alberta, Manitoba, and Saskatchewan in Canada for filing income tax and declaring benefits. It is the official form to report your income, claim deductions, and calculate your tax liability.

In Canada, the Form 5015-R Income Tax and Benefit Return is filed by individuals who are residents of Alberta, Manitoba, or Saskatchewan.

FAQ

Q: What is Form 5015-R?

A: Form 5015-R is the Income Tax and Benefit Return form specifically for residents of Alberta, Manitoba, and Saskatchewan in Canada.

Q: Who needs to fill out Form 5015-R?

A: Residents of Alberta, Manitoba, and Saskatchewan in Canada who have taxable income need to fill out Form 5015-R.

Q: What is the purpose of Form 5015-R?

A: Form 5015-R is used to report your income, claim deductions and credits, and calculate your income tax liability for residents of Alberta, Manitoba, and Saskatchewan in Canada.

Q: When is Form 5015-R due?

A: Form 5015-R is generally due on or before April 30th of each year.

Q: What if I don't file Form 5015-R?

A: If you are required to file Form 5015-R but fail to do so, you may be subject to penalties and interest charges.

Q: Can I get help with filling out Form 5015-R?

A: Yes, you can seek assistance from tax professionals or use the CRA's community volunteer income tax program for free help in filling out your Form 5015-R.

Q: Can I file Form 5015-R in paper format?

A: Yes, you can choose to file Form 5015-R in paper format by mail or in person at a designated CRA office.