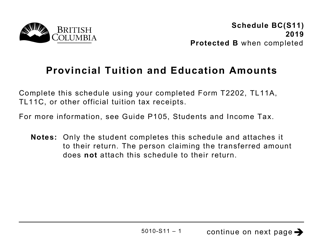

This version of the form is not currently in use and is provided for reference only. Download this version of

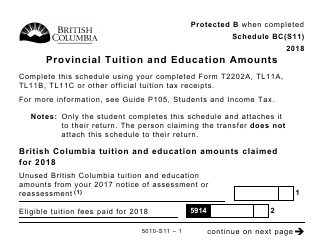

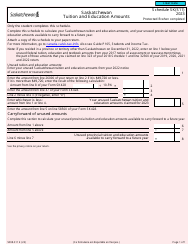

Form 5010-S11 Schedule BC(S11)

for the current year.

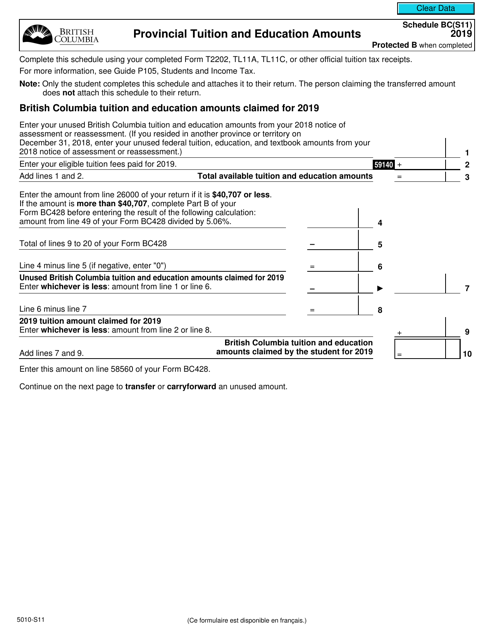

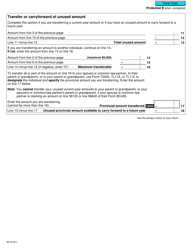

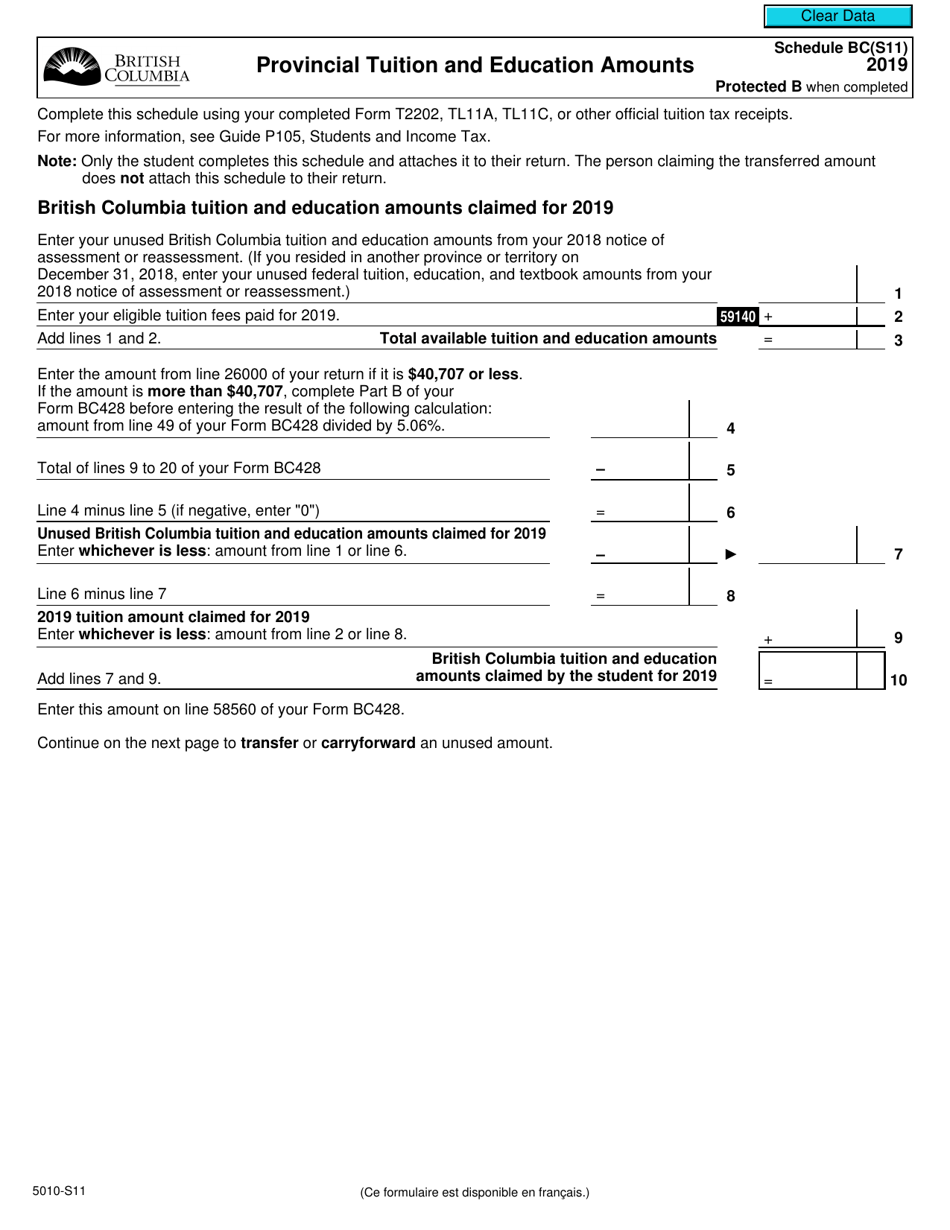

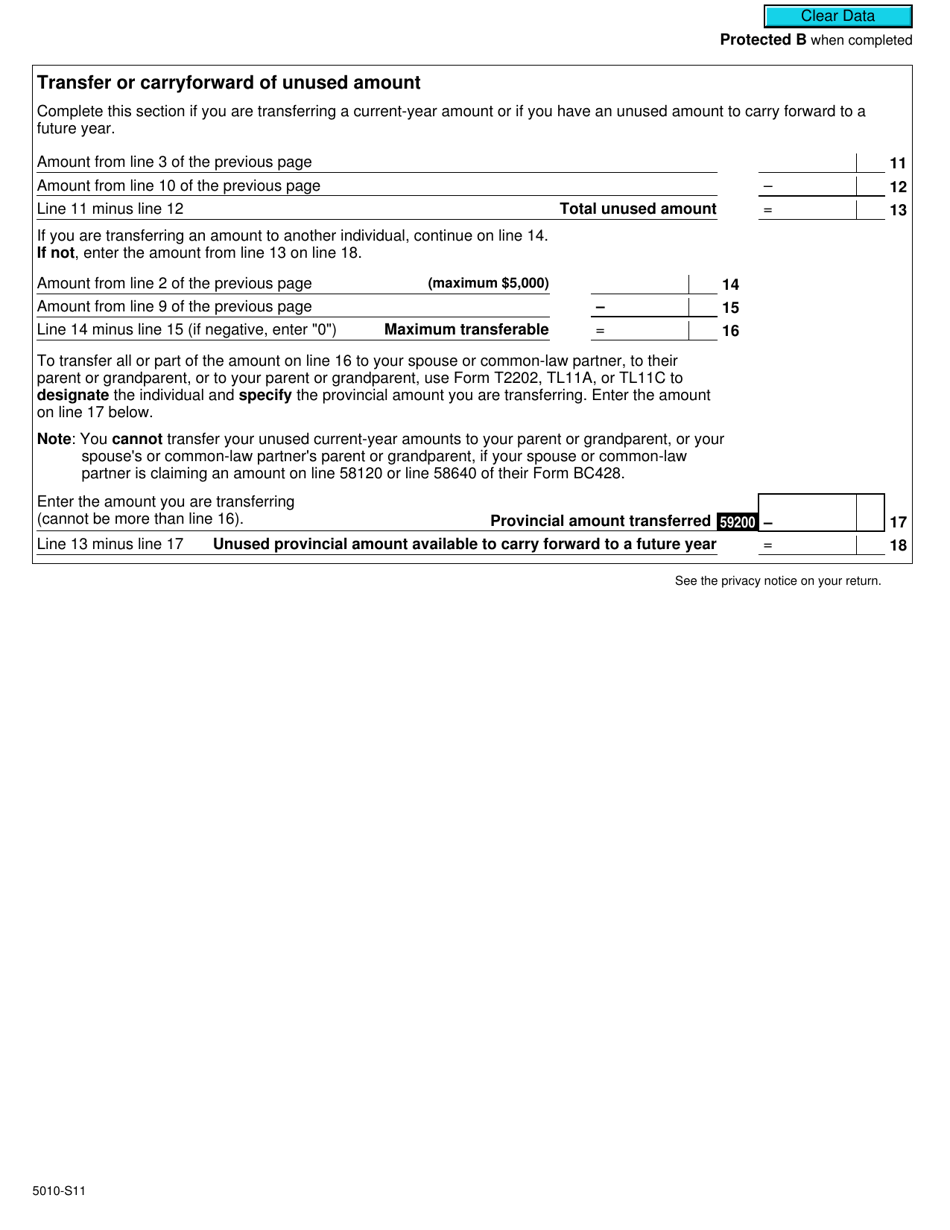

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts - Canada

Form 5010-S11 Schedule BC(S11) is used in Canada for reporting provincial tuition and education amounts. It allows taxpayers to claim tax credits for eligible tuition fees and education expenses incurred in British Columbia.

The taxpayer files the Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts in Canada.

FAQ

Q: What is Form 5010-S11 Schedule BC(S11)?

A: Form 5010-S11 Schedule BC(S11) is a tax form used in Canada to claim provincial tuition and education amounts.

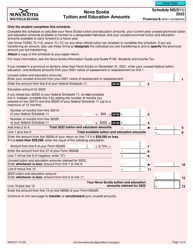

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are tax credits that can be claimed by Canadian residents to reduce their tax liability.

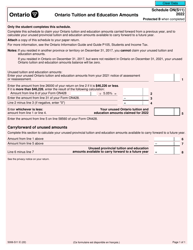

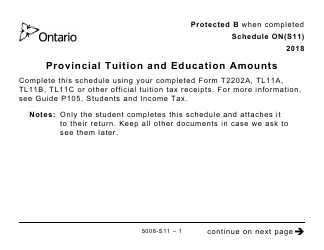

Q: What is the purpose of Schedule BC(S11)?

A: Schedule BC(S11) is used to calculate and claim provincial tuition and education amounts specifically for residents of British Columbia.

Q: Who is eligible to claim these amounts?

A: Canadian residents who have attended post-secondary institutions in British Columbia can claim provincial tuition and education amounts.

Q: How do I fill out Schedule BC(S11)?

A: You need to provide information about your educational expenses and the institutions you attended in British Columbia. Follow the instructions on the form to complete it accurately.

Q: What is the benefit of claiming these amounts?

A: Claiming provincial tuition and education amounts can reduce the amount of income tax you owe, potentially resulting in a lower tax bill or a larger refund.

Q: Is Schedule BC(S11) applicable only in British Columbia?

A: Yes, Schedule BC(S11) is specifically for residents of British Columbia. Other provinces in Canada may have similar provincial tax forms for claiming tuition and education amounts.

Q: Are there any deadlines for filing Schedule BC(S11)?

A: The deadline for filing Schedule BC(S11) depends on the tax year. It is usually aligned with the deadline for filing your income tax return, which is April 30th for most individuals.

Q: Can I claim both federal and provincial tuition credits?

A: Yes, you can claim both federal and provincial tuition credits. However, the rules and eligibility criteria may vary between the two.