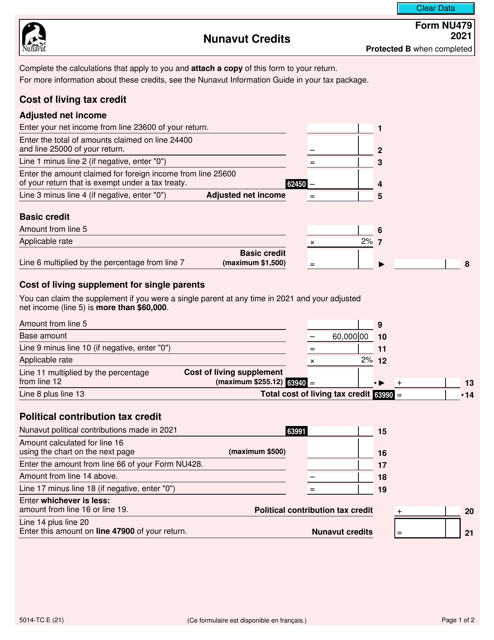

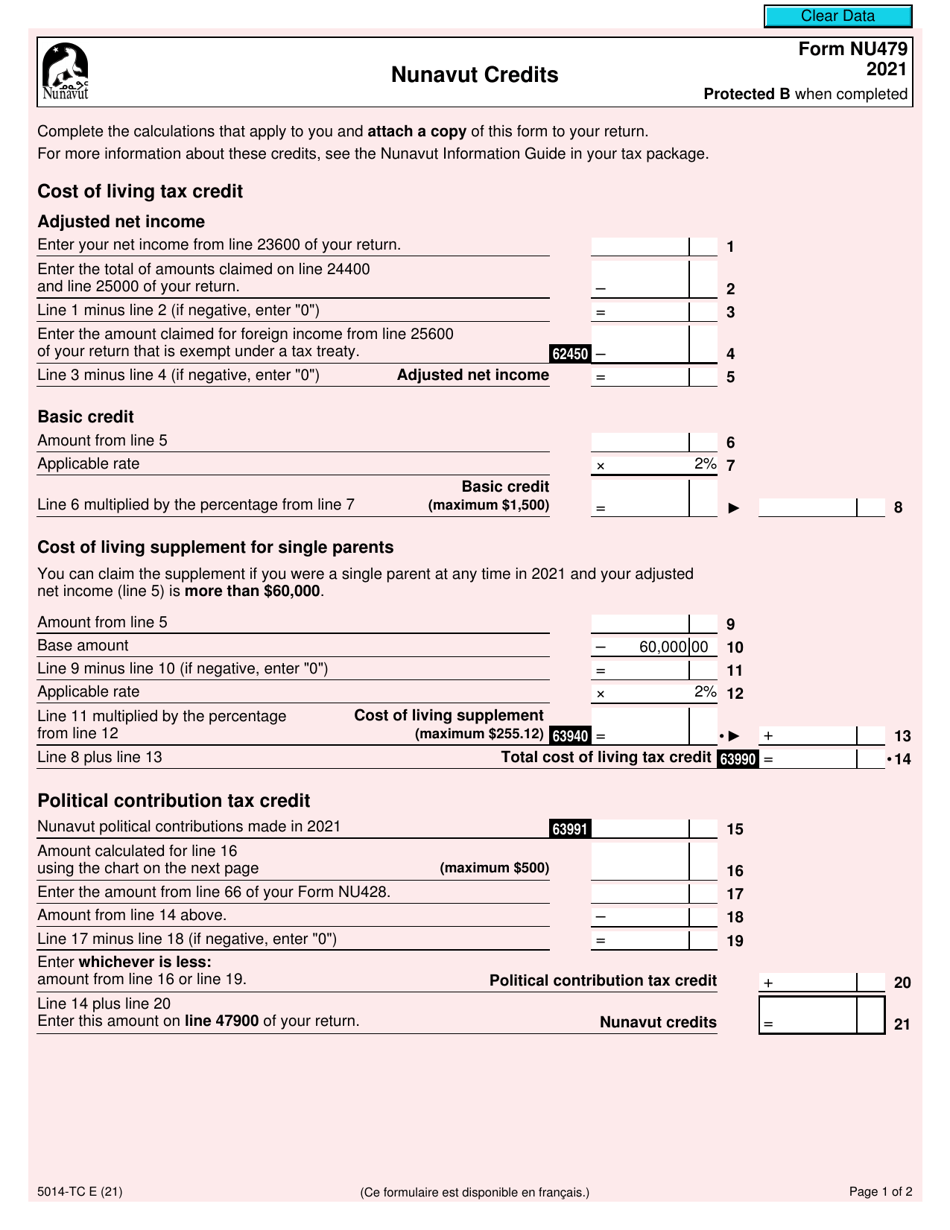

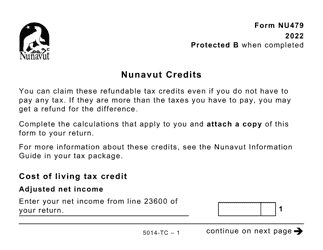

Form NU479 (5014-TC) Nunavut Credits - Canada

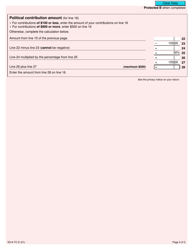

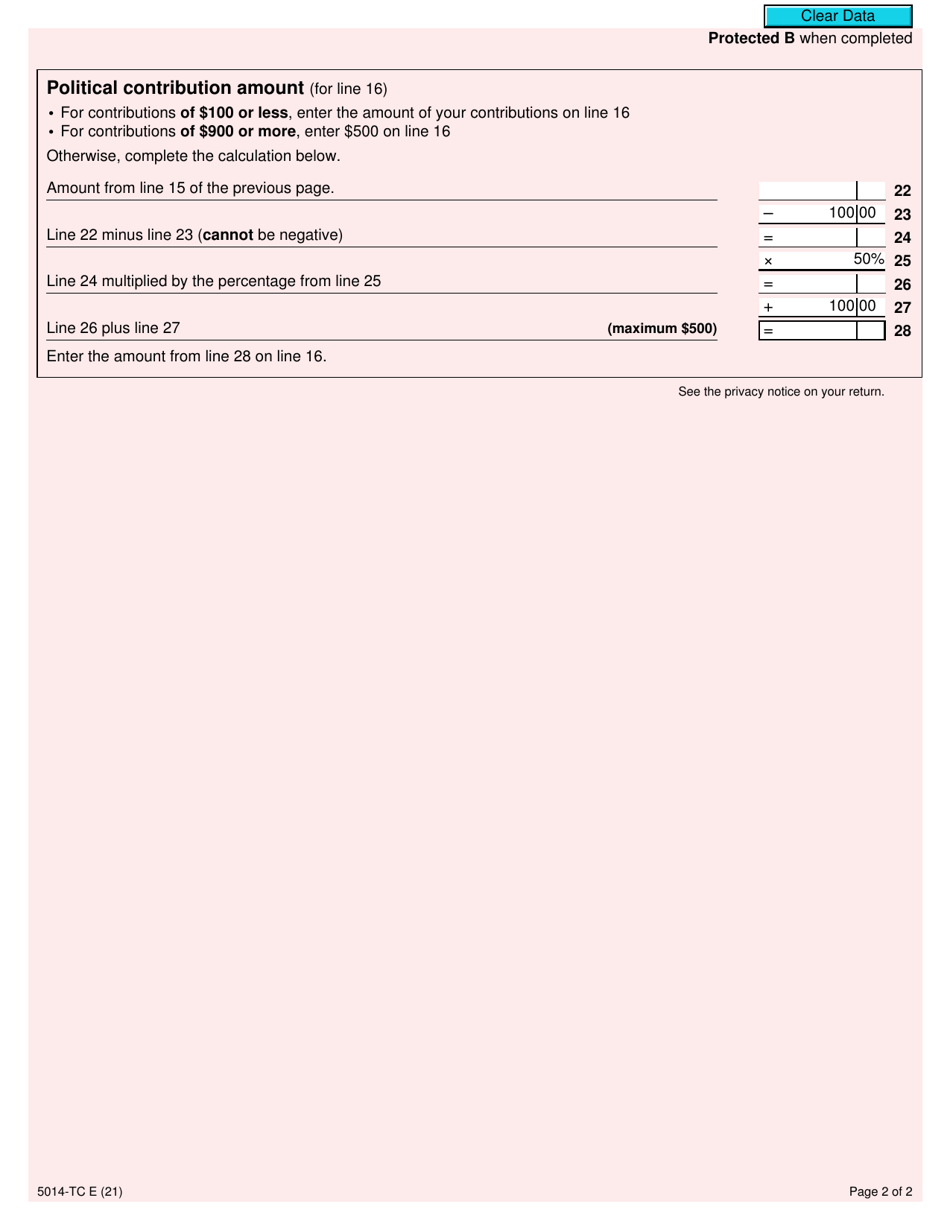

Form NU479 (5014-TC) Nunavut Credits - Canada is used for claiming specific tax credits related to Nunavut in Canada. These credits may include the Nunavut mining explorationtax credit and the Nunavut Research and Development Tax Credit, among others. It allows individuals or corporations to claim these credits on their Canadian tax return.

The Form NU479 (5014-TC) for Nunavut Credits is filed by individual taxpayers in Canada who are eligible for the tax credits specific to the Nunavut territory.

Form NU479 (5014-TC) Nunavut Credits - Canada - Frequently Asked Questions (FAQ)

Q: What is Form NU479 (5014-TC)?

A: Form NU479 (5014-TC) is a tax form used in Nunavut, Canada to claim tax credits.

Q: What are Nunavut credits?

A: Nunavut credits are tax credits specific to Nunavut, which can help reduce your tax liability.

Q: Who can use Form NU479 (5014-TC)?

A: Form NU479 (5014-TC) can be used by individuals who qualify for Nunavut credits.

Q: What information do I need to fill out Form NU479 (5014-TC)?

A: You will need to provide personal information, income details, and information related to the specific Nunavut credits you are claiming.

Q: When is the deadline to file Form NU479 (5014-TC)?

A: The deadline to file Form NU479 (5014-TC) is usually April 30th of the following year, unless extended by the government.

Q: Can I claim Nunavut credits if I live in another province?

A: No, Nunavut credits are only available to residents of Nunavut.

Q: What should I do if I need help filling out Form NU479 (5014-TC)?

A: If you need assistance, you can reach out to the Nunavut government or seek help from a tax professional.