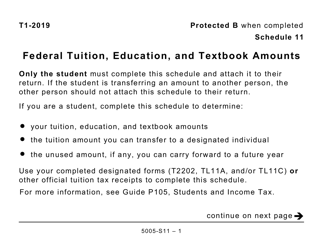

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5005-S11 Schedule 11

for the current year.

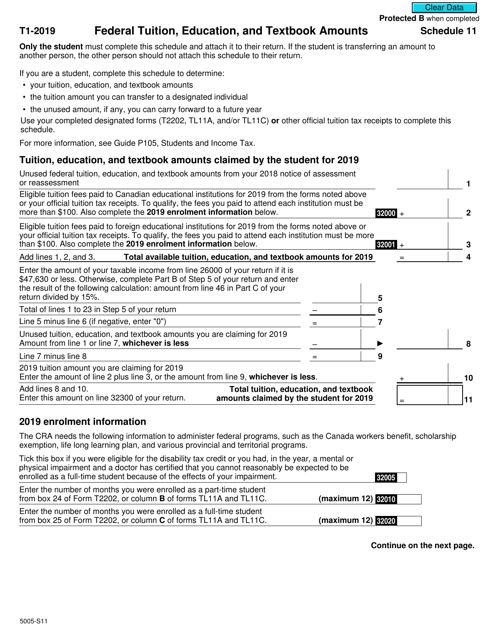

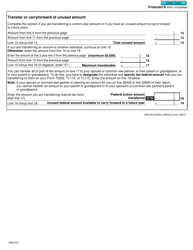

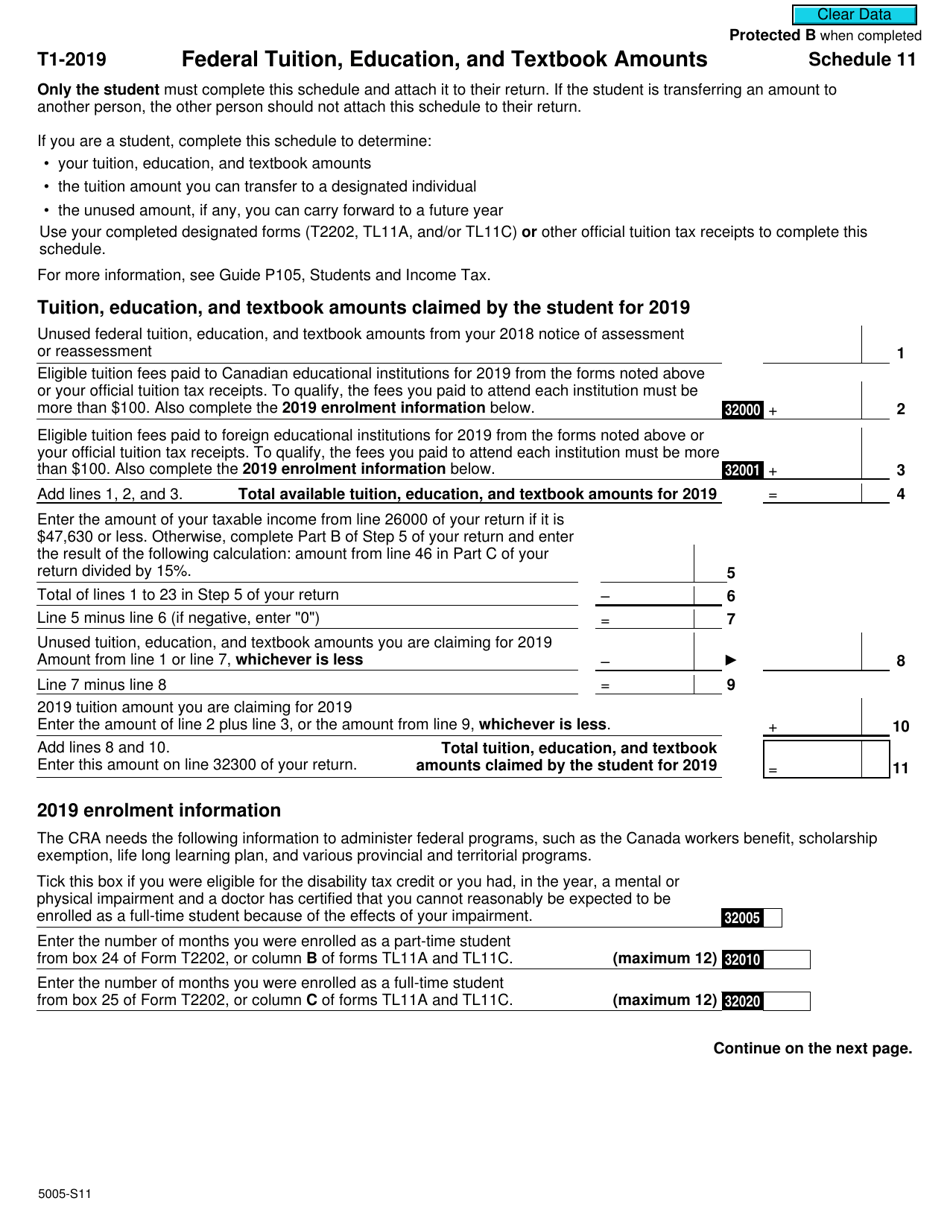

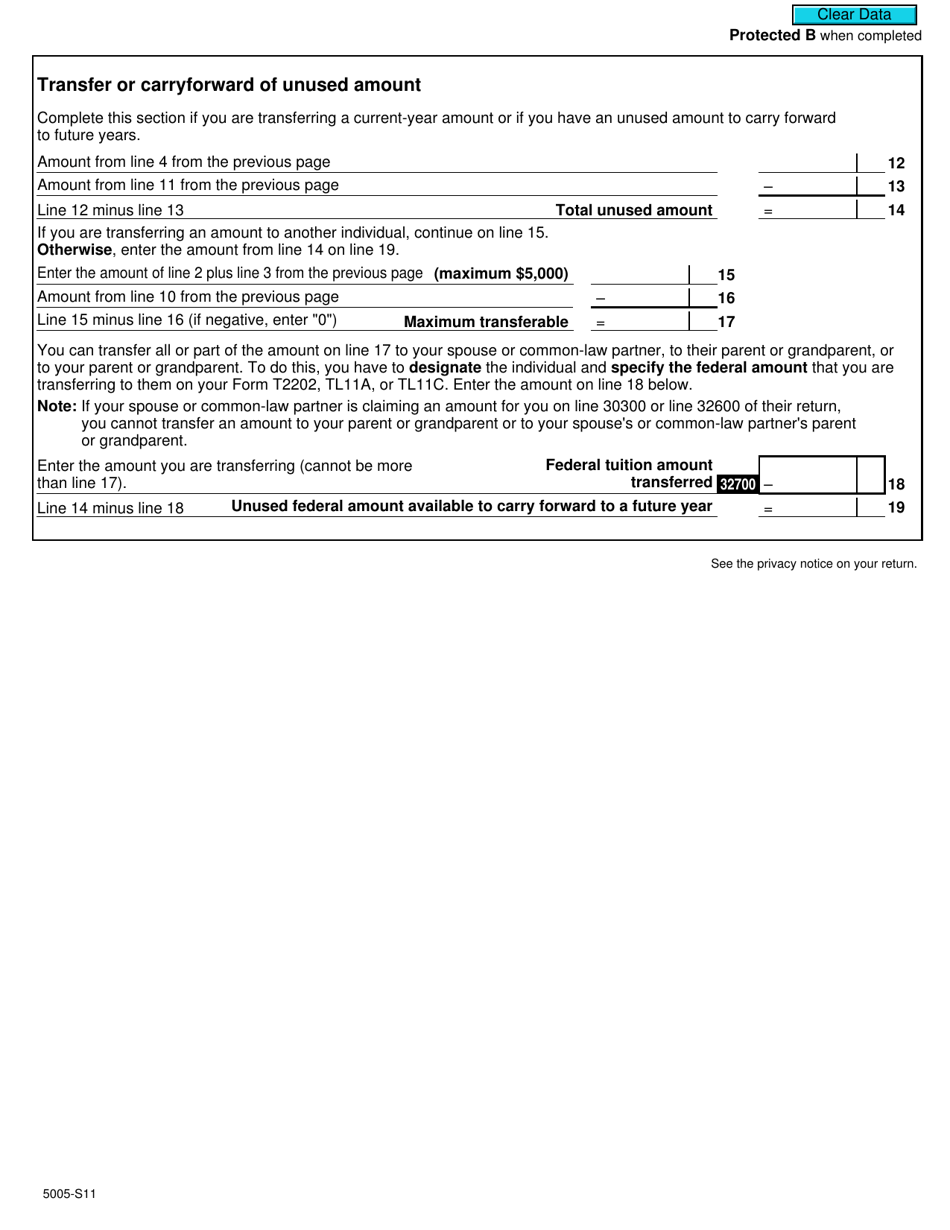

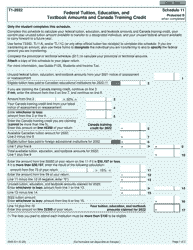

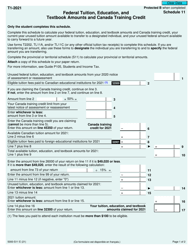

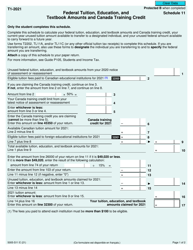

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts - Canada

Form 5005-S11 Schedule 11 is used in Canada to claim federal tax credits for tuition, education, and textbook expenses.

Individual taxpayers who are claiming federal tuition, education, and textbook amounts in Canada file the Form 5005-S11 Schedule 11.

FAQ

Q: What is Form 5005-S11 Schedule 11?

A: Form 5005-S11 Schedule 11 is a tax form used in Canada to claim federal tuition, education, and textbook amounts.

Q: What can I claim on Form 5005-S11 Schedule 11?

A: You can claim tuition fees, education amounts, and textbook amounts for yourself, your spouse, or common-law partner, or your dependent children.

Q: Who is eligible to claim on Form 5005-S11 Schedule 11?

A: Students enrolled in eligible post-secondary education programs, as well as their supporting individuals, can claim on this form.

Q: How do I file Form 5005-S11 Schedule 11?

A: You can file this form along with your federal income tax return. It can be filed electronically or by mail.

Q: Is there a deadline for filing Form 5005-S11 Schedule 11?

A: The deadline to file this form is usually April 30th of the following year, unless you or your spouse or common-law partner is self-employed.