This version of the form is not currently in use and is provided for reference only. Download this version of

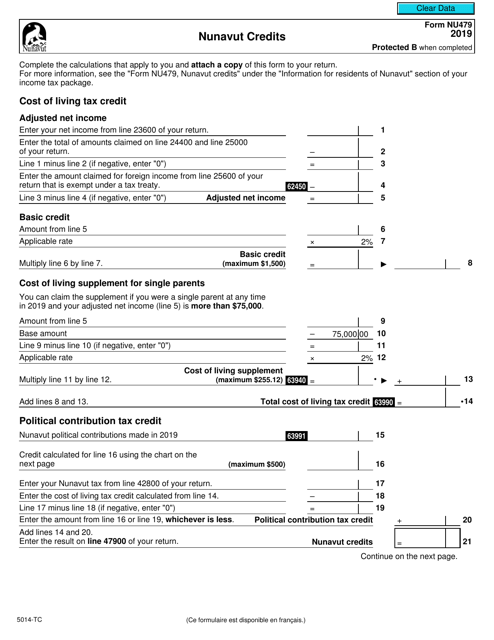

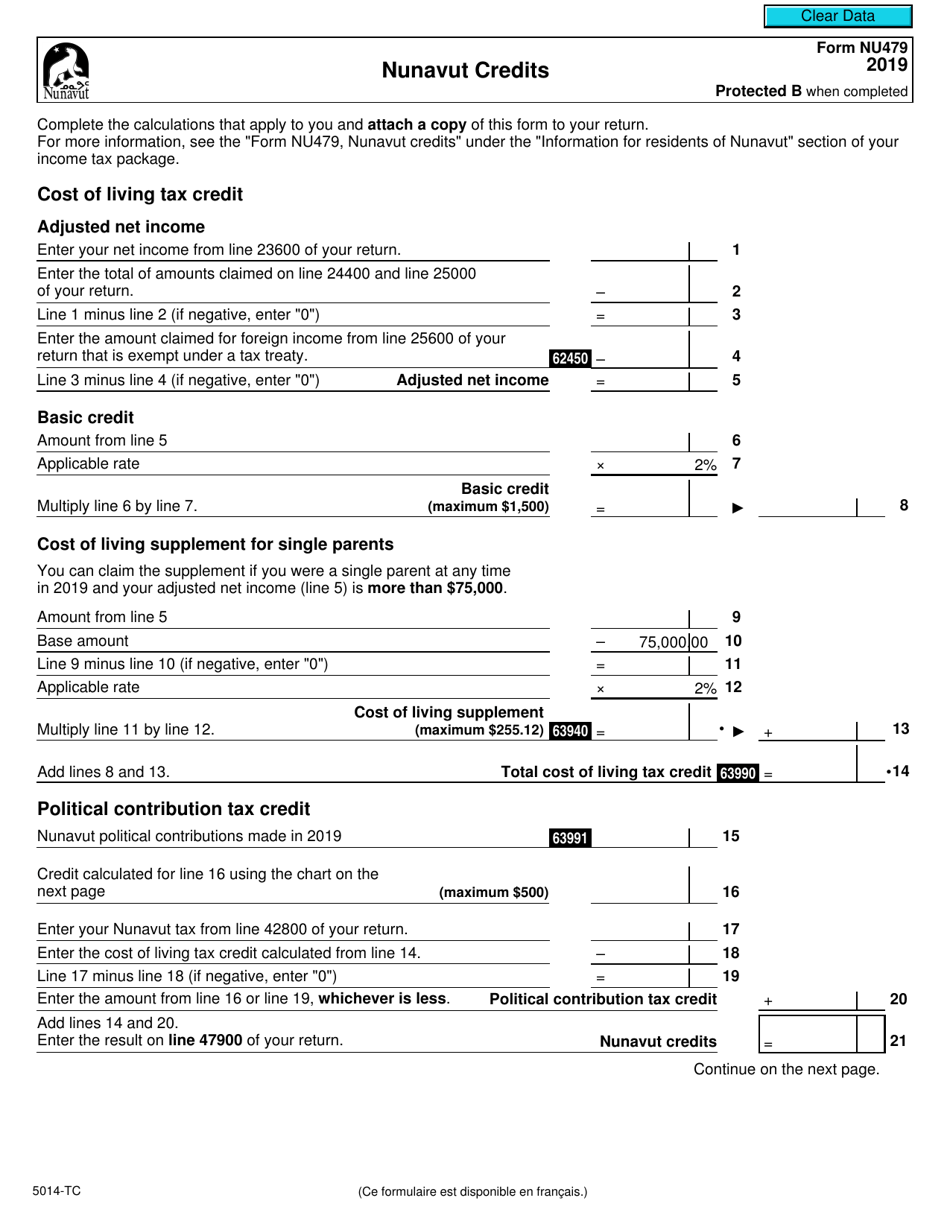

Form NU479 (5014-TC)

for the current year.

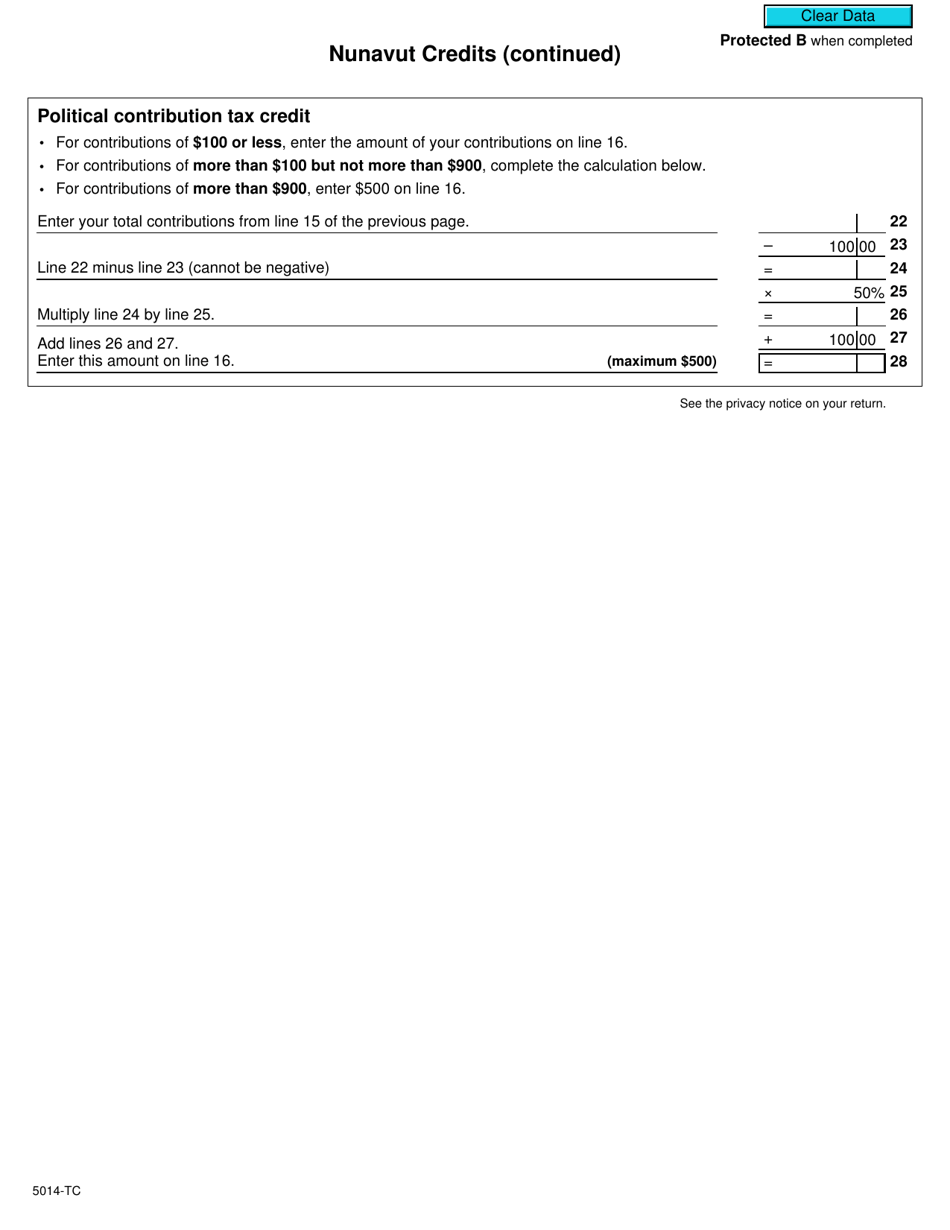

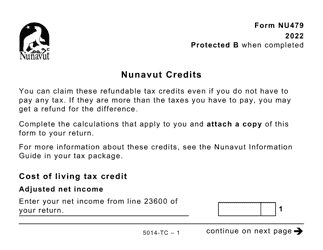

Form NU479 (5014-TC) Nunavut Credits - Canada

Form NU479 (5014-TC) is used for claiming Nunavut Credits in Canada. It allows individuals to claim various tax credits specific to Nunavut, a territory in Canada. These tax credits can help reduce the amount of tax owed or increase the amount of refund received.

The form NU479 (5014-TC) for Nunavut Credits in Canada is filed by individuals who are claiming certain tax credits in the Nunavut territory.

FAQ

Q: What is Form NU479?

A: Form NU479 is a tax form used in Nunavut, Canada to claim certain tax credits.

Q: What are the Nunavut Credits?

A: Nunavut Credits refer to a range of tax credits available to residents of Nunavut, Canada.

Q: Who can use Form NU479?

A: Form NU479 can be used by individuals who are residents of Nunavut and are claiming eligible tax credits.

Q: What tax credits can be claimed on Form NU479?

A: Form NU479 allows for the claiming of various tax credits available in Nunavut, such as the Nunavut Mineral ExplorationTax Credit and the Nunavut Fuel Tax Refund.

Q: When is Form NU479 due?

A: Form NU479 is typically due on or before April 30th of each year, along with your personal income tax return.

Q: Can Form NU479 be filed electronically?

A: Yes, Form NU479 can be filed electronically using NETFILE or EFILE, depending on your tax preparation software.

Q: What supporting documents are required for Form NU479?

A: You may be required to provide supporting documents such as receipts or statements to substantiate your claims on Form NU479.

Q: Can I claim Nunavut Credits if I am not a resident of Nunavut?

A: No, Nunavut Credits are only available to residents of Nunavut.

Q: What happens if I make an error on Form NU479?

A: If you make an error on Form NU479, you can file an amended return to correct the mistake.