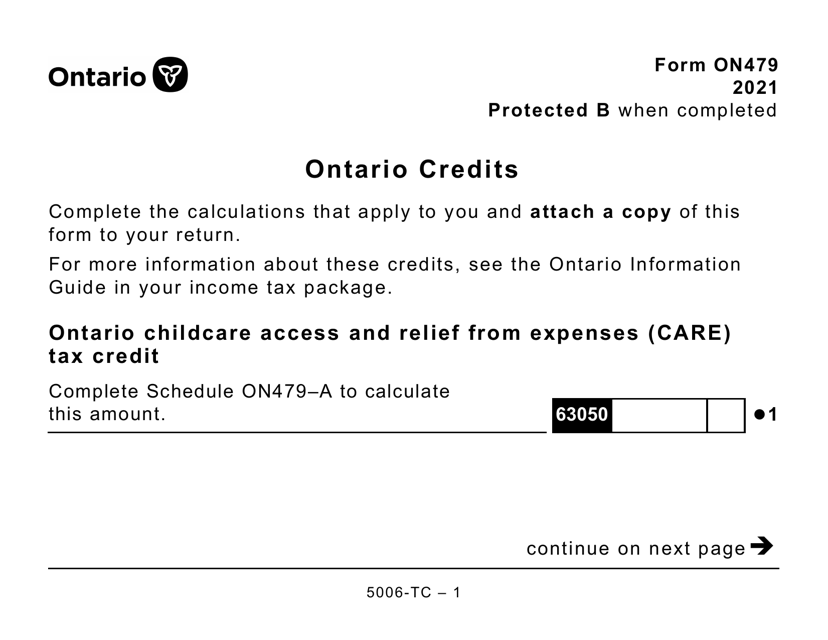

Form ON479 (5006-TC) Ontario Credits (Large Print) - Canada

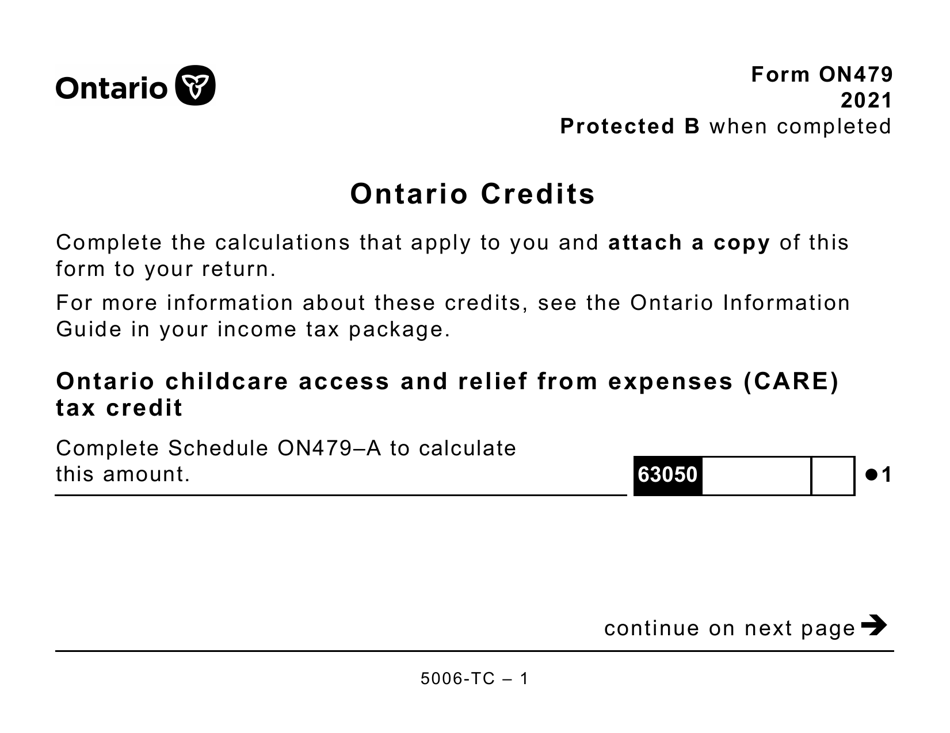

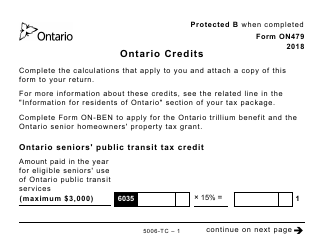

Form ON479 (5006-TC) Ontario Credits (Large Print) is a tax form used in Canada, specifically in the province of Ontario. It is used to claim various credits, deductions, and benefits available to Ontario residents for tax purposes.

The form ON479 (5006-TC) Ontario Credits (Large Print) in Canada is typically filed by individual taxpayers who are claiming Ontario tax credits.

FAQ

Q: What is Form ON479 (5006-TC)?A: Form ON479 (5006-TC) is a tax form used in Ontario, Canada to claim various tax credits.

Q: Who can use Form ON479 (5006-TC)?A: Ontario residents who qualify for the tax credits listed on the form can use it.

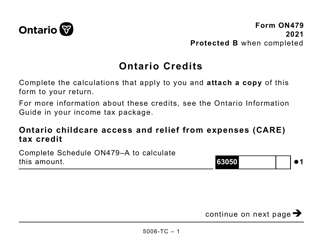

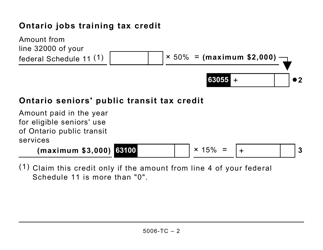

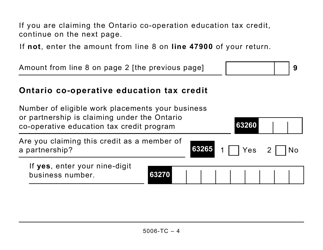

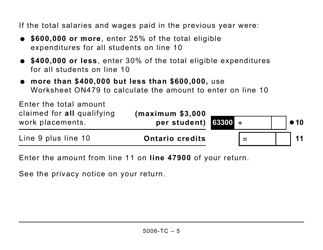

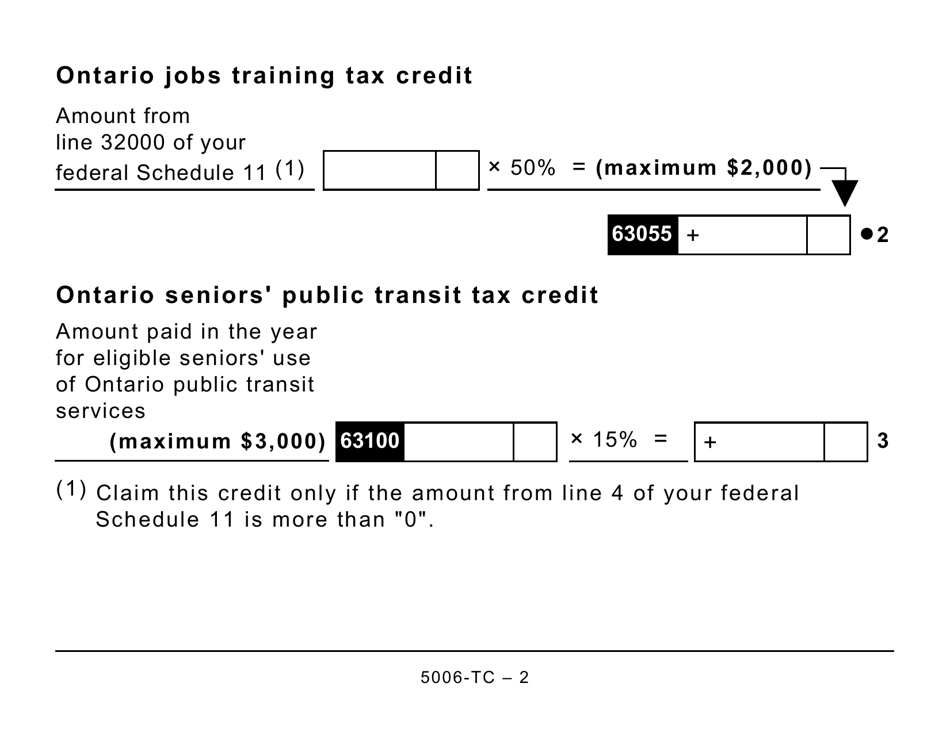

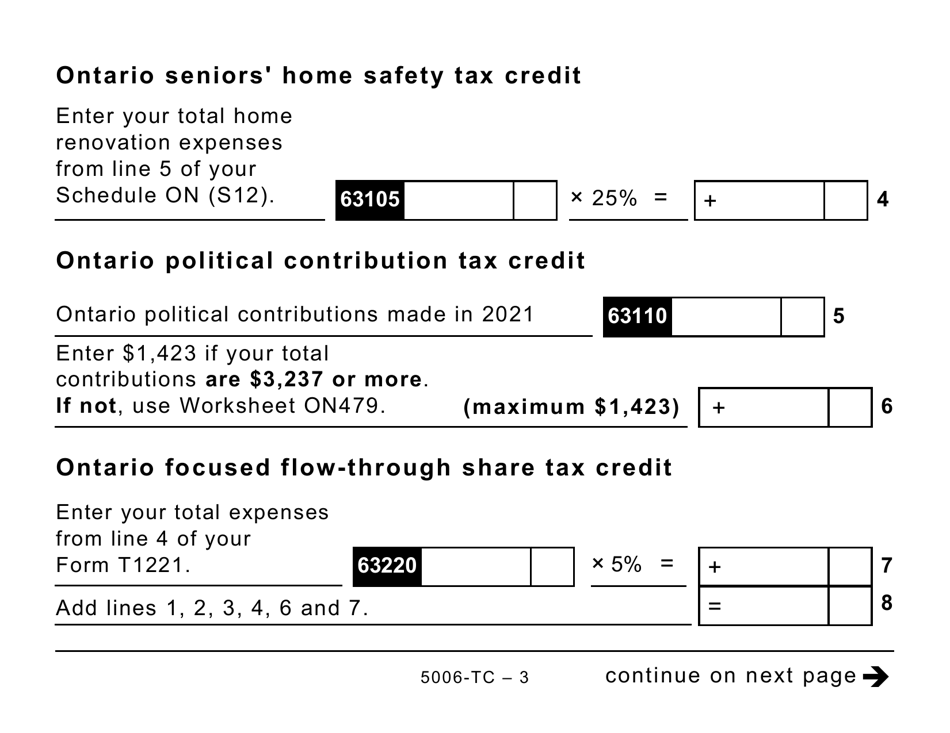

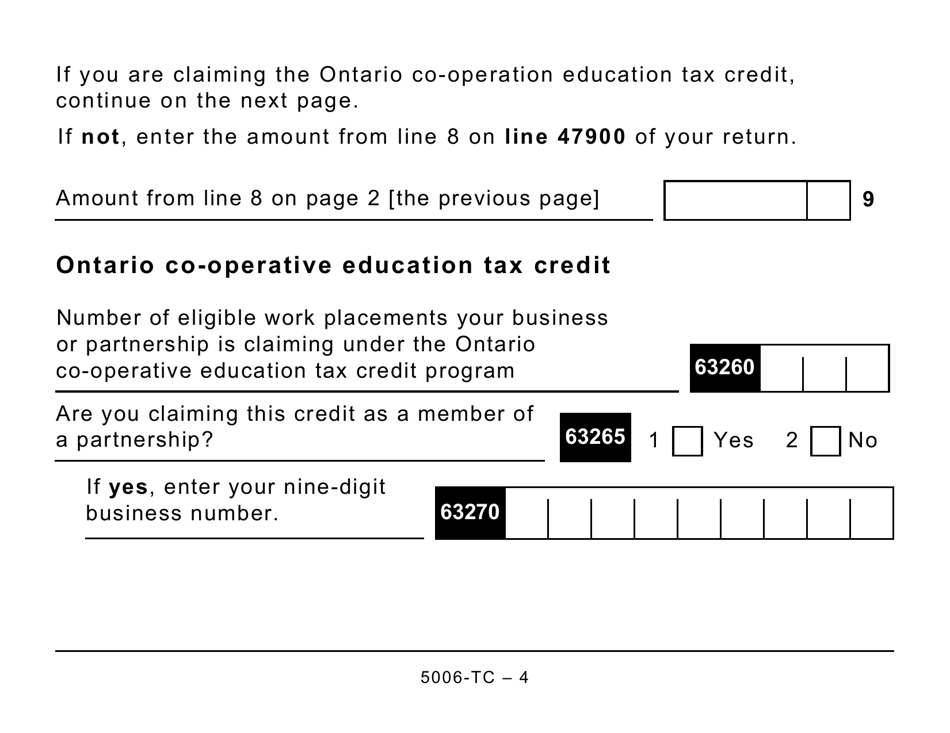

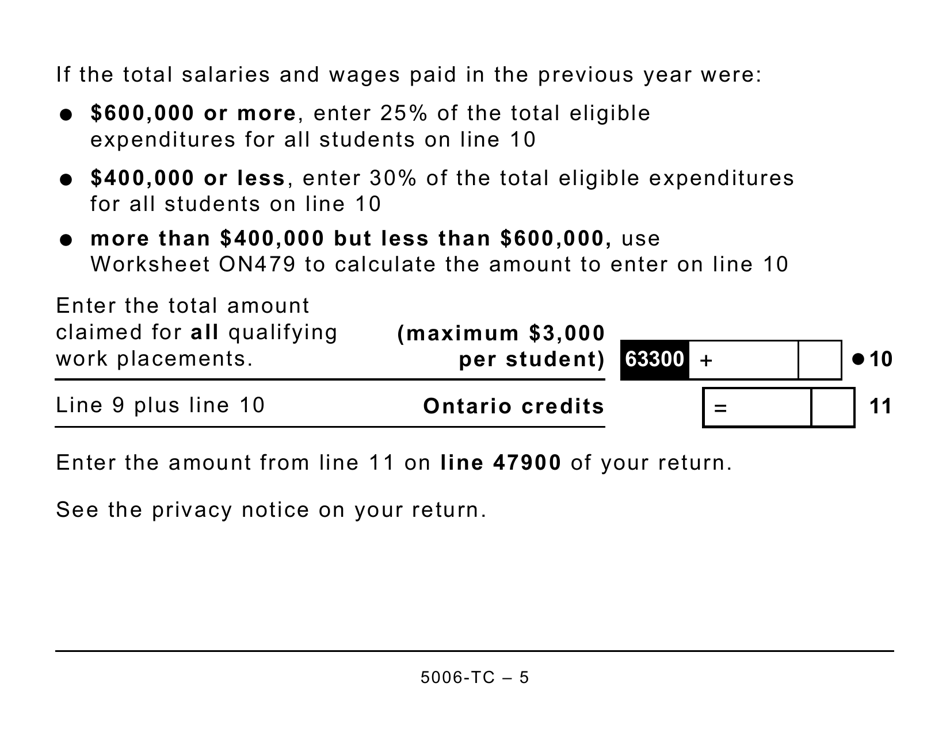

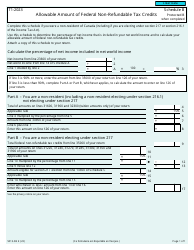

Q: What are the tax credits that can be claimed using Form ON479 (5006-TC)?A: Some of the tax credits that can be claimed using this form include the Ontario Property and Sales Tax Credit, Ontario Seniors' Public Transit Tax Credit, and Ontario Children's Activity Tax Credit.

Q: How do I fill out Form ON479 (5006-TC)?A: You will need to provide your personal information, including your social insurance number, and fill out the appropriate sections depending on the tax credits you are claiming.

Q: When is the deadline to file Form ON479 (5006-TC)?A: The deadline to file this form is usually April 30th of the following year, but it is always best to check with the CRA for the most up-to-date information.

Q: What should I do if I have questions or need help with Form ON479 (5006-TC)?A: If you have questions or need help, you can contact the CRA directly or seek assistance from a tax professional.

Q: Are the tax credits claimed on Form ON479 (5006-TC) refundable?A: Some of the tax credits on this form are refundable, meaning you may receive a refund even if you have no tax owing.

Q: Can I claim both federal and provincial tax credits using Form ON479 (5006-TC)?A: Yes, you can claim both federal and provincial tax credits on this form, as long as you meet the eligibility criteria for each credit.