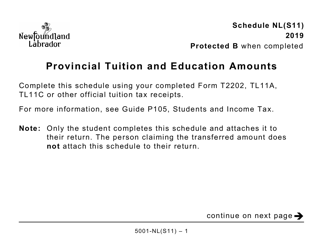

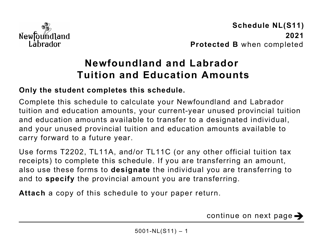

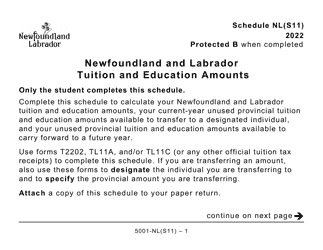

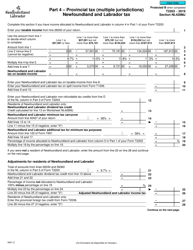

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5001-S11 Schedule NL(S11)

for the current year.

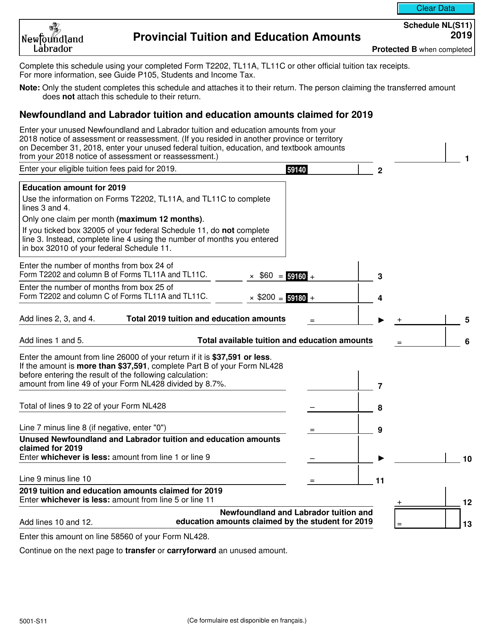

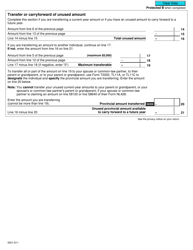

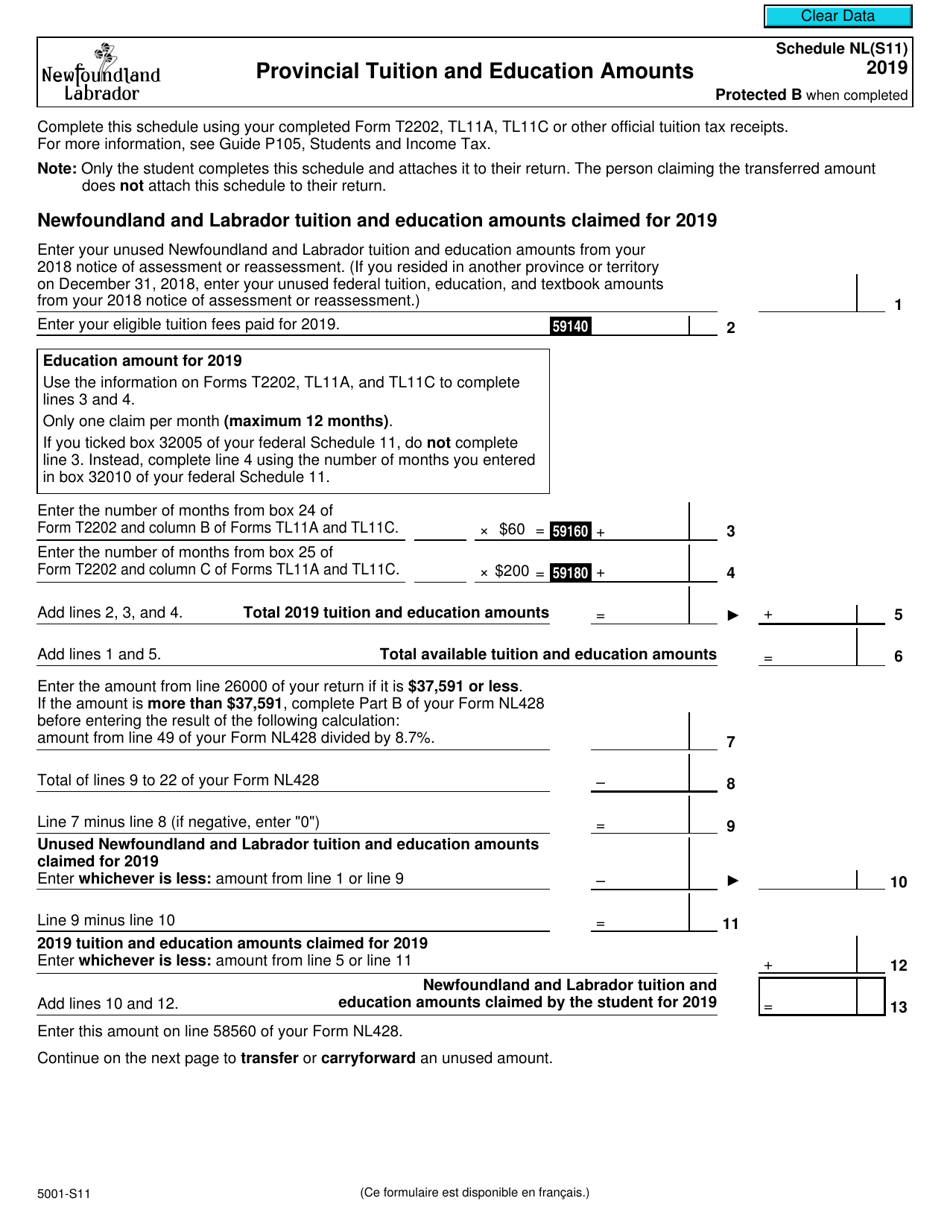

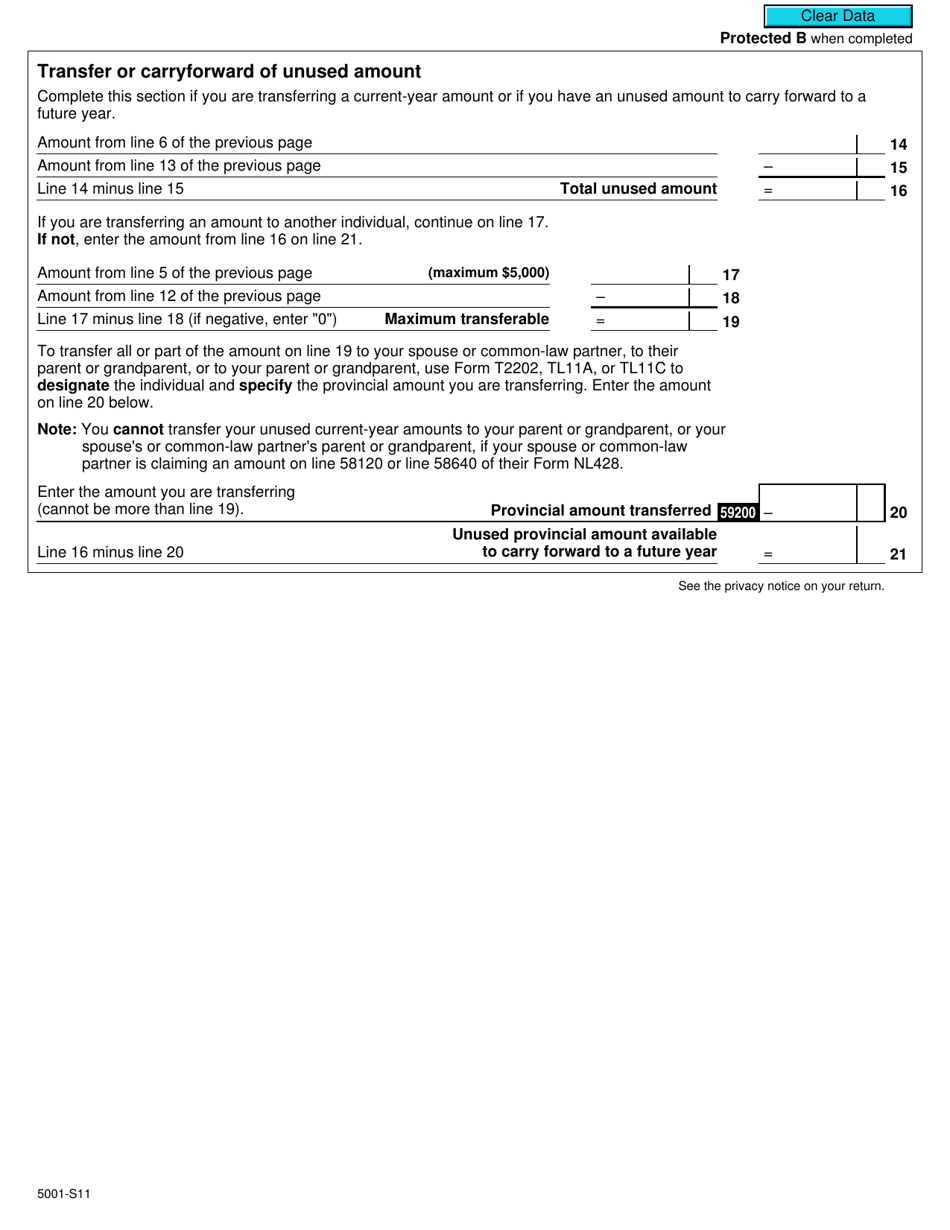

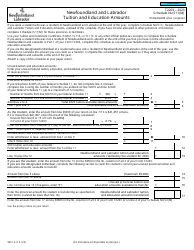

Form 5001-S11 Schedule NL(S11) Provincial Tuition and Education Amounts - Canada

Form 5001-S11 Schedule NL(S11) Provincial Tuition and Education Amounts in Canada is used to calculate and claim the provincial tuition and education amounts available in the province of Newfoundland and Labrador.

The Form 5001-S11 Schedule NL(S11) for Provincial Tuition and Education Amounts in Canada is filed by individual residents of Newfoundland and Labrador.

FAQ

Q: What is Form 5001-S11 Schedule NL(S11)?

A: Form 5001-S11 Schedule NL(S11) is a tax form used in Canada to claim provincial tuition and education amounts.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are tax credits that can be claimed by Canadian residents to offset the cost of their education.

Q: How can I use Form 5001-S11 Schedule NL(S11)?

A: You can use this form to calculate and claim your provincial tuition and education amounts when filing your taxes in Canada.

Q: Who is eligible to claim provincial tuition and education amounts?

A: Canadian residents who have incurred eligible education expenses may be eligible to claim provincial tuition and education amounts.

Q: What expenses are eligible for claiming provincial tuition and education amounts?

A: Eligible expenses may include tuition fees, textbooks, and other education-related costs.

Q: Is there a maximum amount that can be claimed for provincial tuition and education amounts?

A: Yes, there is a maximum amount that can be claimed, and it varies by province. You should refer to the specific guidelines for your province.