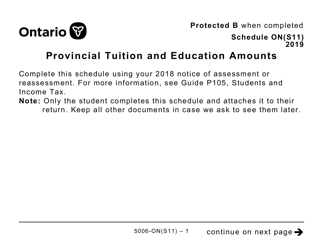

This version of the form is not currently in use and is provided for reference only. Download this version of

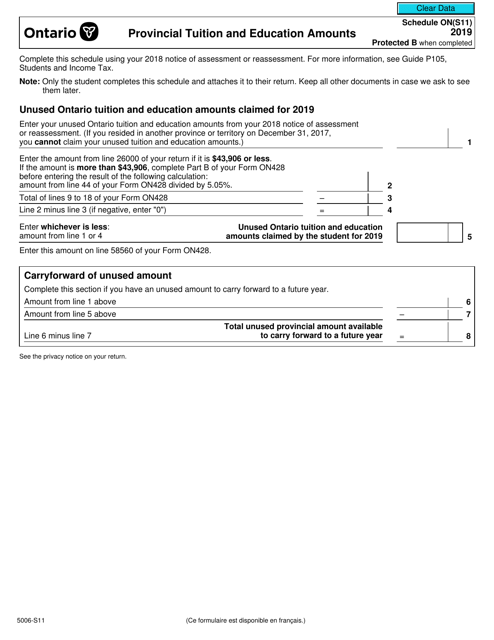

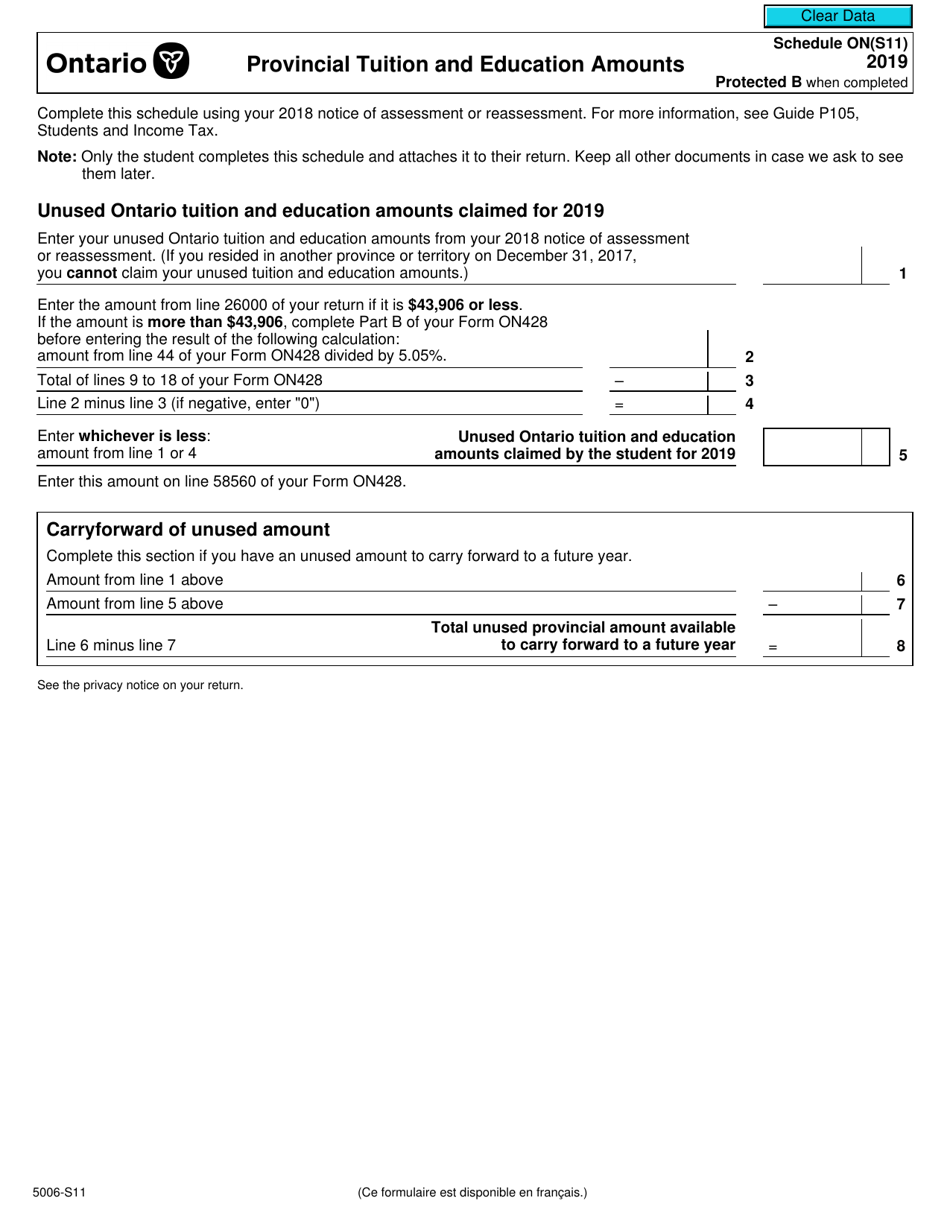

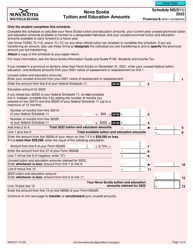

Form 5006-S11 Schedule ON(S11)

for the current year.

Form 5006-S11 Schedule ON(S11) Provincial Tuition and Education Amounts - Ontario - Canada

Form 5006-S11 Schedule ON(S11) is used to claim the Ontario Tuition and Education Amounts for tax purposes in Canada. It allows residents of Ontario to claim credits related to tuition fees and education expenses.

The Form 5006-S11 Schedule ON(S11) for Provincial Tuition and Education Amounts in Ontario, Canada is typically filed by individual taxpayers who are residents of Ontario and looking to claim their eligible tuition and education expenses.

FAQ

Q: What is Form 5006-S11?

A: Form 5006-S11 is a tax form used in Canada to report Provincial Tuition and Education Amounts for Ontario.

Q: What is Schedule ON(S11)?

A: Schedule ON(S11) is a specific schedule within Form 5006-S11 that is used to report Provincial Tuition and Education Amounts for Ontario.

Q: What are Provincial Tuition and Education Amounts?

A: Provincial Tuition and Education Amounts are tax credits or deductions that can be claimed by eligible individuals to reduce their tax liability.

Q: Who is eligible to claim Provincial Tuition and Education Amounts in Ontario?

A: In Ontario, eligible individuals include students who attended a designated educational institution and paid tuition fees to finance their education.

Q: When is the deadline to file Form 5006-S11 and Schedule ON(S11)?

A: The deadline to file Form 5006-S11 and Schedule ON(S11) is typically on or before April 30th of the following year.

Q: Do I need to submit Form 5006-S11 and Schedule ON(S11) if I did not incur any Provincial Tuition and Education Amounts in Ontario?

A: If you did not incur any Provincial Tuition and Education Amounts in Ontario, you may not need to submit Form 5006-S11 and Schedule ON(S11). However, it is always recommended to consult with a tax professional or the Canada Revenue Agency (CRA) for specific guidance.

Q: Can I carry forward unused Provincial Tuition and Education Amounts to future years?

A: Yes, unused Provincial Tuition and Education Amounts may be carried forward to future years to reduce your tax liability.