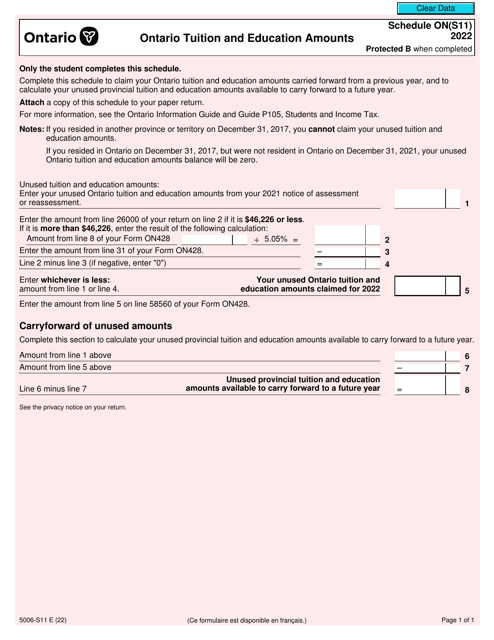

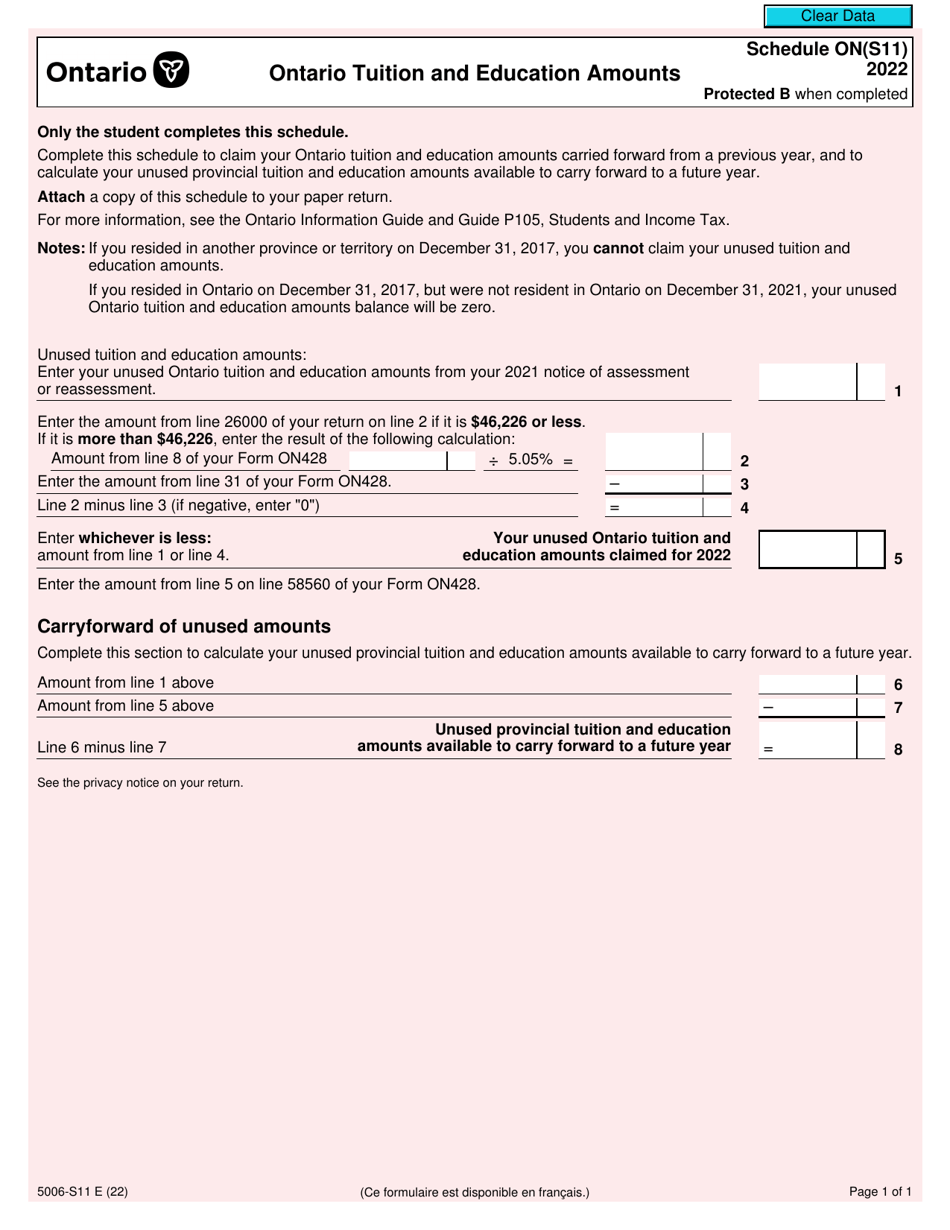

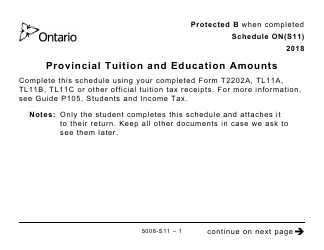

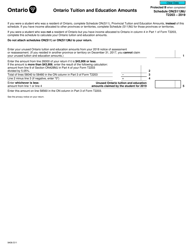

Form 5006-S11 Schedule ON(S11) Ontario Tuition and Education Amounts - Canada

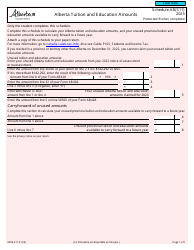

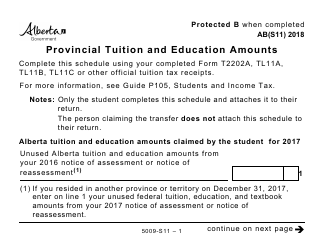

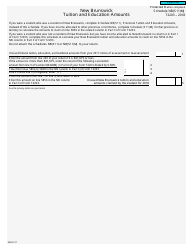

Form 5006-S11 Schedule ON(S11) is used in Ontario, Canada to claim tuition and education amounts for tax purposes. It allows individuals to report their tuition fees, education amounts, and related expenses to potentially receive tax credits or deductions.

The individual taxpayer files the Form 5006-S11 Schedule ON(S11) Ontario Tuition and Education Amounts in Canada.

Form 5006-S11 Schedule ON(S11) Ontario Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is form 5006-S11?

A: Form 5006-S11 is the schedule for claiming Ontario Tuition and Education Amounts in Canada.

Q: What is the purpose of form 5006-S11?

A: The purpose of form 5006-S11 is to calculate and claim the tuition and education amounts for residents of Ontario, Canada.

Q: Who can use form 5006-S11?

A: Residents of Ontario, Canada can use form 5006-S11 to claim the tuition and education amounts.

Q: What are the tuition and education amounts?

A: The tuition and education amounts are tax credits that can be claimed for eligible tuition fees paid and education expenses incurred.

Q: What is the schedule ON(S11)?

A: The schedule ON(S11) is the Ontario-specific section of form 5006-S11 that calculates the tuition and education amounts for residents of Ontario.

Q: Are there any eligibility criteria for claiming these amounts?

A: Yes, there are eligibility criteria that must be met in order to claim the tuition and education amounts. These criteria include being enrolled in a qualifying program and having eligible education expenses.

Q: Is there a deadline for submitting form 5006-S11?

A: Yes, the deadline for submitting form 5006-S11 is usually April 30th of the year following the tax year for which the amounts are being claimed.

Q: How do I claim the tuition and education amounts?

A: To claim the tuition and education amounts, you need to complete form 5006-S11 and include it with your income tax return.

Q: Can I carry forward any unused amounts?

A: Yes, you can carry forward any unused tuition and education amounts to future years if you are unable to fully utilize them in the current year.