This version of the form is not currently in use and is provided for reference only. Download this version of

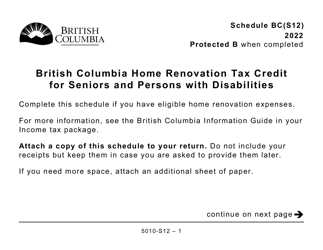

Form 5010-S12 Schedule BC(S12)

for the current year.

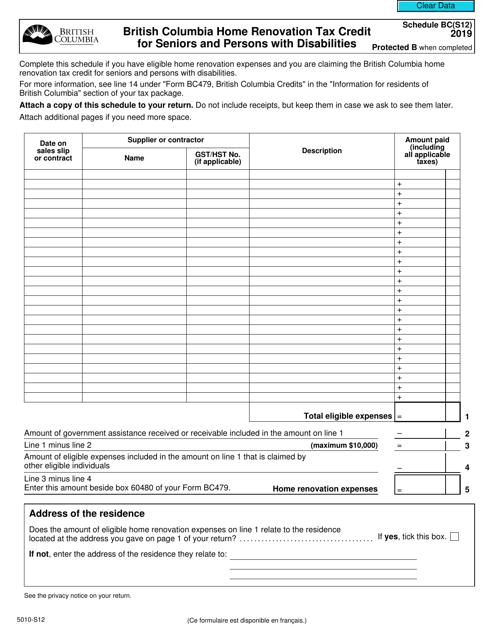

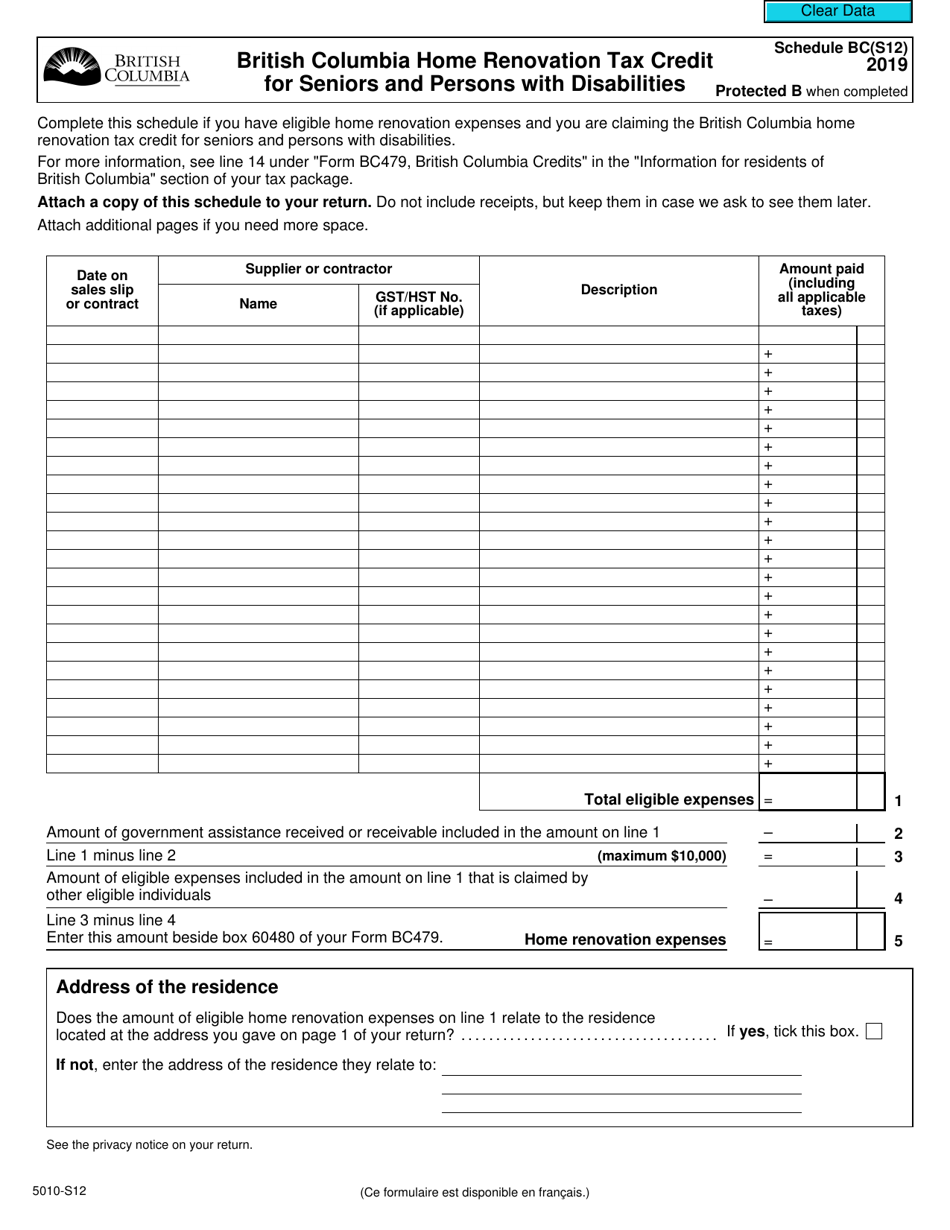

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities - Canada

Form 5010-S12 Schedule BC(S12) is used in Canada for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities. This tax credit is intended to provide financial assistance to seniors and individuals with disabilities who make eligible home renovations to improve accessibility and independent living.

The Form 5010-S12 Schedule BC(S12) is filed by eligible individuals in British Columbia who are seniors or persons with disabilities seeking to claim the Home Renovation Tax Credit.

FAQ

Q: What is Form 5010-S12 Schedule BC(S12)?

A: Form 5010-S12 Schedule BC(S12) is a tax form used in Canada for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities.

Q: What is the British Columbia Home Renovation Tax Credit?

A: The British Columbia Home Renovation Tax Credit is a tax credit available in British Columbia, Canada, for seniors and persons with disabilities who make eligible home renovations.

Q: Who can claim the British Columbia Home Renovation Tax Credit?

A: Seniors and persons with disabilities who have made eligible home renovations in British Columbia, Canada, can claim the British Columbia Home Renovation Tax Credit.

Q: What are eligible home renovations for the tax credit?

A: Eligible home renovations for the British Columbia Home Renovation Tax Credit include modifications to improve accessibility, mobility, or safety for seniors or persons with disabilities.

Q: How do I claim the British Columbia Home Renovation Tax Credit?

A: To claim the British Columbia Home Renovation Tax Credit, you need to complete Form 5010-S12 Schedule BC(S12) and include it with your income tax return.

Q: Is the tax credit available only in British Columbia?

A: Yes, the British Columbia Home Renovation Tax Credit is only available for eligible home renovations made in British Columbia.

Q: Are there any income requirements for the tax credit?

A: No, there are no specific income requirements for claiming the British Columbia Home Renovation Tax Credit.

Q: How much is the tax credit?

A: The tax credit amount is 10% of eligible expenses, up to a maximum of $20,000, resulting in a maximum credit of $2,000.

Q: When is the deadline for claiming the tax credit?

A: The deadline for claiming the British Columbia Home Renovation Tax Credit is the same as the deadline for filing your income tax return, usually April 30th.

Q: Can the tax credit be transferred or shared?

A: No, the British Columbia Home Renovation Tax Credit cannot be transferred or shared with another person.

Q: Is the tax credit refundable?

A: No, the British Columbia Home Renovation Tax Credit is non-refundable. It can only be used to reduce your taxes owing for the year.