This version of the form is not currently in use and is provided for reference only. Download this version of

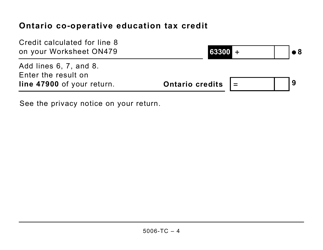

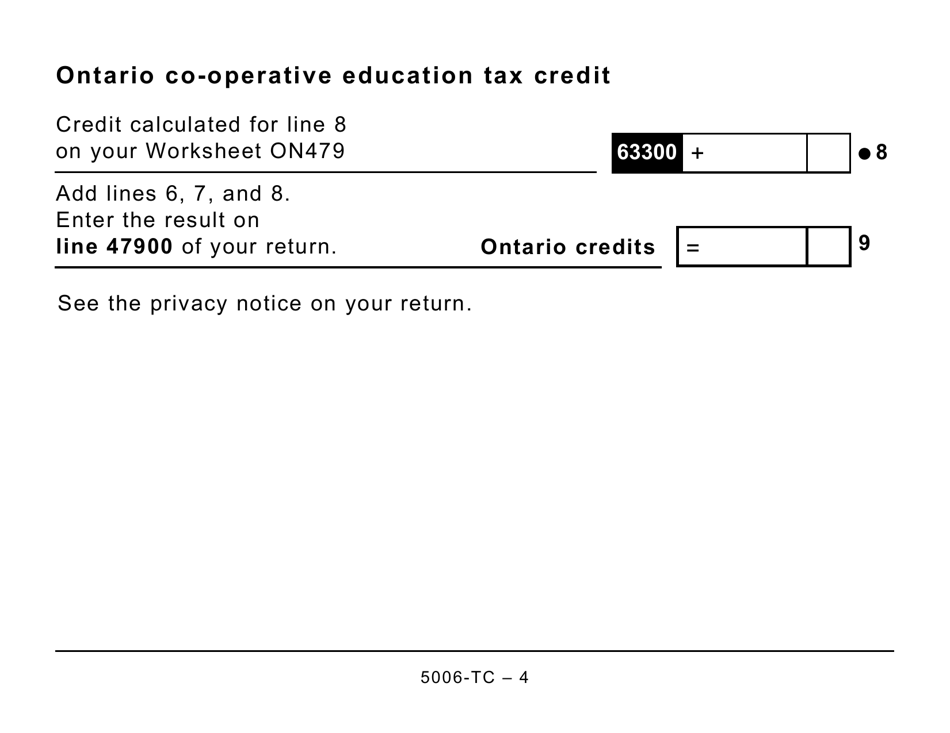

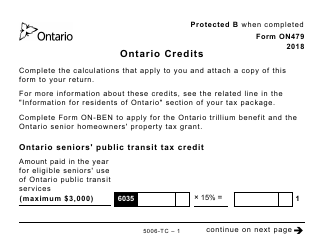

Form ON479 (5006-TC)

for the current year.

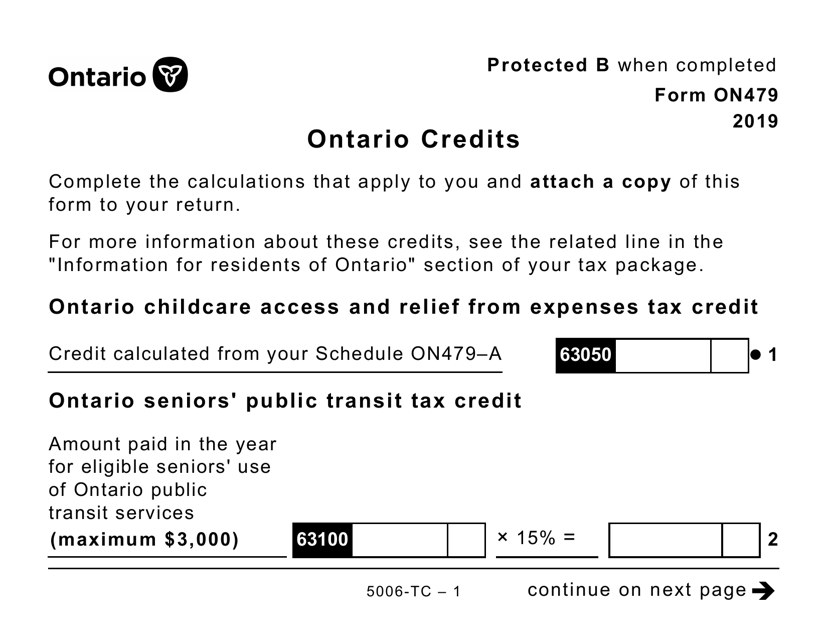

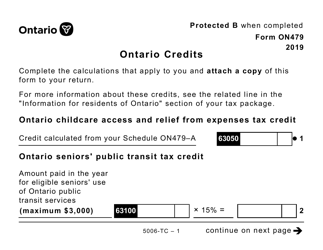

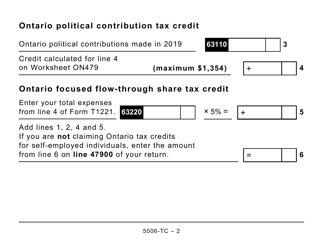

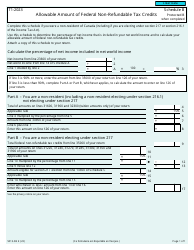

Form ON479 (5006-TC) Ontario Credits (Large Print) - Canada

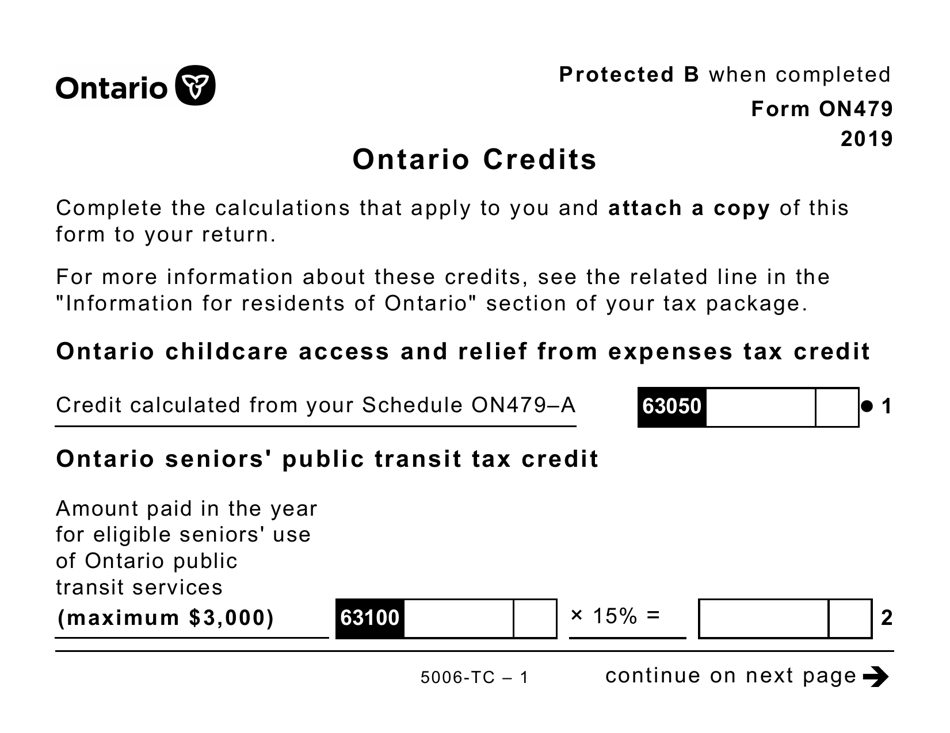

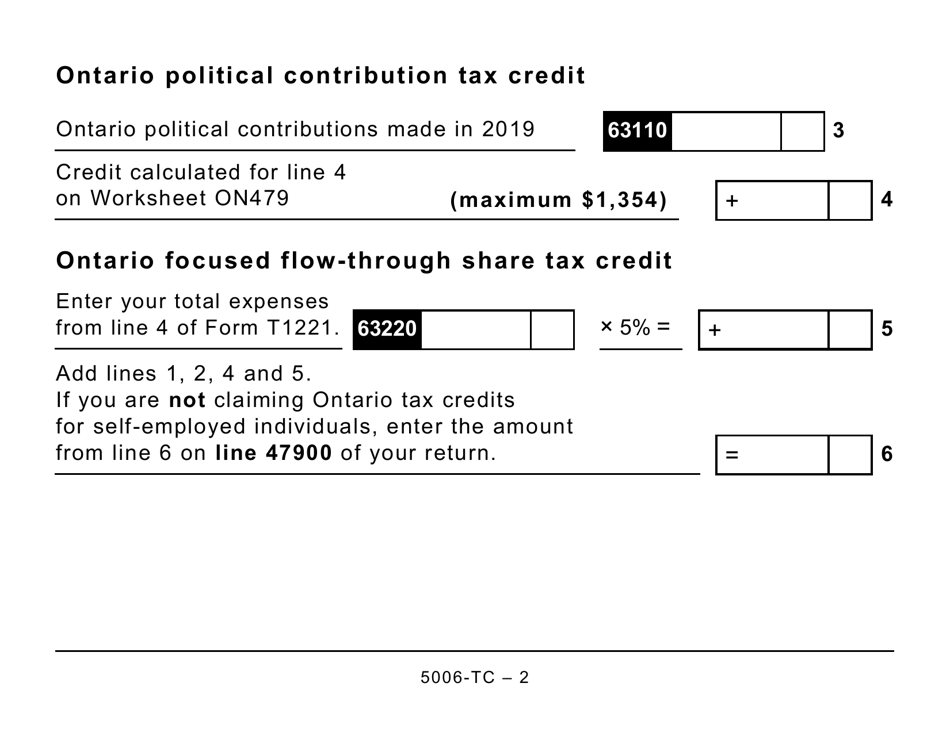

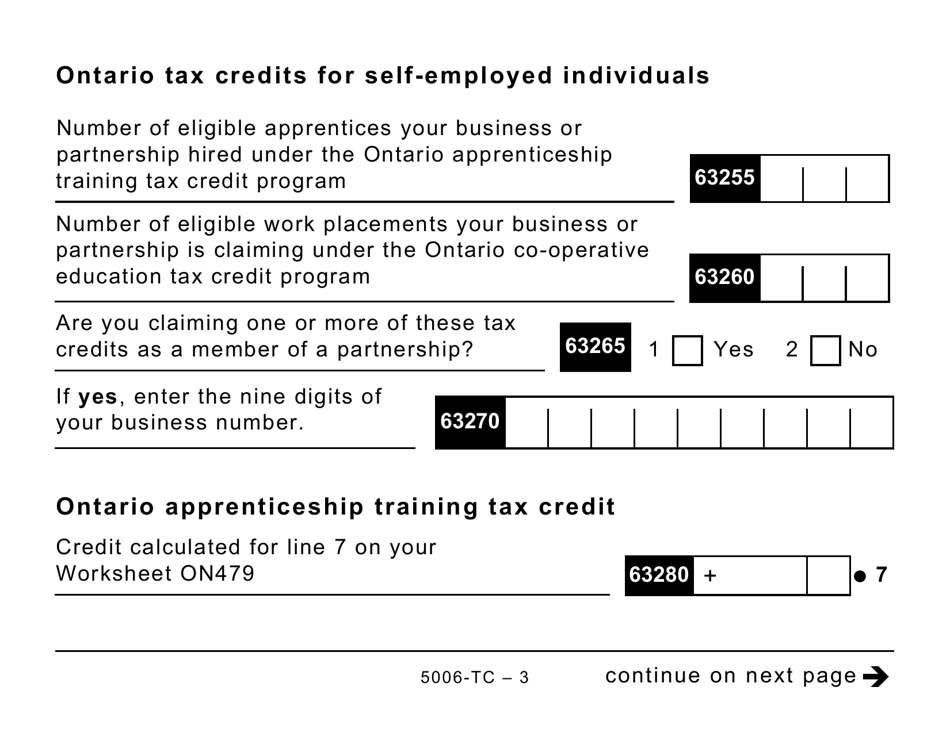

Form ON479 (5006-TC) Ontario Credits (Large Print) is a form used in Canada for claiming various tax credits specific to the province of Ontario. These credits can include the Ontario Energy and Property Tax Credit, the Ontario Senior Homeowners' Property Tax Grant, and other credits related to education and child care expenses.

The Form ON479 (5006-TC) Ontario Credits (Large Print) in Canada is filed by individual taxpayers who are eligible for Ontario tax credits.

FAQ

Q: What is form ON479?

A: Form ON479 is a tax form specific to residents of Ontario, Canada.

Q: What is the purpose of form ON479?

A: Form ON479 is used to claim various tax credits that are available to residents of Ontario.

Q: What types of tax credits can be claimed on form ON479?

A: Form ON479 allows you to claim credits such as the Ontario energy and property tax credit, the Ontario senior homeowners' property tax grant, and the Ontario sales tax credit, among others.

Q: Who is eligible to file form ON479?

A: Residents of Ontario who meet the eligibility criteria for the tax credits listed on the form are eligible to file form ON479.

Q: When is the deadline to file form ON479?

A: The deadline to file form ON479 is usually April 30th of the year following the tax year for which you are claiming credits.

Q: Are there any limitations on the credits that can be claimed on form ON479?

A: Yes, there are income limitations and other eligibility criteria that apply to each specific tax credit listed on form ON479. It is important to review the instructions accompanying the form to determine if you qualify for any particular credits.