This version of the form is not currently in use and is provided for reference only. Download this version of

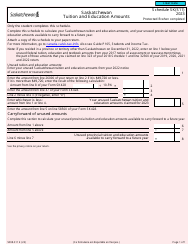

Form 5012-S11 Schedule NT(S11)

for the current year.

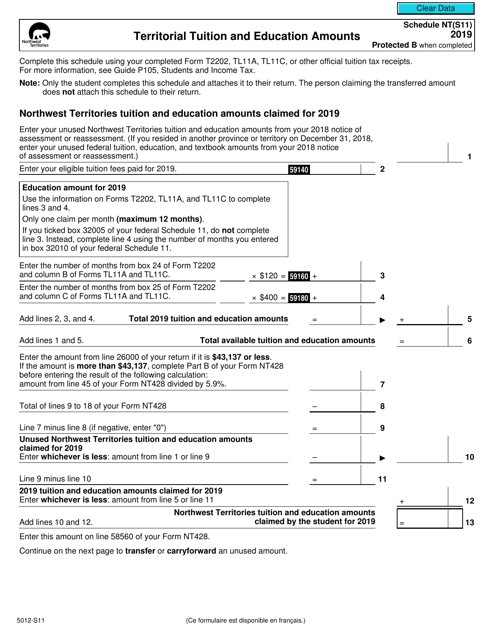

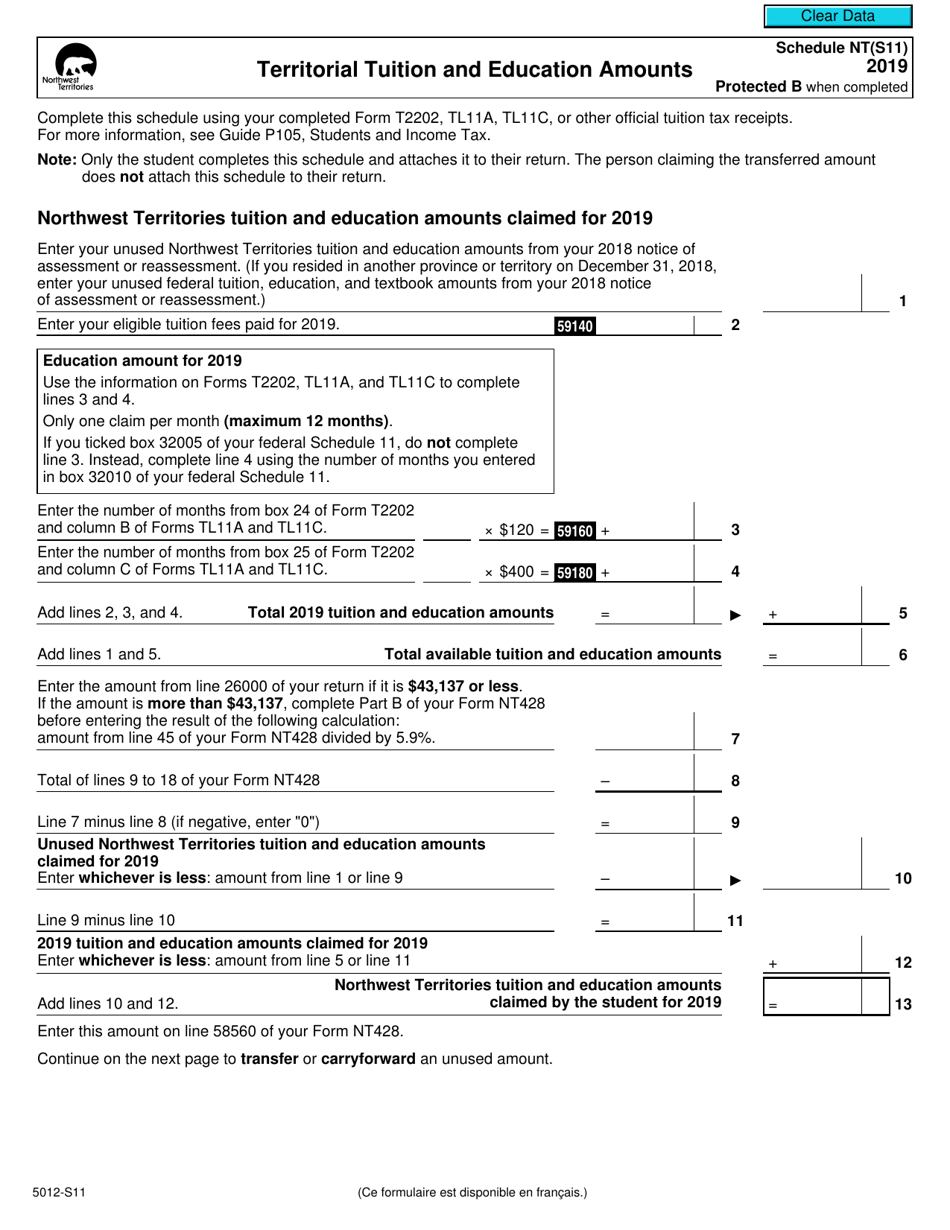

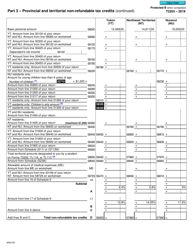

Form 5012-S11 Schedule NT(S11) Territorial Tuition and Education Amounts - Northwest Territories - Canada

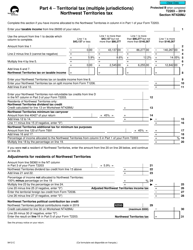

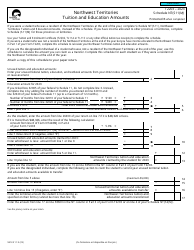

Form 5012-S11 Schedule NT(S11) Territorial Tuition and Education Amounts in Northwest Territories, Canada is used to claim education-related tax credits specific to the Northwest Territories. It allows taxpayers to report eligible tuition and education expenses for individuals residing in the Northwest Territories.

The form 5012-S11 Schedule NT(S11) for the Territorial Tuition and Education Amounts in the Northwest Territories, Canada is filed by individual taxpayers who are residents of the Northwest Territories and are claiming tuition and education amounts.

FAQ

Q: What is Form 5012-S11 Schedule NT(S11)?

A: Form 5012-S11 Schedule NT(S11) is a tax form used in Canada, specifically in the Northwest Territories, to calculate territorial tuition and education amounts.

Q: What are territorial tuition and education amounts?

A: Territorial tuition and education amounts refer to tax credits available to residents of the Northwest Territories in Canada to help offset the cost of post-secondary education.

Q: Who is eligible for territorial tuition and education amounts?

A: Residents of the Northwest Territories in Canada who have incurred post-secondary education expenses are eligible for territorial tuition and education amounts.

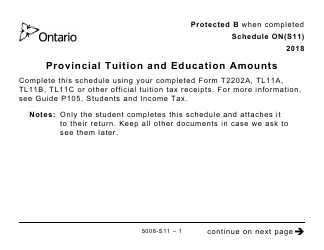

Q: What expenses qualify for territorial tuition and education amounts?

A: Expenses such as tuition fees, textbooks, and other educational supplies may qualify for territorial tuition and education amounts.

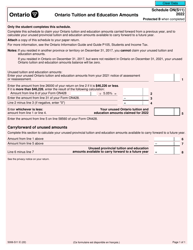

Q: How do I calculate territorial tuition and education amounts?

A: Form 5012-S11 Schedule NT(S11) provides instructions on how to calculate territorial tuition and education amounts. It considers various factors such as the amount of eligible expenses and the individual's income.

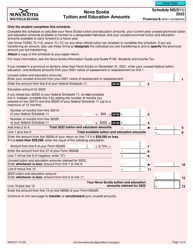

Q: Do territorial tuition and education amounts vary in different provinces of Canada?

A: Yes, each province and territory in Canada may have its own tax laws and credits related to tuition and education expenses.

Q: Are territorial tuition and education amounts refundable?

A: No, territorial tuition and education amounts are non-refundable tax credits, meaning they can only be used to reduce tax payable and cannot be refunded if they exceed the tax owed.

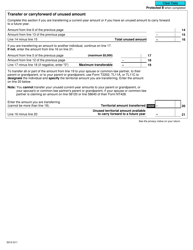

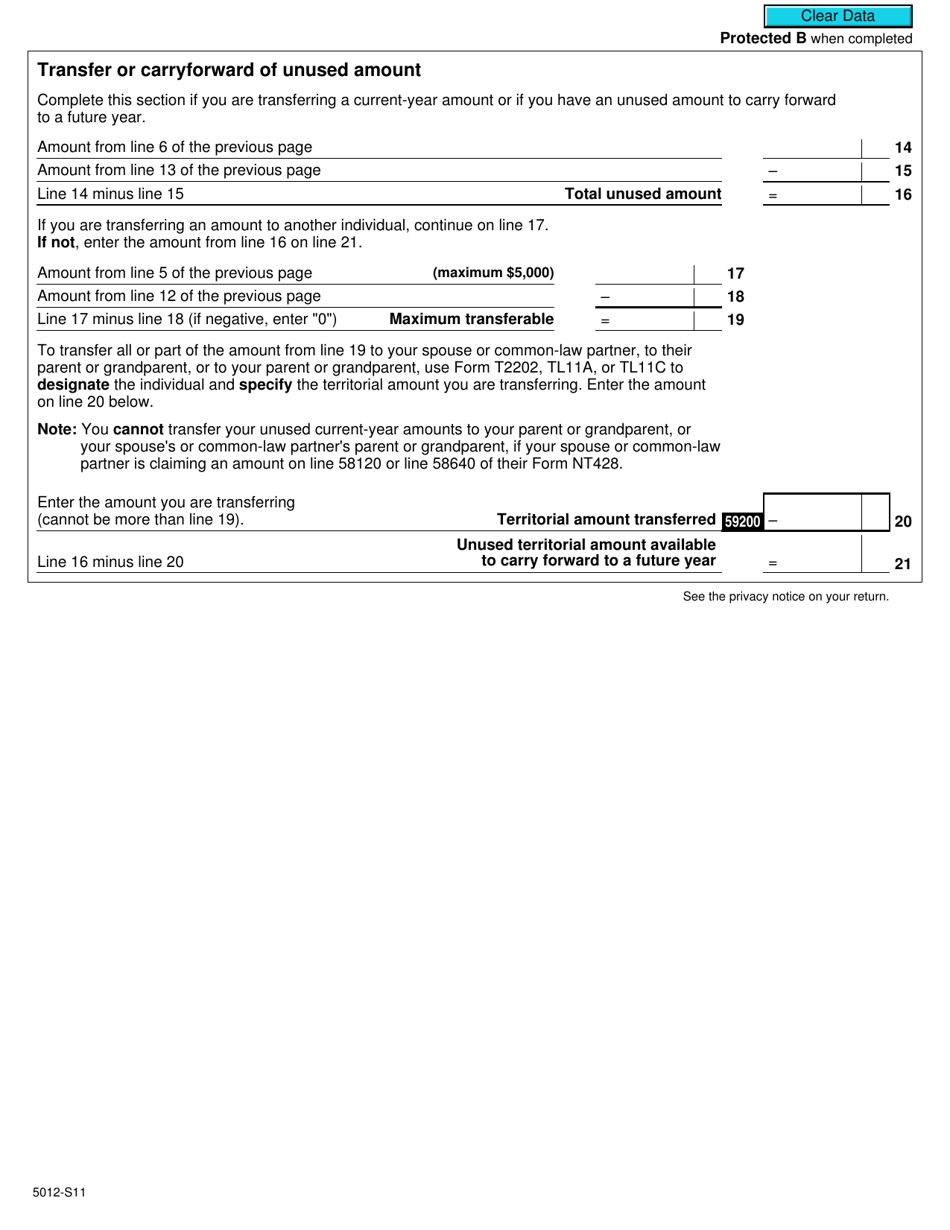

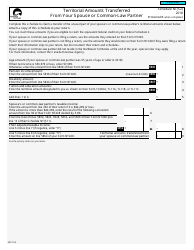

Q: Can territorial tuition and education amounts be carried forward or transferred?

A: Yes, unused territorial tuition and education amounts can be carried forward to future years or transferred to a spouse, parent, or grandparent, as long as they are supporting the student's education.