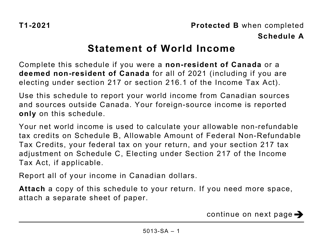

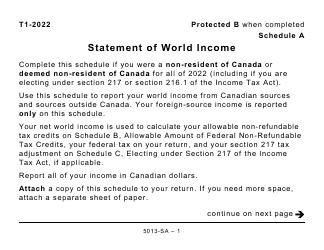

This version of the form is not currently in use and is provided for reference only. Download this version of

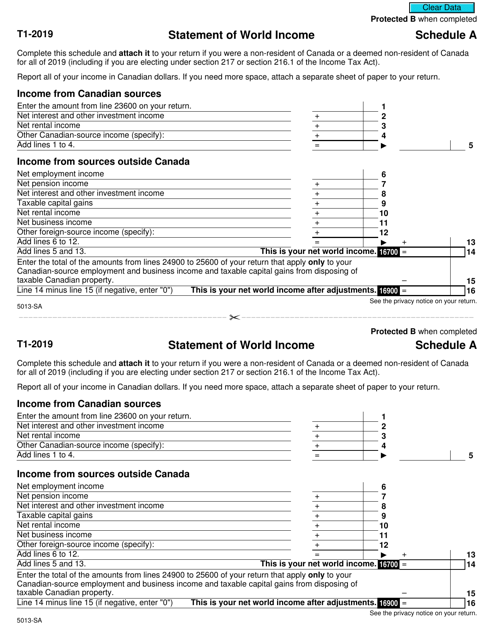

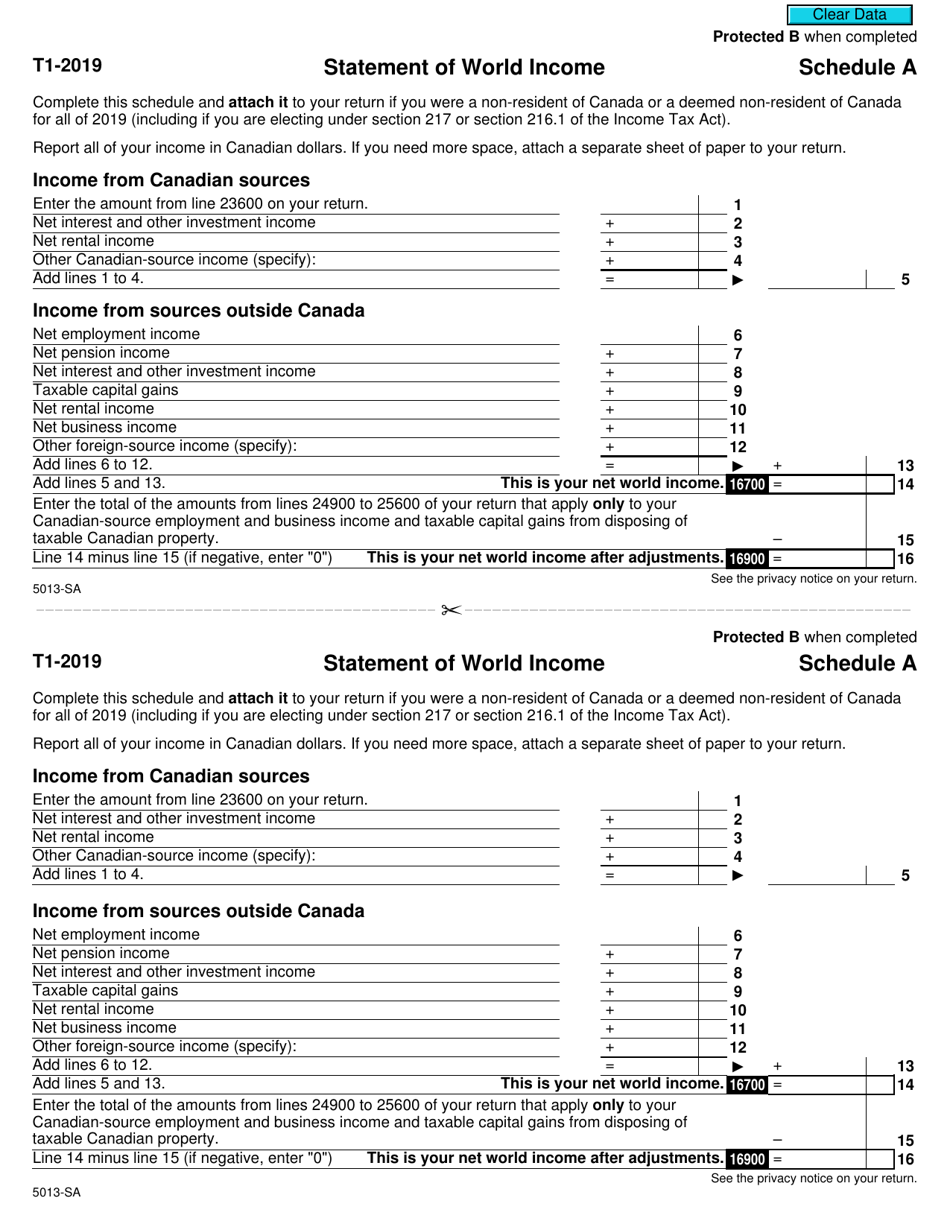

Form 5013-SA Schedule A

for the current year.

Form 5013-SA Schedule A Statement of World Income - Non-residents of Canada - Canada

Form 5013-SA Schedule A Statement of World Income - Non-residents of Canada - Canada is used for reporting worldwide income for individuals who are non-residents of Canada.

FAQ

Q: What is a Form 5013-SA?

A: Form 5013-SA is a statement of world income for non-residents of Canada.

Q: Who needs to file Form 5013-SA?

A: Non-residents of Canada who have world income and need to report it for tax purposes.

Q: What is Schedule A?

A: Schedule A is a part of Form 5013-SA where non-residents report their world income.

Q: What is considered world income?

A: World income includes income from all sources worldwide, not just in Canada.

Q: Who are non-residents of Canada?

A: Non-residents of Canada are individuals who are not considered residents for tax purposes.

Q: What is the purpose of filing Form 5013-SA?

A: The purpose of filing Form 5013-SA is to report and pay taxes on world income for non-residents of Canada.

Q: When is the deadline for filing Form 5013-SA?

A: The deadline for filing Form 5013-SA is typically April 30th of the following year, similar to the deadline for Canadian tax returns.

Q: Are there any penalties for not filing Form 5013-SA?

A: Yes, there can be penalties for not filing Form 5013-SA, including interest charges on unpaid taxes.