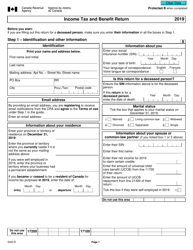

This version of the form is not currently in use and is provided for reference only. Download this version of

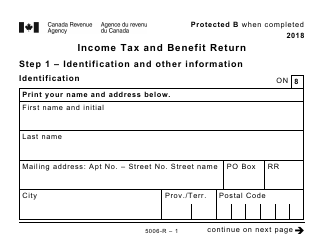

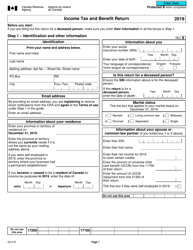

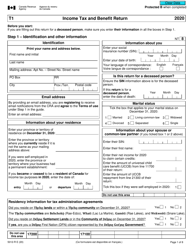

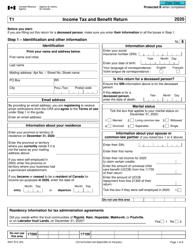

Form 5013-R

for the current year.

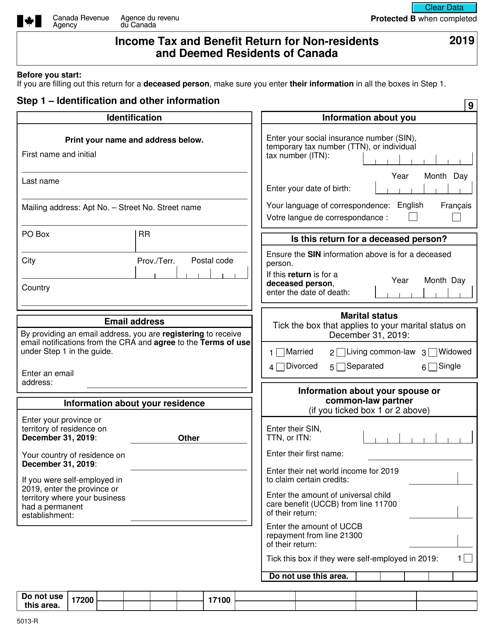

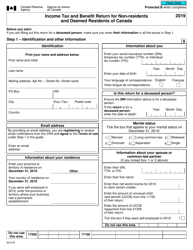

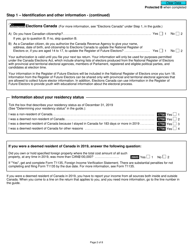

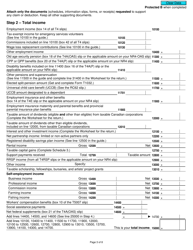

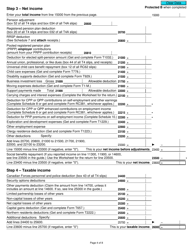

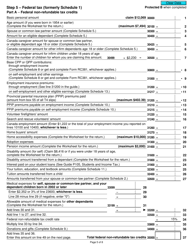

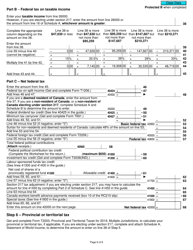

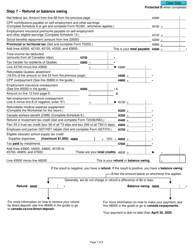

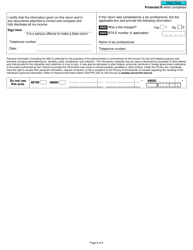

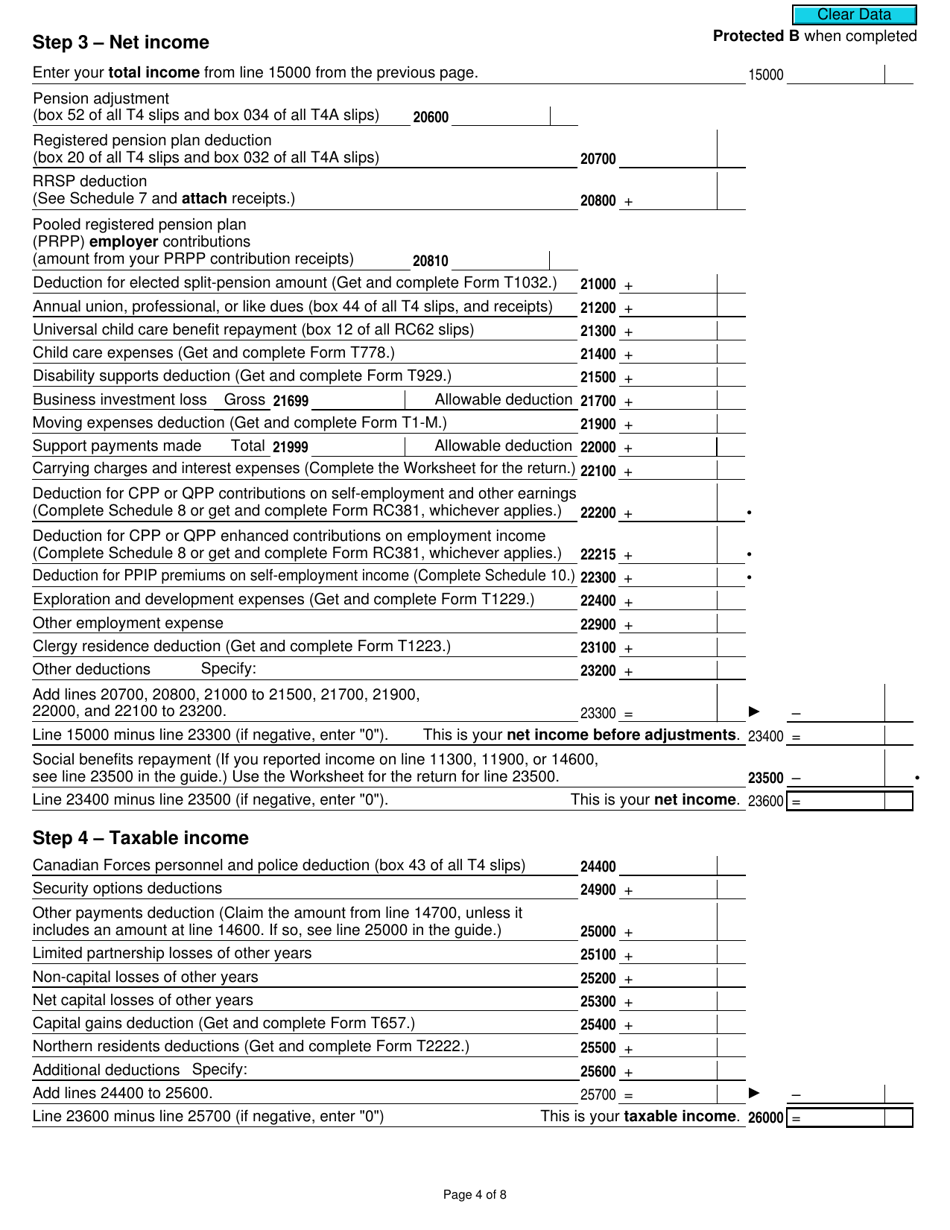

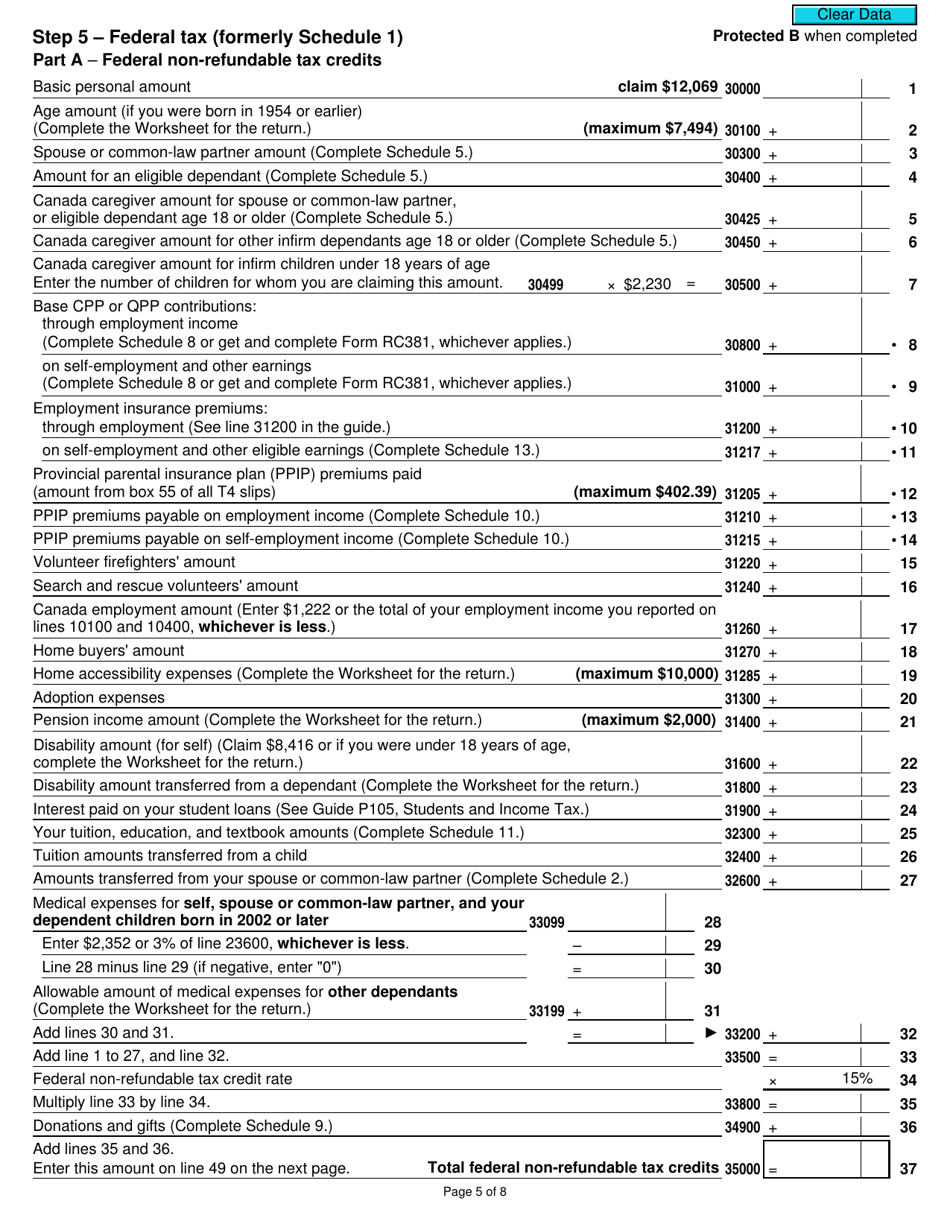

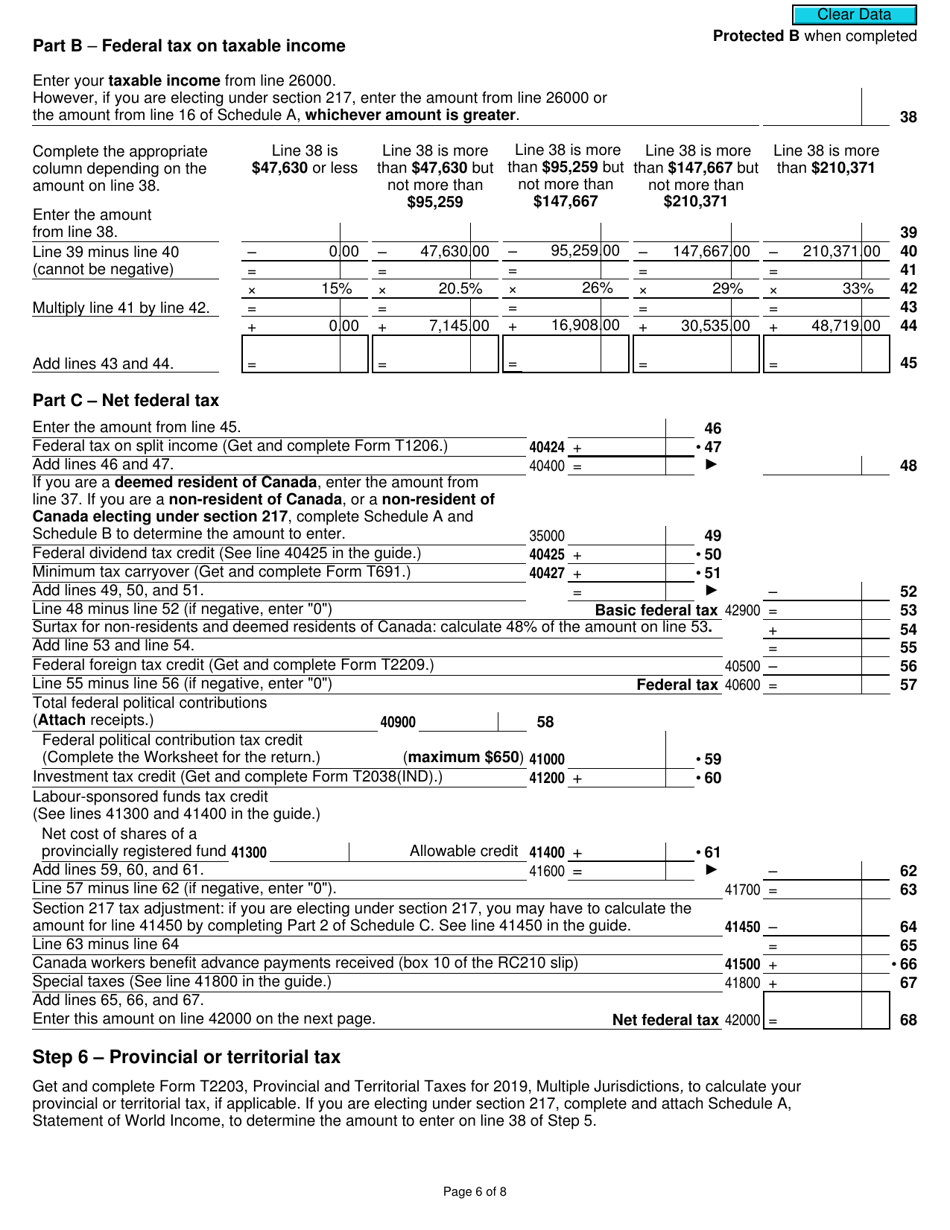

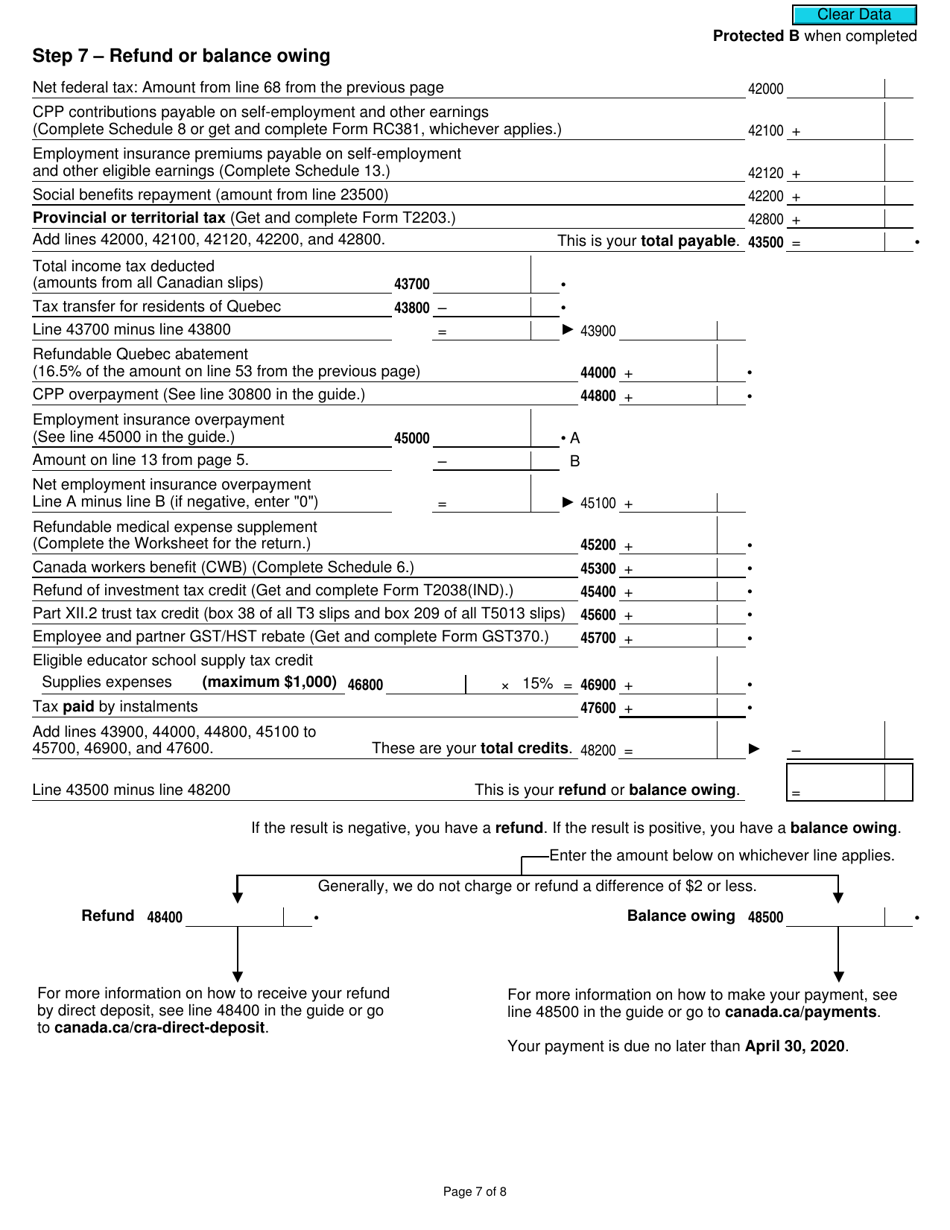

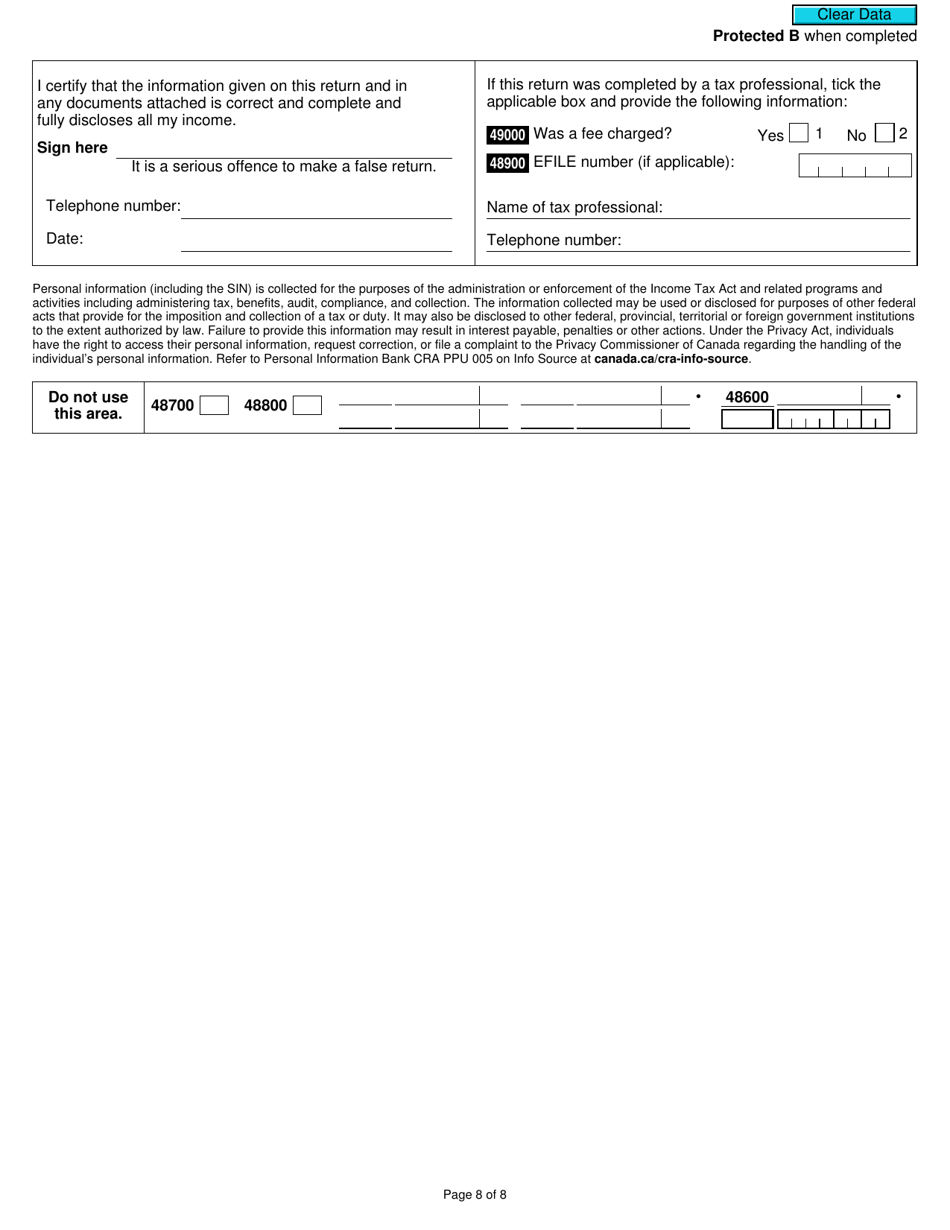

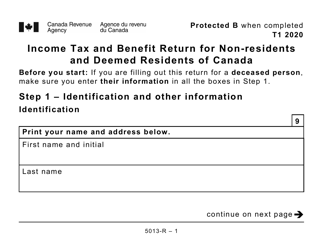

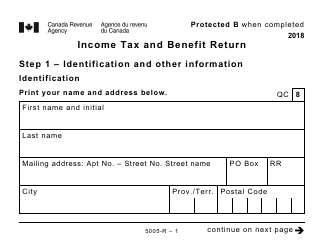

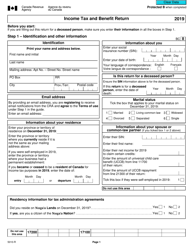

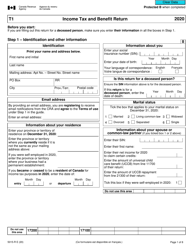

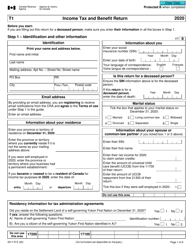

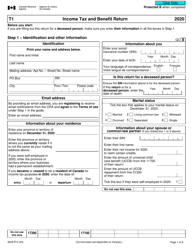

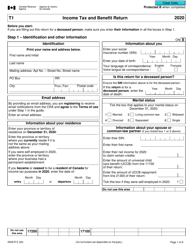

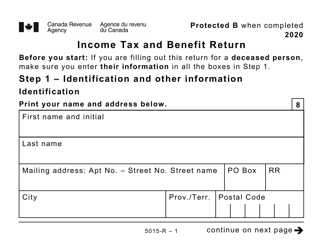

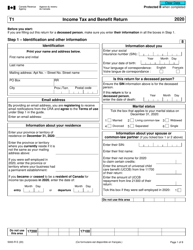

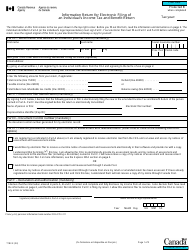

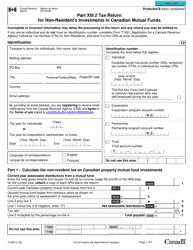

Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada - Canada

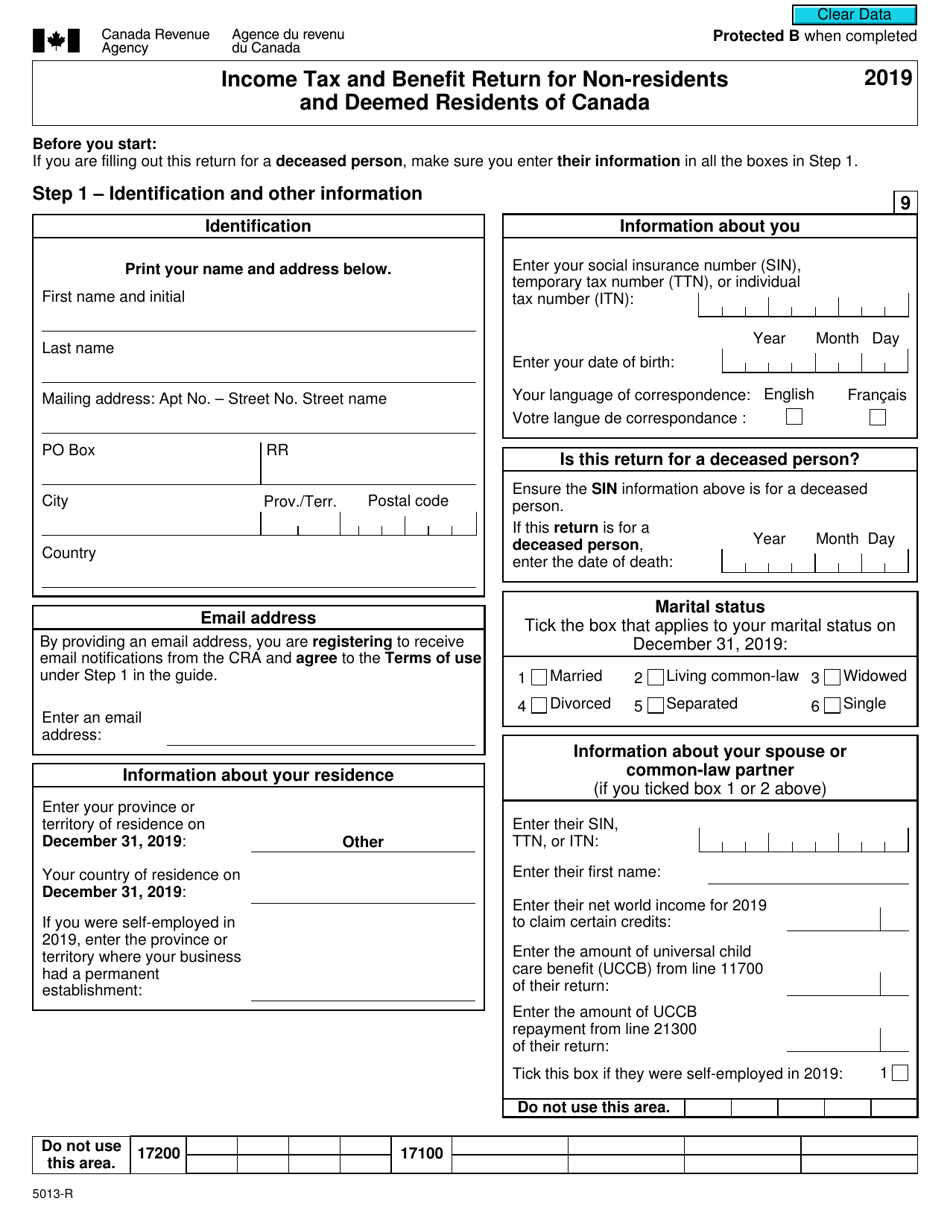

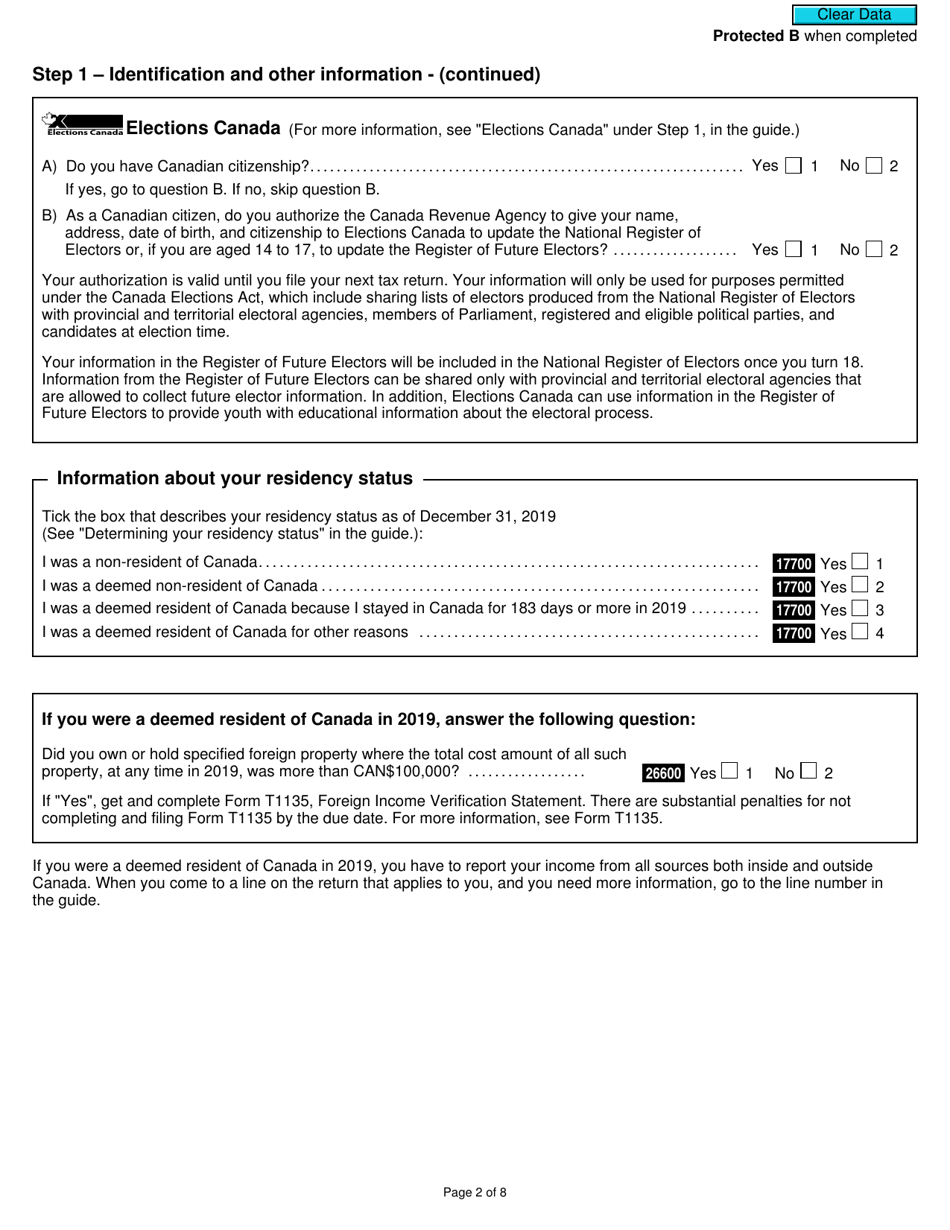

Form 5013-R is the Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada. It is used by individuals who are not Canadian residents for tax purposes, or those who are considered deemed residents, to report their income and claim any applicable deductions and credits in Canada.

Individuals who are non-residents and deemed residents of Canada file the Form 5013-R Income Tax and Benefit Return.

FAQ

Q: What is Form 5013-R?

A: Form 5013-R is the Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada.

Q: Who needs to file Form 5013-R?

A: Non-residents and deemed residents of Canada who have income from Canadian sources need to file Form 5013-R.

Q: What is a non-resident of Canada?

A: A non-resident of Canada is someone who does not have significant residential ties to Canada.

Q: What is a deemed resident of Canada?

A: A deemed resident of Canada is someone who is not a resident of Canada under the usual rules, but is required to pay Canadian income tax.

Q: What income is subject to Canadian tax for non-residents?

A: Non-residents are generally subject to Canadian tax on income earned from Canadian sources, such as employment income, rental income, and business income.

Q: When is the deadline to file Form 5013-R?

A: The deadline to file Form 5013-R is generally June 30th of the following year, but may be different in certain cases.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties and interest charges for filing Form 5013-R late.