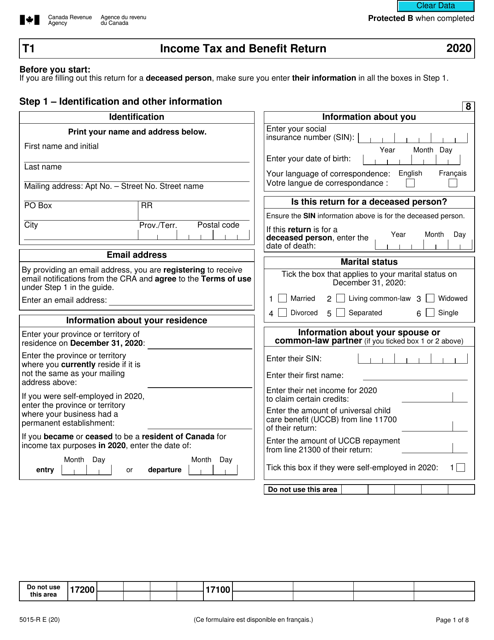

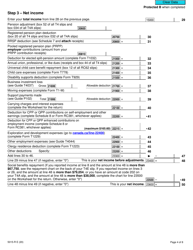

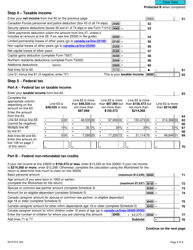

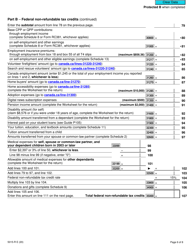

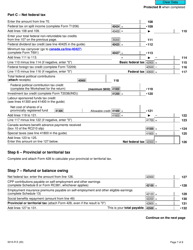

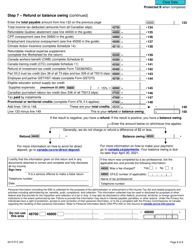

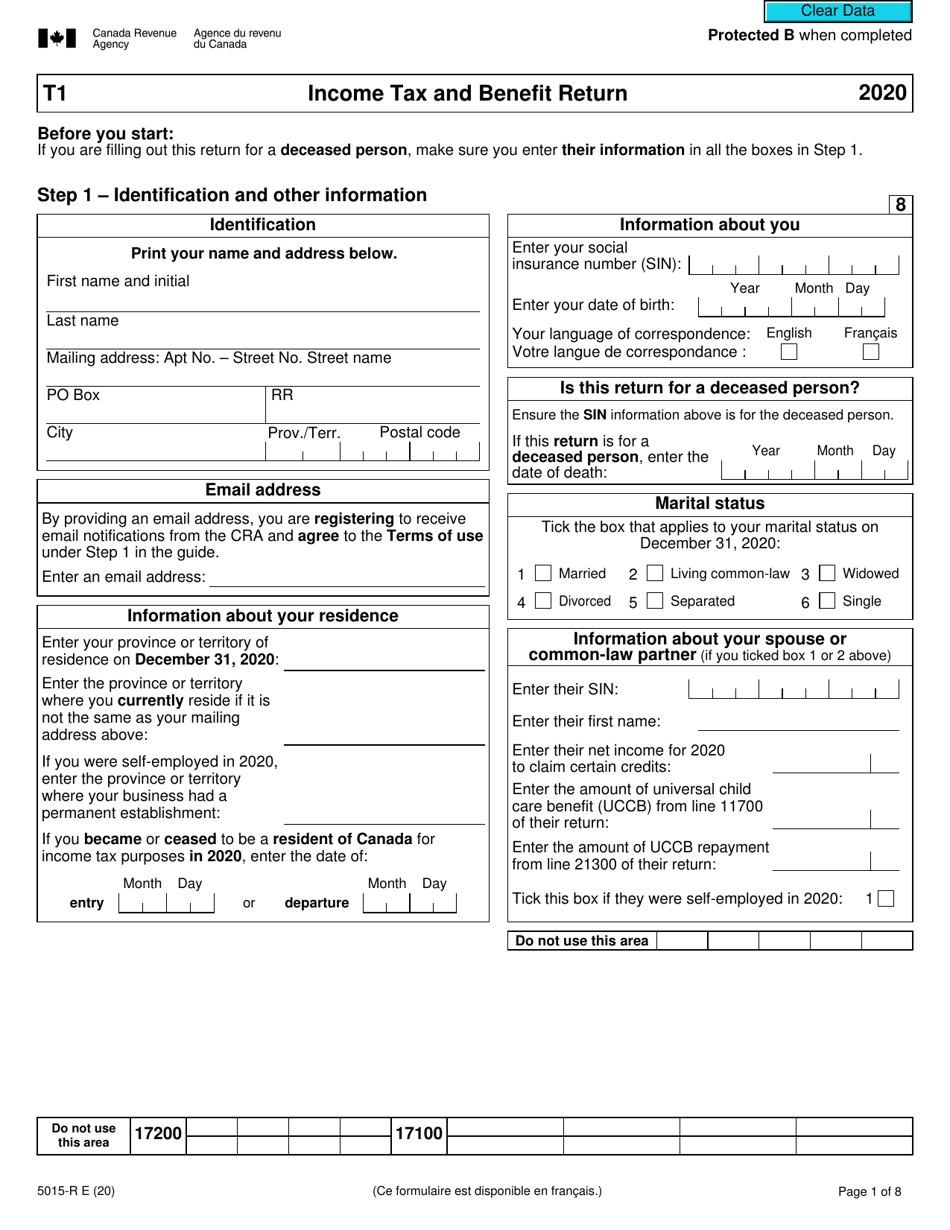

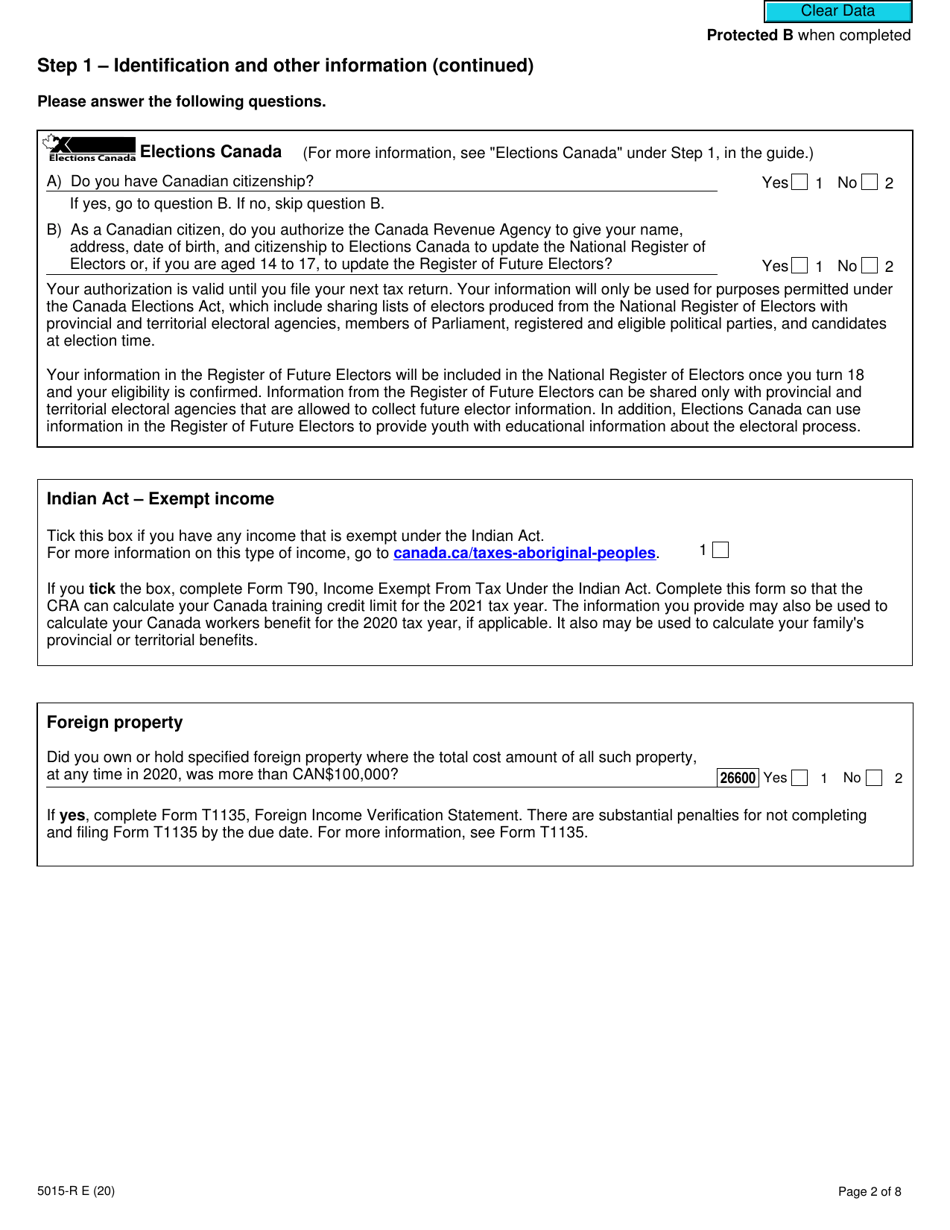

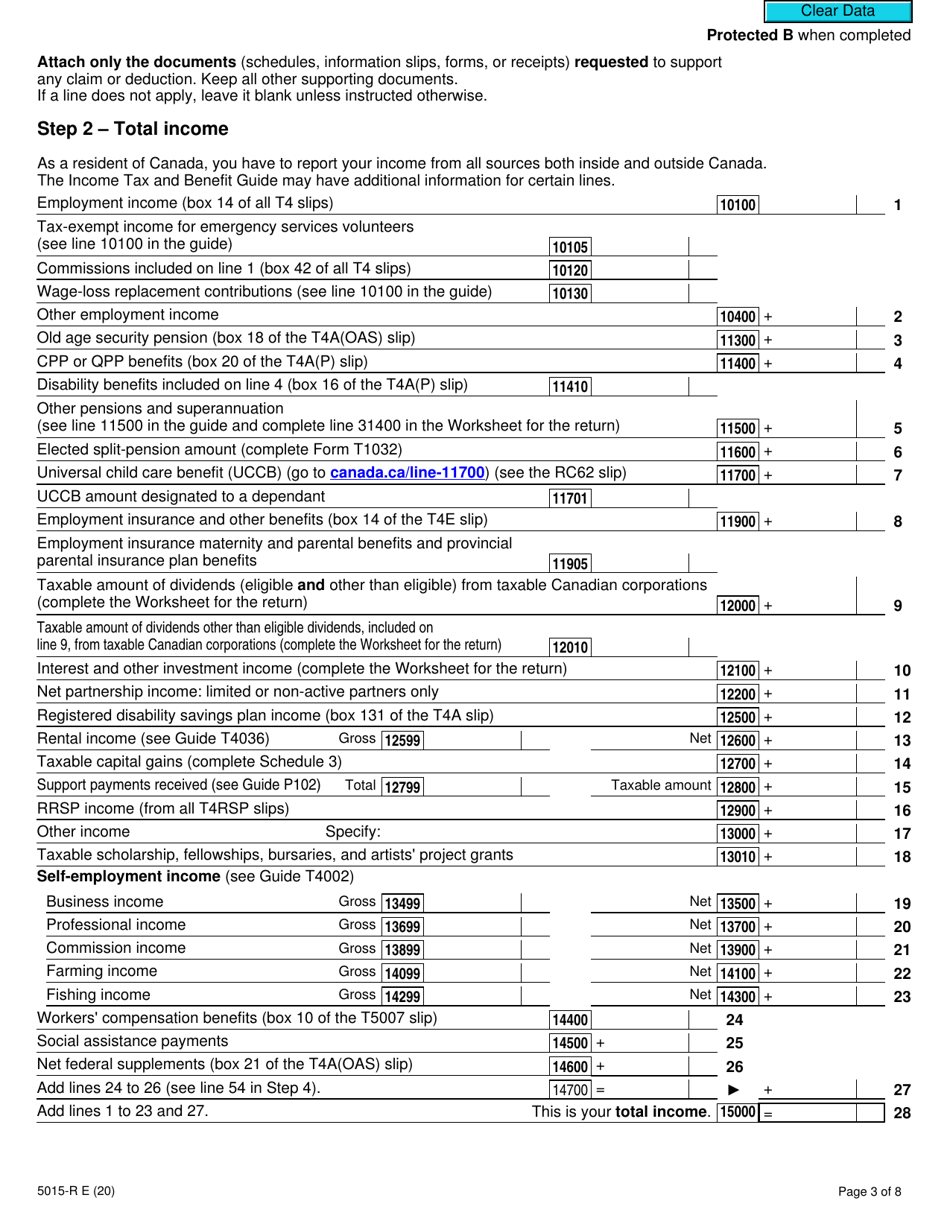

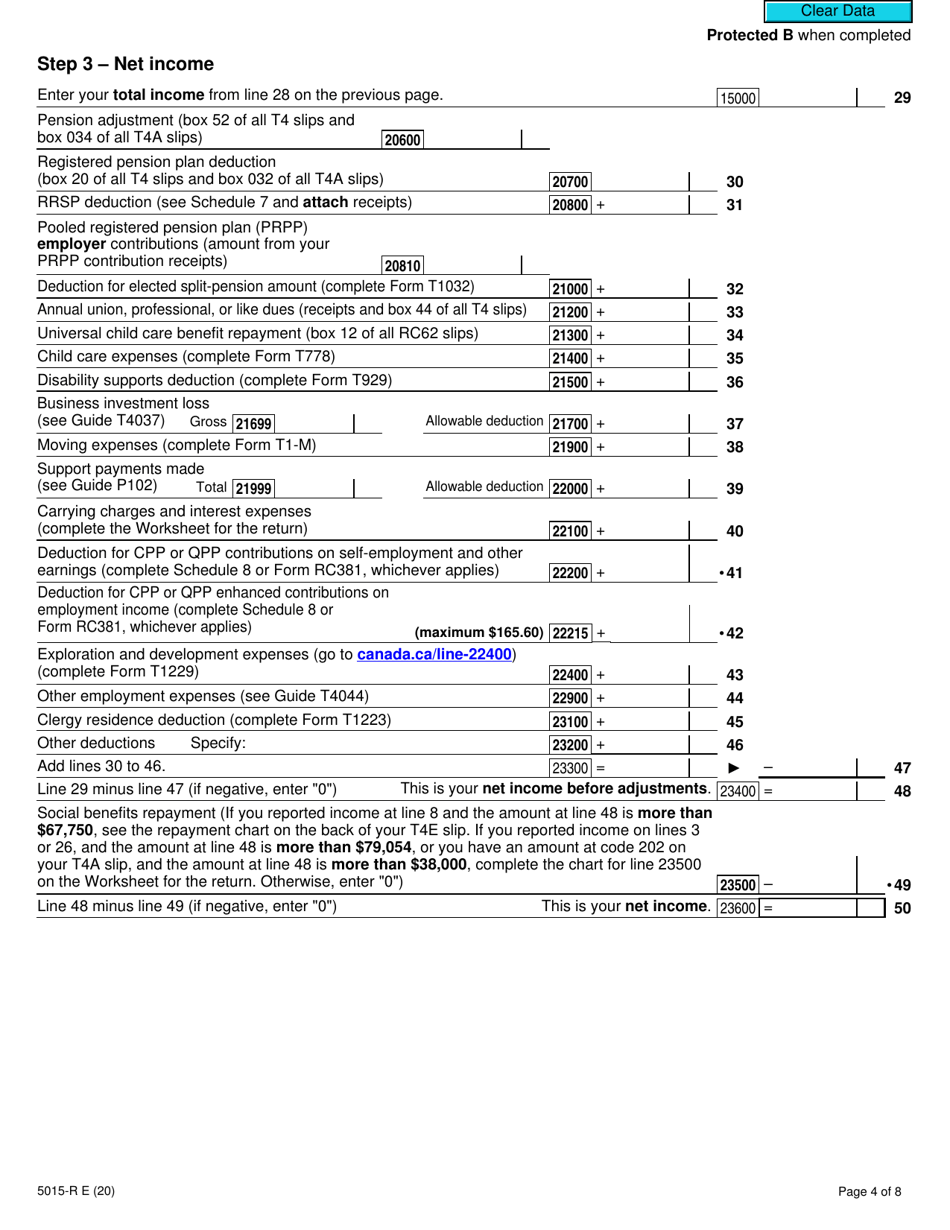

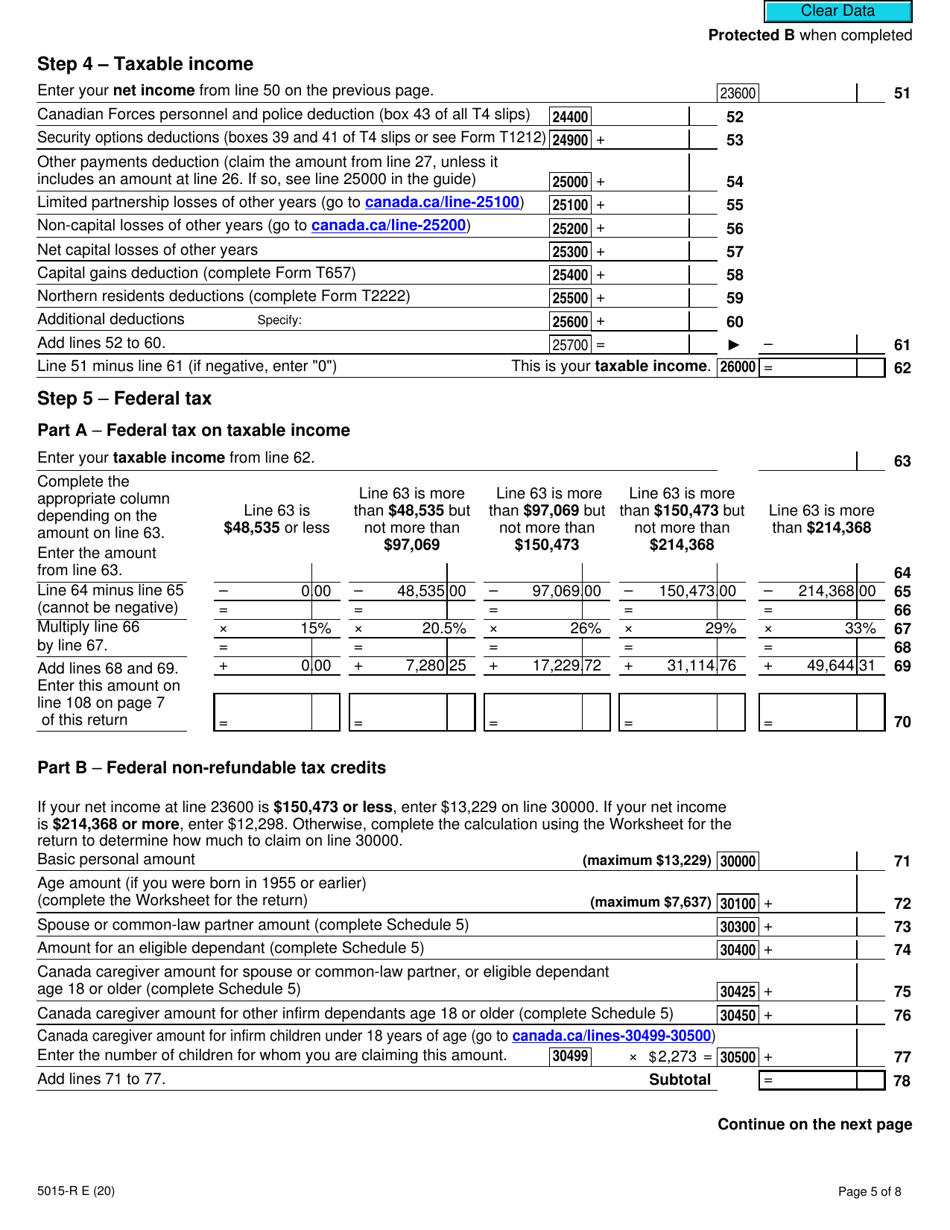

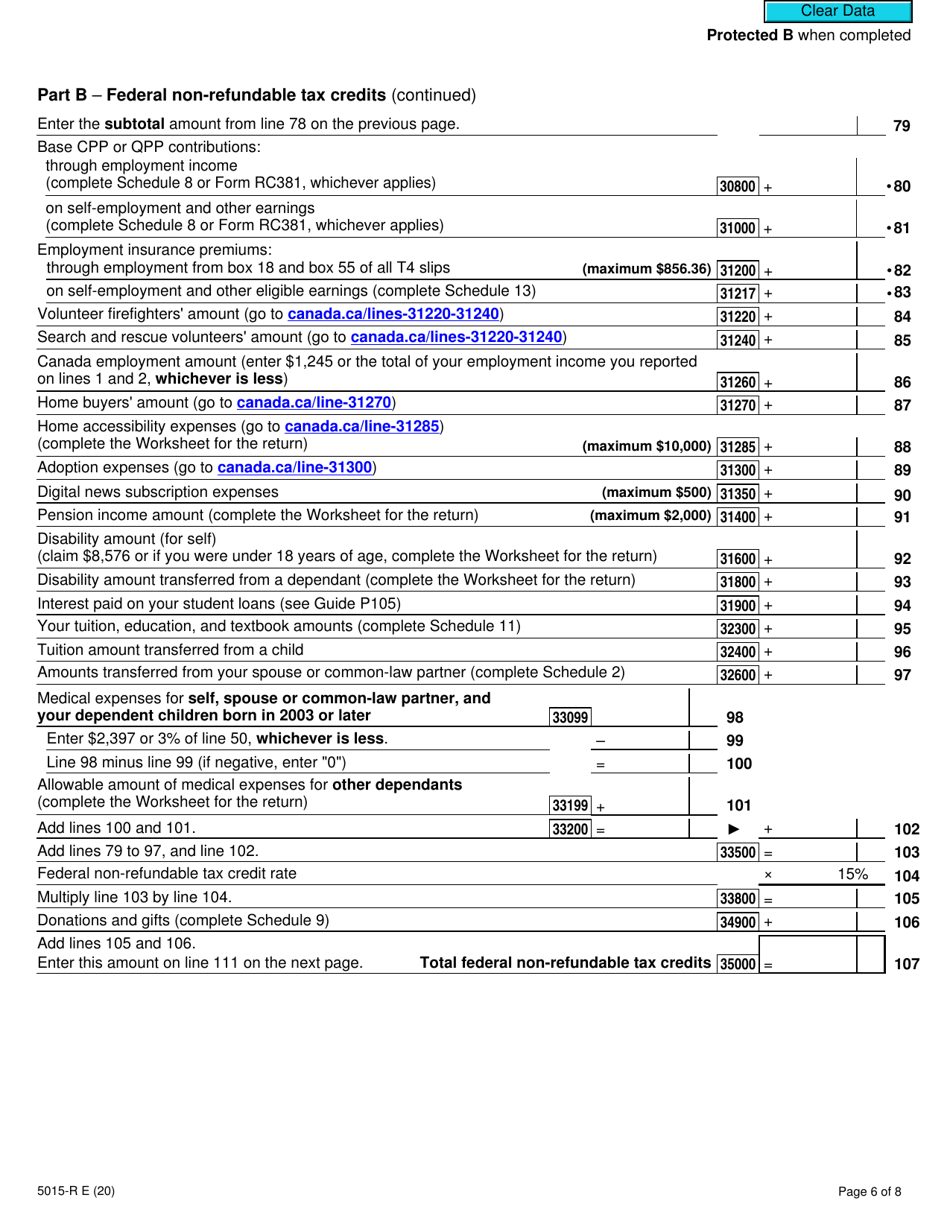

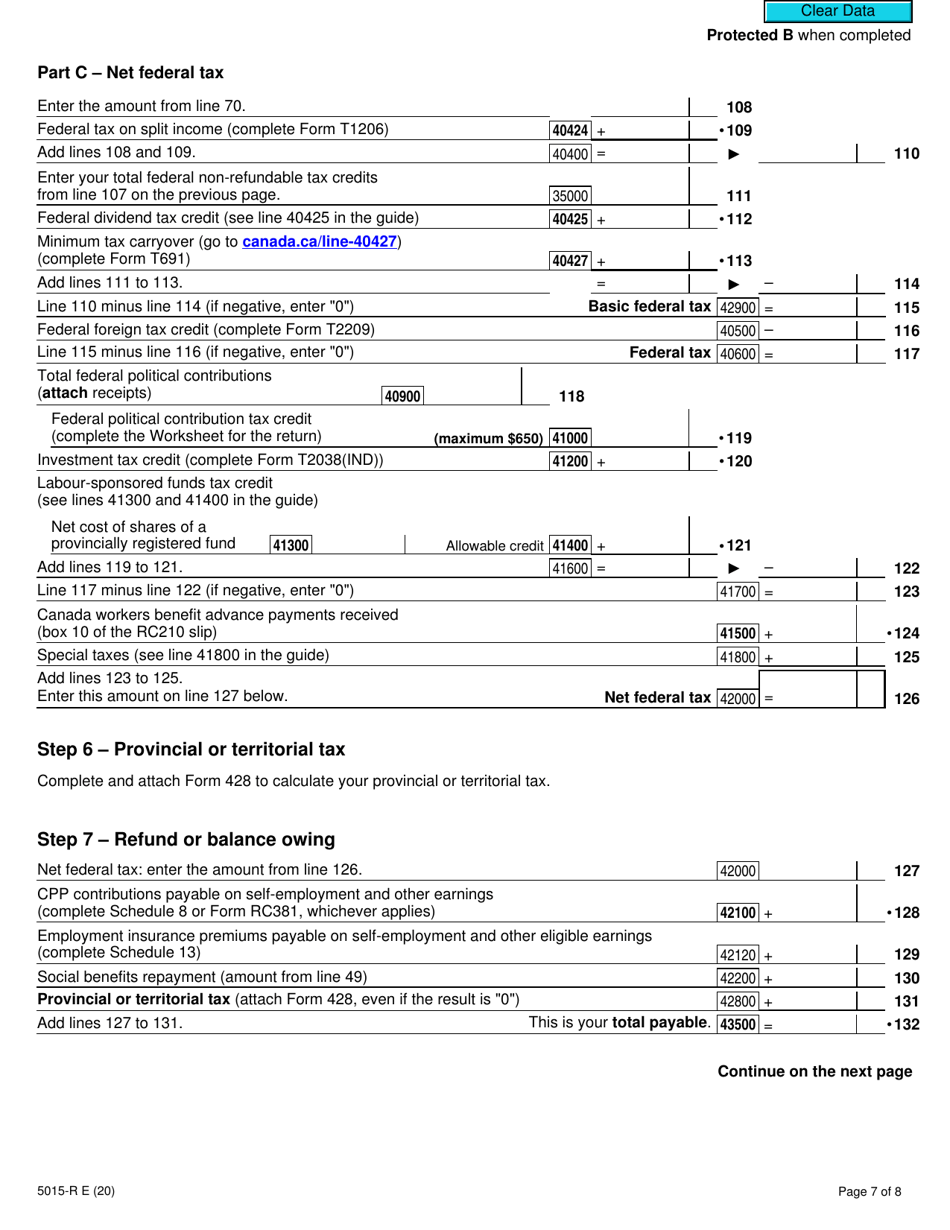

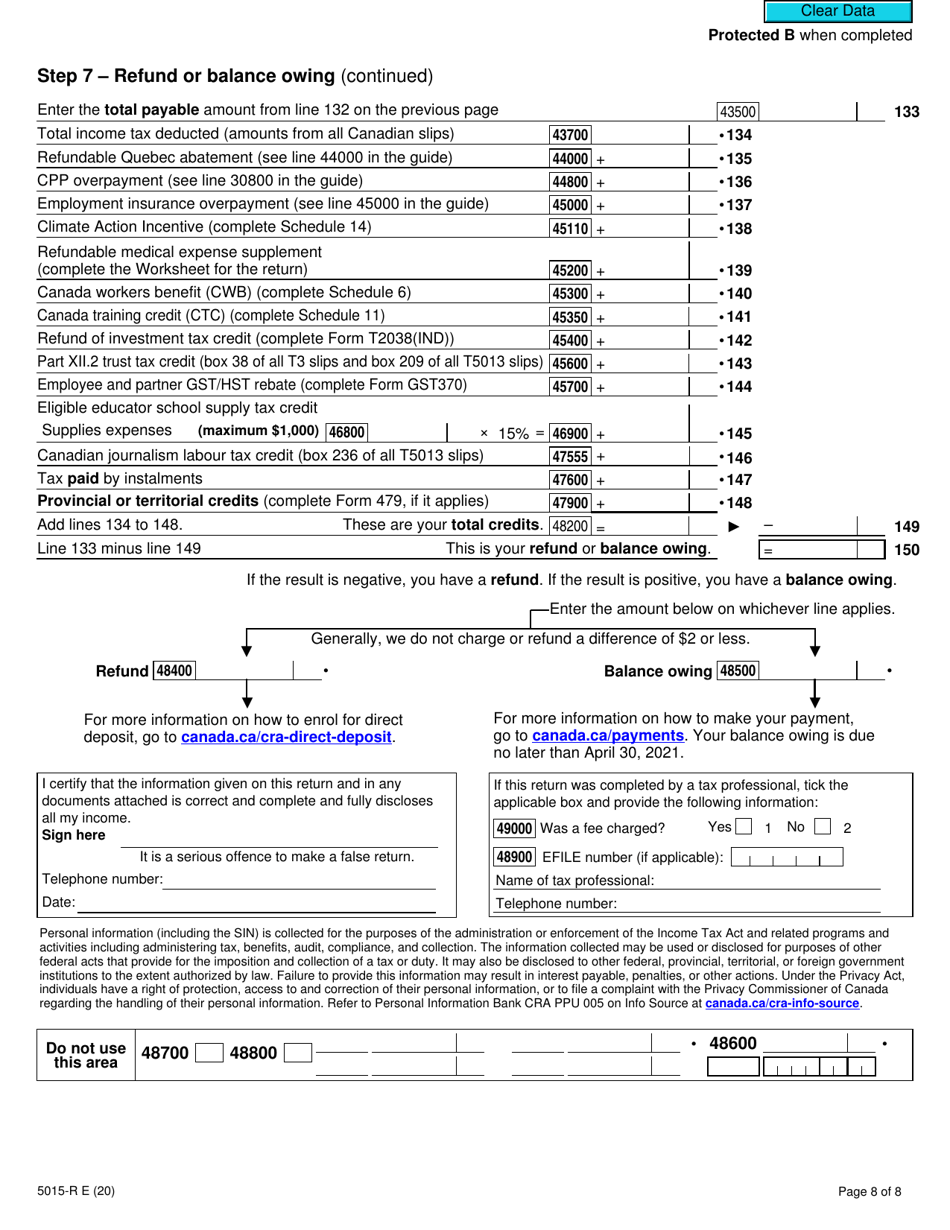

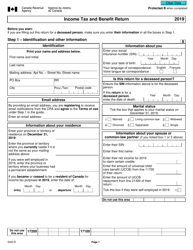

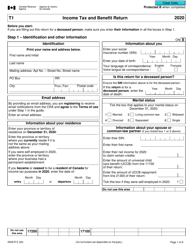

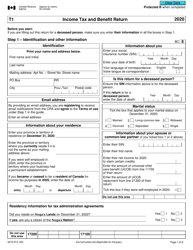

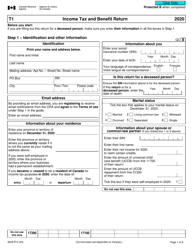

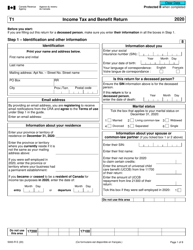

Form 5015-R Income Tax and Benefit Return - Canada

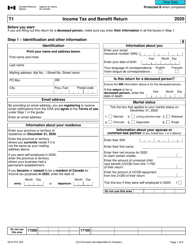

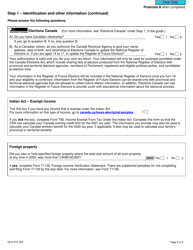

Form 5015-R Income Tax and Benefit Return is used by Canadian residents to report their income and claim various deductions, credits, and benefits for the tax year. It is filed with the Canada Revenue Agency (CRA) to fulfill their income tax obligations.

Individuals who are residents of Canada and need to file their income tax and benefit return are required to complete and submit Form 5015-R.

Form 5015-R Income Tax and Benefit Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5015-R?

A: Form 5015-R is the Income Tax and Benefit Return used in Canada to report your income and claim any eligible tax credits and deductions.

Q: Who needs to file Form 5015-R?

A: Any individual who is a resident of Canada and has income to report or is eligible for benefits or tax credits should file Form 5015-R.

Q: When is Form 5015-R due?

A: Form 5015-R is generally due on April 30th of each year for most individuals. However, the due date may vary in certain situations, so it's important to check with the Canada Revenue Agency (CRA) for any specific deadlines.

Q: What information do I need to complete Form 5015-R?

A: You will need various information including your personal details, income information (such as T4 slips), and any applicable deductions and credits. The CRA provides detailed instructions on what information to include on the form.

Q: What happens if I don't file Form 5015-R?

A: If you don't file Form 5015-R or file it late, you may be subject to penalties and interest charges. It's important to file your income tax return on time to avoid any potential consequences.