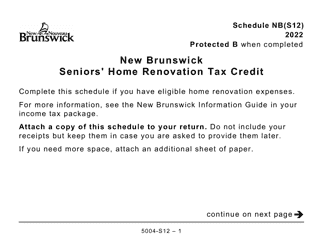

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5004-S12 Schedule NB(S12)

for the current year.

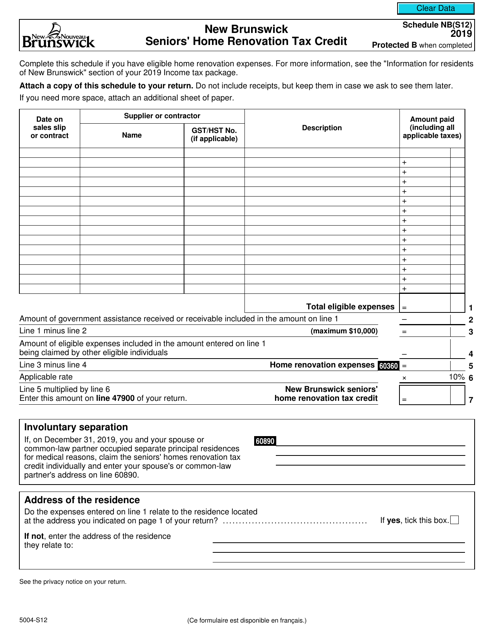

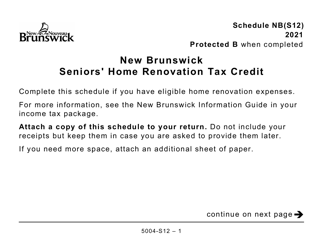

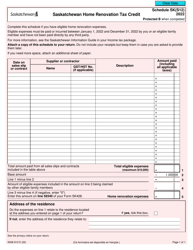

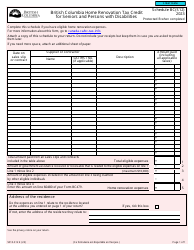

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Canada

Form 5004-S12 Schedule NB(S12) is used in Canada for claiming the New Brunswick Seniors' Home Renovation Tax Credit. This credit is meant to assist senior citizens in New Brunswick with the costs of eligible home renovations.

The Form 5004-S12 Schedule NB(S12) for the New Brunswick Seniors' Home Renovation Tax Credit is filed by eligible seniors in New Brunswick, Canada.

FAQ

Q: What is Form 5004-S12 Schedule NB(S12)?

A: Form 5004-S12 Schedule NB(S12) is a tax form specific to the province of New Brunswick in Canada that is used to apply for the New Brunswick Seniors' Home Renovation Tax Credit.

Q: What is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a tax credit available to seniors in New Brunswick, Canada, to assist with the costs of renovating their homes.

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: To be eligible for the New Brunswick Seniors' Home Renovation Tax Credit, you must be a resident of New Brunswick, be 65 years of age or older, and have incurred eligible expenses for home renovations.

Q: What expenses qualify for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Eligible expenses for the New Brunswick Seniors' Home Renovation Tax Credit include renovations that improve accessibility, mobility, or safety for seniors, such as installing handrails, ramps, or accessible bathtubs.

Q: How much is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a non-refundable tax credit that can be claimed for eligible expenses up to a maximum of $10,000.

Q: How do I claim the New Brunswick Seniors' Home Renovation Tax Credit?

A: To claim the New Brunswick Seniors' Home Renovation Tax Credit, you must complete Form 5004-S12 Schedule NB(S12) and include it with your New Brunswick provincial tax return.

Q: Do I need to provide receipts for my home renovation expenses?

A: Yes, you must keep all receipts and documentation for your home renovation expenses as they may be requested by the Canada Revenue Agency during an audit.

Q: Is the New Brunswick Seniors' Home Renovation Tax Credit taxable income?

A: No, the New Brunswick Seniors' Home Renovation Tax Credit is not considered taxable income.

Q: Can I claim the New Brunswick Seniors' Home Renovation Tax Credit if I rent my home?

A: No, the New Brunswick Seniors' Home Renovation Tax Credit is only available to seniors who own their homes.

Q: Are there any other tax credits or benefits available to seniors in New Brunswick?

A: Yes, there are other tax credits and benefits available to seniors in New Brunswick, such as the New Brunswick Seniors' Prescription Drug Program and the New Brunswick Low-Income Seniors' Benefit.