This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2125

for the current year.

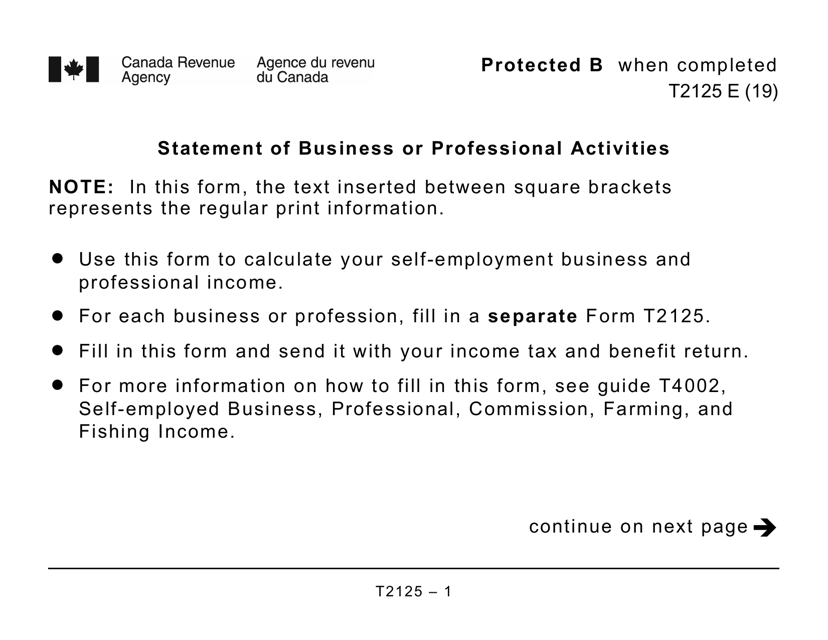

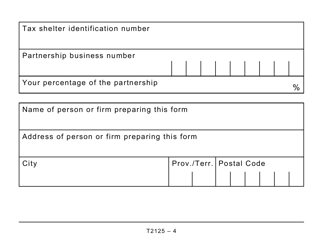

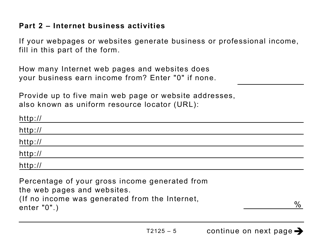

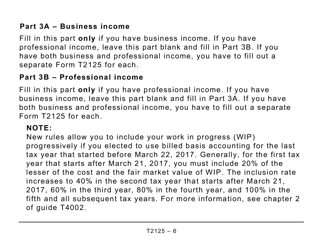

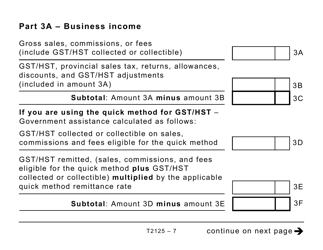

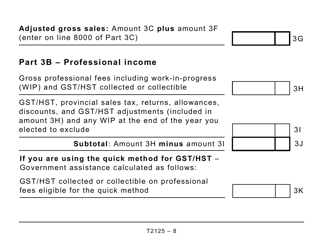

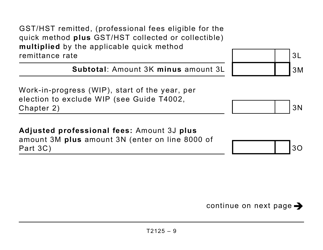

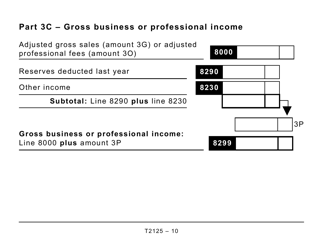

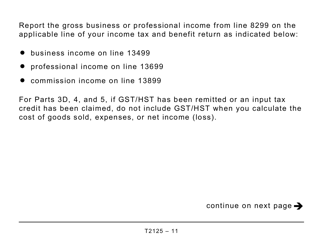

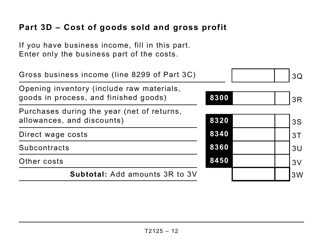

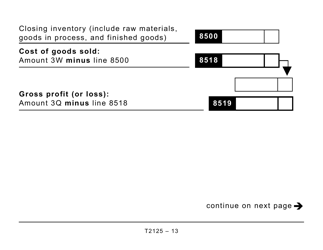

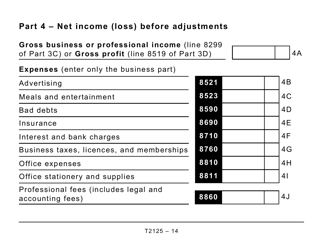

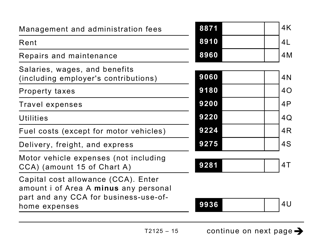

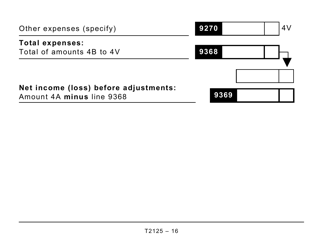

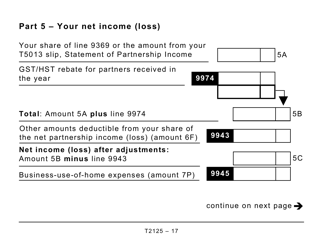

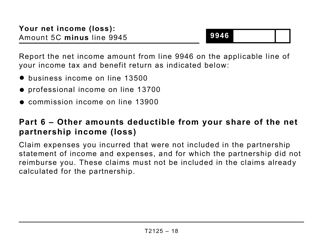

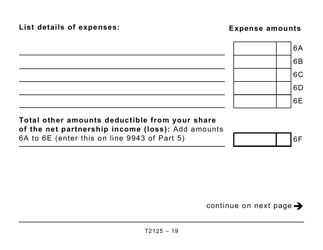

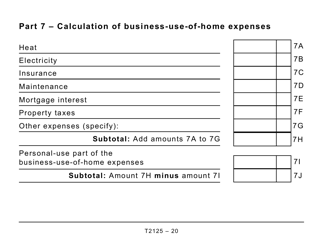

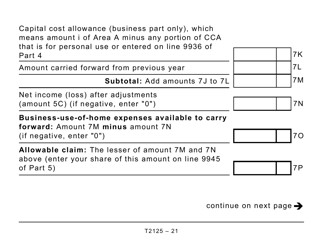

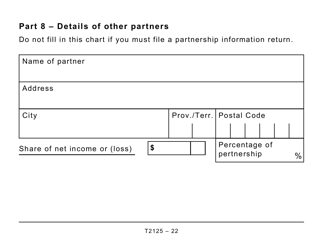

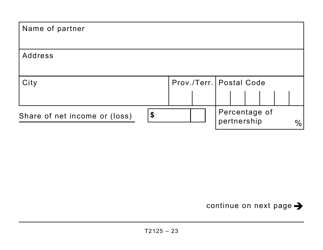

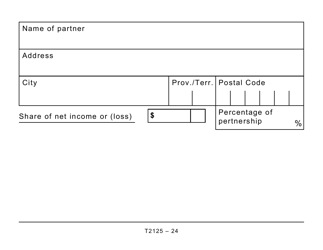

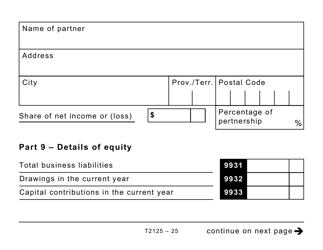

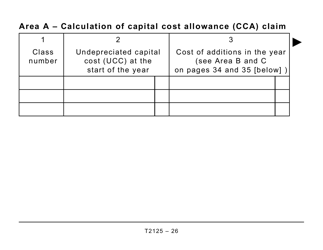

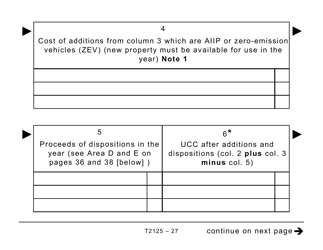

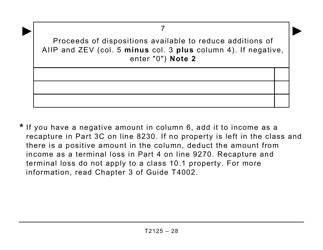

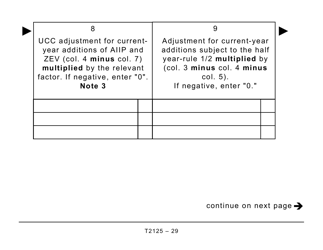

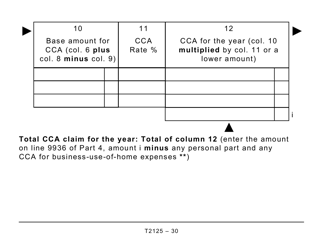

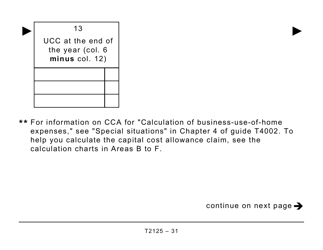

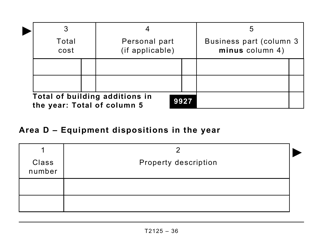

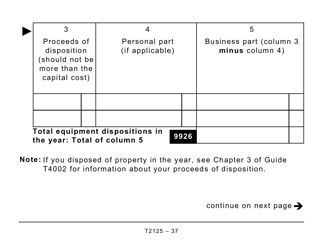

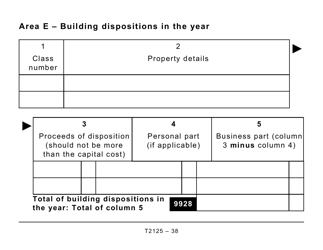

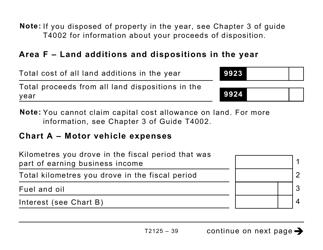

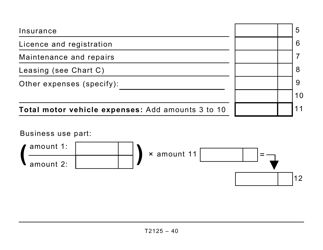

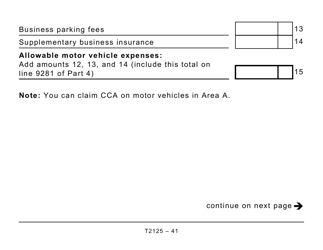

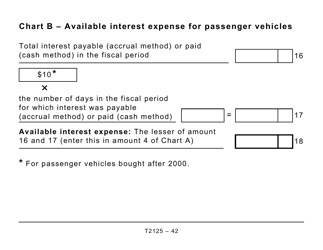

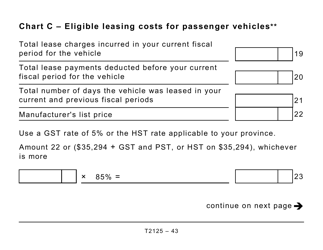

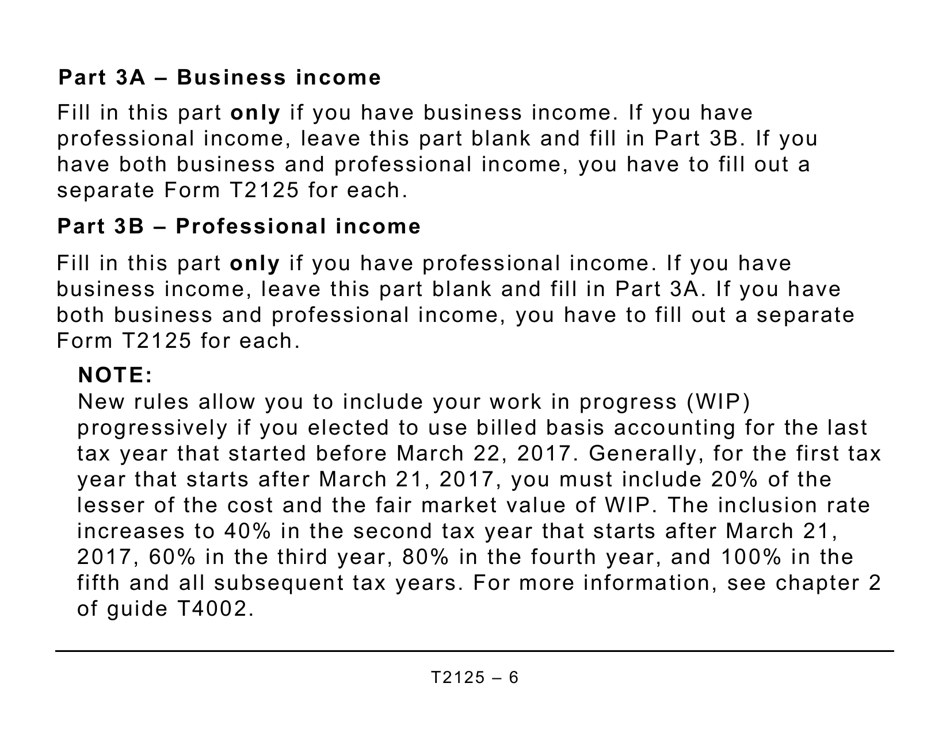

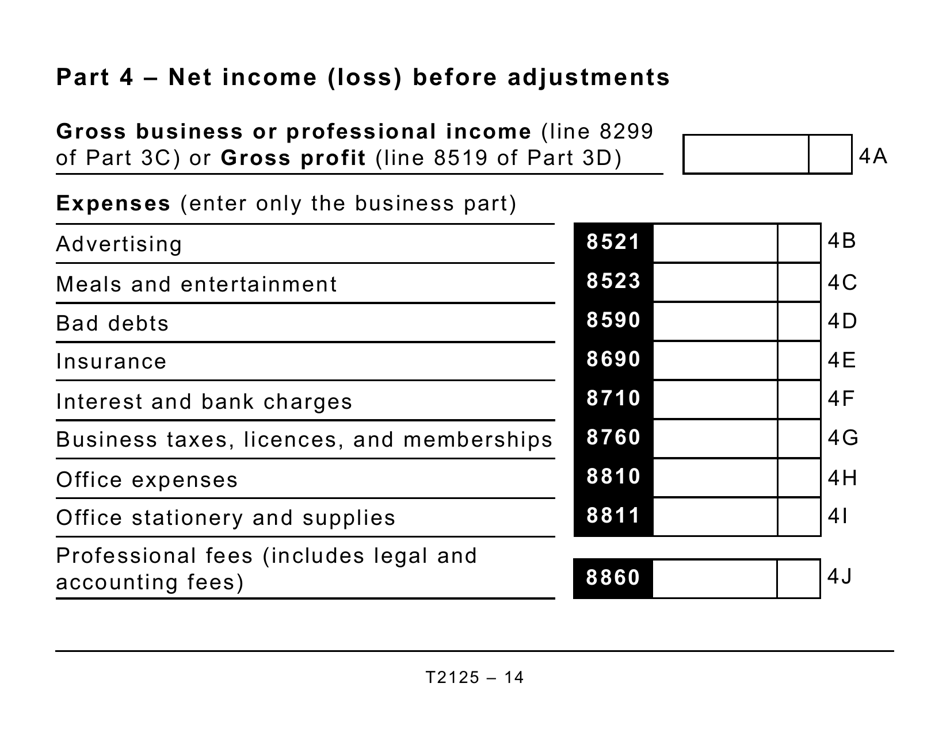

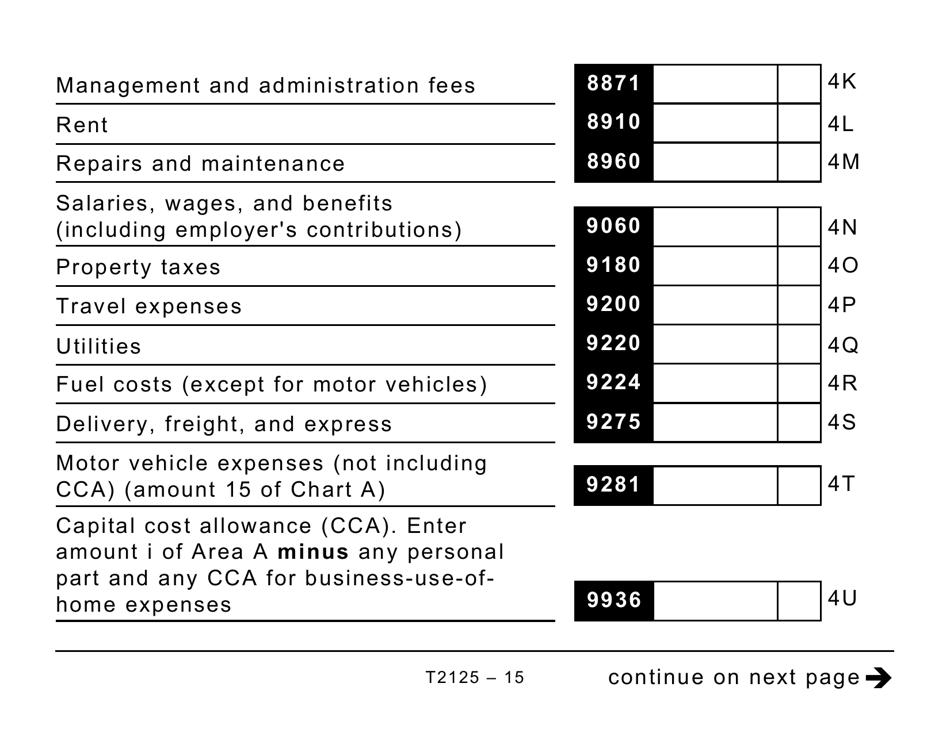

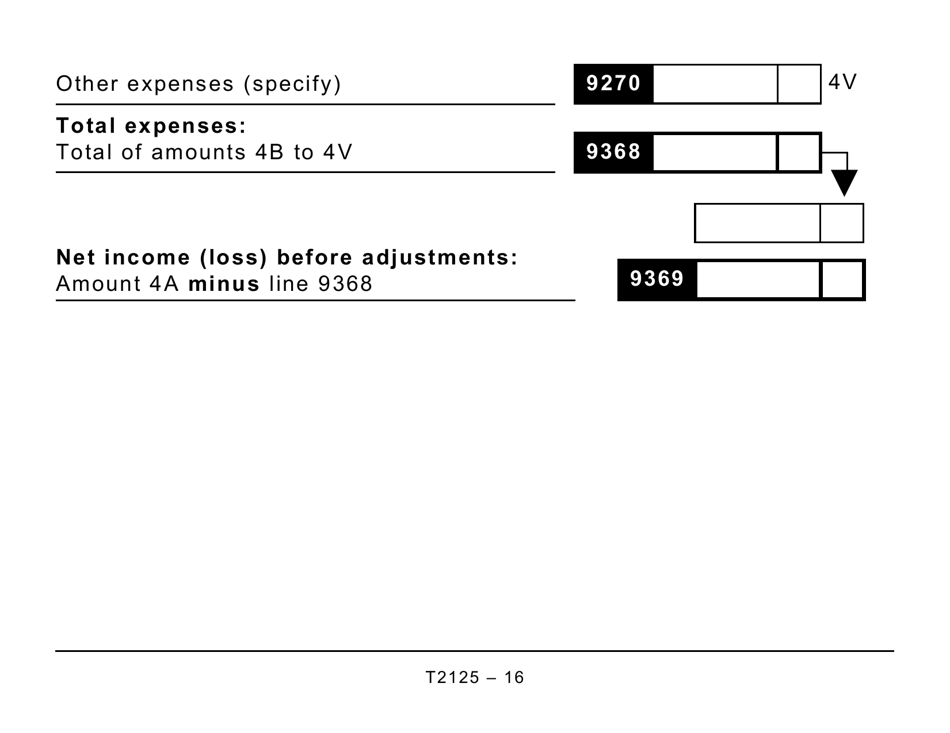

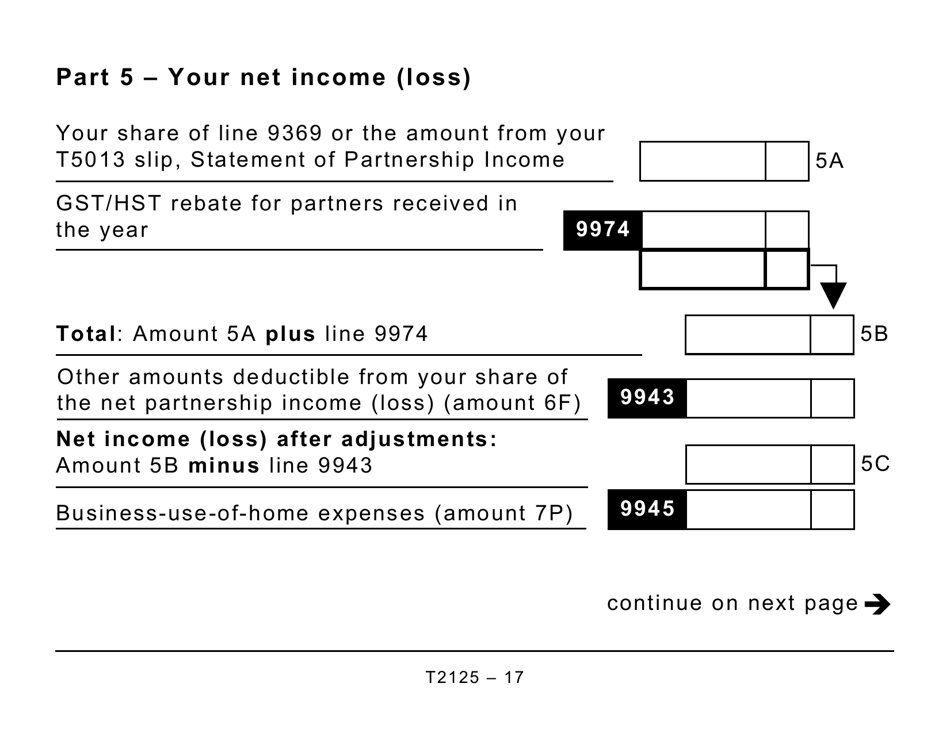

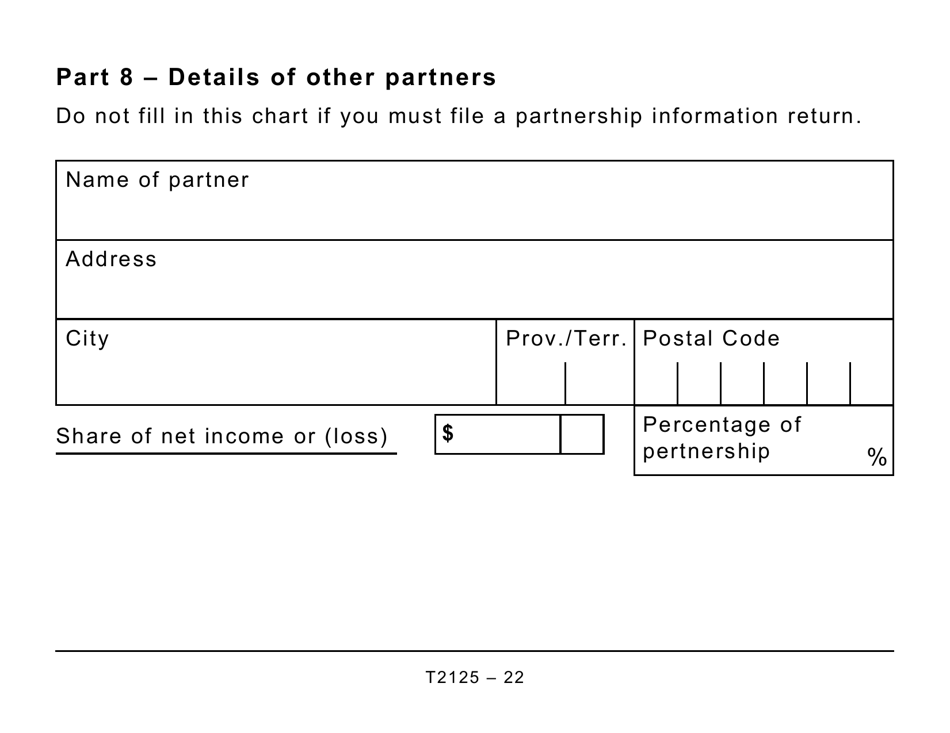

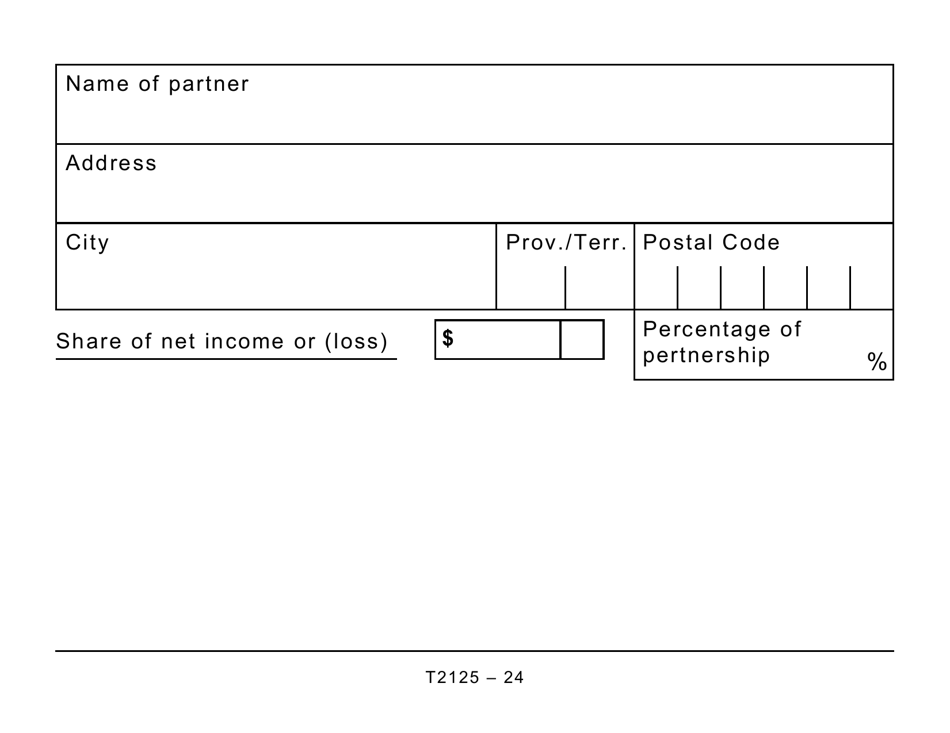

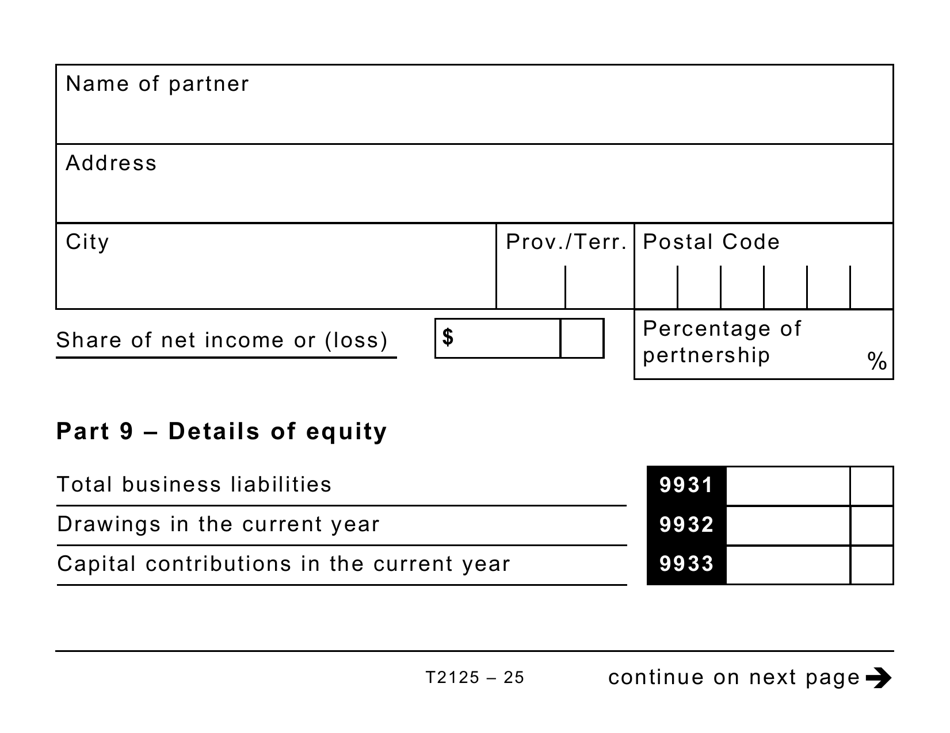

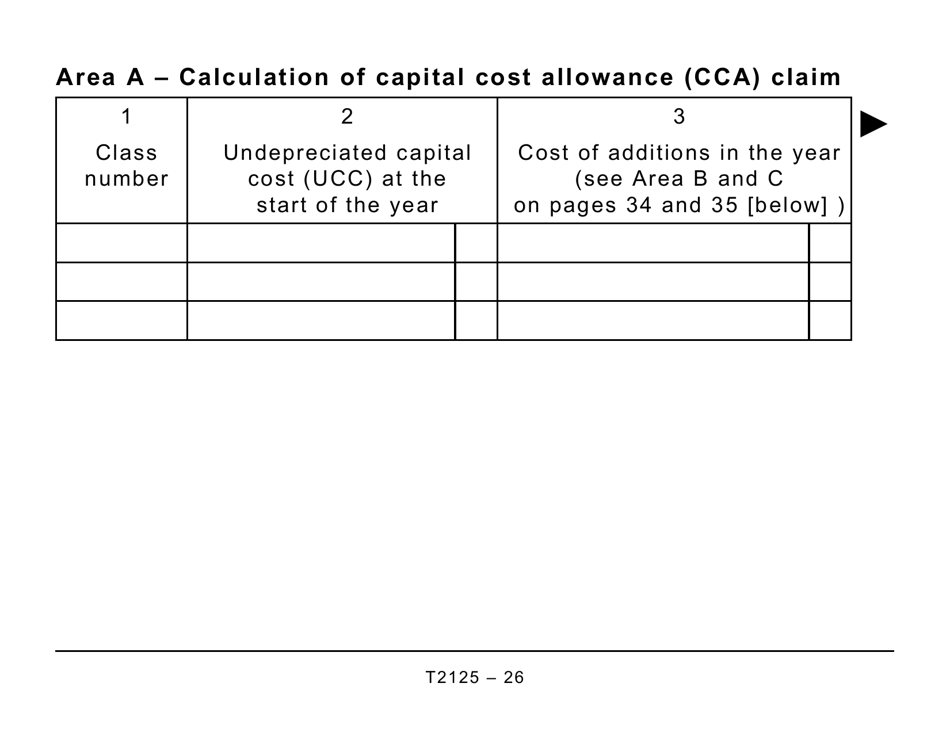

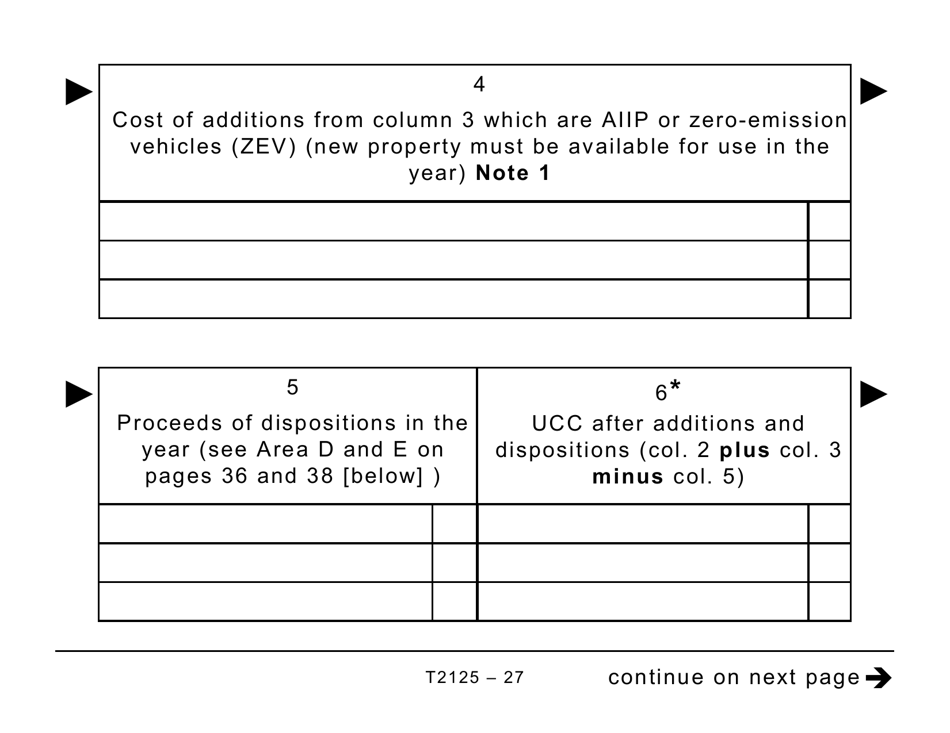

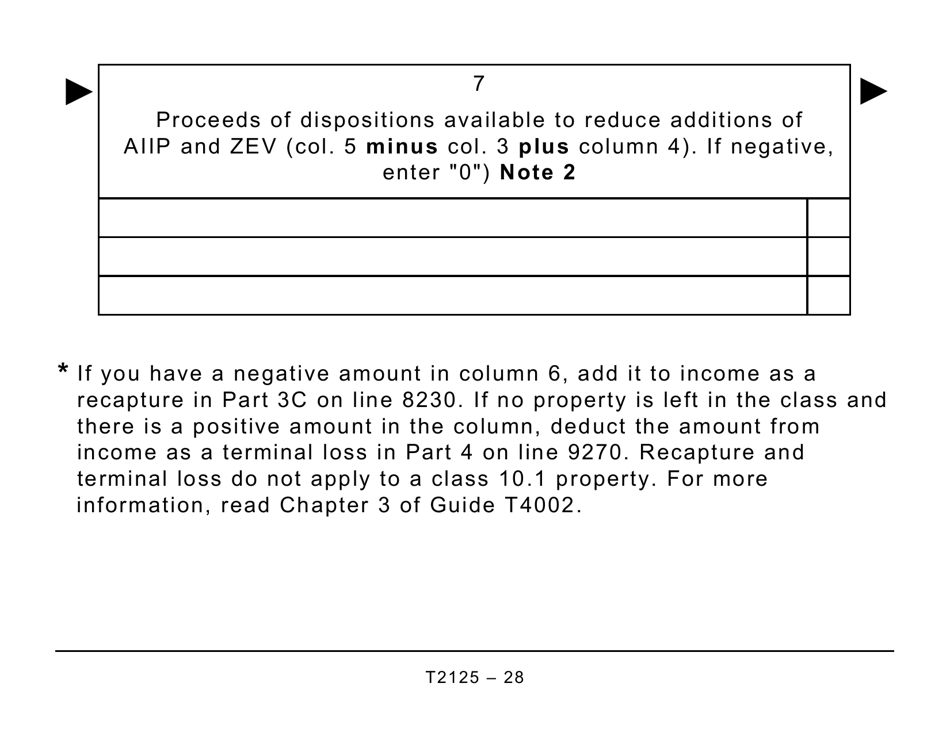

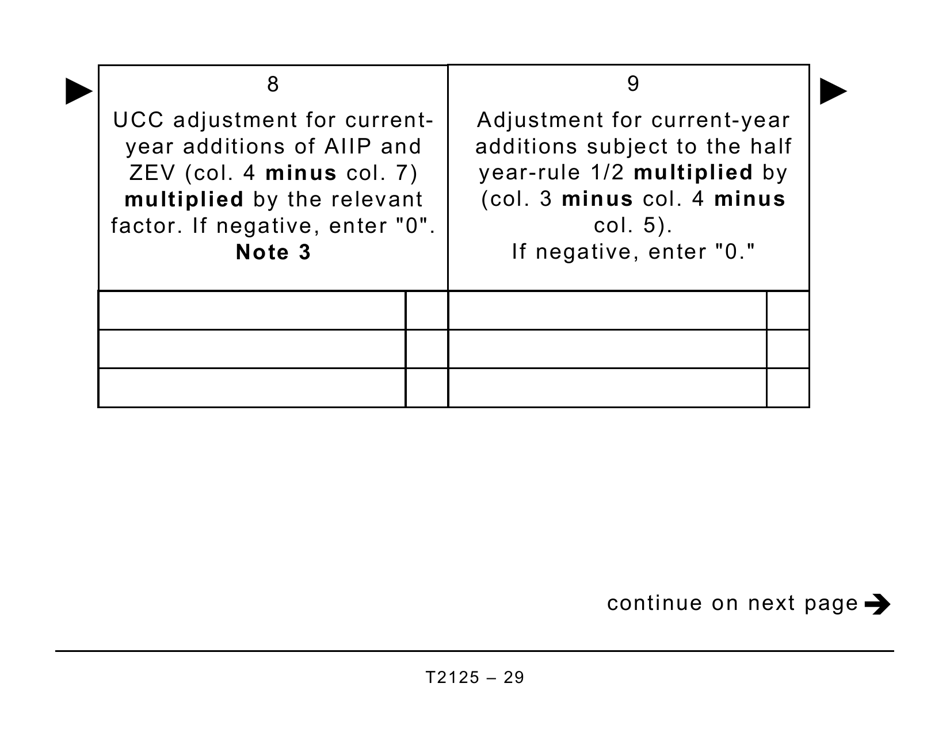

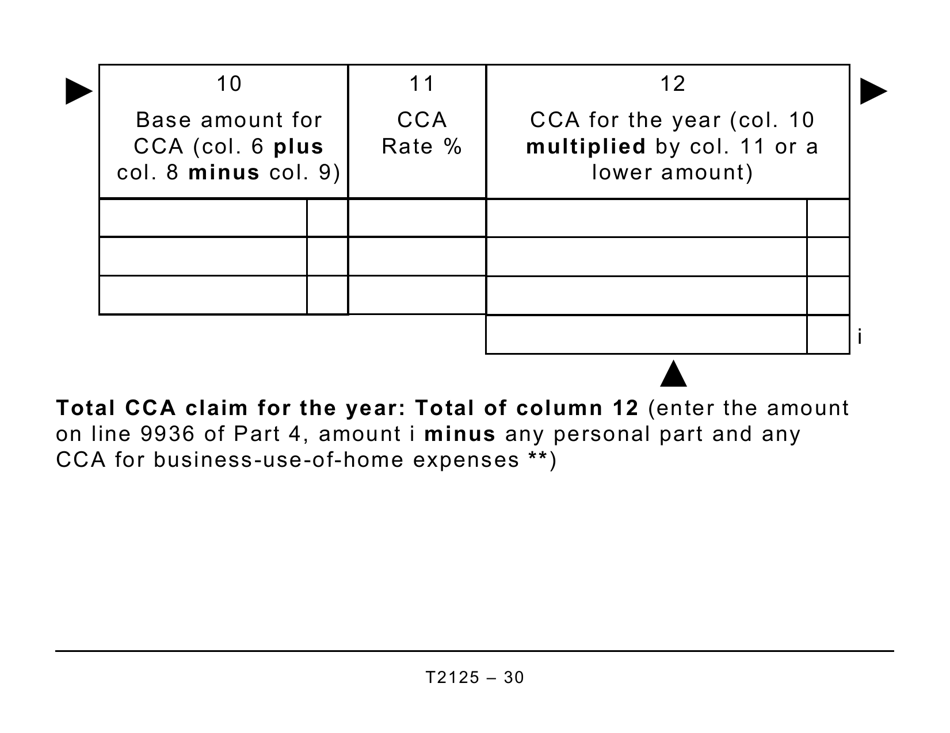

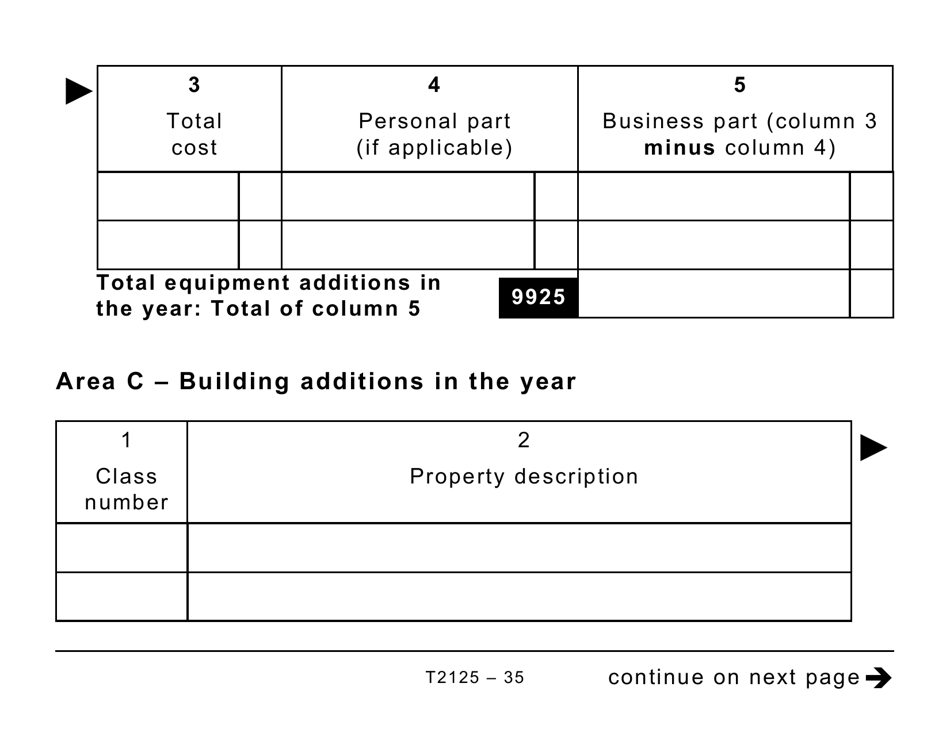

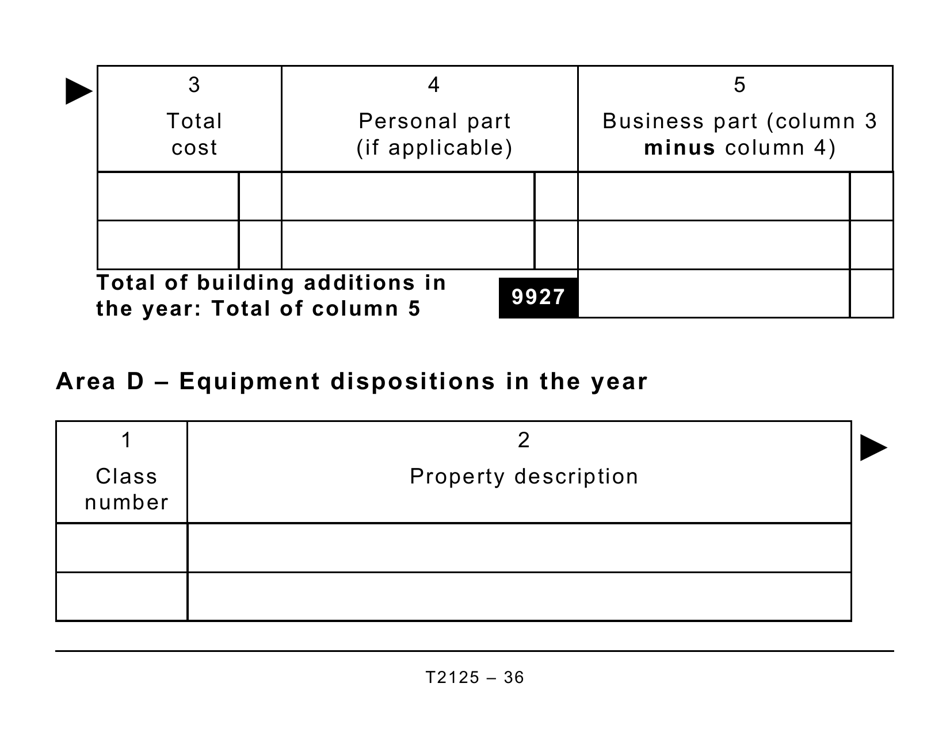

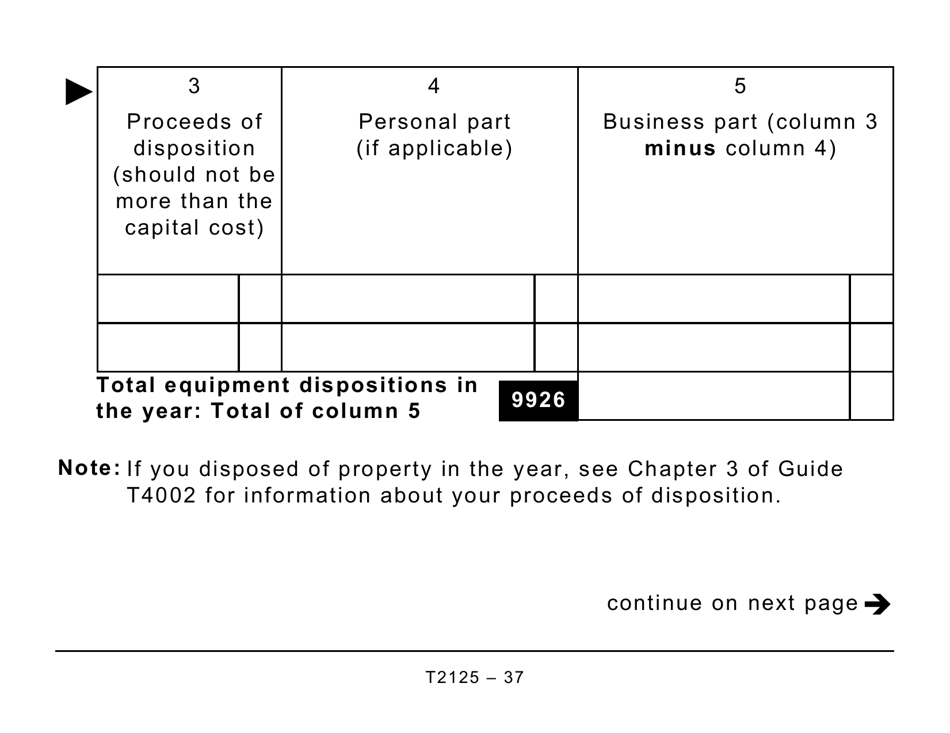

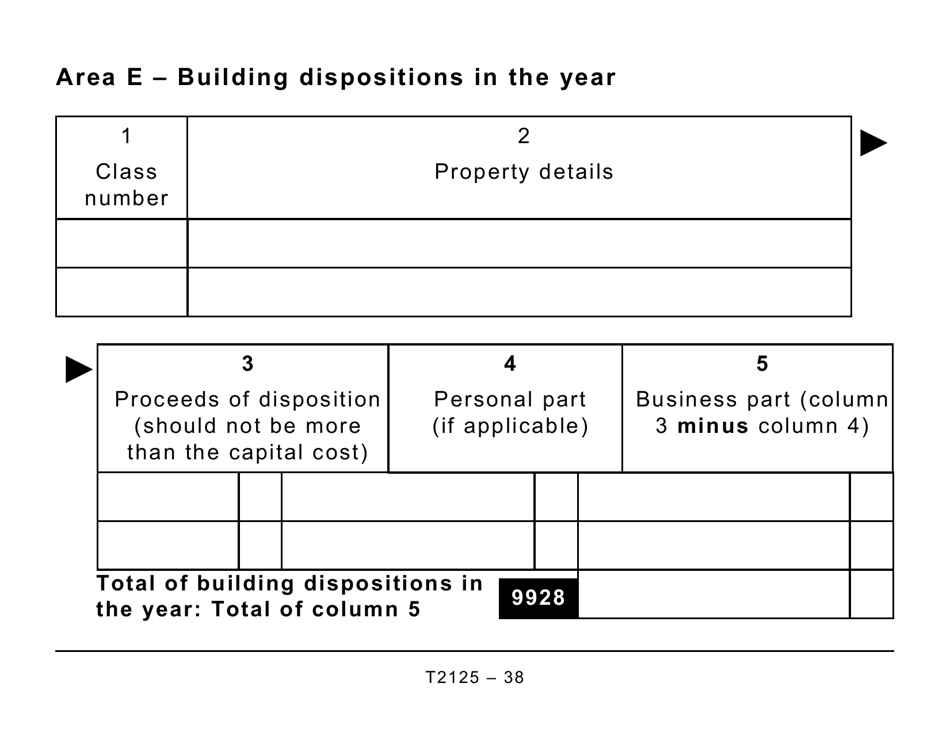

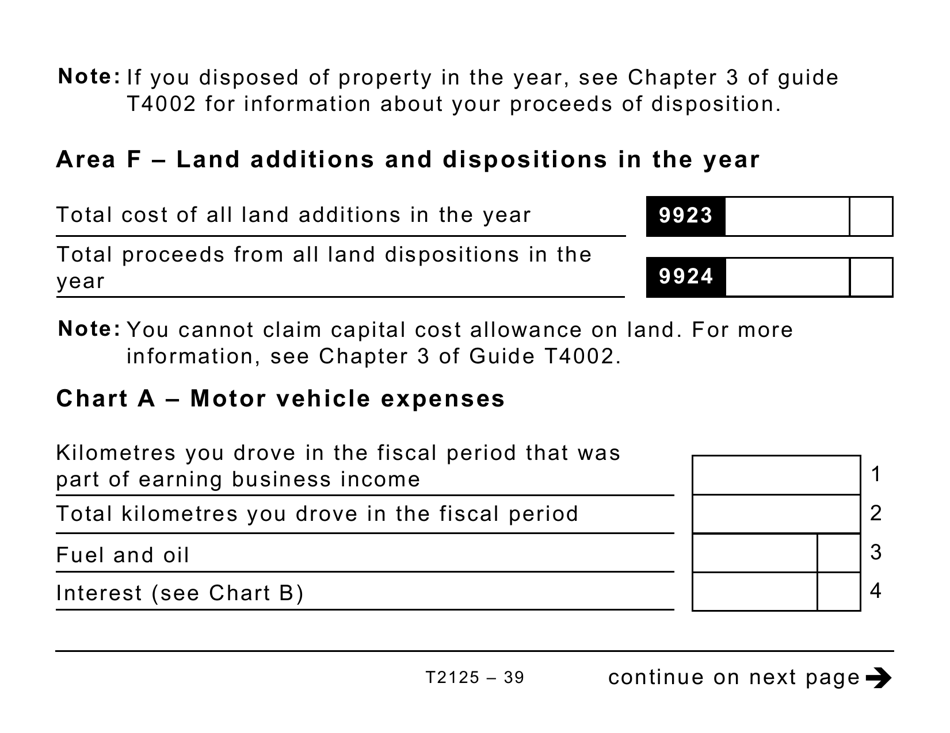

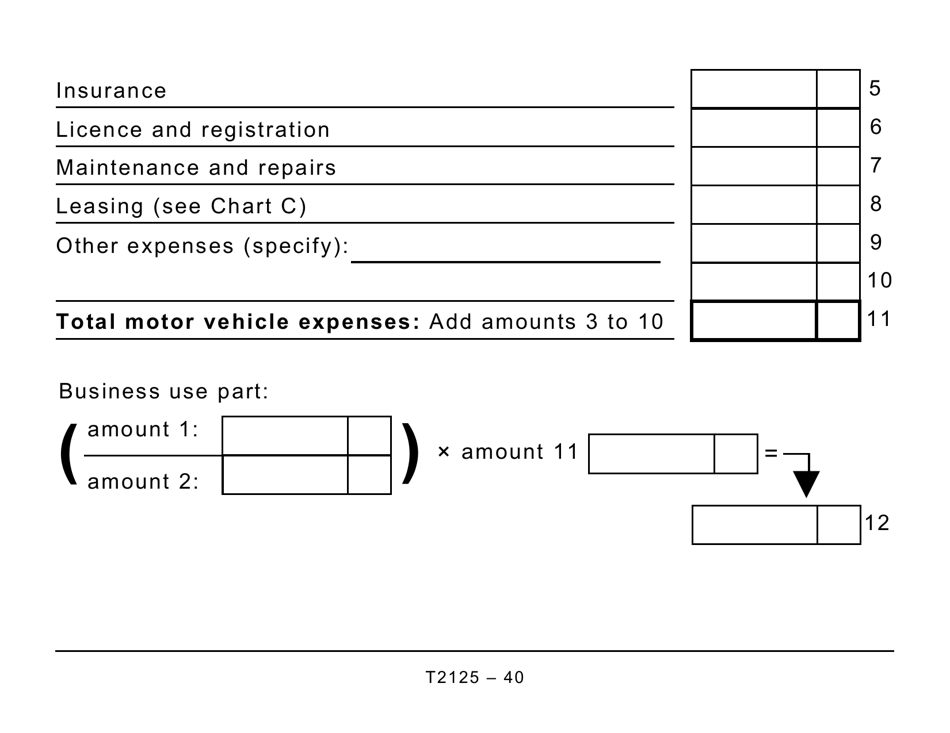

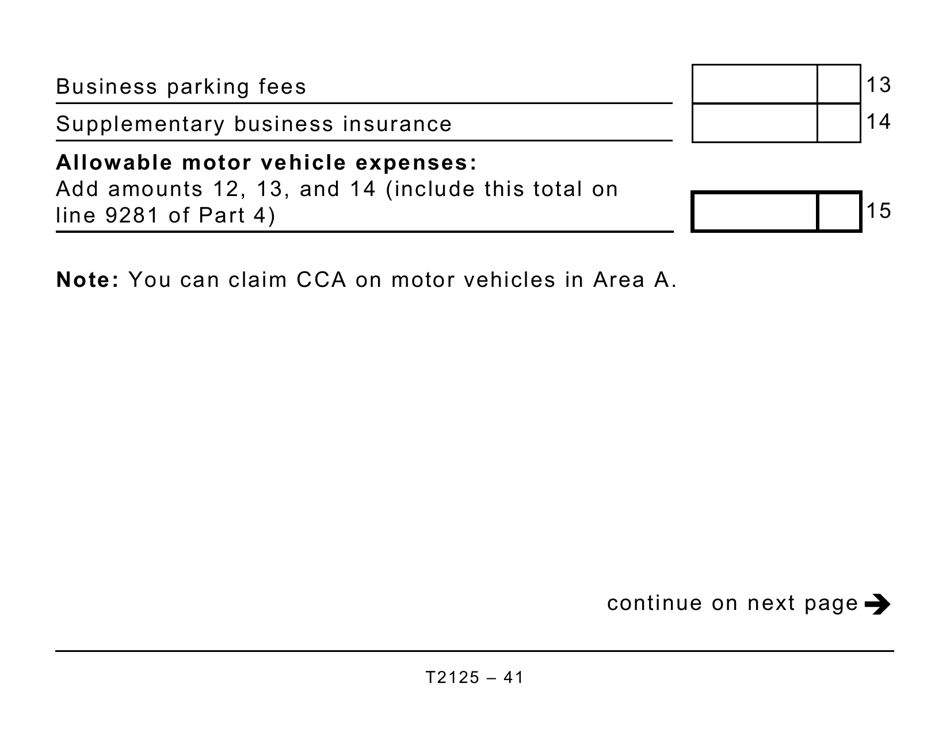

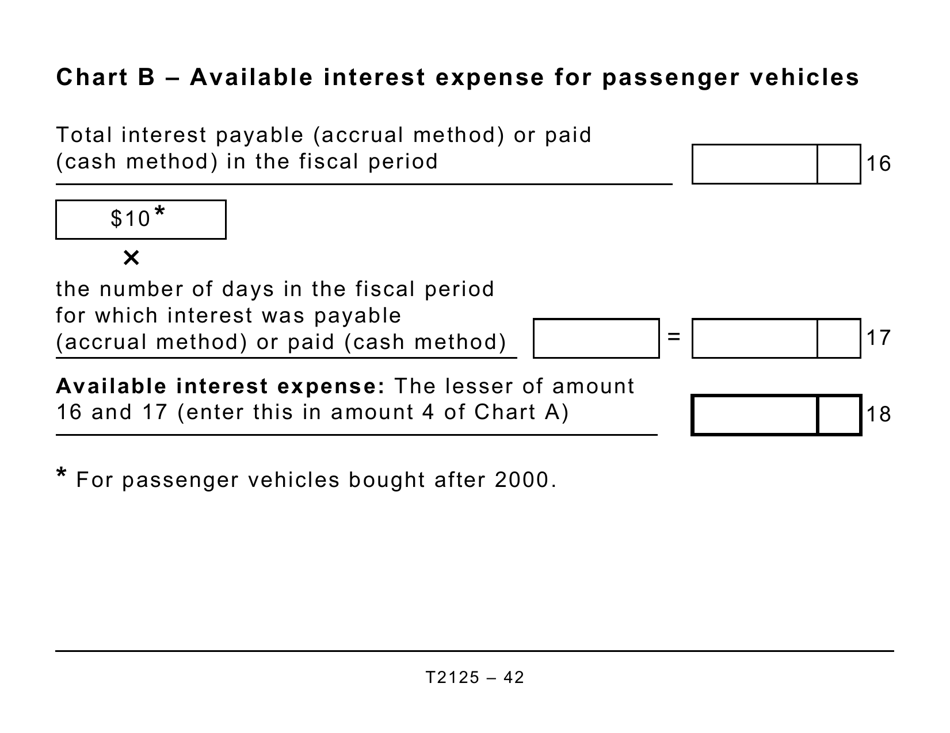

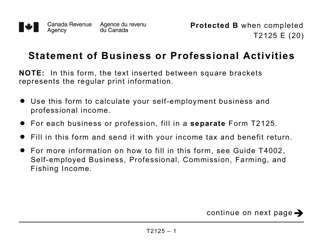

Form T2125 Statement of Business or Professional Activities (Large Print) - Canada

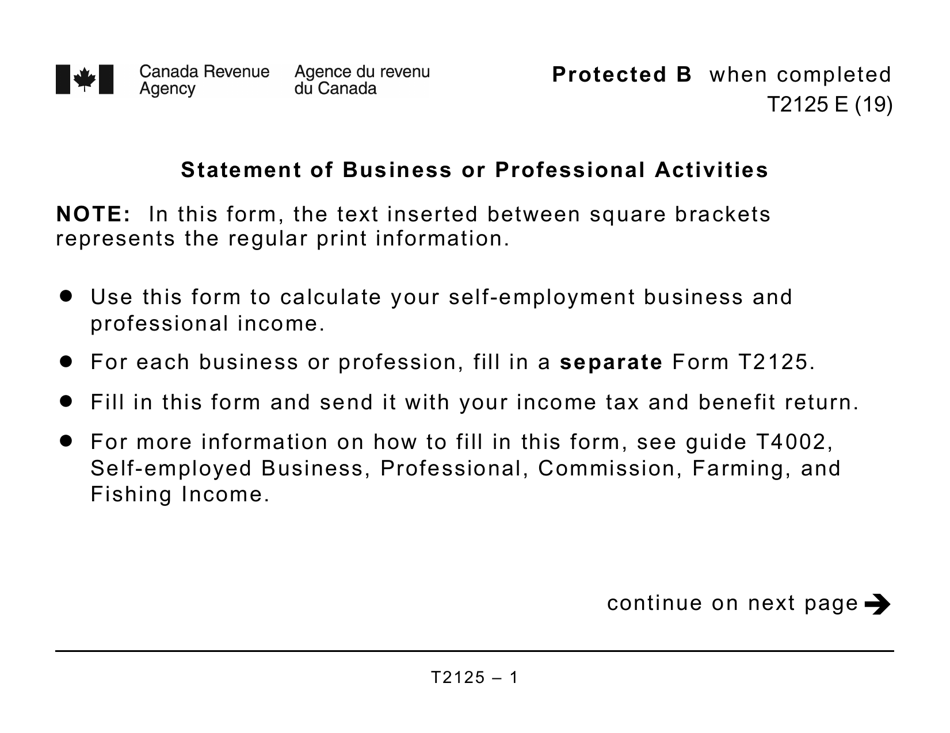

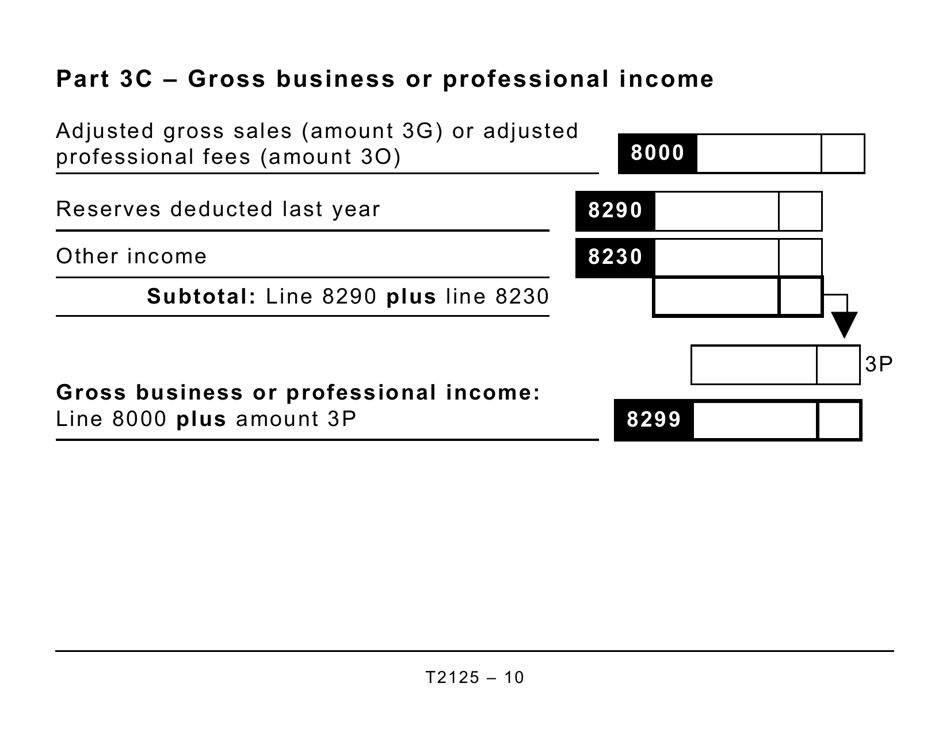

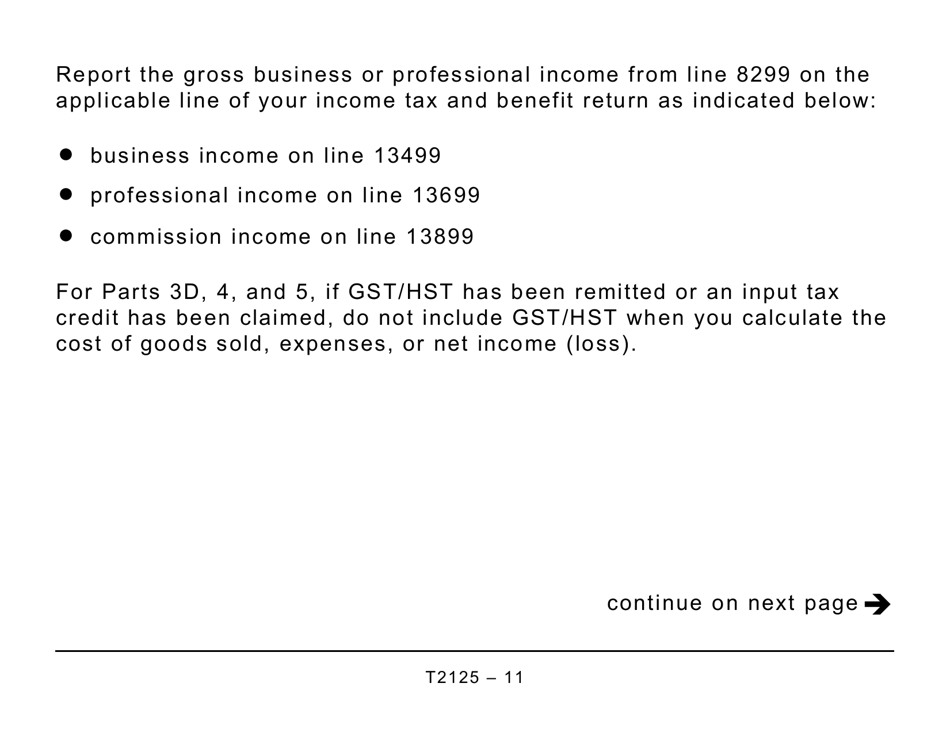

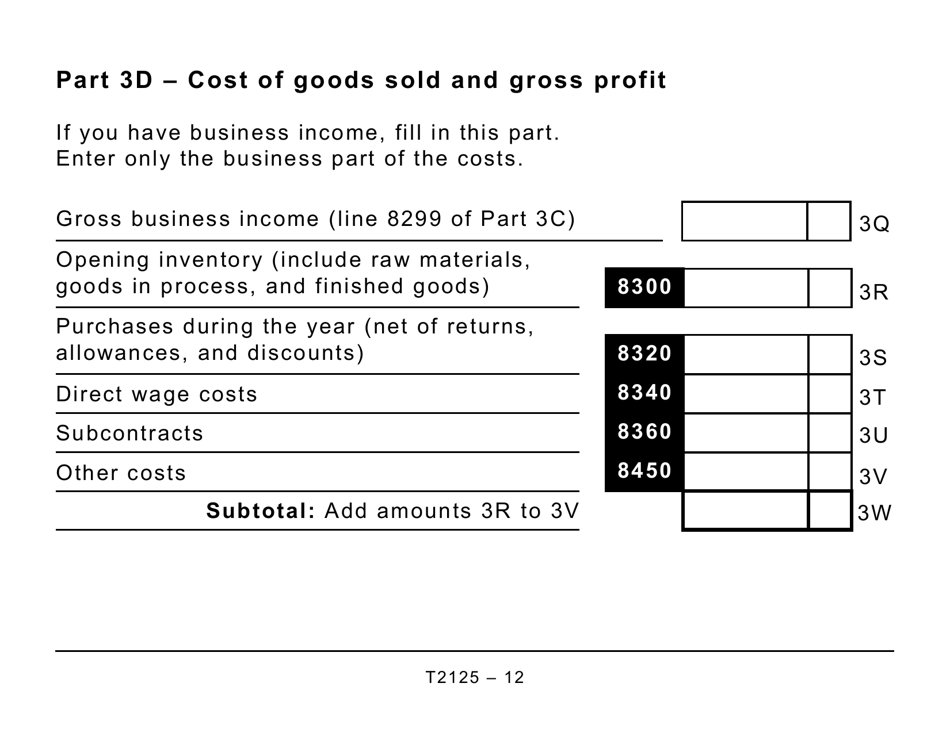

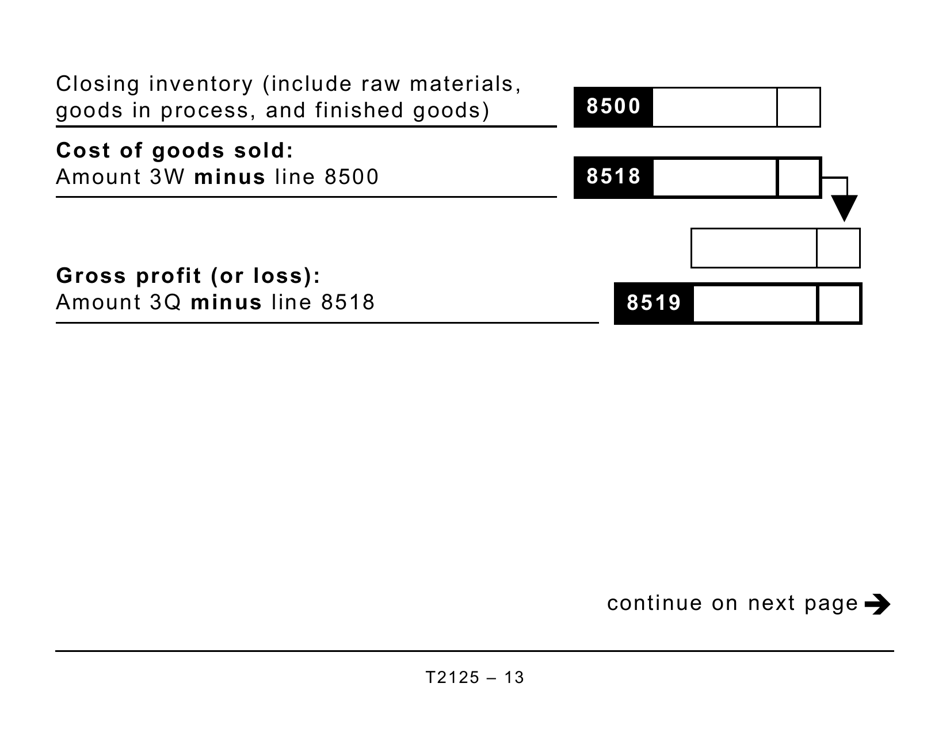

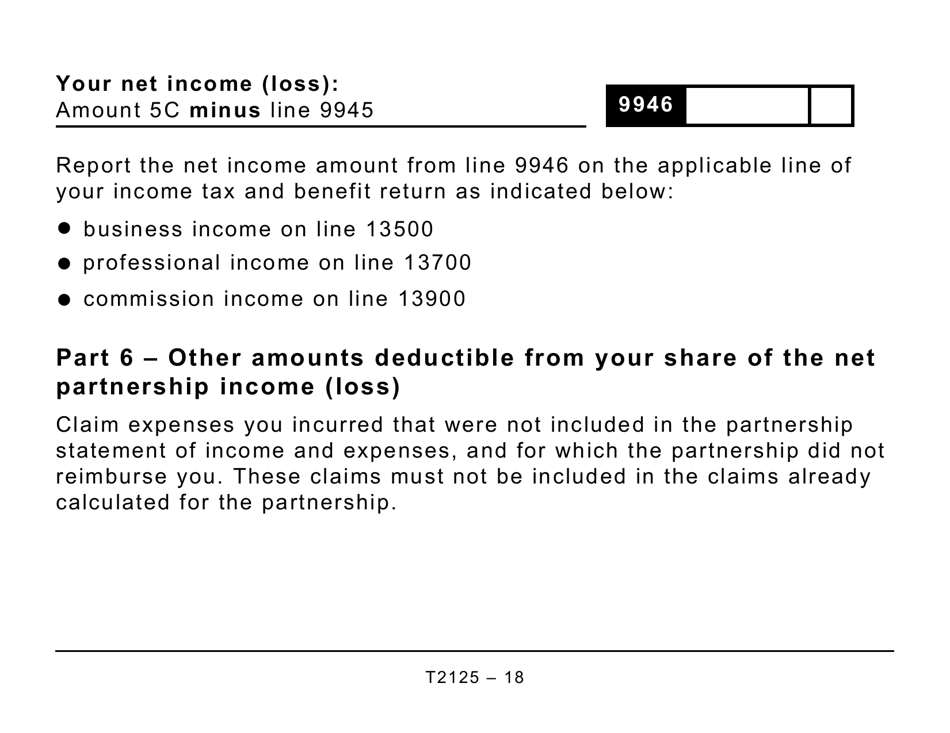

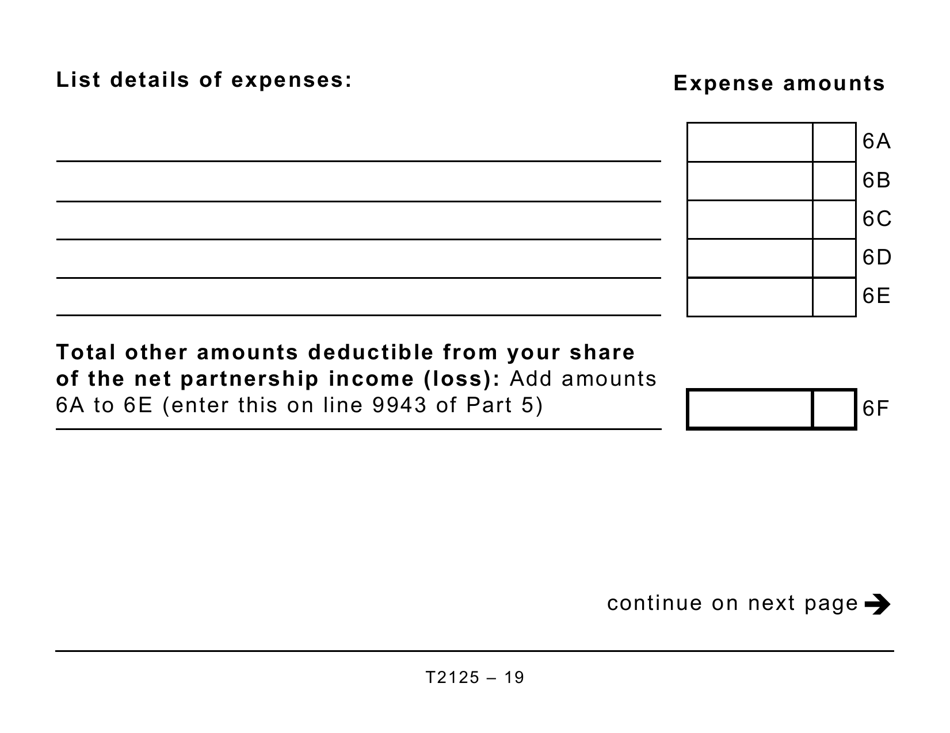

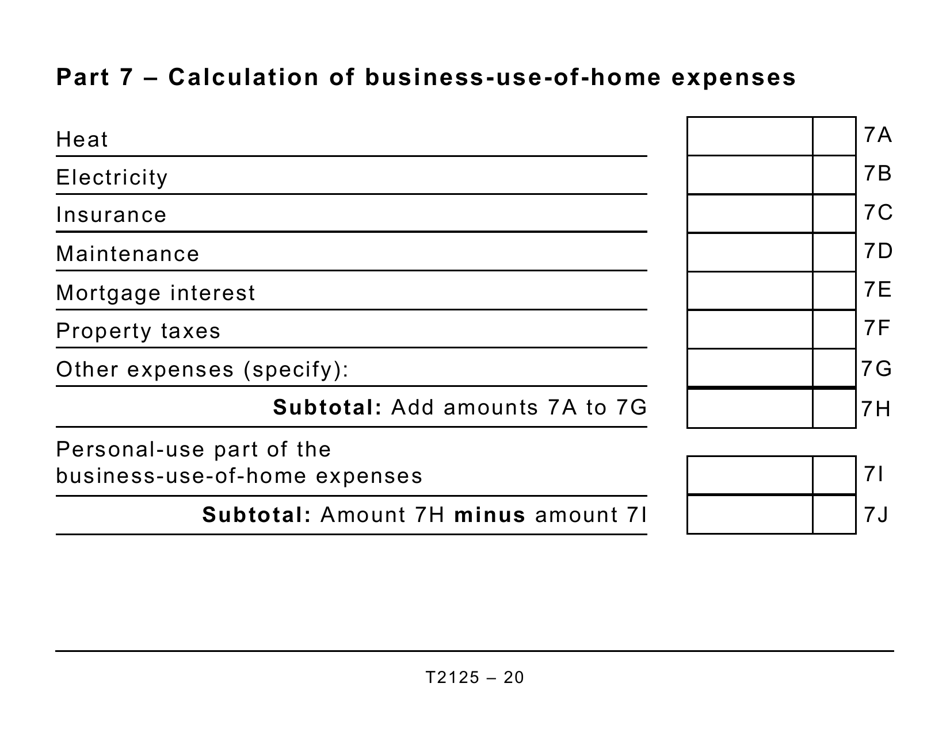

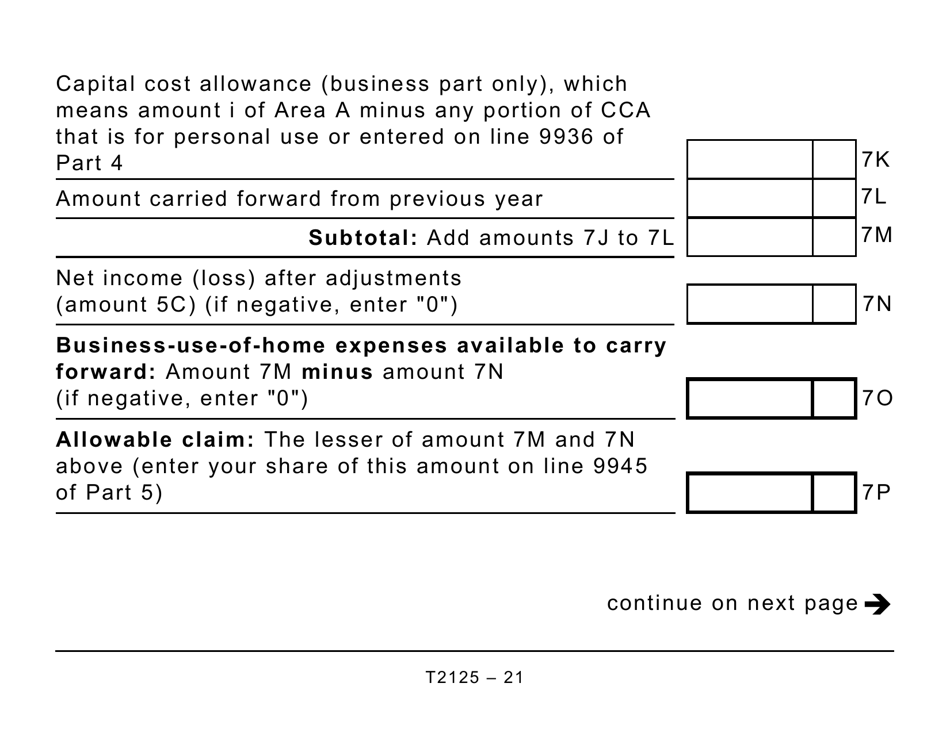

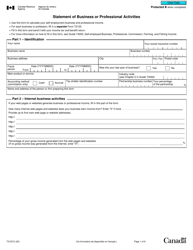

Form T2125 Statement of Business or Professional Activities is used by self-employed individuals in Canada to report their business income and expenses. It is used to calculate the net income from their business or professional activities for income tax purposes.

The Form T2125 Statement of Business or Professional Activities (Large Print) in Canada is filed by self-employed individuals who have income from a business or professional activities.

FAQ

Q: What is Form T2125?

A: Form T2125 is a statement used in Canada to report business or professional activities.

Q: Who needs to file Form T2125?

A: Individuals who are self-employed or carry on a business or professional activities in Canada need to file Form T2125.

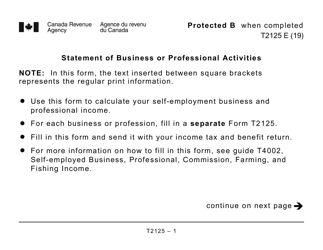

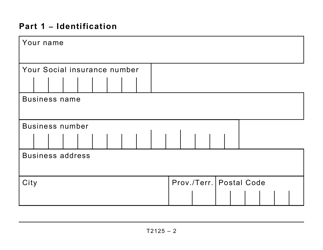

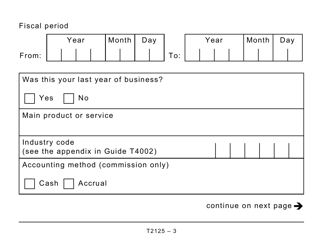

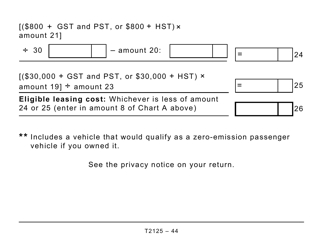

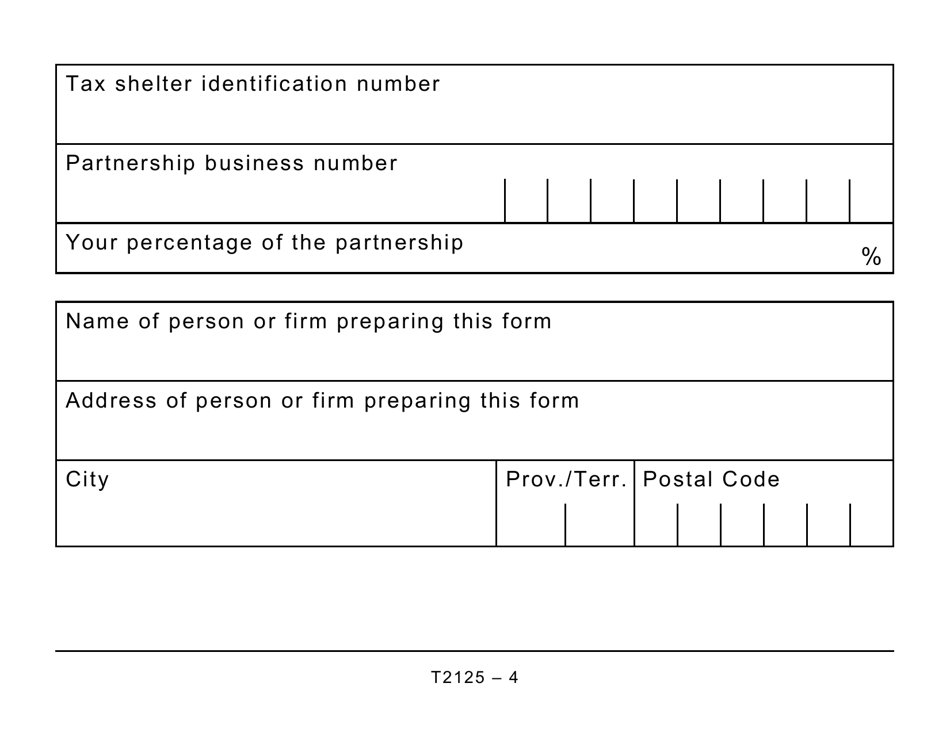

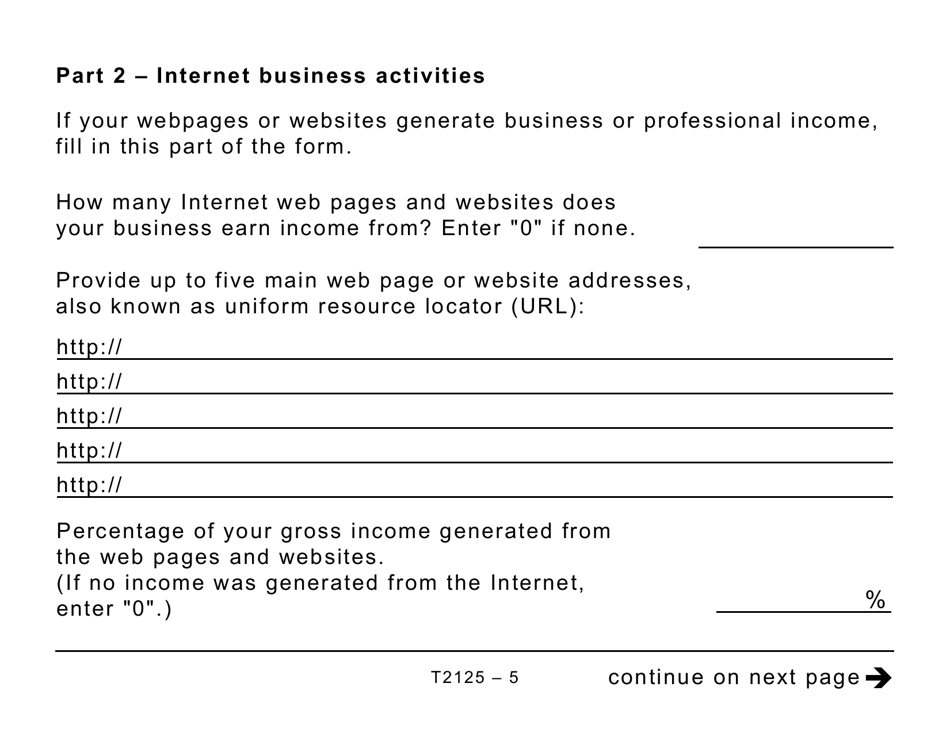

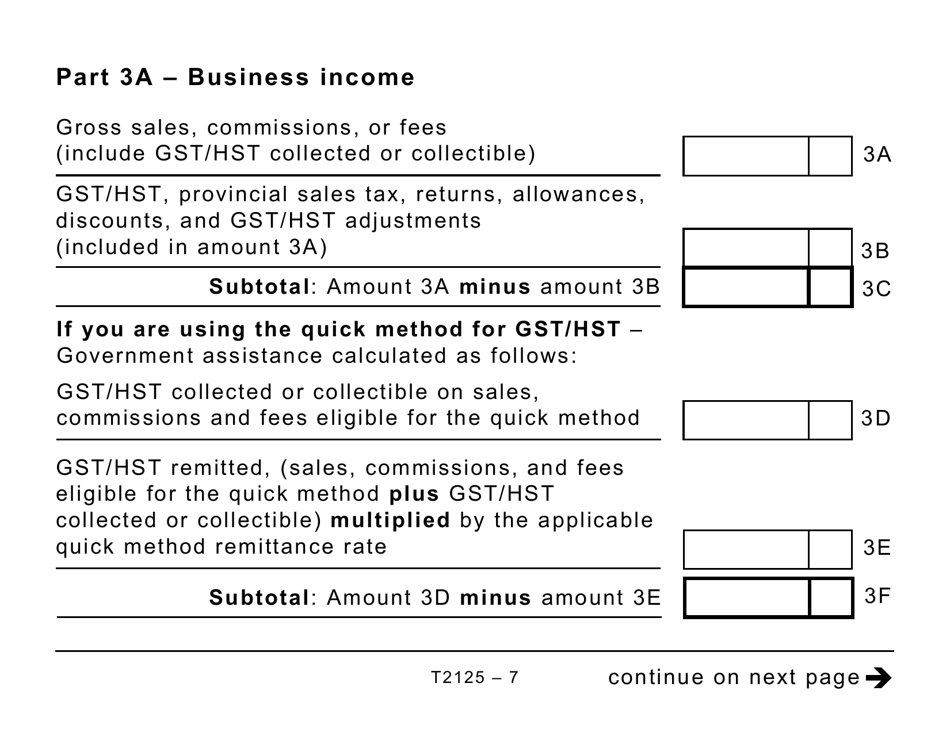

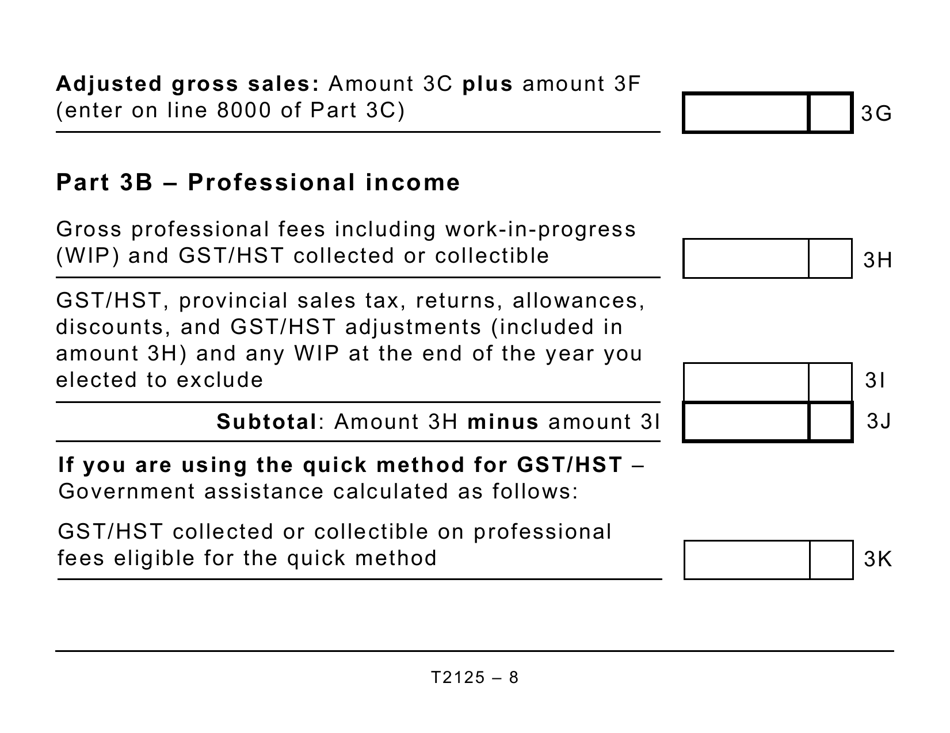

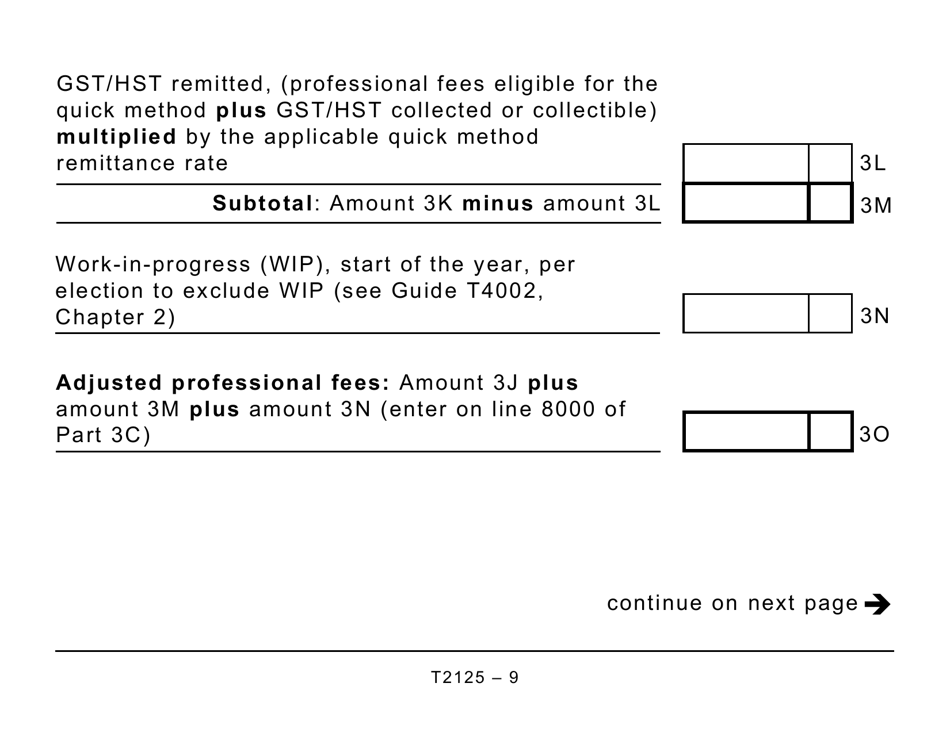

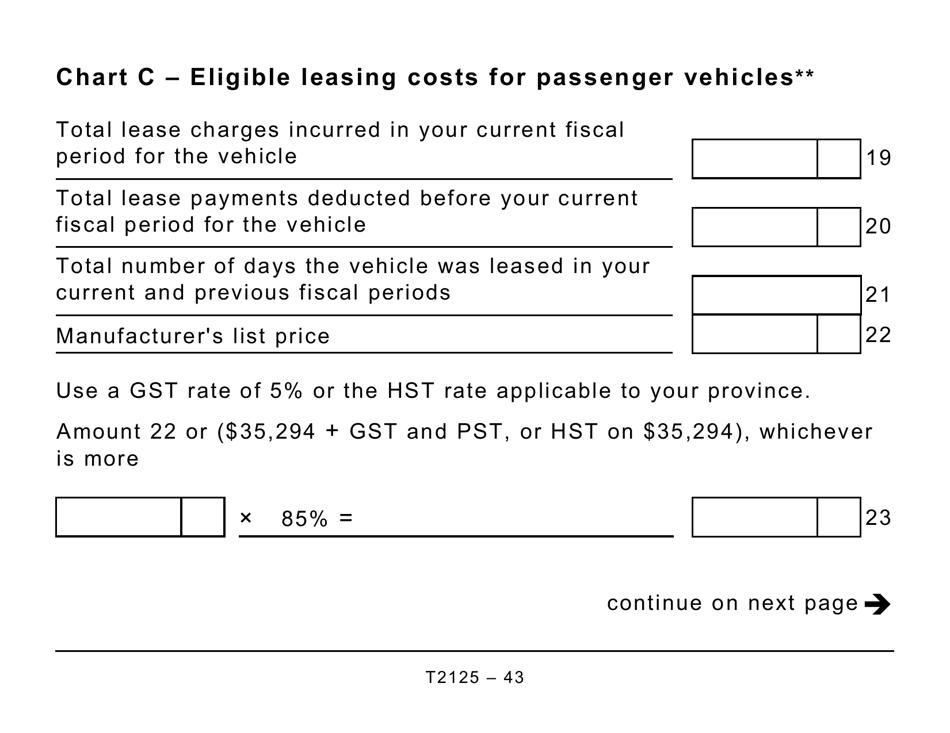

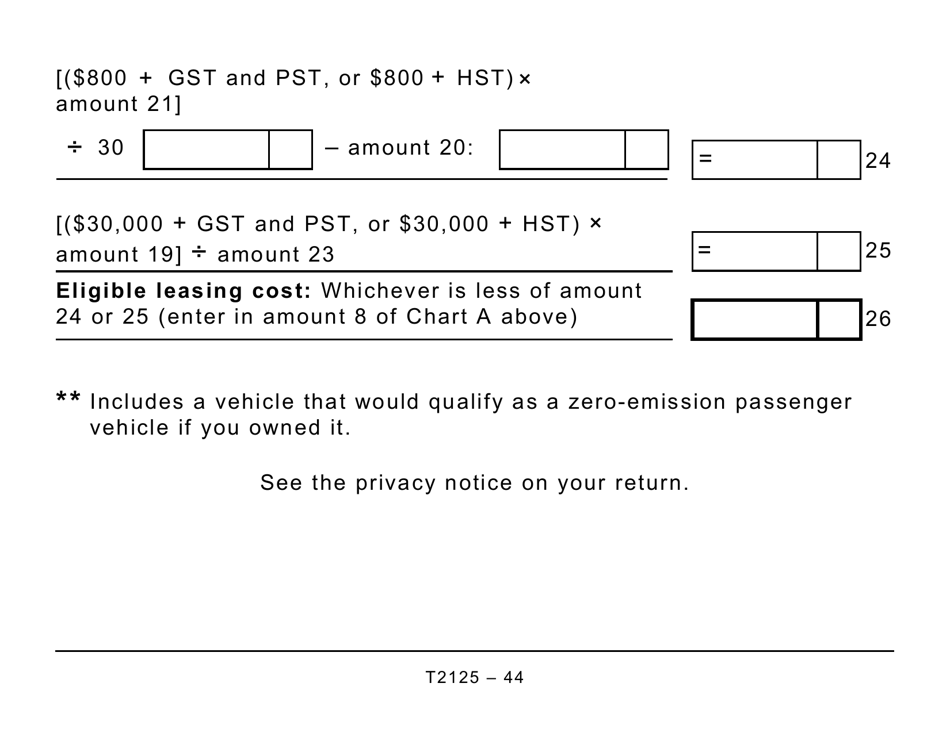

Q: What information is required on Form T2125?

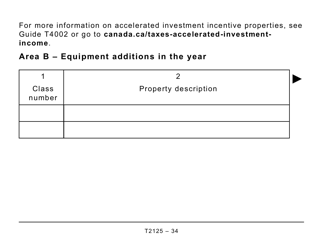

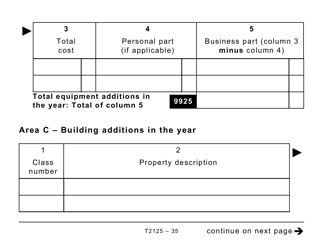

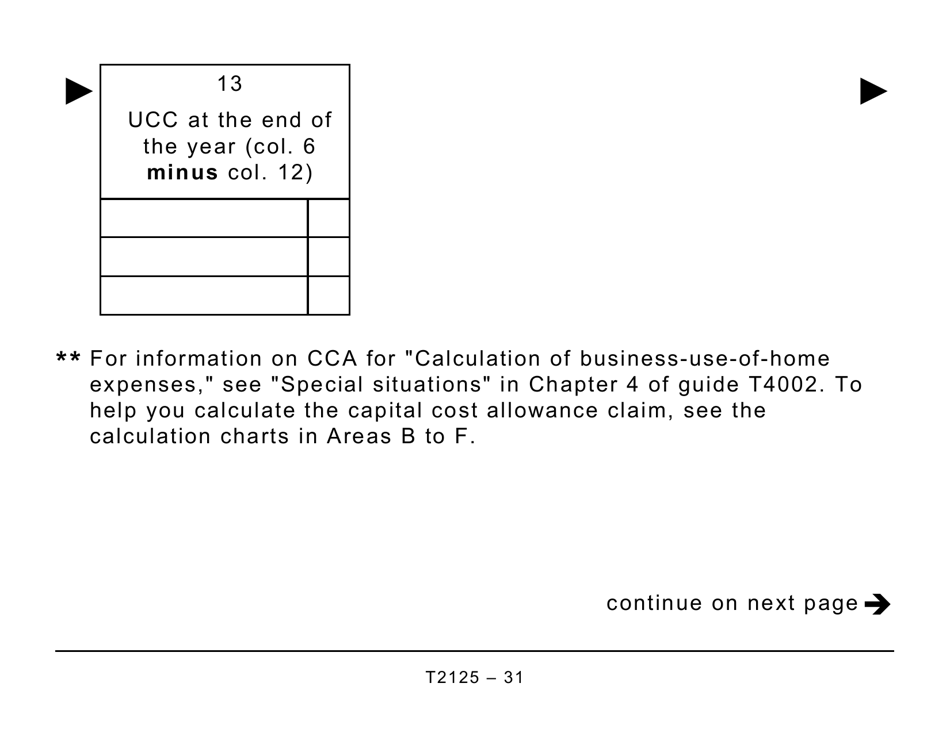

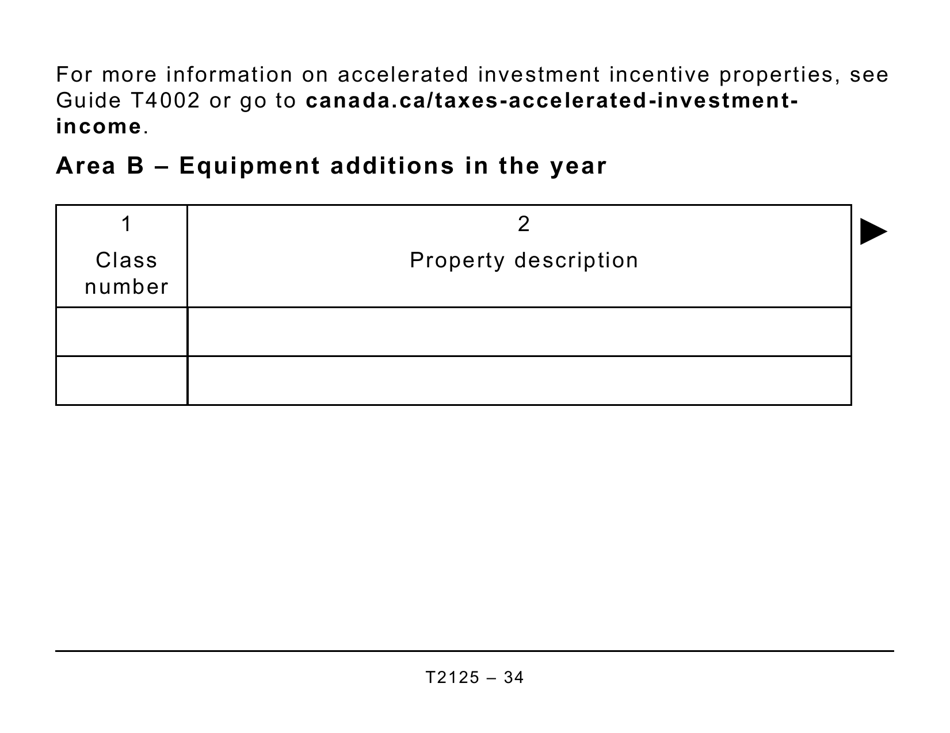

A: Form T2125 requires you to provide details about your business or professional activities, including income, expenses, and any assets you use for the business.

Q: When is the deadline to file Form T2125?

A: The deadline to file Form T2125 is generally the same as the deadline for filing your personal income tax return, which is April 30th of each year.

Q: Are there any penalties for not filing Form T2125?

A: Yes, failing to file Form T2125 or providing inaccurate information can result in penalties and interest charged by the CRA.

Q: Can I claim expenses related to my business or professional activities on Form T2125?

A: Yes, you can claim allowable expenses on Form T2125 to help reduce your taxable income.

Q: Do I need to keep records to support the information on Form T2125?

A: Yes, it is important to keep records and supporting documentation for at least six years in case of a review or audit by the CRA.