This version of the form is not currently in use and is provided for reference only. Download this version of

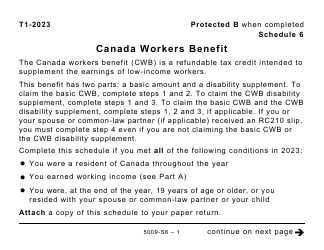

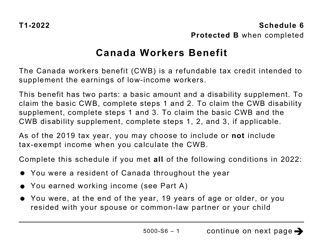

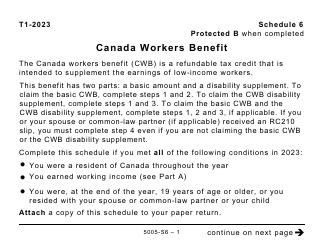

Form 5005-S6 Schedule 6

for the current year.

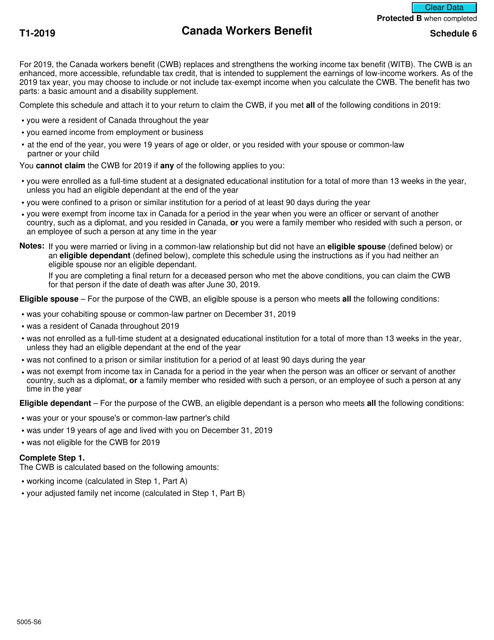

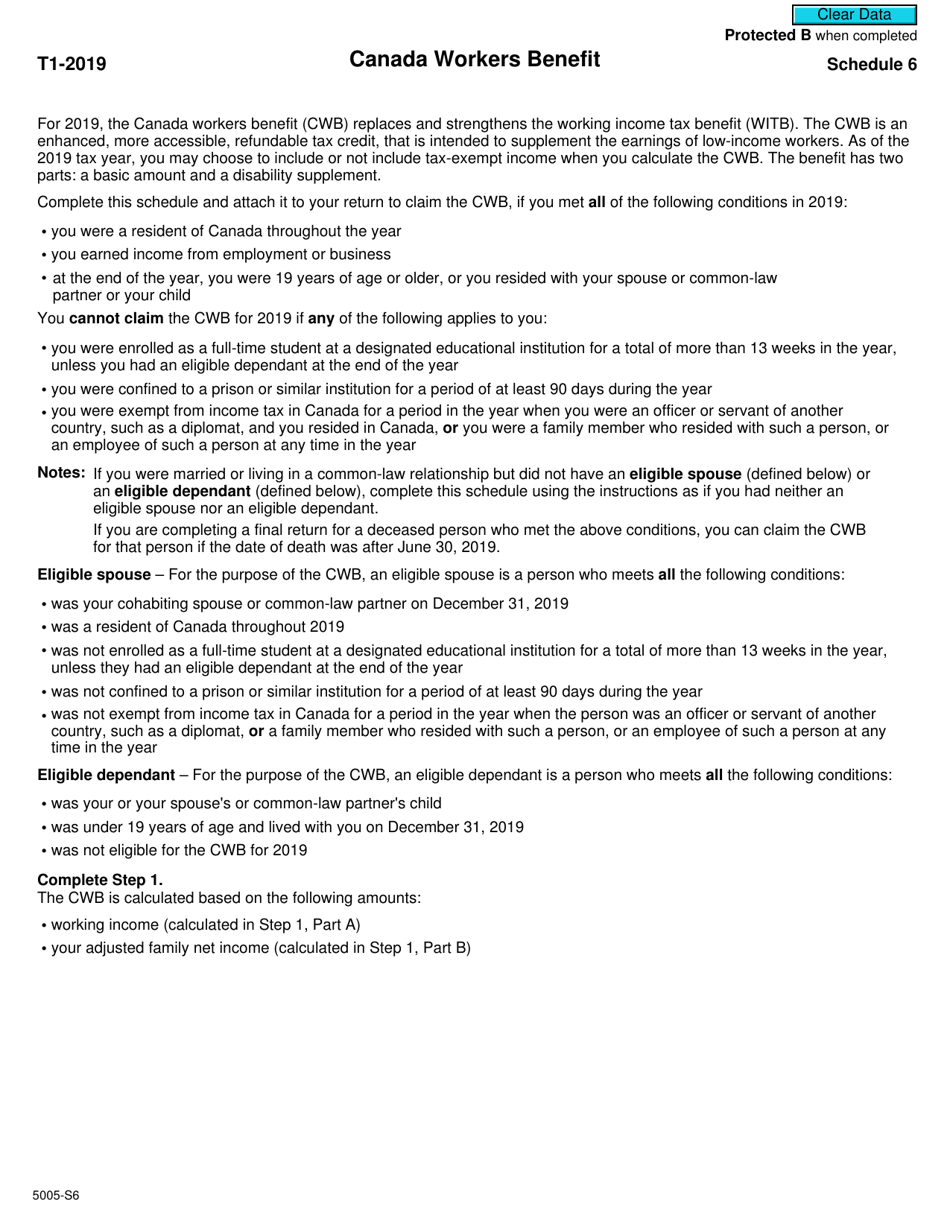

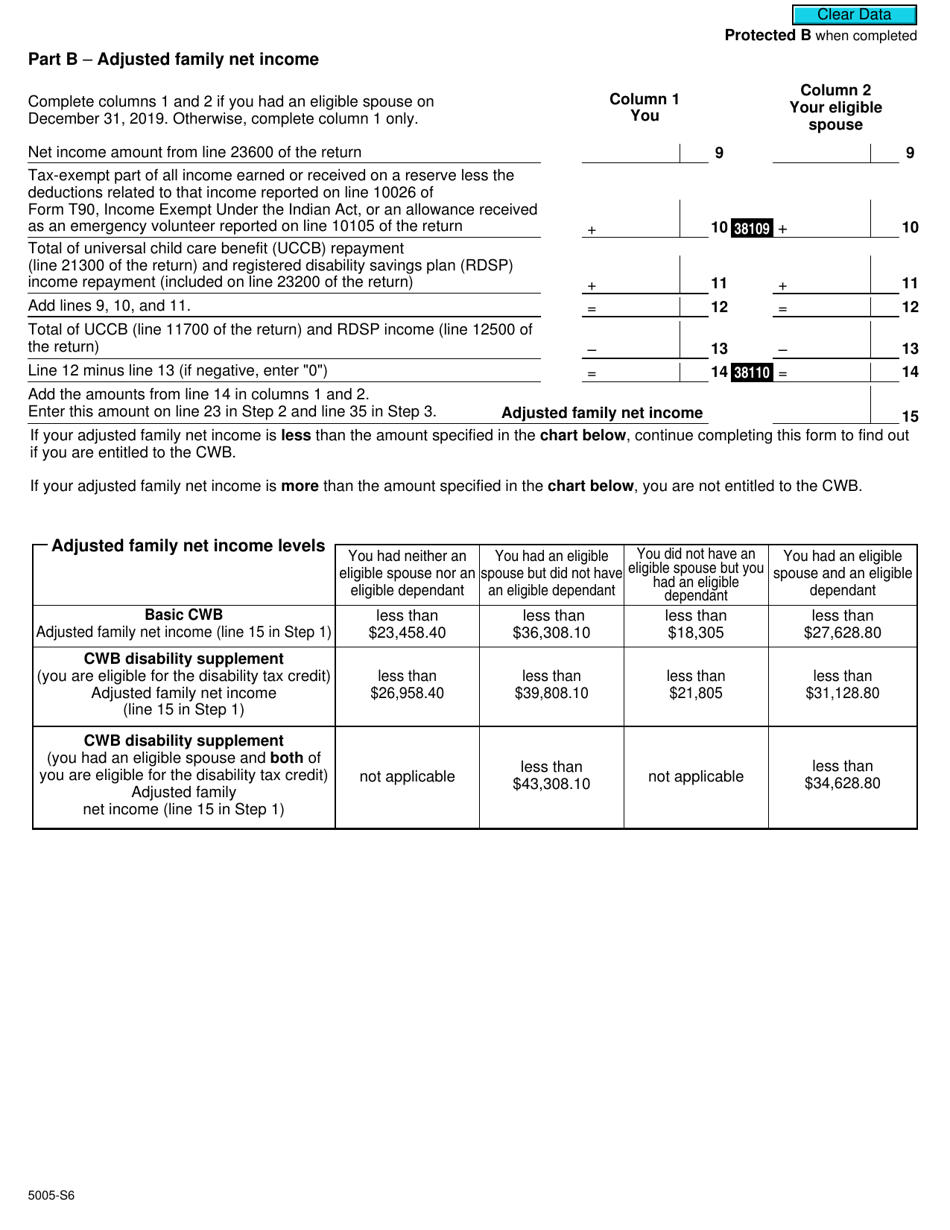

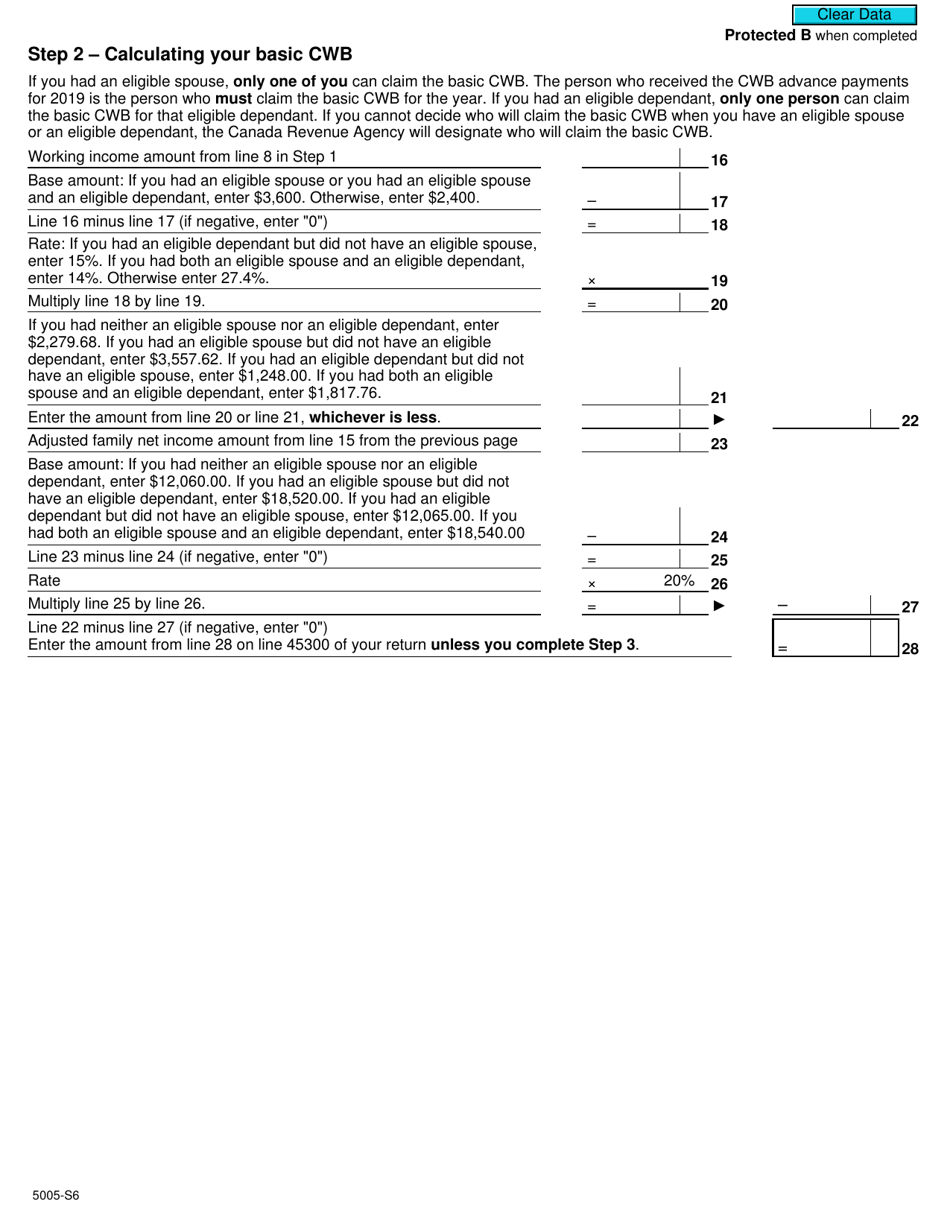

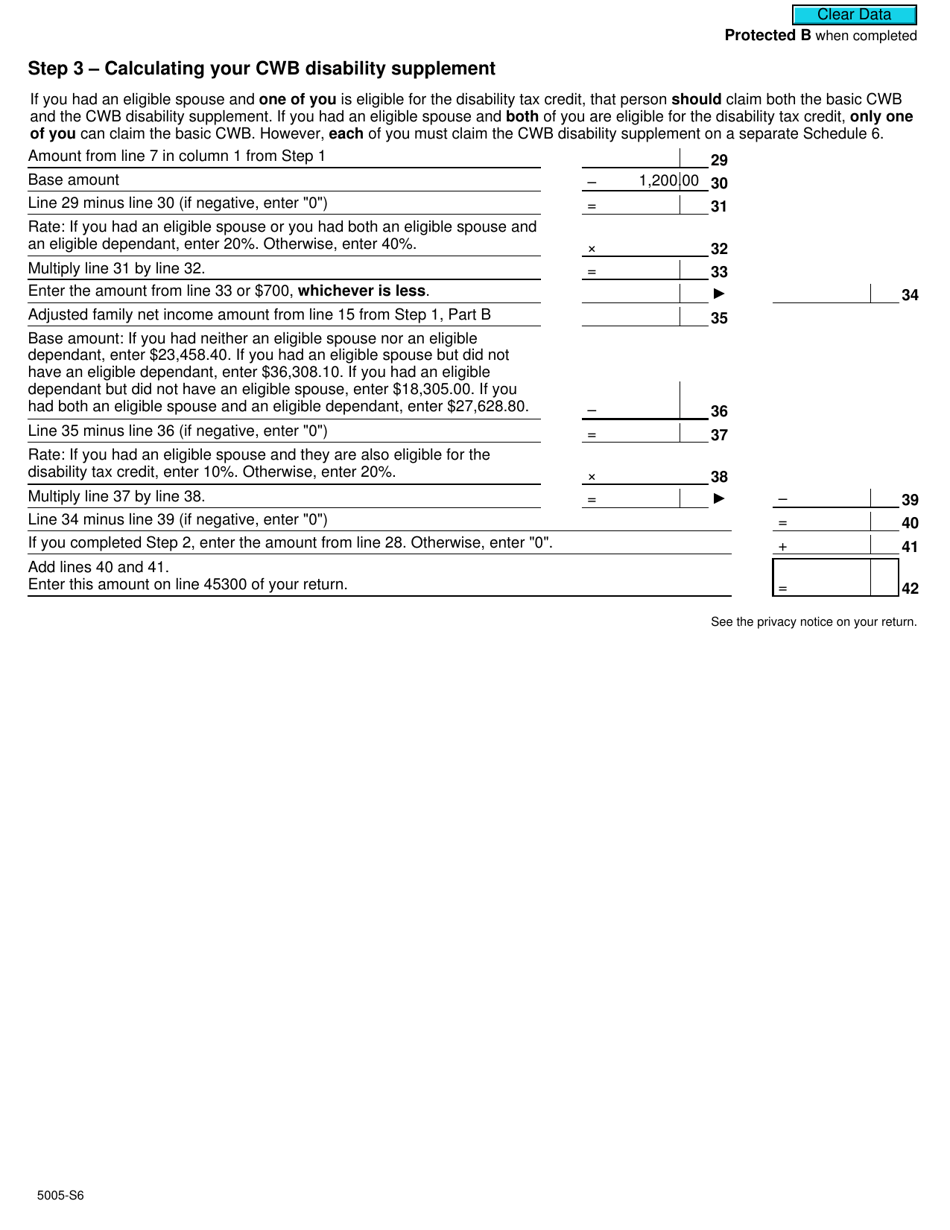

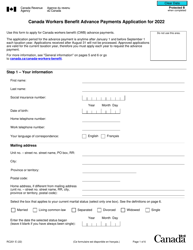

Form 5005-S6 Schedule 6 Canada Workers Benefit - Quebec - Canada

Form 5005-S6 Schedule 6 is used in Canada for reporting the Quebec Workers Benefit. It is designed to calculate and claim the tax credit for working individuals in the province of Quebec.

The Form 5005-S6 Schedule 6 for the Canada Workers Benefit - Quebec in Canada is filed by residents of Quebec who meet the necessary eligibility criteria.

FAQ

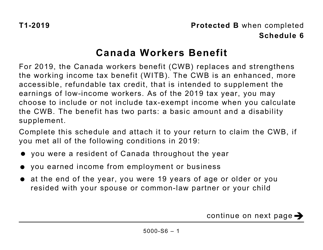

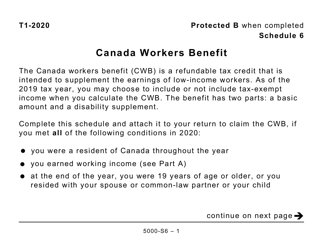

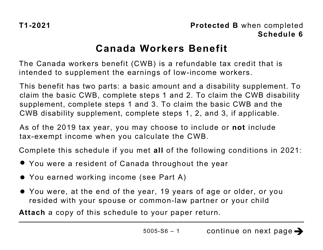

Q: What is Form 5005-S6?

A: Form 5005-S6 is a schedule used in Canada to calculate the Quebec Workers Benefit.

Q: What is the Quebec Workers Benefit?

A: The Quebec Workers Benefit is a tax credit available to low-income workers in Quebec, Canada.

Q: Who is eligible for the Quebec Workers Benefit?

A: Individuals who meet the income and residency requirements in Quebec are eligible for the Quebec Workers Benefit.

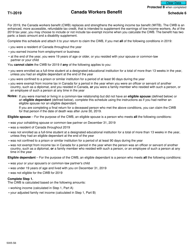

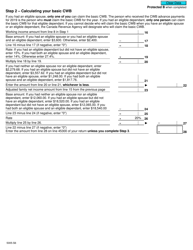

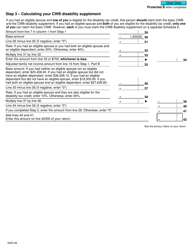

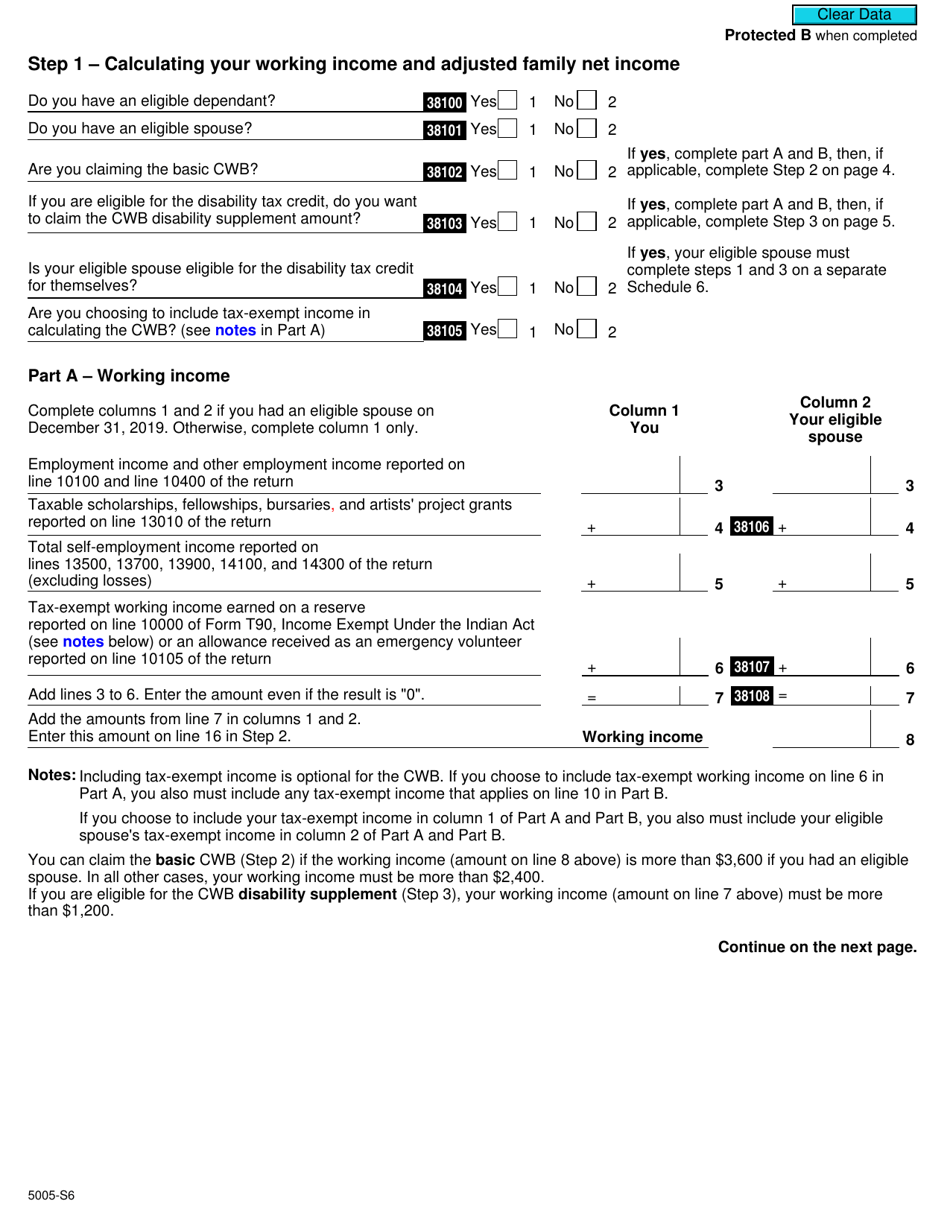

Q: How do I fill out Form 5005-S6?

A: You can refer to the instructions provided on the form to fill out Form 5005-S6 accurately.

Q: When is the deadline to file Form 5005-S6?

A: The deadline for filing Form 5005-S6 is usually the same as the deadline for filing your income tax return in Quebec.

Q: What happens after I submit Form 5005-S6?

A: After submitting Form 5005-S6, the Canada Revenue Agency will review your application and determine if you are eligible for the Quebec Workers Benefit.

Q: Is the Quebec Workers Benefit taxable income?

A: No, the Quebec Workers Benefit is a tax credit and is not considered taxable income.

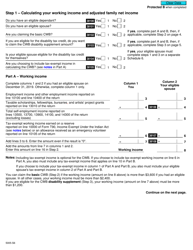

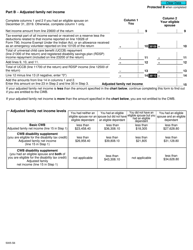

Q: How much can I receive from the Quebec Workers Benefit?

A: The amount you can receive from the Quebec Workers Benefit depends on your income and family situation. It is calculated using the information provided on Form 5005-S6.

Q: Can I claim the Quebec Workers Benefit if I live in another province?

A: No, the Quebec Workers Benefit is only available to residents of Quebec.