This version of the form is not currently in use and is provided for reference only. Download this version of

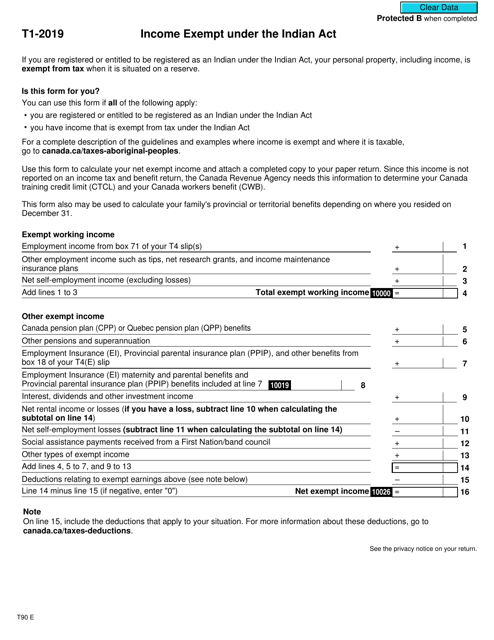

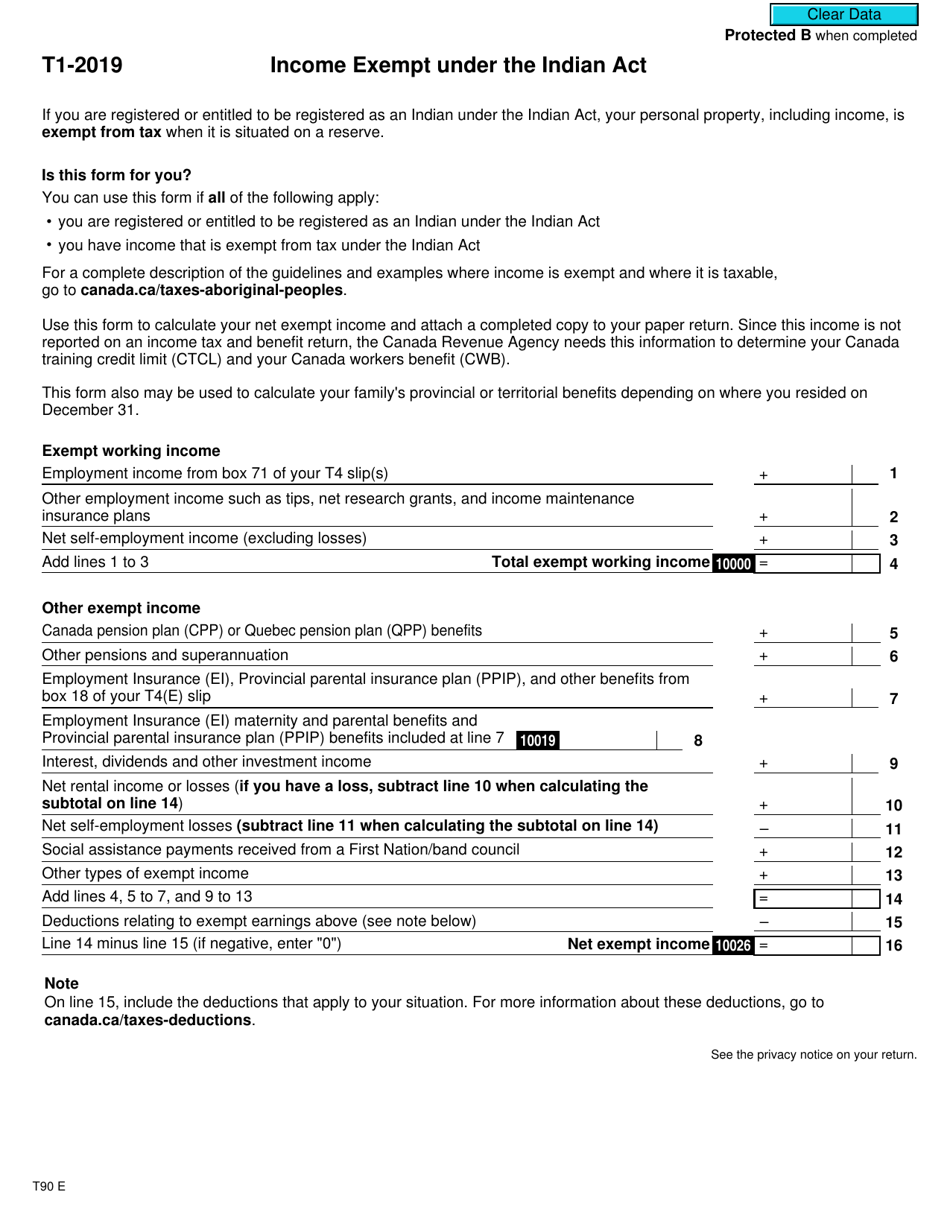

Form T90

for the current year.

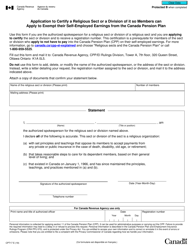

Form T90 Income Exempt Under the Indian Act - Canada

FAQ

Q: What is Form T90?

A: Form T90 is a form used for reporting income exempt under the Indian Act in Canada.

Q: What does the Indian Act refer to?

A: The Indian Act is a Canadian federal law that governs the rights and status of Indigenous peoples in Canada.

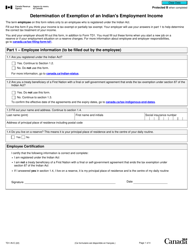

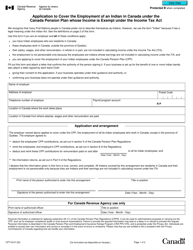

Q: Who is eligible to claim income exemption under the Indian Act?

A: Indigenous individuals who are registered under the Indian Act and live on a reserve in Canada are eligible to claim income exemption.

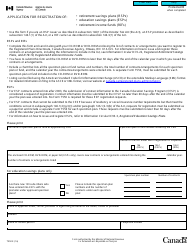

Q: What types of income can be exempt under the Indian Act?

A: Income from employment on a reserve, income from a business located on a reserve, and certain income from property located on a reserve can be exempt.

Q: Do I need to file Form T90 to claim income exemption?

A: Yes, individuals who want to claim income exemption under the Indian Act need to file Form T90 with the Canada Revenue Agency (CRA).

Q: Are there any specific requirements or documentation needed to claim income exemption?

A: Yes, individuals need to provide supporting documentation such as a copy of their Certificate of Indian Status and details of their income sources on the reserve.

Q: Is there a deadline for filing Form T90?

A: Form T90 should be filed with the CRA by the individual's income tax filing deadline, which is usually April 30th of each year.

Q: What happens if I fail to report my income exempt under the Indian Act?

A: Failure to report income exempt under the Indian Act can result in penalties and potential tax liabilities.

Q: Can I claim both income exemption under the Indian Act and other tax credits or deductions?

A: Yes, individuals who are eligible for income exemption can also claim other tax credits and deductions for which they qualify.