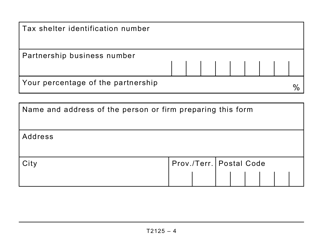

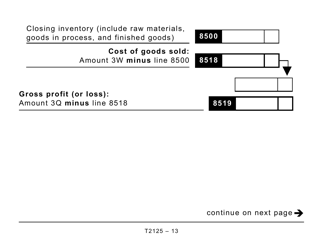

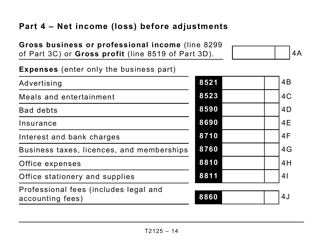

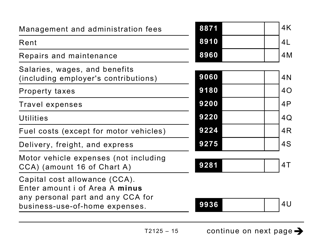

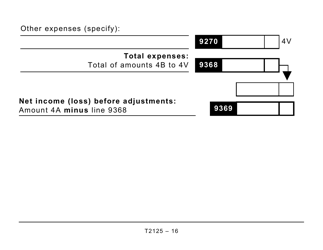

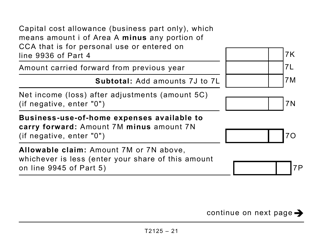

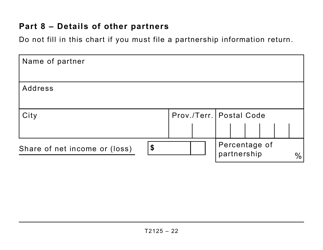

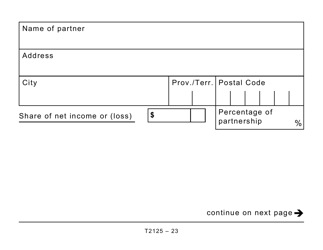

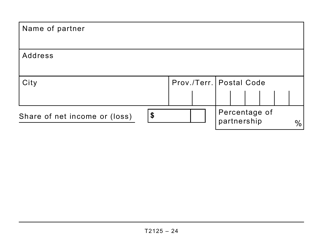

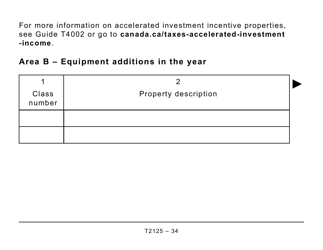

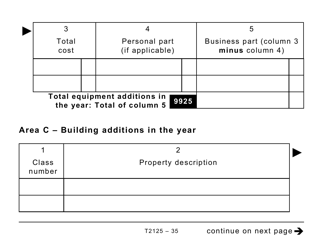

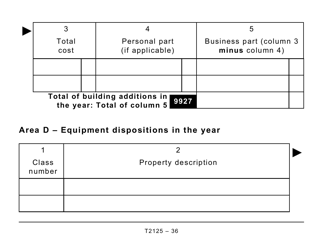

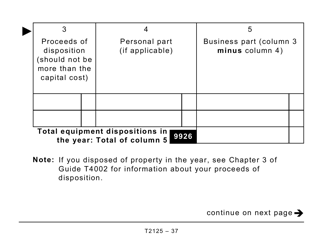

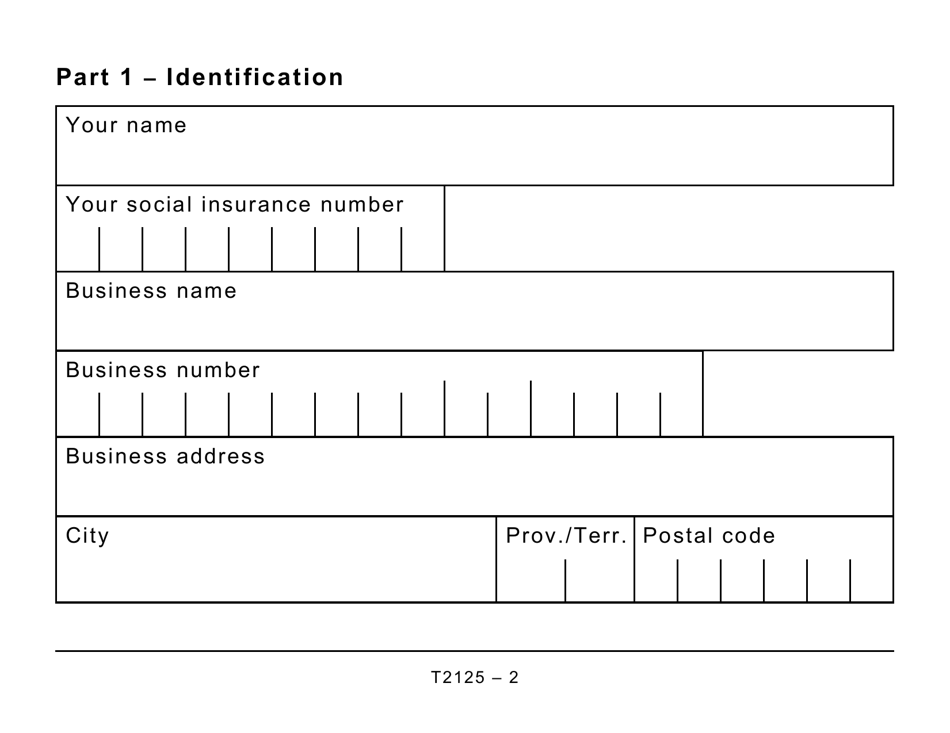

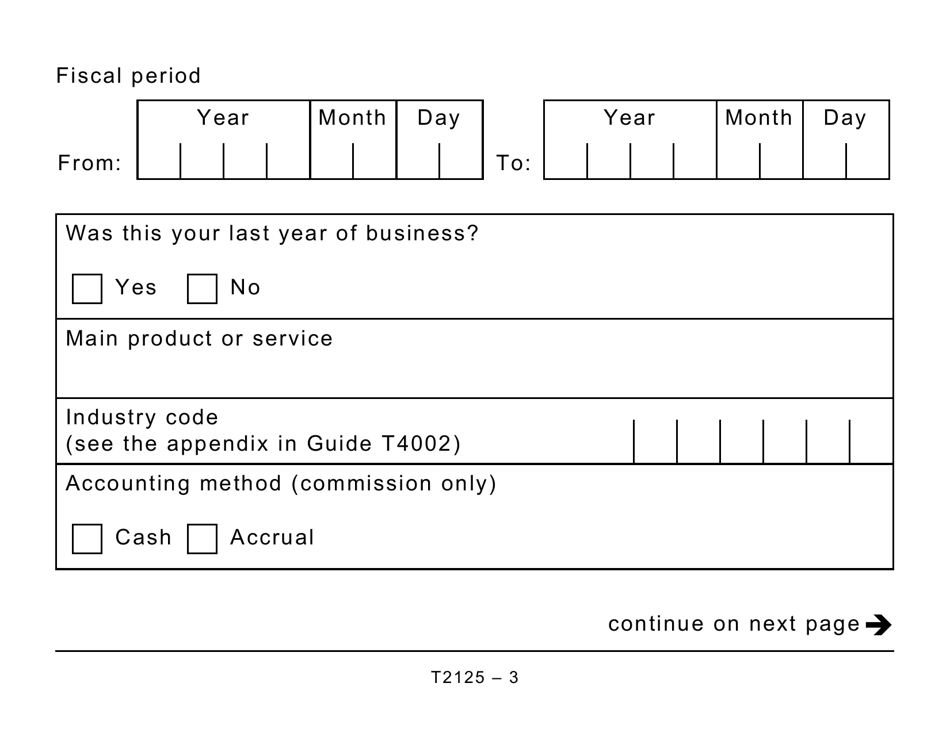

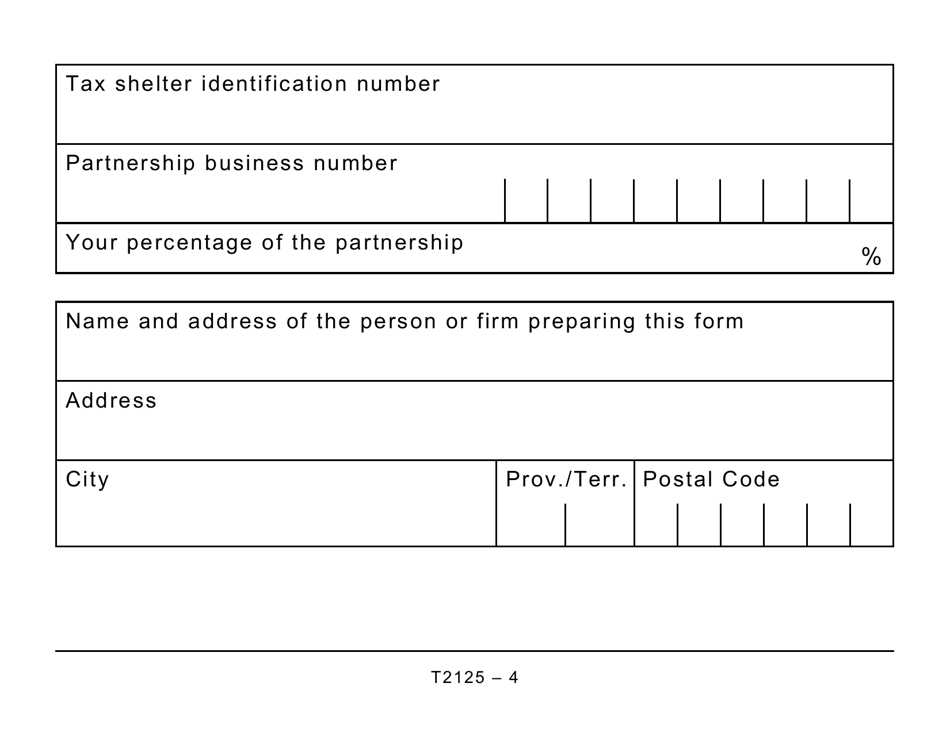

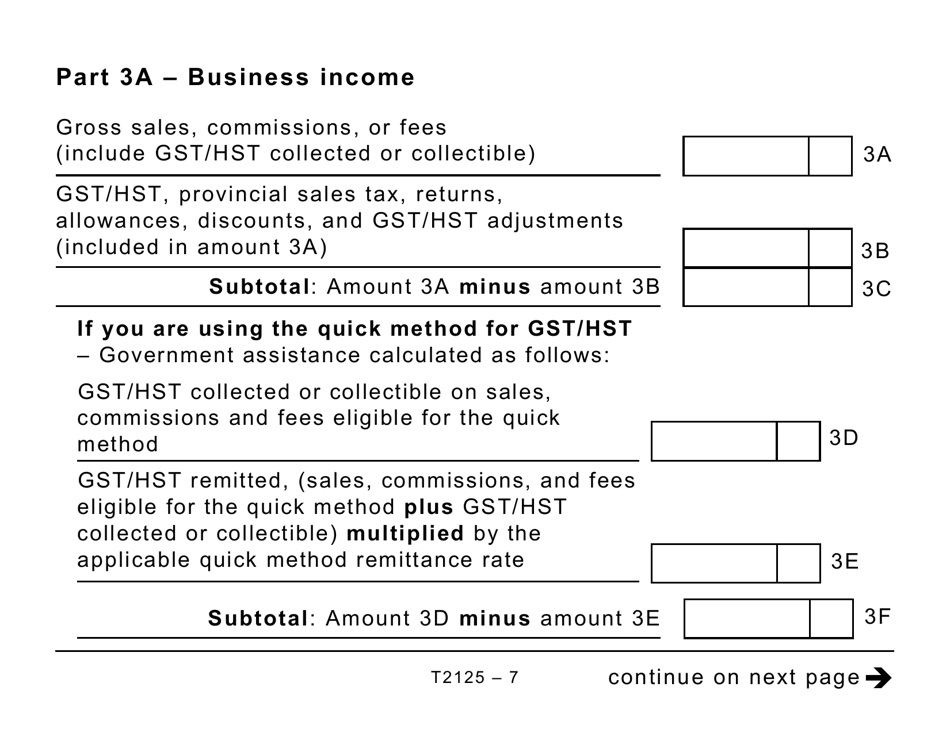

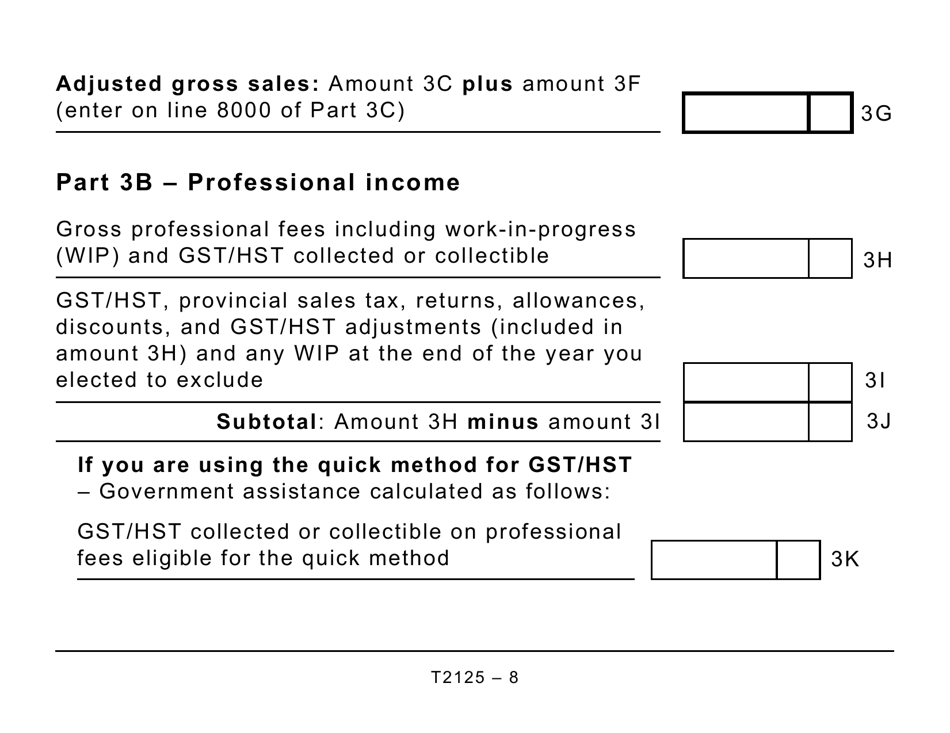

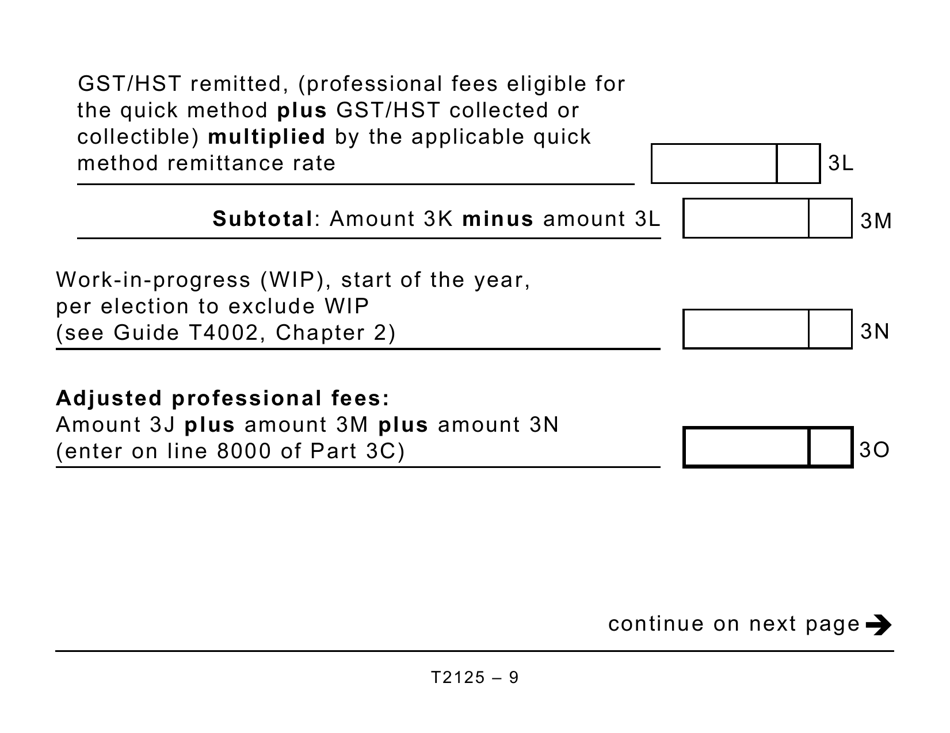

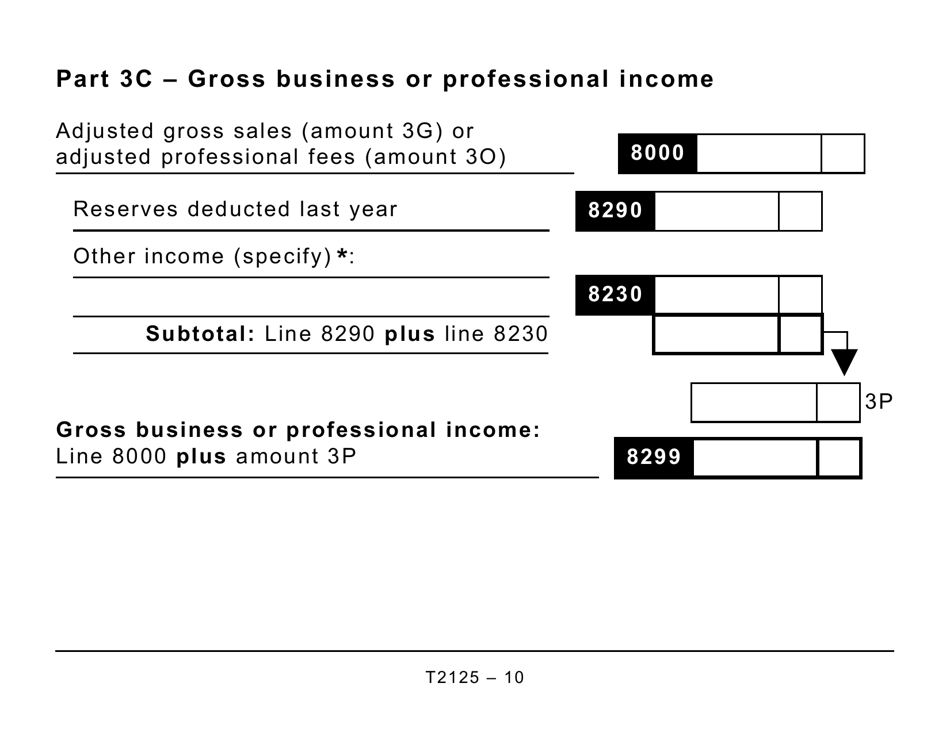

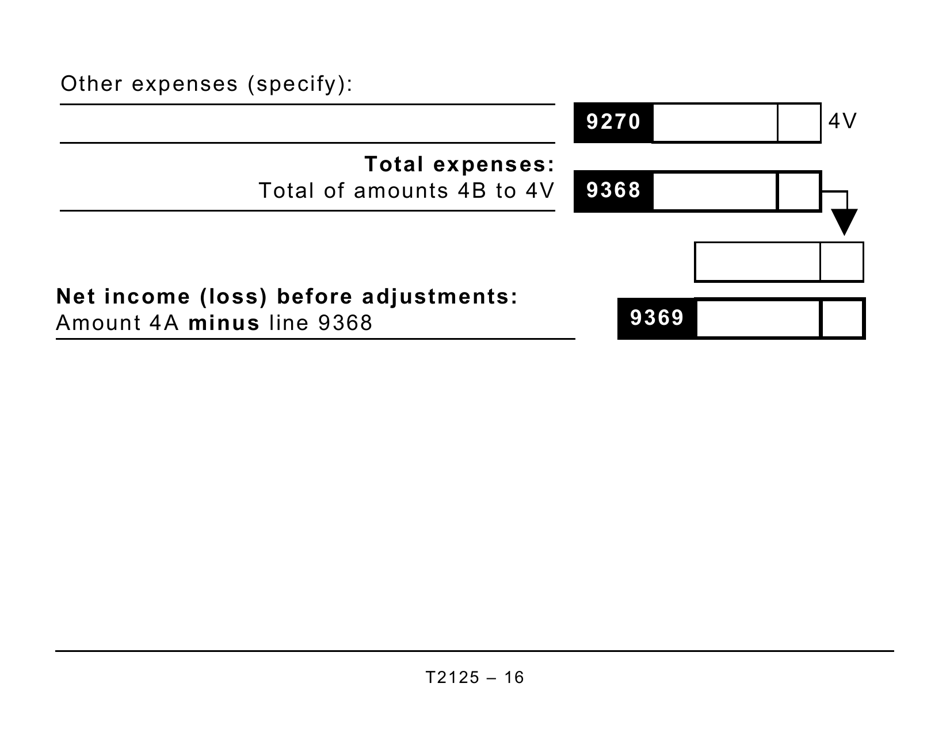

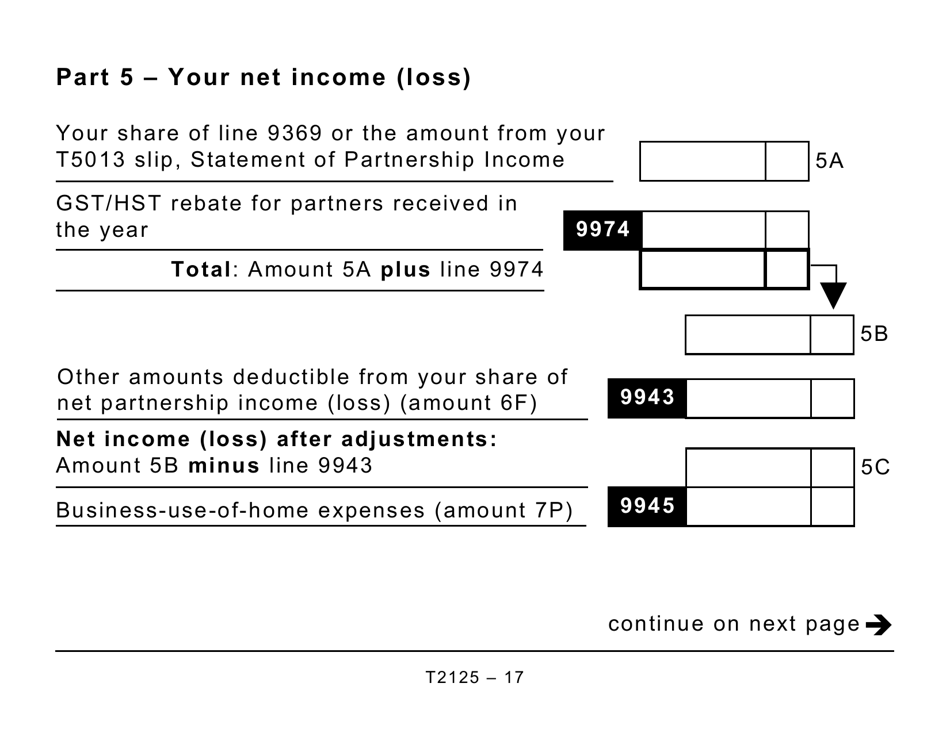

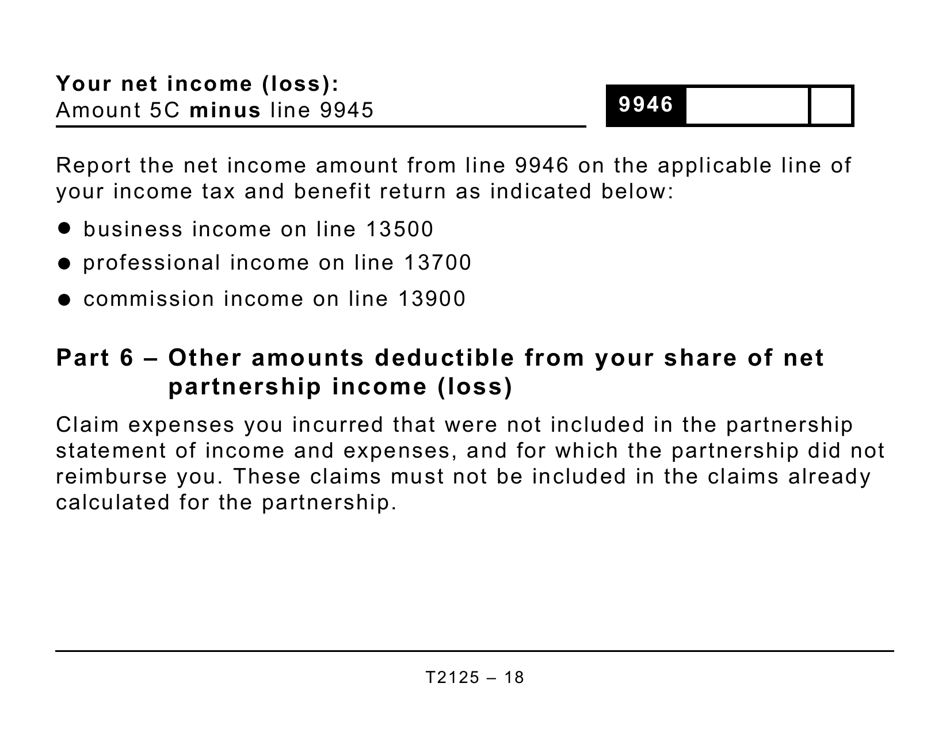

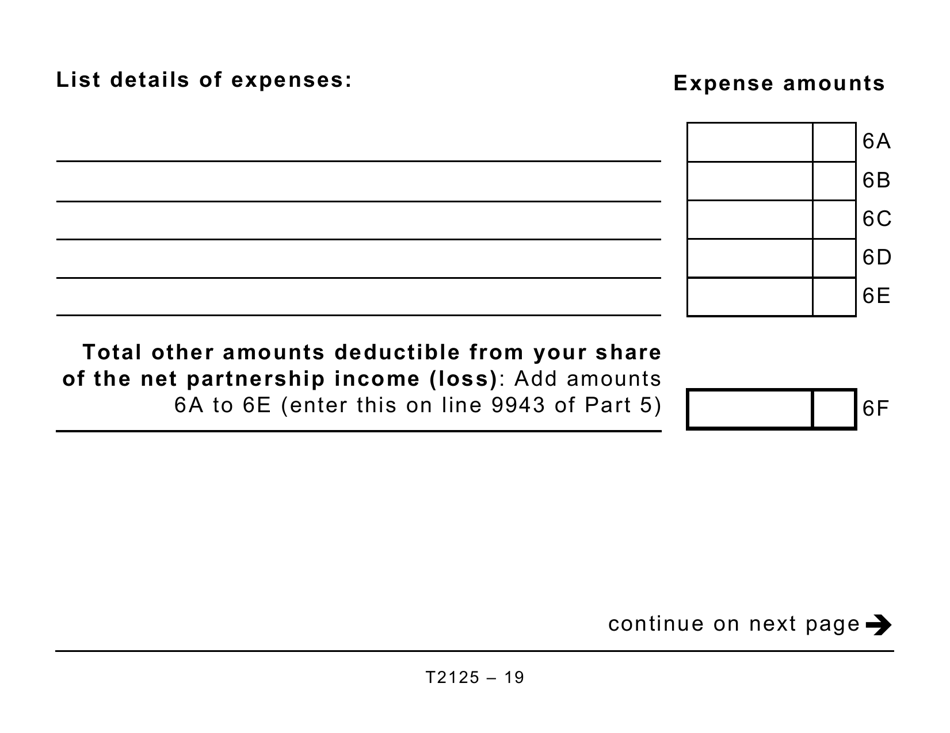

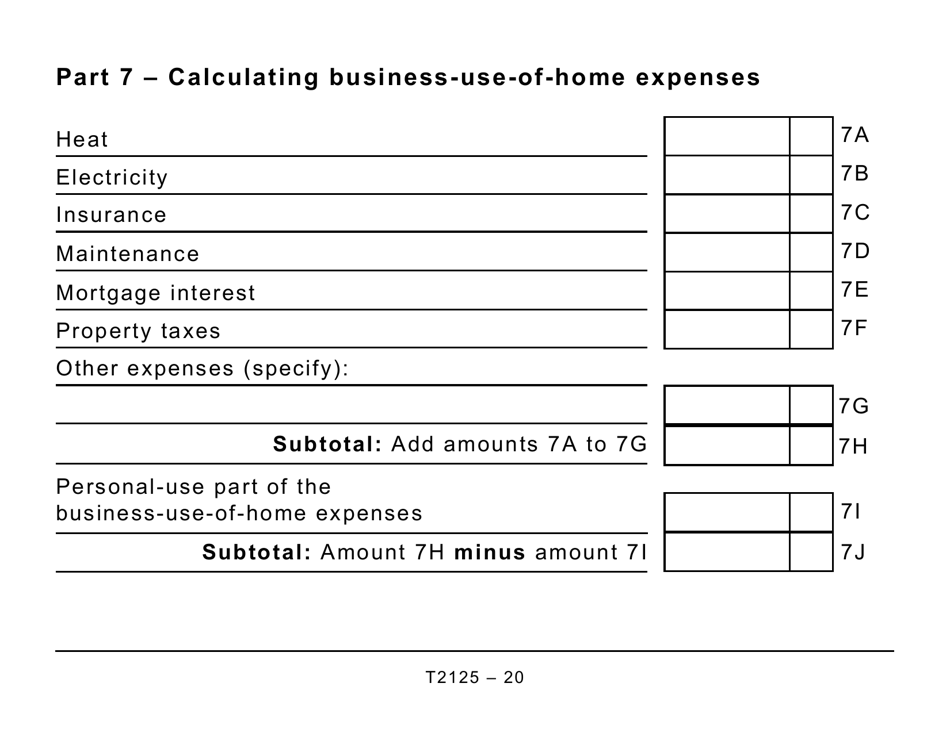

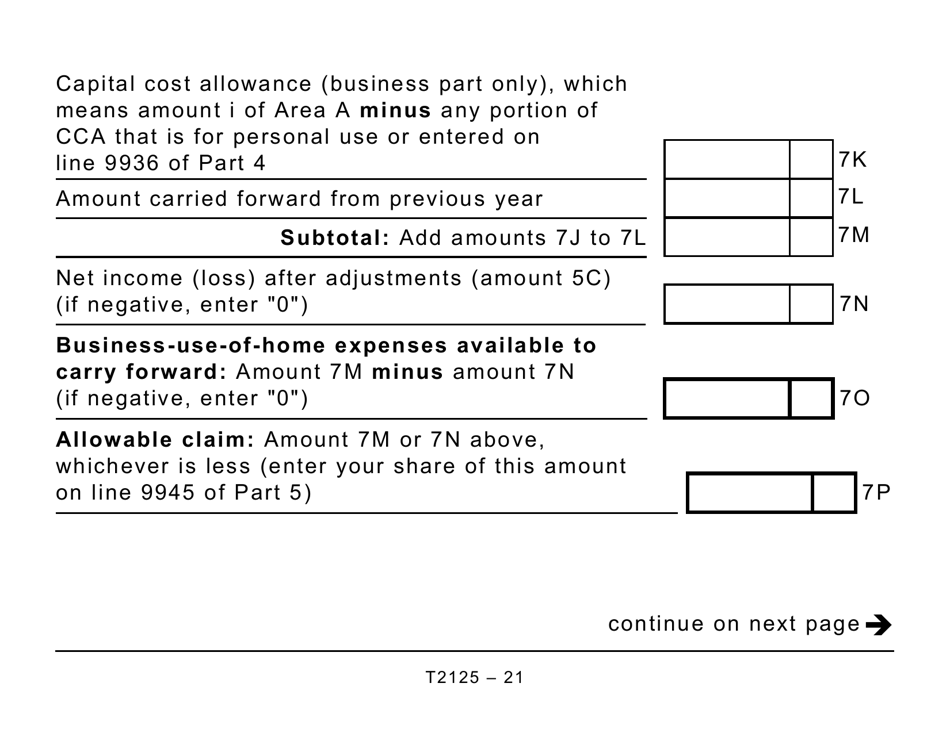

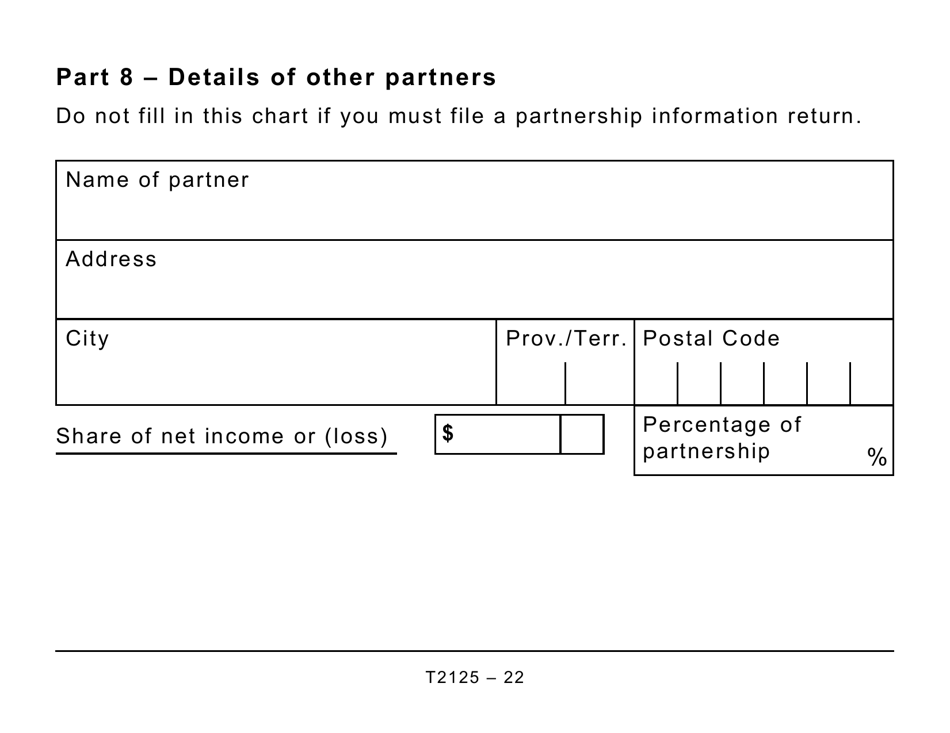

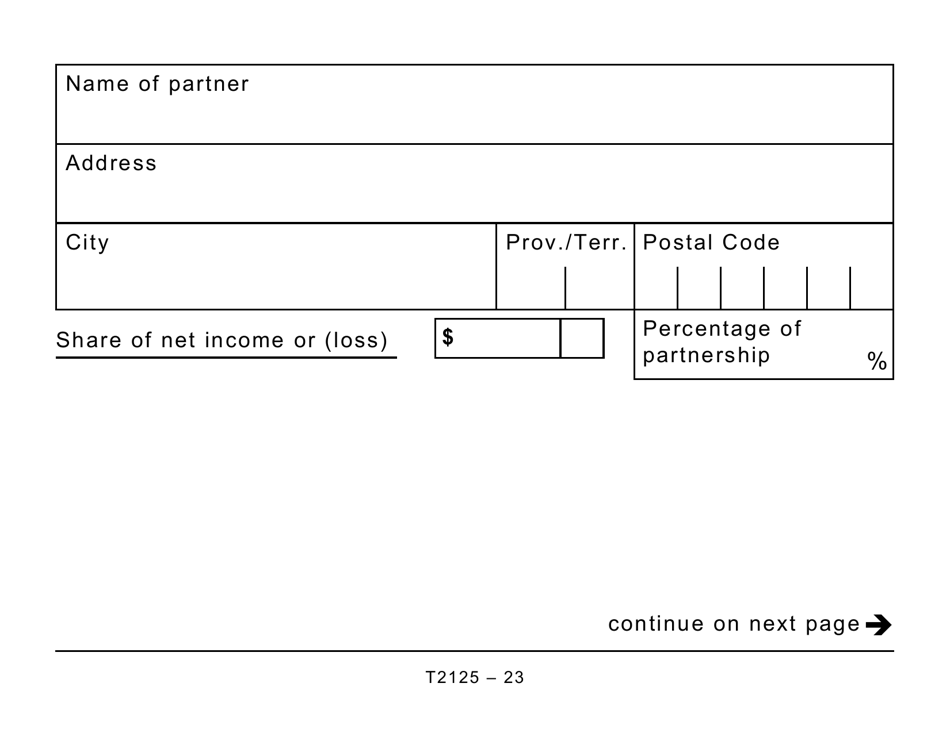

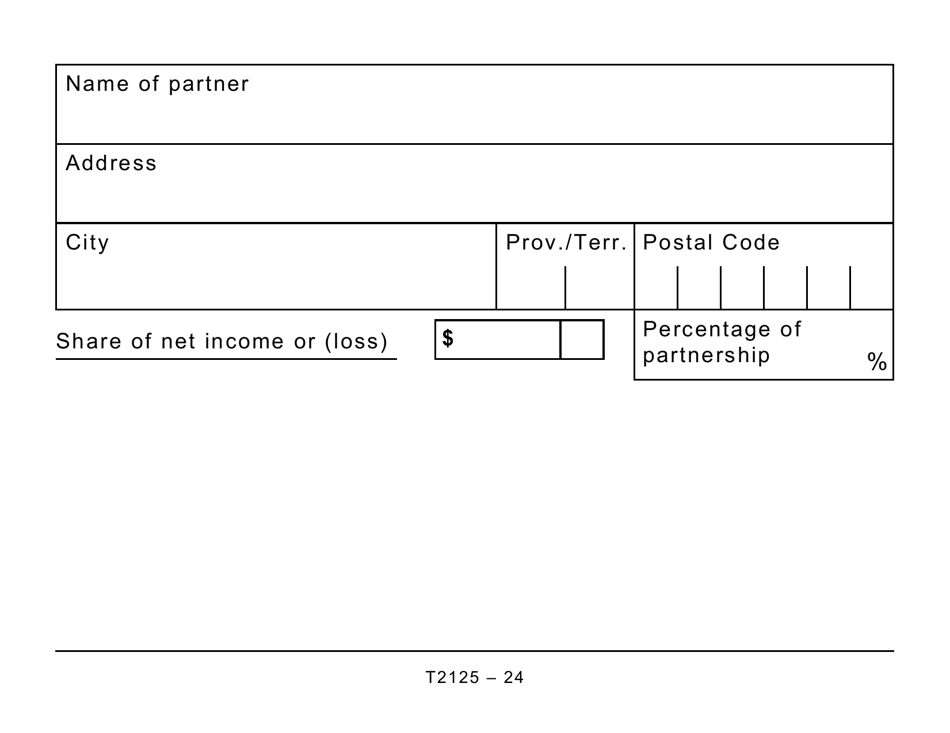

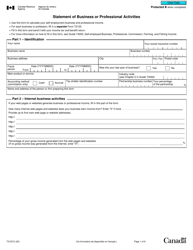

Form T2125 Statement of Business or Professional Activities (Large Print) - Canada

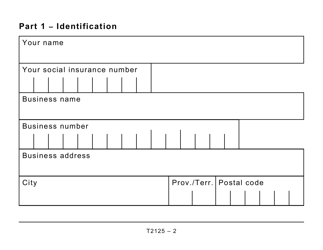

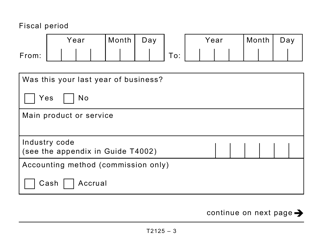

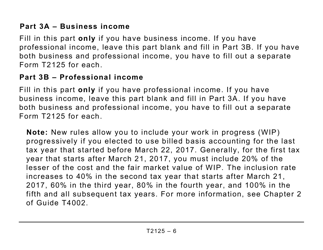

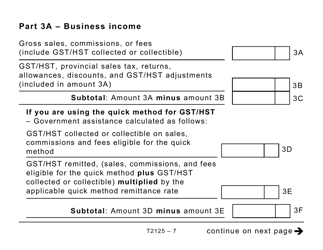

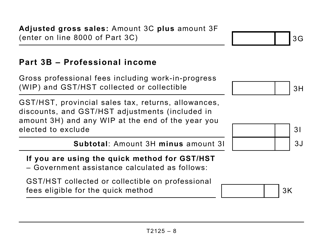

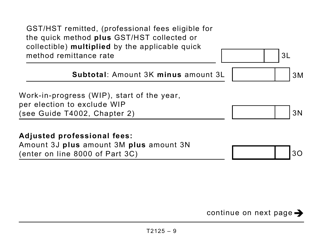

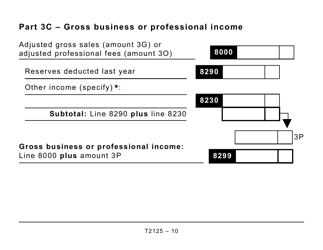

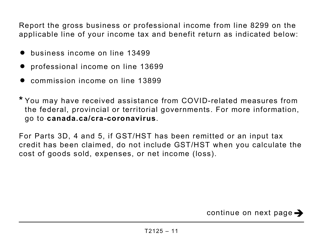

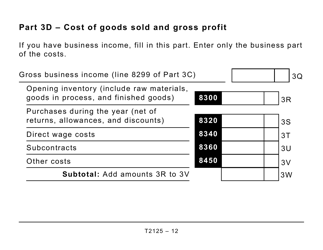

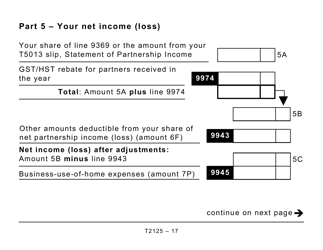

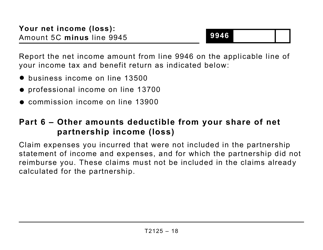

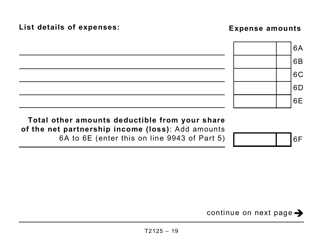

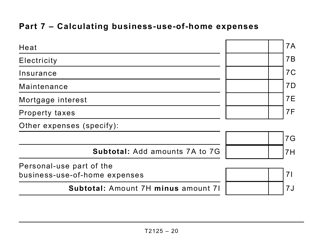

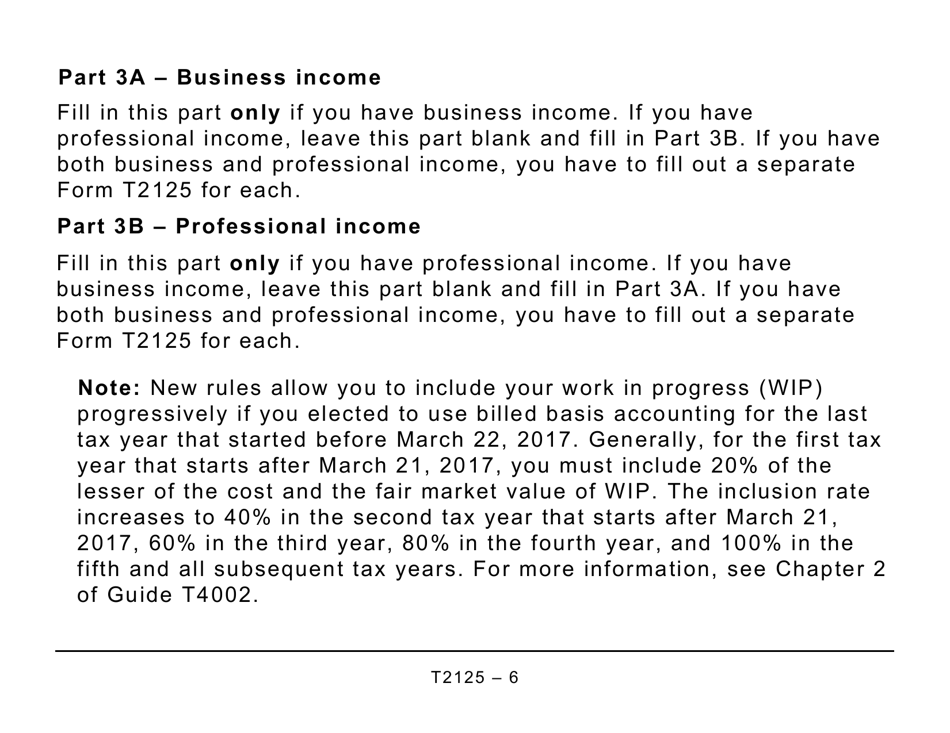

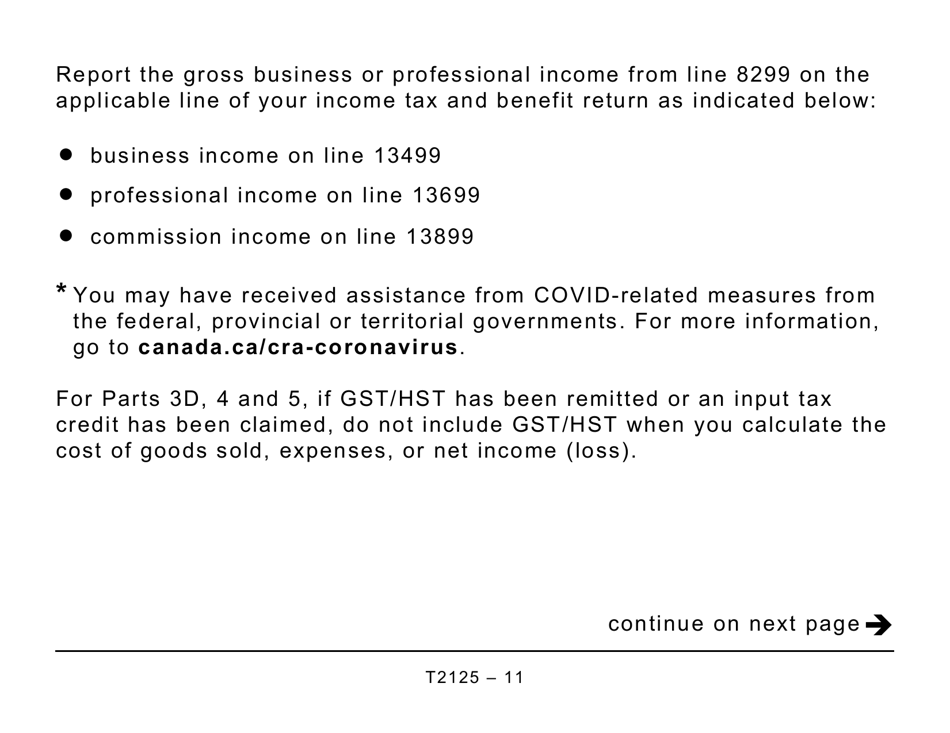

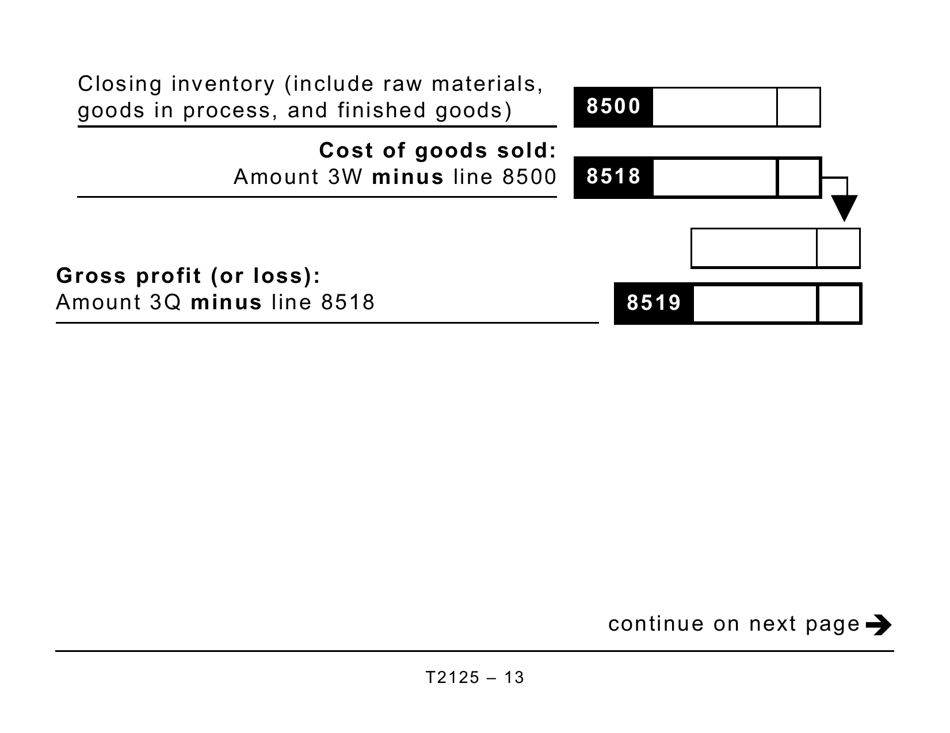

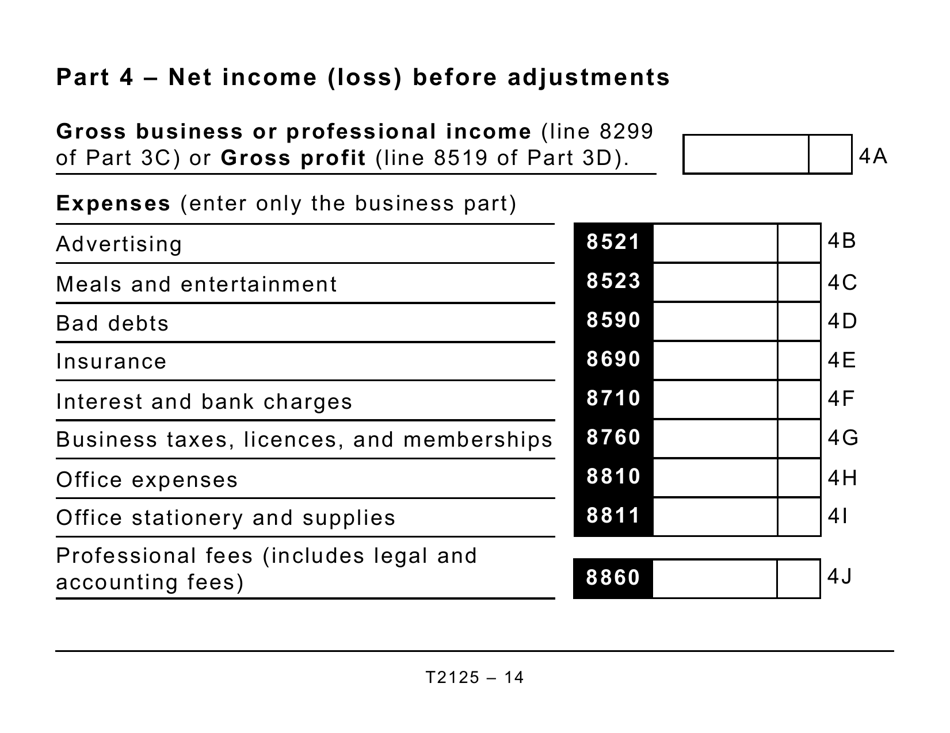

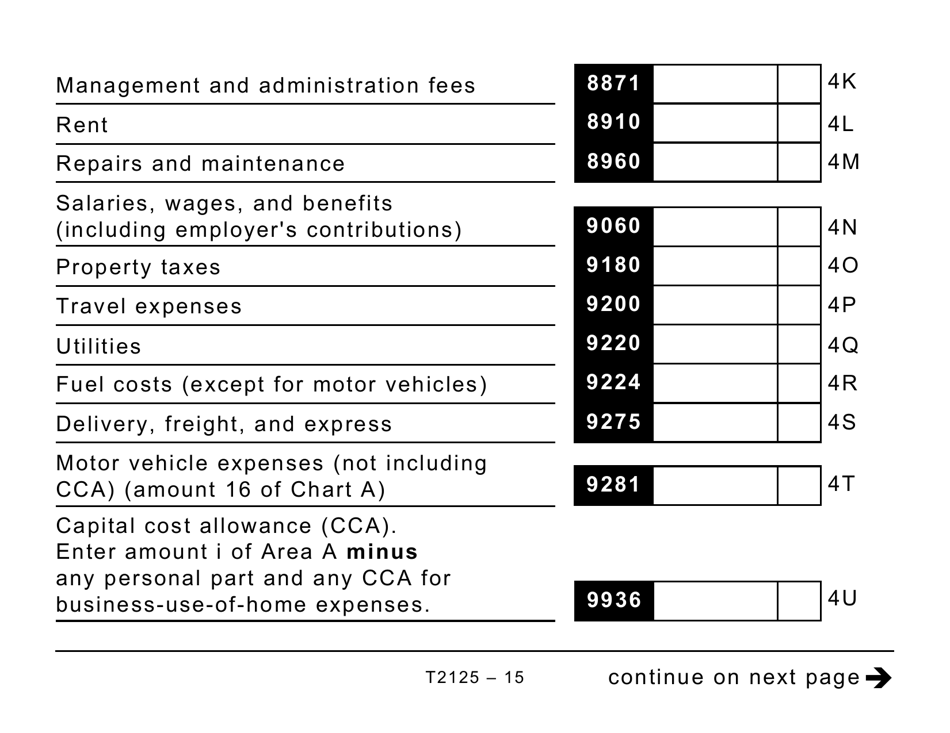

Form T2125 Statement of Business or Professional Activities - Large Print is used in Canada to report business or professional income and expenses for individuals who are self-employed or work as a sole proprietor. It is a tax form that helps individuals accurately report their business or professional income and claim any eligible deductions or expenses.

In Canada, the Form T2125 Statement of Business or Professional Activities can be filed by self-employed individuals or individuals who have freelance or professional activities as part of their business. This form is used to report your business income and expenses.

FAQ

Q: What is Form T2125?A: Form T2125 is a tax form used in Canada to report business or professional activities.

Q: Who should use Form T2125?A: Anyone in Canada who has a business or professional activity should use Form T2125 to report their income and expenses.

Q: What kind of activities are reported on Form T2125?A: Form T2125 is used to report various types of business or professional activities, such as freelancing, consulting, and self-employed businesses.

Q: Do I need to file Form T2125 if my business is incorporated?A: Yes, even if your business is incorporated, you still need to file Form T2125 to report your income and expenses.

Q: Is there a deadline to file Form T2125?A: Yes, Form T2125 must be filed along with your personal income tax return, which is typically due by April 30th of each year.

Q: Are there any penalties for not filing Form T2125?A: Yes, failing to file Form T2125 or reporting incorrect information may result in penalties and interest charges.

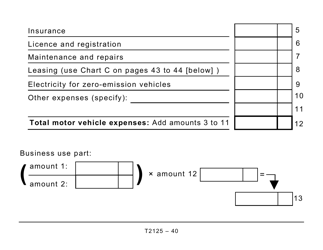

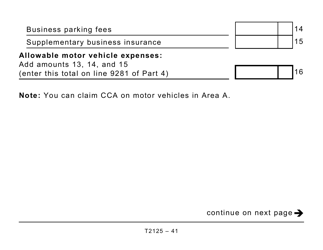

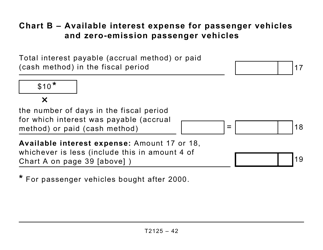

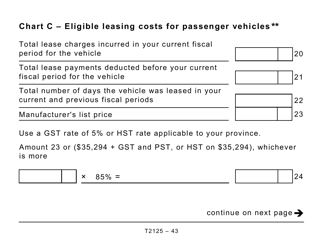

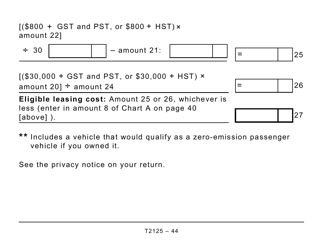

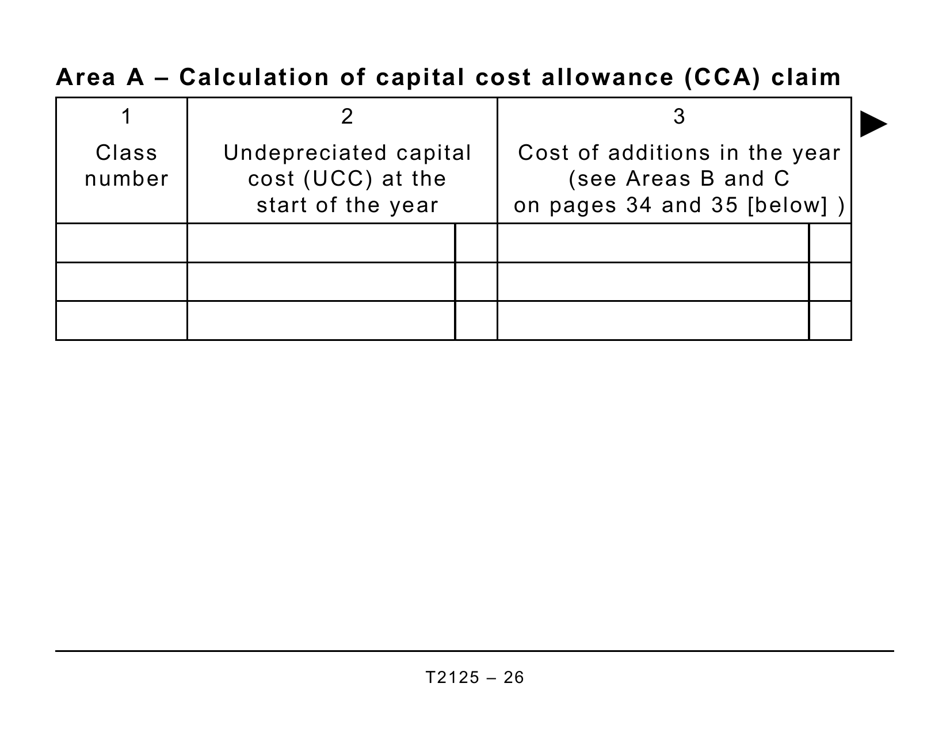

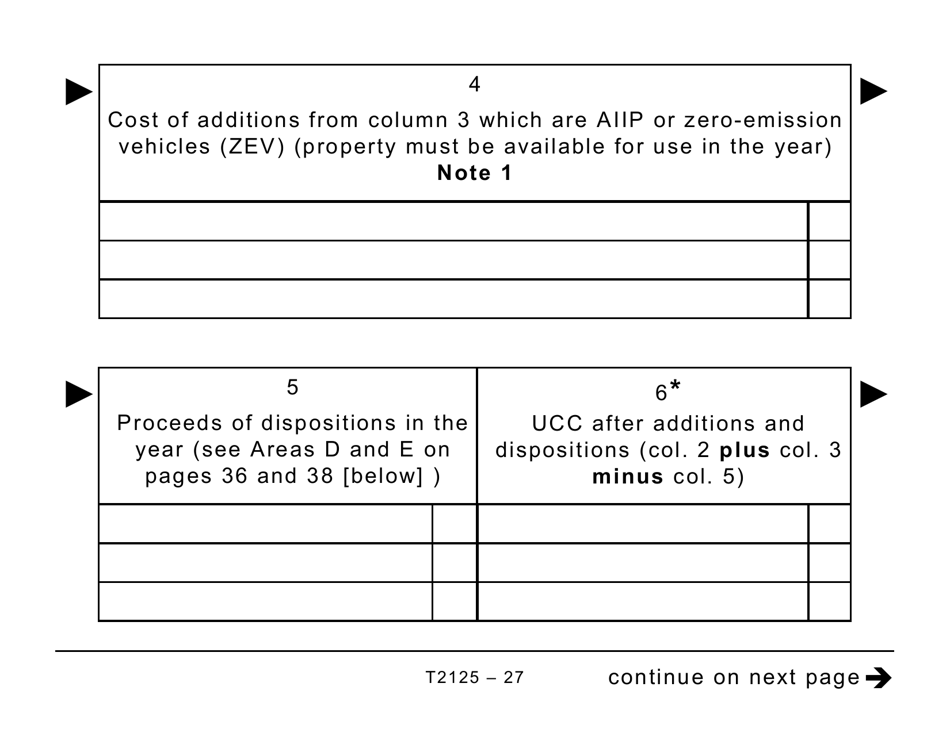

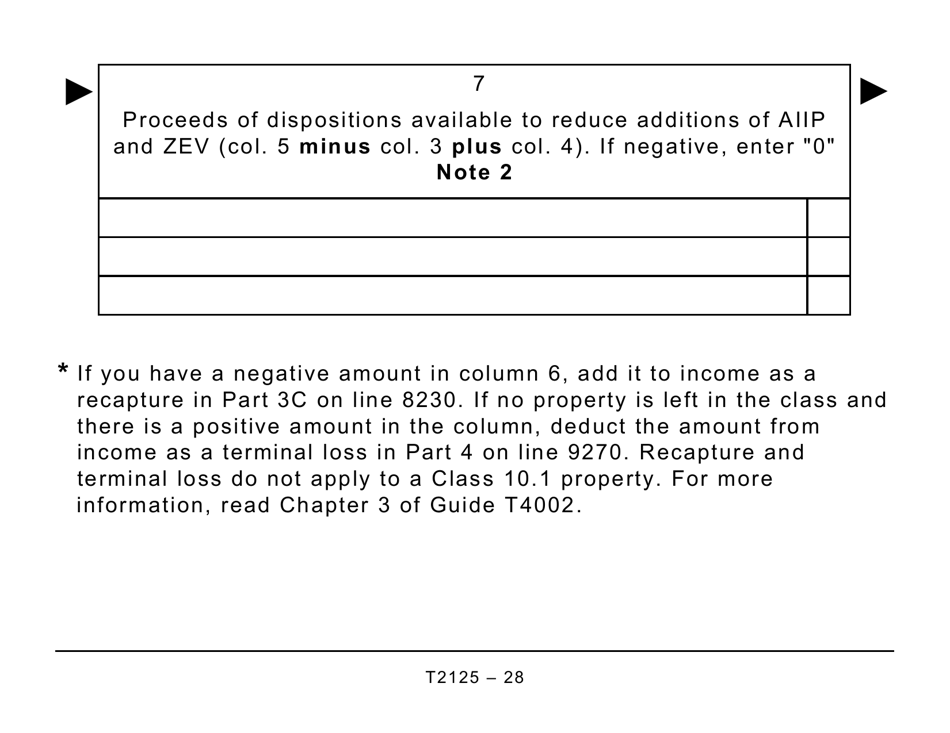

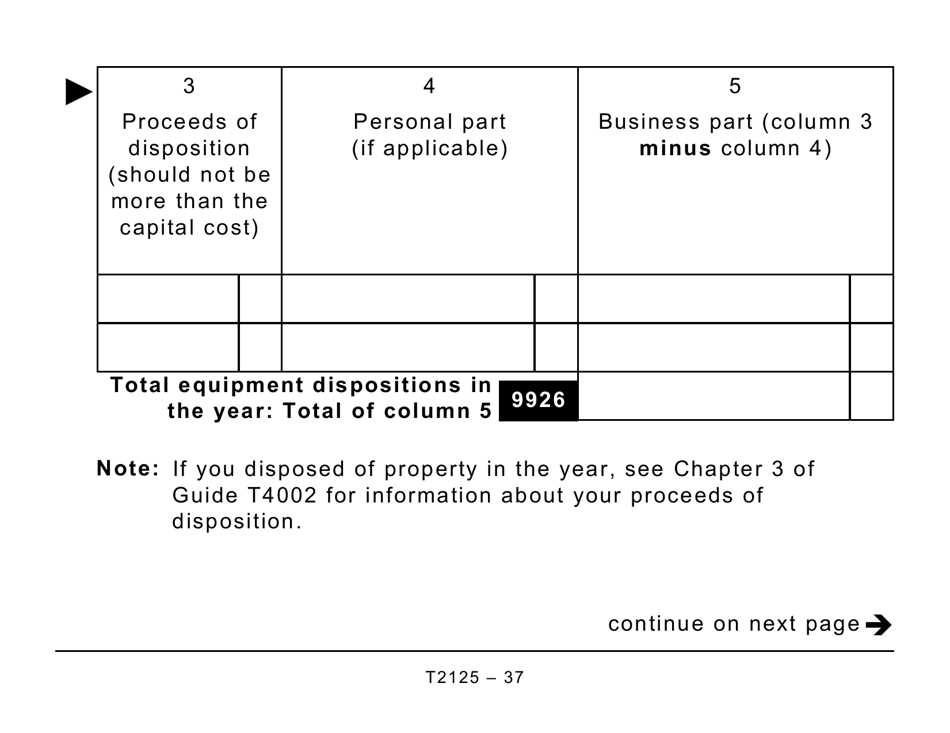

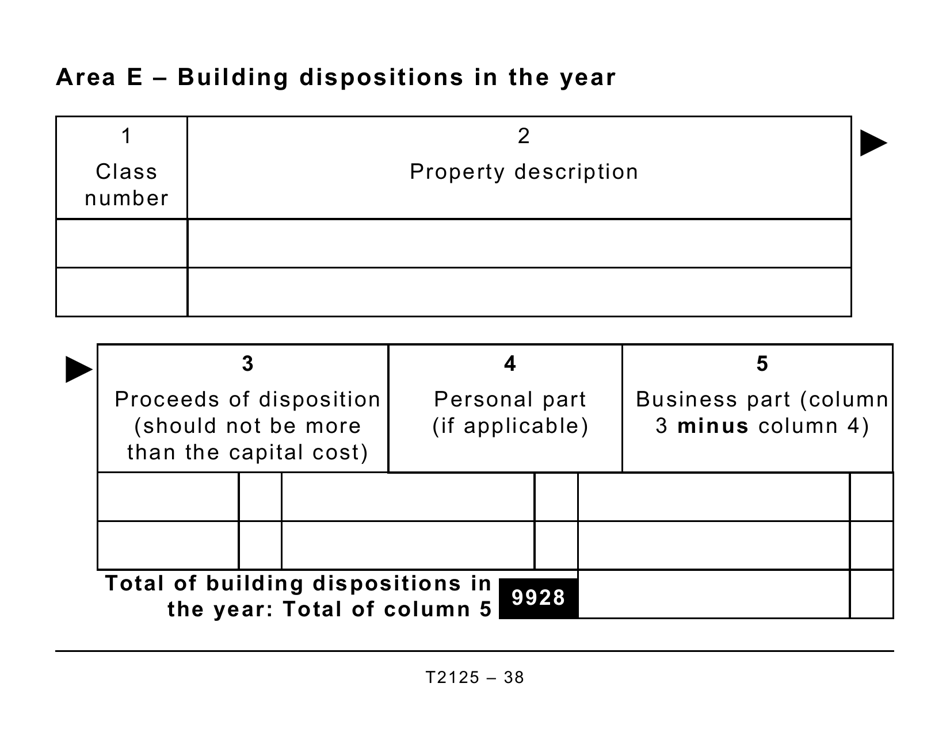

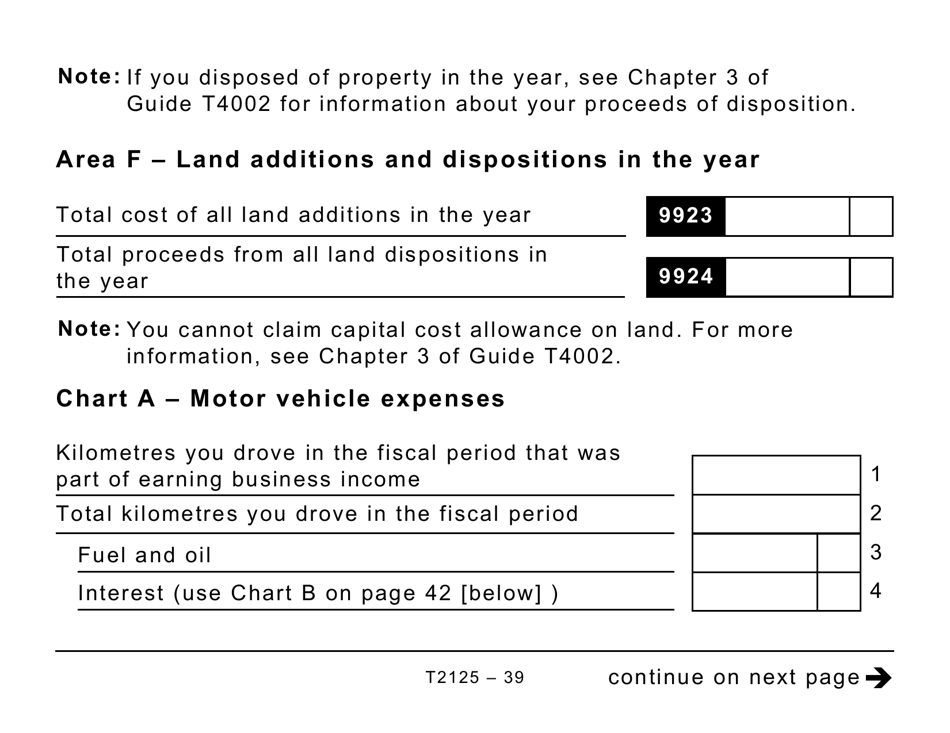

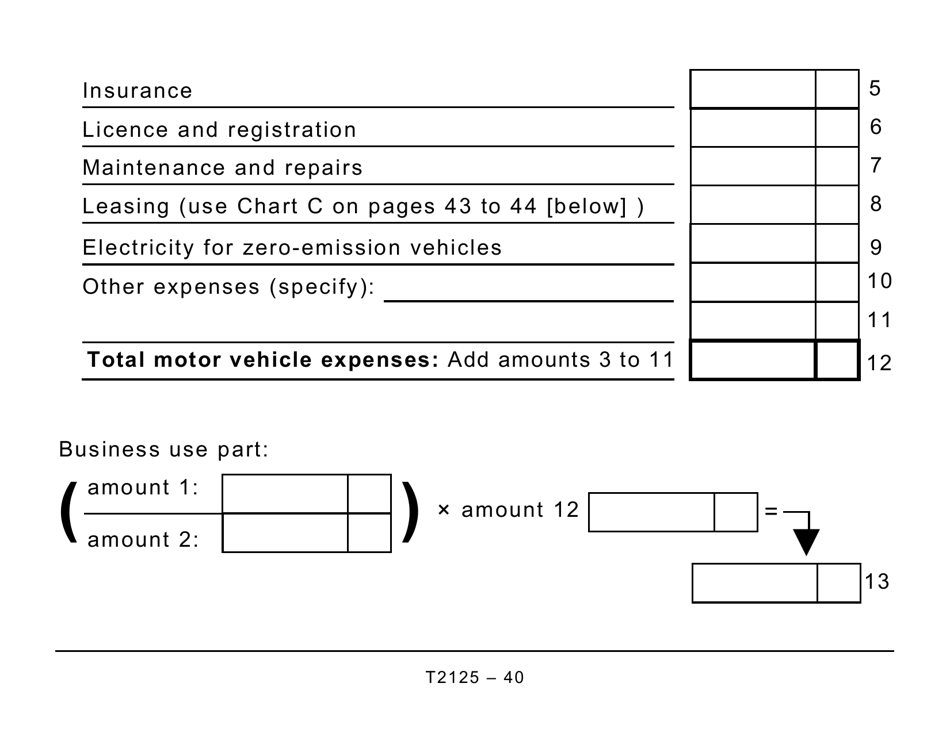

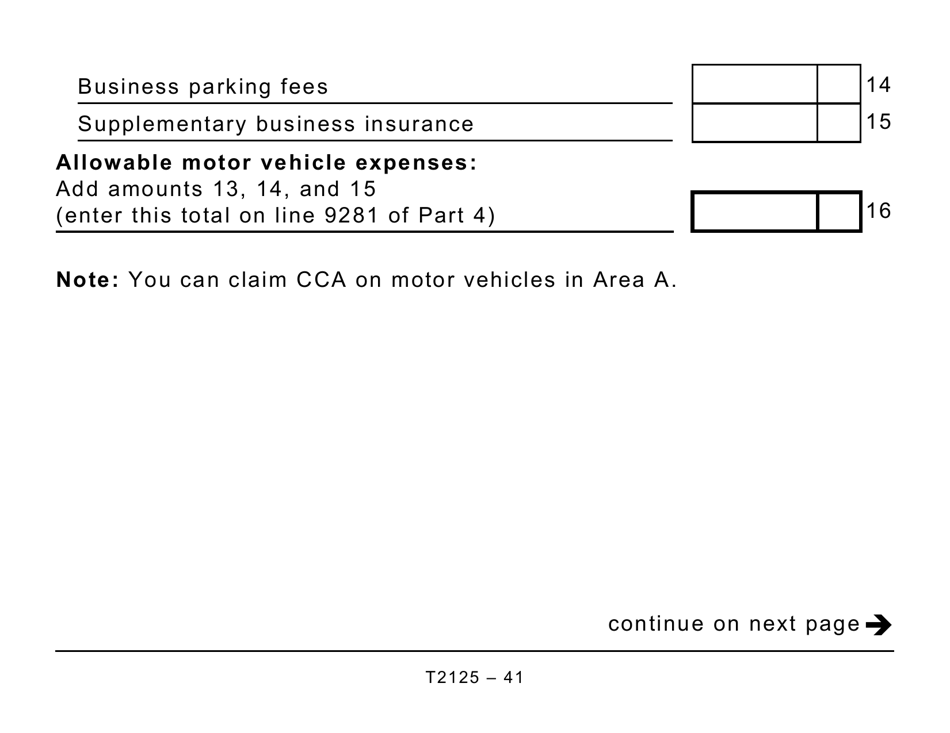

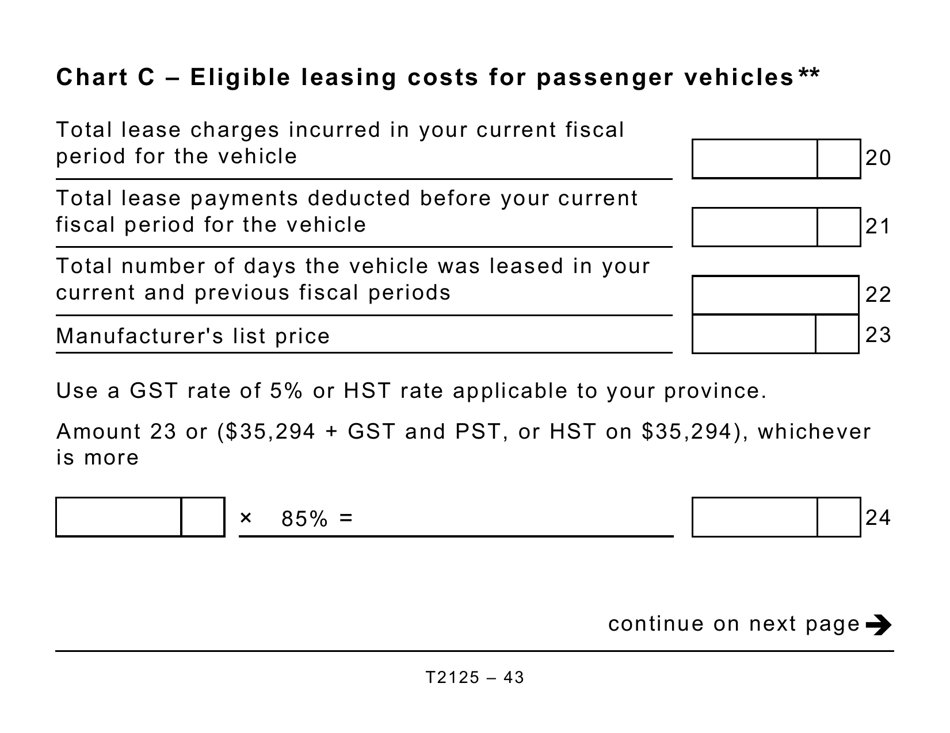

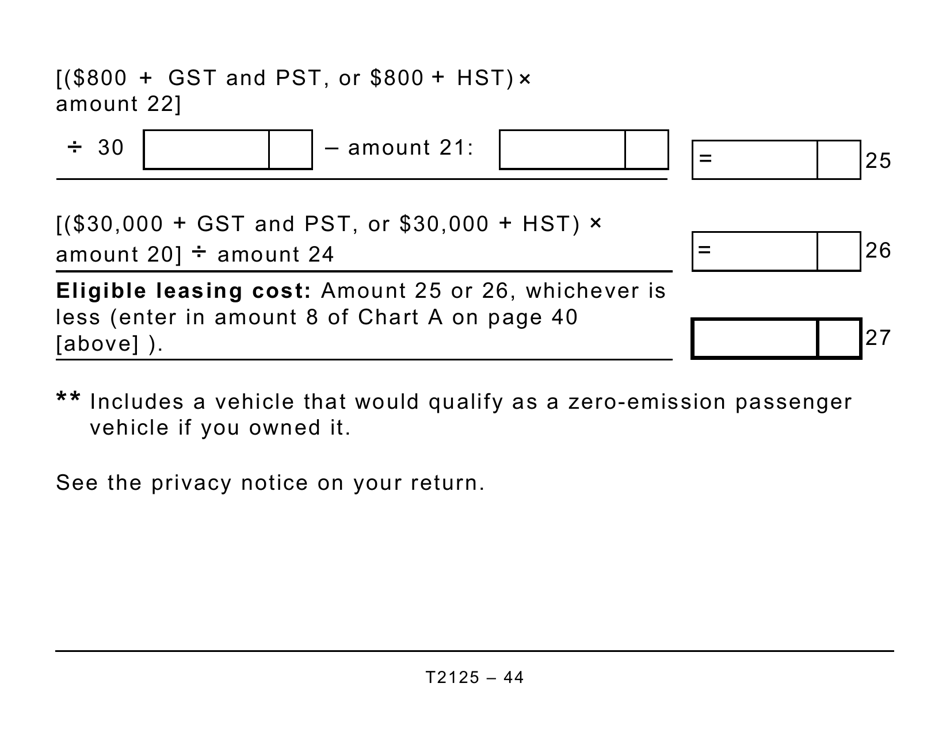

Q: Can I claim expenses on Form T2125?A: Yes, you can claim various business expenses on Form T2125, such as office supplies, advertising costs, and vehicle expenses.

Q: Do I need to keep records of my business activities?A: Yes, it is important to keep detailed records of your business activities, including receipts and invoices, in case of an audit by the CRA.

Q: Can I use Form T2125 if I have more than one business?A: Yes, if you have multiple businesses or professional activities, you can use multiple copies of Form T2125 to report each activity separately.