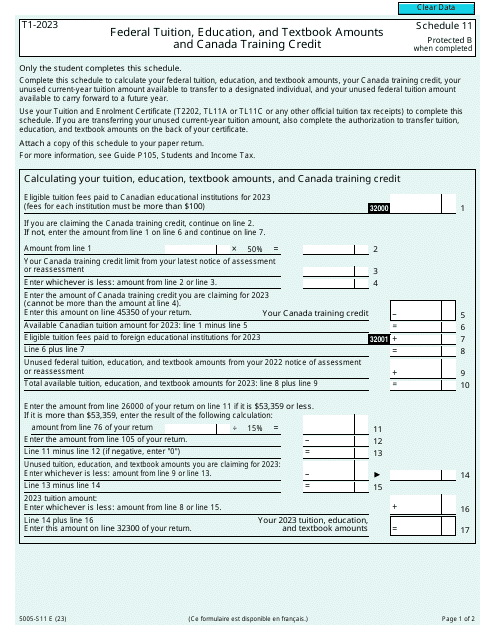

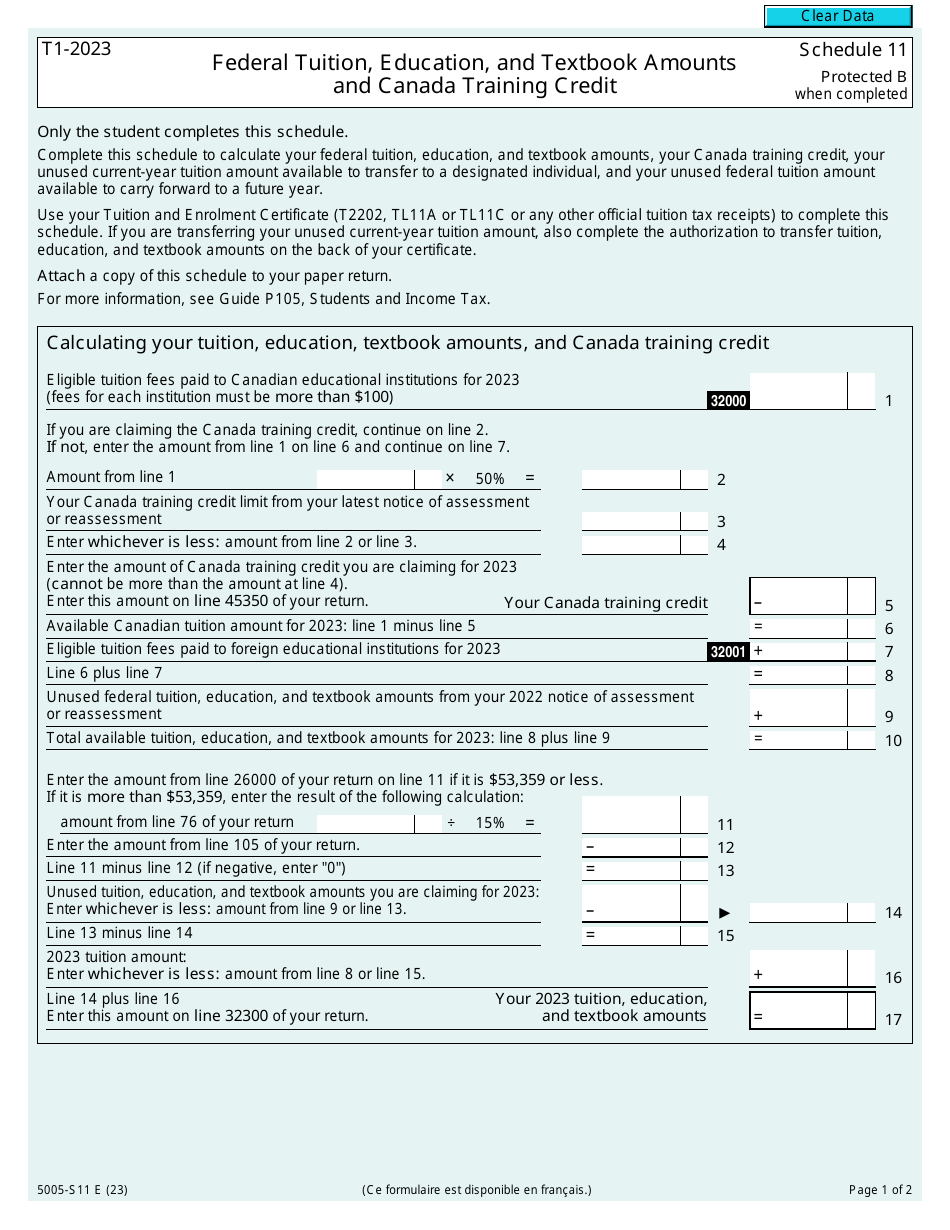

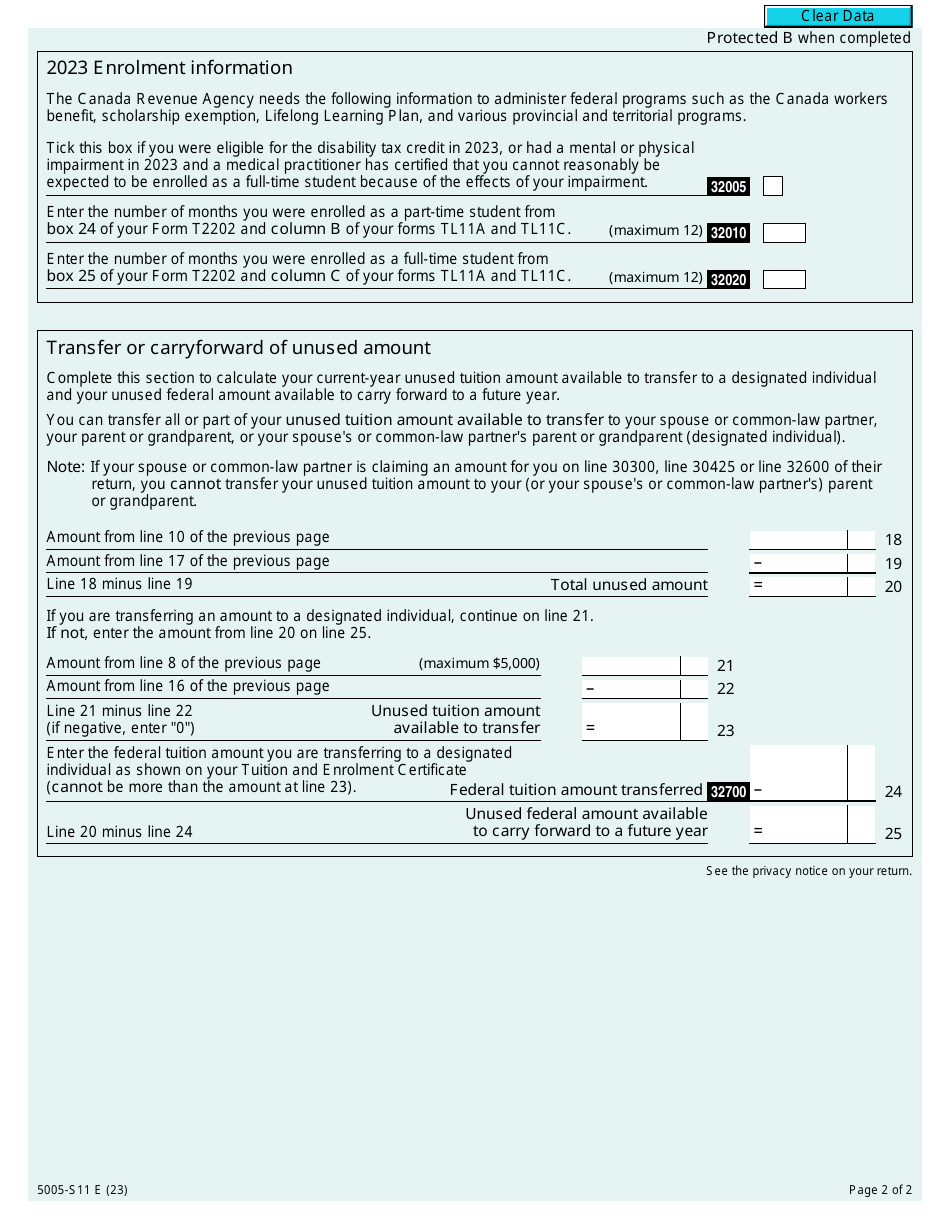

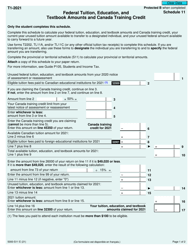

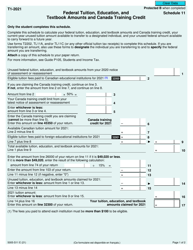

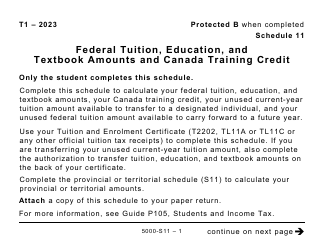

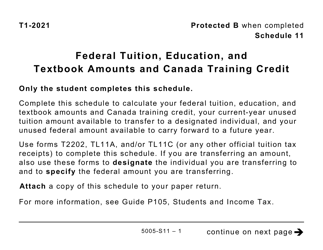

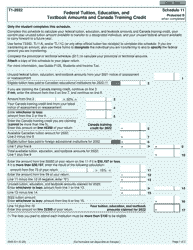

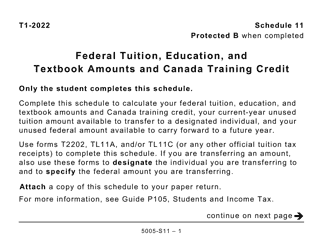

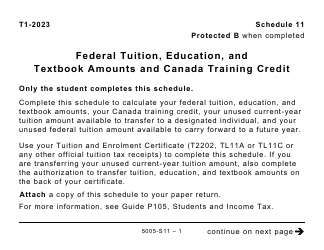

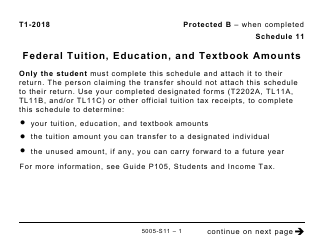

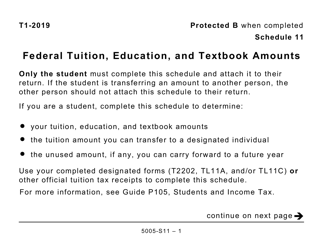

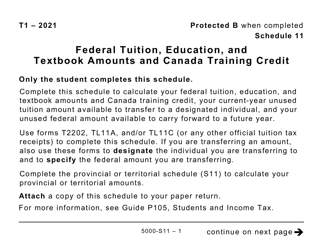

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit - Canada

Form 5005-S11 Schedule 11 is used in Canada for claiming federal tuition, education, and textbook amounts, as well as the Canada Training Credit. However, it is only applicable for Quebec residents and non-residents of Canada.

The Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For Quebec and Non-residents of Canada Only) form is filed by individuals who are residents of Quebec or non-residents of Canada.

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For Quebec and Non-residents of Canada Only) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5005-S11?

A: Form 5005-S11 is a schedule used in Canada to report federal tuition, education, and textbook amounts as well as the Canada Training Credit for Quebec and non-residents of Canada.

Q: Who needs to use Form 5005-S11?

A: Form 5005-S11 is used by individuals who are residents of Quebec or non-residents of Canada and want to claim federal tuition, education, and textbook amounts as well as the Canada Training Credit.

Q: What can be reported on Form 5005-S11?

A: Form 5005-S11 allows individuals to report the amounts related to their tuition, education, and textbook expenses, as well as any Canada Training Credit they may be eligible for.

Q: Can residents of Canada outside of Quebec use Form 5005-S11?

A: No, Form 5005-S11 is specifically for residents of Quebec or non-residents of Canada. Residents of other provinces in Canada have different forms to report their tuition, education, and textbook amounts.

Q: Is Form 5005-S11 only for individuals?

A: Yes, Form 5005-S11 is specifically for individuals to report their federal tuition, education, and textbook amounts and Canada Training Credit. Businesses and corporations have different forms for their tax reporting.

Q: When is the deadline to file Form 5005-S11?

A: The deadline to file Form 5005-S11 is the same as the deadline for filing your income tax return. In general, the deadline for most individuals is April 30th, but it may vary depending on your specific circumstances.

Q: Is Form 5005-S11 the same as a tax return?

A: No, Form 5005-S11 is a schedule that is filed along with your income tax return. It specifically reports your federal tuition, education, and textbook amounts and Canada Training Credit.

Q: What should I do if I still have questions about Form 5005-S11?

A: If you have any questions or need further assistance regarding Form 5005-S11, it is recommended to contact the Canada Revenue Agency (CRA) for guidance.

Q: Can I claim both federal and provincial tuition credits on Form 5005-S11?

A: No, Form 5005-S11 is specifically for reporting federal tuition, education, and textbook amounts. Provincial tuition credits are claimed on separate forms specific to each province.