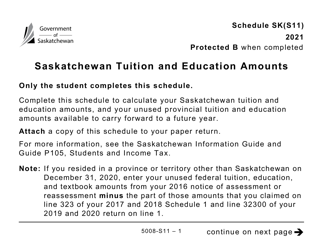

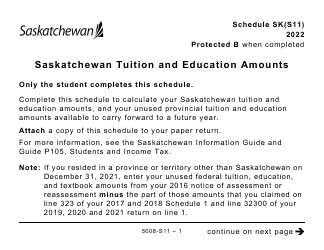

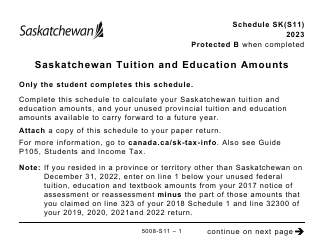

This version of the form is not currently in use and is provided for reference only. Download this version of

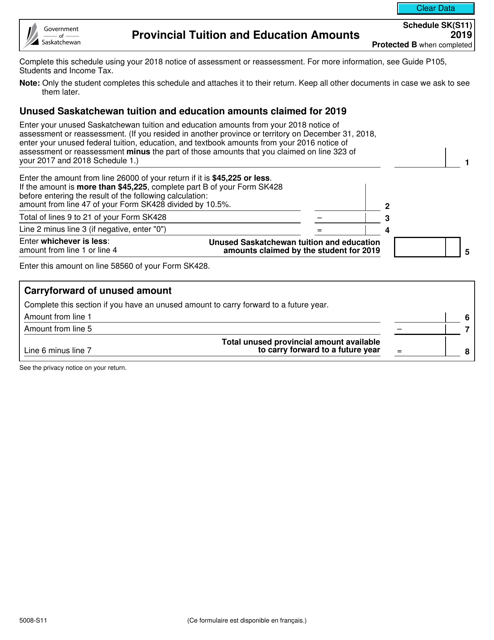

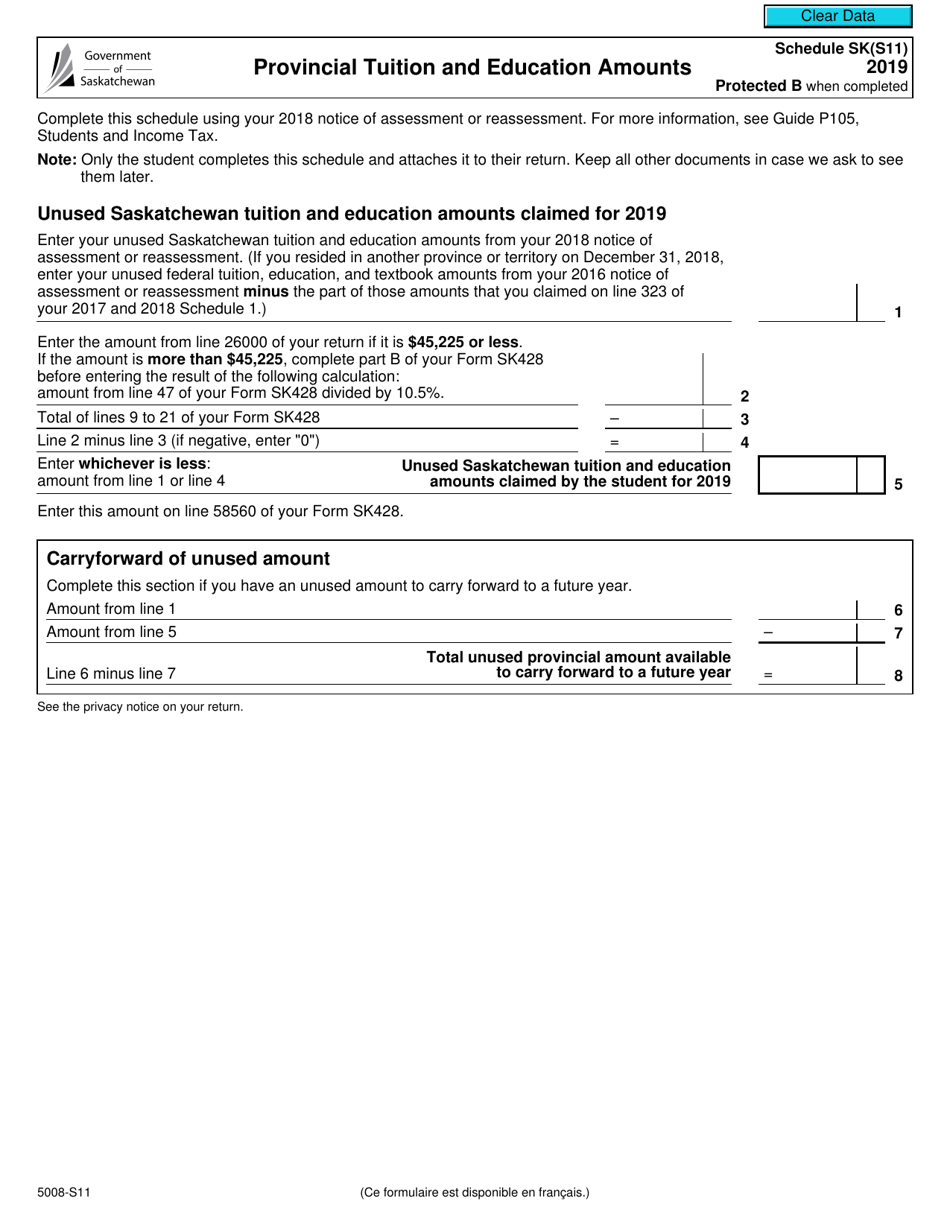

Form 5008-S11 Schedule SK(S11)

for the current year.

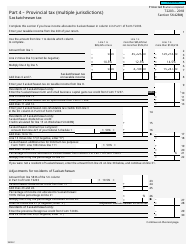

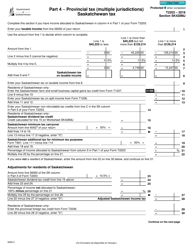

Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts - Canada

Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts is used to claim provincial tuition and education amounts on your Canadian tax return. These amounts can provide tax benefits for individuals residing in the province of Saskatchewan.

The eligible student files the Form 5008-S11 Schedule SK(S11) Provincial Tuition and Education Amounts in Canada.

FAQ

Q: What is Form 5008-S11?

A: Form 5008-S11 is a tax form used in Canada to claim provincial tuition and education amounts.

Q: What is Schedule SK(S11)?

A: Schedule SK(S11) is a part of Form 5008-S11 used specifically in the province of Saskatchewan.

Q: What can I claim with Schedule SK(S11)?

A: With Schedule SK(S11), you can claim provincial tuition and education amounts paid.

Q: Who can use Form 5008-S11?

A: Anyone who paid eligible tuition and education amounts in the province of Saskatchewan can use Form 5008-S11.

Q: Is there a deadline to submit Form 5008-S11?

A: Yes, the deadline to submit Form 5008-S11 is usually the same as the deadline to file your income tax return, which is April 30th.